Fintech’s new growth sustainability mantra; Charging up the gig economy

Indian fintechs are shifting away from breakneck growth to focus on profitability. Chargeup partners with OEMs and provides gig workers with tailored EV leasing and financing solutions.

Hello,

IndiGo is chasing new horizons.

India’s largest airline has entered an agreement with Air France-KLM, Virgin Atlantic, and Delta to expand its long-haul services to North America, Europe, and the UK.

It will enable the Indian carrier to sell flights under its own name on those operated by its partners out of India, and onward travel from Amsterdam and Manchester, UK, on selected flights to Europe and North America.

Separately, it also said it would convert 30 out of 70 options for Airbus A350 jets into firm orders for new planes.

IndiGo’s love for Airbus is shared by Emirates too, which plans to keep its giant fleet of Airbus SE A380 double-deckers in operation until the end of next decade, in an attempt to extend the lifespan of the aircraft model that helped build its dominance on global routes.

Meanwhile, at the International Air Transport Association meeting in Delhi, aviation executives are charting the future of the industry, including the global demand outlook post US President Trump’s tariffs.

Among other topics is the industry’s commitment to net-zero emissions in 2050. While the amount of sustainable aviation fuel produced is expected to double in 2025, that’s still far from meeting the sector’s sustainability goals.

In today’s newsletter, we will talk about

- Fintech’s new growth sustainability mantra

- Charging up the gig economy

Here’s your trivia for today: Which two aeronautical engineers, serving opposing sides during World War II, independently invented the jet engine?

Fintech

Fintech’s new growth sustainability mantra

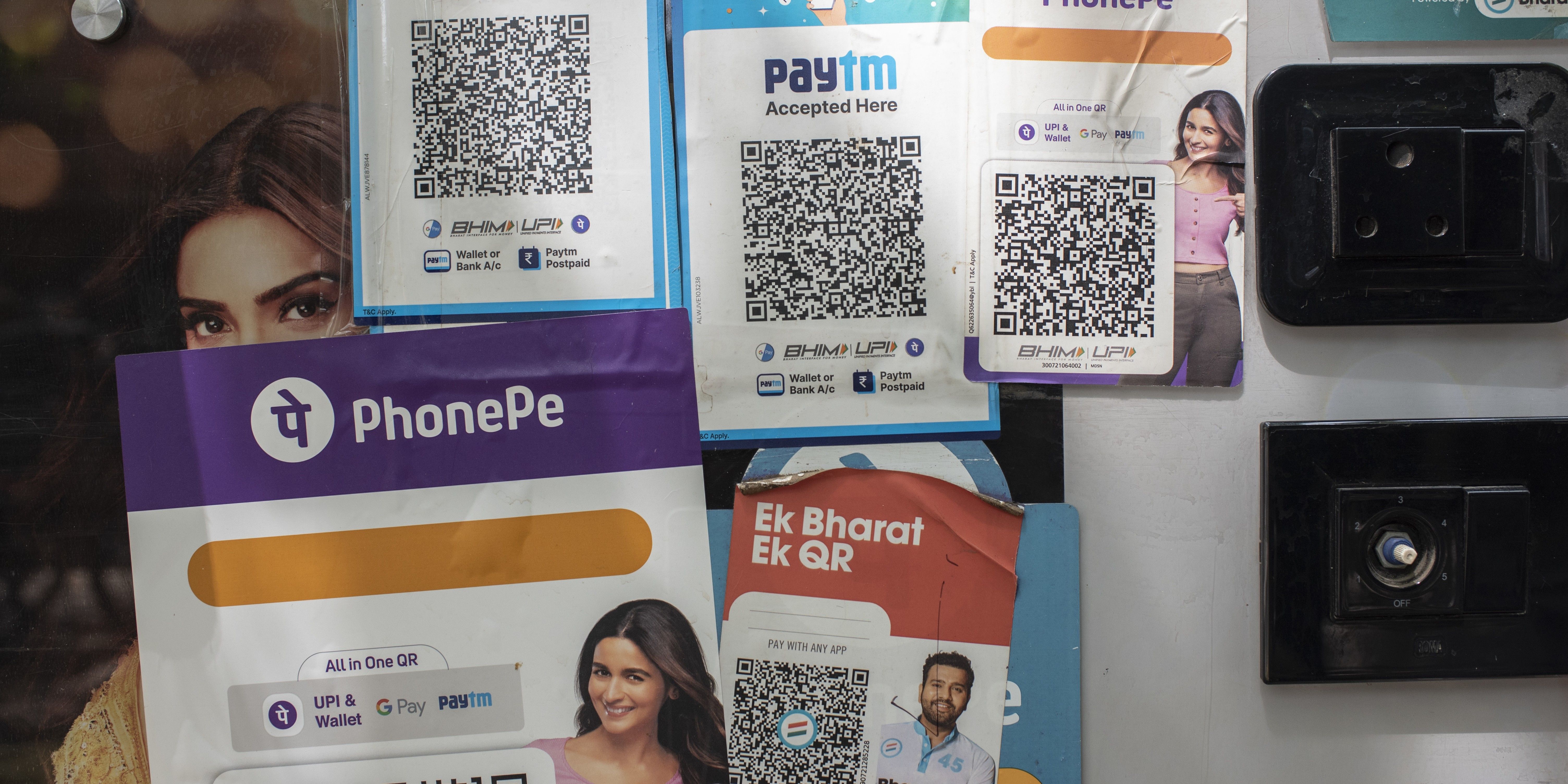

Today, Indian fintech startups are focusing on making each rupee count—whether through fatter margins on secured loans, improved take rates on payments, or streamlined operating costs.

RBI’s regulatory clampdown on unsecured credit has compelled digital lenders to reassess their strategies. Risky, short-tenure loan products are phased out; business models are reworked, and across the board, fintech firms are moving towards lending models and payment flows that promise margin stability over market share.

Strategy pivot:

- Among the first to react was MobiKwik, after its flagship BNPL product, Zip, saw disbursals drop to Rs 5,358 crore in FY25—down 41% annually. The firm subsequently turned to its payments arm, ZaakPay, to drive growth, tightened user incentives and is focusing on high-yield use cases such as RentPay.

- Meanwhile, Vijay Shekhar Sharma’s Paytm is leaning into merchant lending, where the risk is partly underwritten by default loss guarantee structures. In Q4, merchant loans grew 13% sequentially to Rs 4,315 crore, now accounting for over three-fourths of Paytm’s total disbursals.

- PB Fintech, which operates credit marketplace Paisabazaar, is working towards de-risking by doubling down on secured products such as home loans and loans against property, as the unsecured loan engine slows.

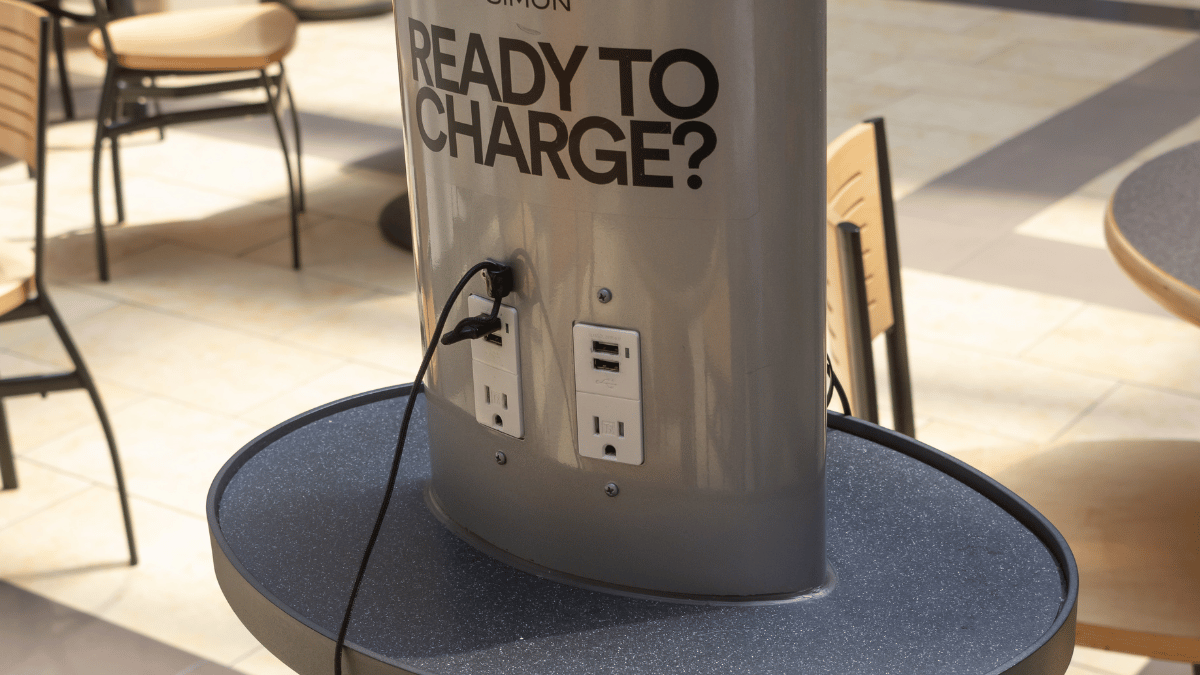

Electric Vehicles

Charging up the gig economy

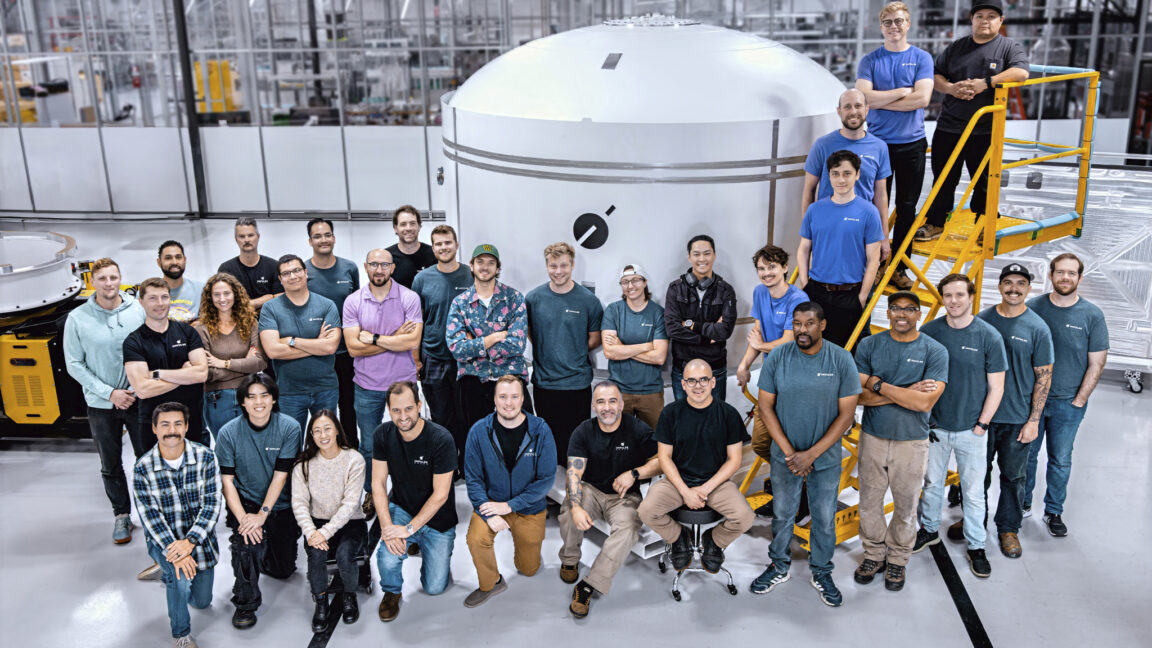

In India, where electrification is being encouraged on a national scale, users having negative attitudes towards EV adoption can be a hindrance. Chargeup set out to solve this problem by providing asset management, leasing solutions, and battery-swapping products.

Today, the company operates 300 battery swapping stations, has onboarded 8,000 drivers onto its platform and plans to raise that number to 35,000 by FY26. Additionally, Chargeup has raised $3 million in a bridge round from both new and existing investors and is preparing to raise between $8-10 million this year.

From EV to asset:

- Chargeup was founded in 2019 by Satish Mittal, Varun Goenka, and Arun Madan, to solve commonly recurring issues with EV battery management. Commercial vehicles on its platform include a pre-fitted tech-enabled IoT device attached to the battery which helps monitor and track battery usage and health.

- Chargeup has rolled out multiple products to help finance EVs, one of which is the Karma Score—based on how many kilometres the driver covers, how much they earn based on the rate per kilometre in each city, and how much of their EMI they pay on time.

- While the company operates around 300 swapping stations currently, Mittal added that it is doubling down on its battery leasing operations. This comes as the segment is seeing rising adoption since most last-mile delivery drivers run for roughly 80 kilometres a day—which is more suited for leasing than swapping.

News & updates

- Countermeasures: The European Commission said on Saturday that Europe was prepared to retaliate against President Donald Trump’s plan to double tariffs on imported steel and aluminium, raising the prospect of an escalating trade fight between two of the world’s largest economic powers.

- Antitrust: Alphabet’s Google on Saturday said it will appeal an antitrust decision under which a federal judge proposed less aggressive ways to restore online search competition than the 10-year regime suggested by antitrust enforcers.

- Breakthrough: AstraZeneca has unveiled positive trial results for a breast cancer drug that can stop mutating tumours before they start to grow. The late-stage trial of Camizestrant for “advanced” breast cancer cut the risk of a tumour progressing, or a patient dying, by 56% in aggregate.

What you should watch out for

- RBI interest rate decision: A key factor that will dictate market sentiments next week is the interest rate decision by the RBI Monetary Policy Committee due on June 6. Most economists expect the central bank to cut interest rates for the third time this year by 25 bps to 5.75%, given that inflation is below its 4% target.

- US jobs data: On the global front, investors are expected to be focused on US jobs data and subsequent developments with respect to the US bond market and Trump tariffs, which will give indications about further rate cuts by the US Federal Reserve.

Which two aeronautical engineers, serving opposing sides during World War II, independently invented the jet engine?

Answer: American Royal Air Force College cadet Frank Whittle conceived the turbojet in 1928. In ignorance of Whittle’s work, German engineer Hans Joachim Pabst von Ohain arrived at the same concept in 1933.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[DEALS] FileJump 2TB Cloud Storage: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Epic Games: Apple’s attempt to pause App Store antitrust order fails [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/epic-games-app-store.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple AI Launch in China Delayed Amid Approval Roadblocks and Trade Tensions [Report]](https://www.iclarified.com/images/news/97500/97500/97500-640.jpg)

![[UPDATED] New Android Trojan Can Fake Contacts to Scam You — Meet Crocodilus](https://www.androidheadlines.com/wp-content/uploads/2022/12/Android-malware-image-1.jpg)

![T-Mobile may be misleading customers into spending more with new switch offer [UPDATED]](https://m-cdn.phonearena.com/images/article/171029-two/T-Mobile-may-be-misleading-customers-into-spending-more-with-new-switch-offer-UPDATED.jpg?#)