Xero AI: How to improve AP and invoice tasks

See how Nanonets enhances Xero AI for accounts payable, invoice automation, PO matching, and analytics—without changing your existing workflow.

Accounting work has always been tedious. Every day, we spend hours on tasks that should be simpler. We are forced to manually enter data, reconcile transactions, and sift through files trying to locate financial information we need.

But artificial intelligence is starting to change this reality. Xero, one of the leading cloud accounting platforms, has integrated AI features that are streamlining these daily tasks. From their new conversational assistant JAX to automated bank reconciliation, these tools are helping accountants and business owners reclaim time for more valuable work.

Xero AI: Native features explained

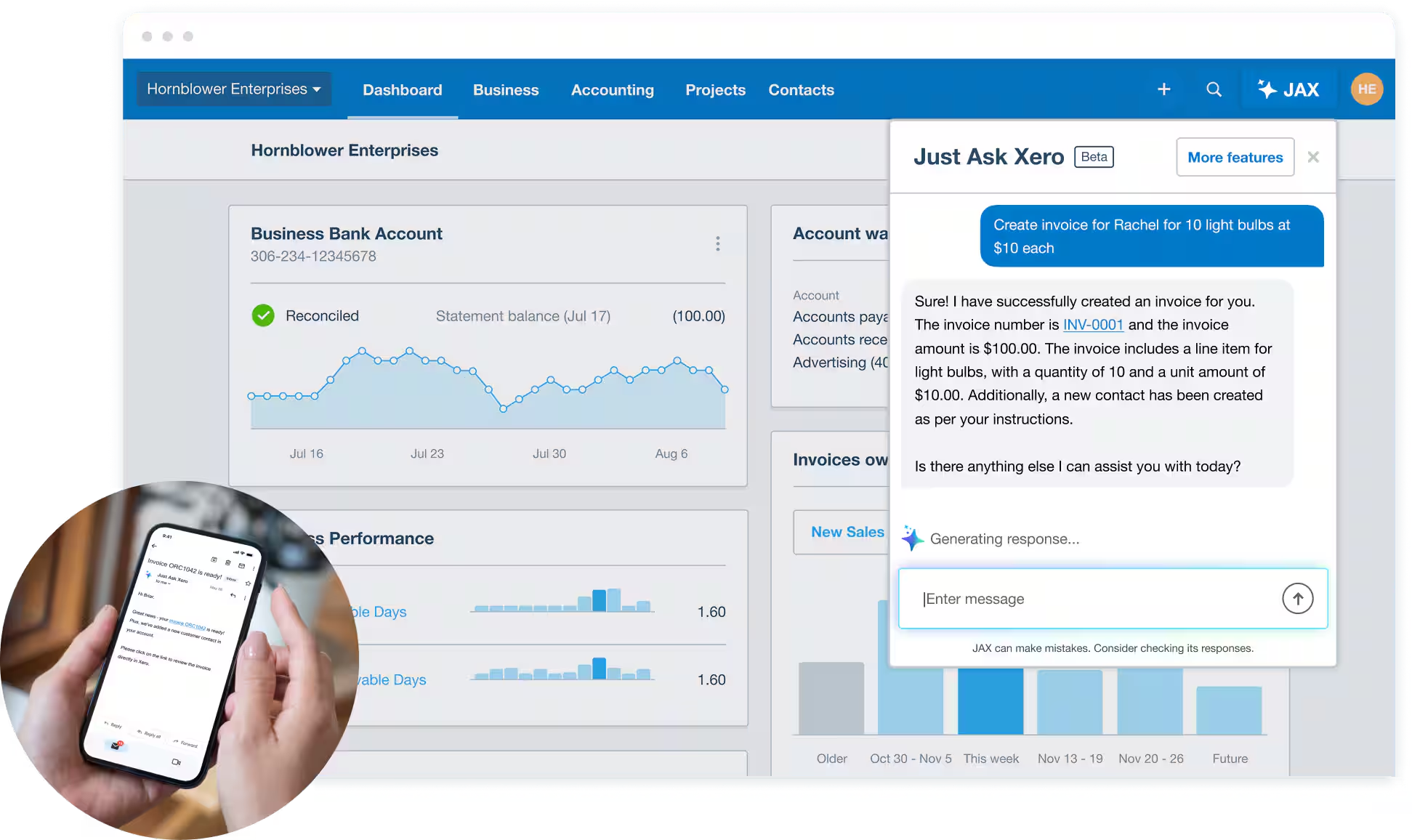

At Xerocon 2024, one main product reveal was an AI assistant named JAX (Just Ask Xero). It represented an interesting shift in how we interact with accounting software. Instead of navigating menus and forms, you can simply message JAX through WhatsApp or email to create invoices, check cash flow, or handle bills.

Xero has added several AI capabilities that can make a difference in how you handle daily accounting tasks. Let's break them down.

1. Just Ask Xero (JAX)

JAX marks Xero's biggest step into conversational AI. Announced in February 2024, this AI assistant does more than just respond to commands. It helps you work naturally with your accounting data. When you need to generate an invoice, rather than opening Xero and navigating through menus, you can simply message JAX through WhatsApp or email with your request.

The assistant handles core accounting tasks like creating invoices, managing quotes, and processing bills. But its real value comes from its ability to think ahead. It suggests follow-up actions, alerts you about potential cash flow issues, or reminds you about pending approvals. As Xero continues to develop JAX's capabilities, they're focusing on making accounting workflows more intuitive and proactive.

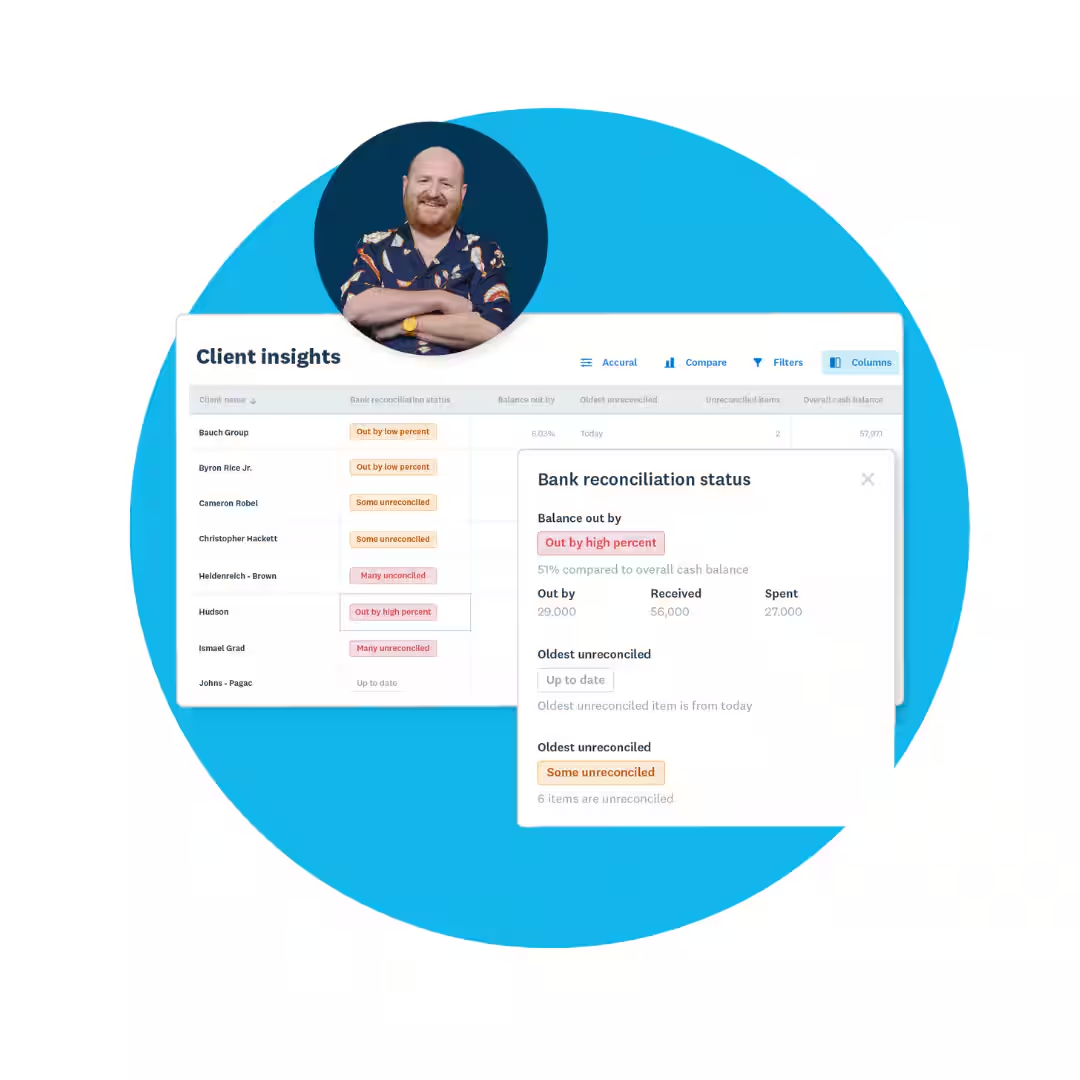

2. AI-powered bank reconciliation

This system learns from your reconciliation history to predict and suggest matches between bank transactions and your accounting records.

Key capabilities include:

- Learning from your past reconciliation patterns to improve matching accuracy

- Cross-referencing incoming payments against outstanding invoices

- Identifying and flagging unusual transactions that don't match typical patterns

- Suggesting transaction categories based on historical data

- Automating recurring transaction matching

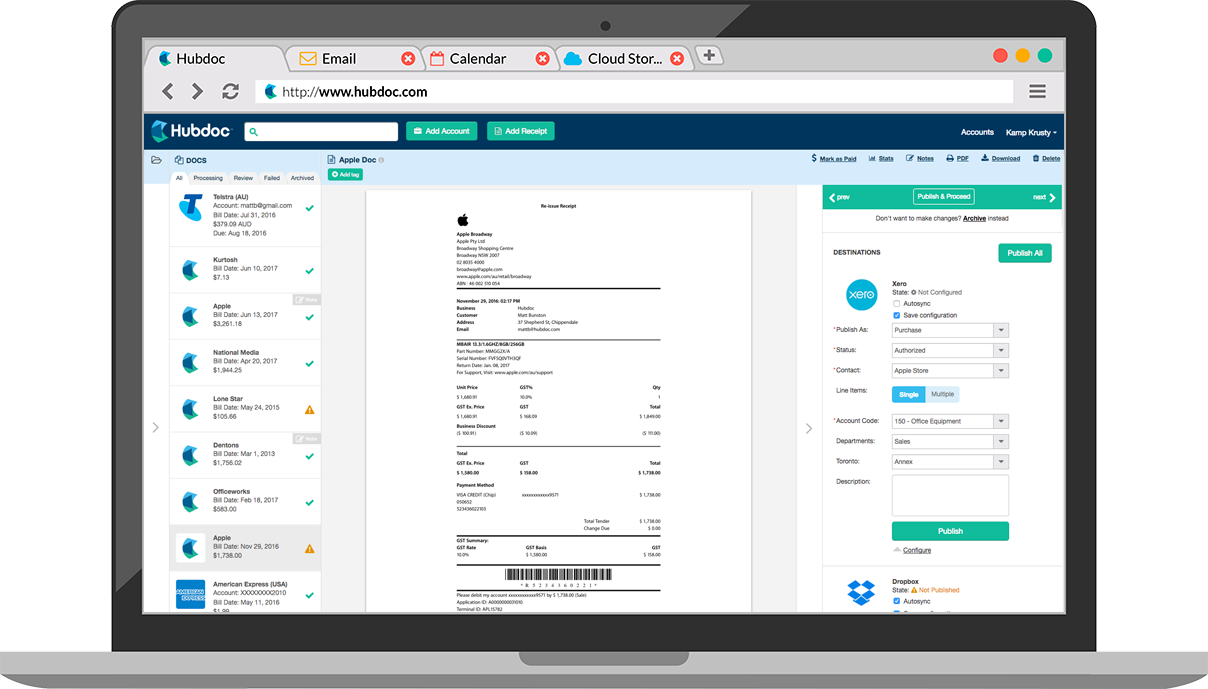

3. Smart data extraction

Xero's Hubdoc tool can automatically extract transaction data from bank statements and receipts and integrate it into your accounting records. The system can process multiple statement formats, identifying key information like dates, amounts, and transaction types.

The AI validates extracted data against existing records, flagging any discrepancies that need human attention. This means you spend less time on data entry and more time on ensuring your financial records are accurate.

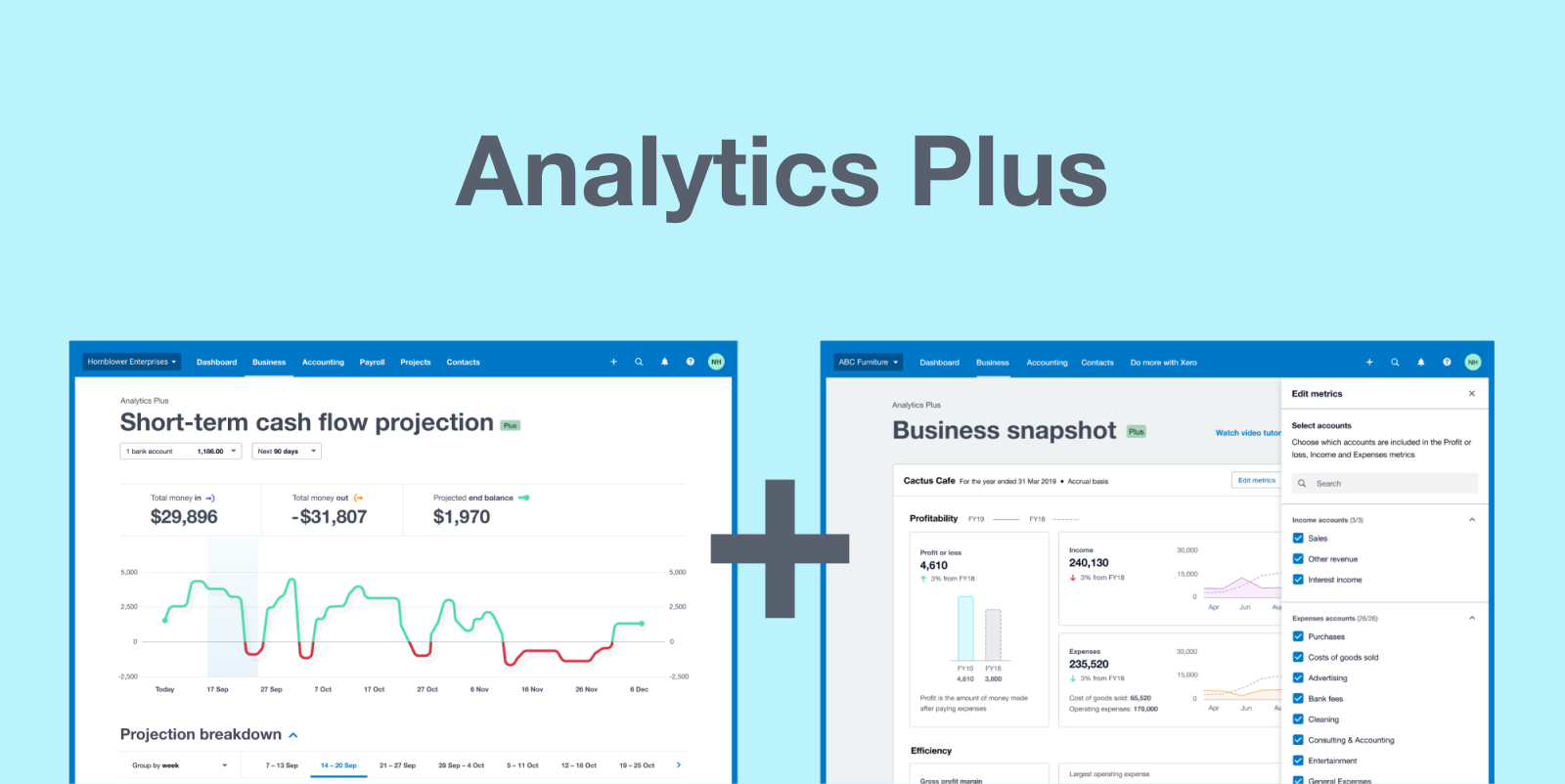

4. Analytics Plus

It brings AI-driven insights to your financial data. Instead of spending hours analyzing spreadsheets, you get automatic forecasts based on your actual business data.

Key features include:

- Cash flow projections using your real invoice and bill data

- Short-term cash position monitoring

- Tracking of upcoming payments and bills

- Business performance monitoring

The power lies in how it uses your actual business data. It analyzes everything from your invoices and bills to bank transactions to provide these insights. This means you're getting predictions based on your business's real patterns, not just generic forecasts.

5. AI-powered support

Xero's integration of GenAI into their help center, Xero Central, has transformed how users find answers. Instead of scrolling through help articles, you can now ask questions in plain language and get relevant answers drawn from Xero's support documentation.

It can help reduce average search time and decrease support requests needing additional help. The best part is that it offers personalized responses based on your role (business owner, accountant, or bookkeeper and provides answers generated from verified support content.

The system understands context and can piece together information from multiple support articles to give you comprehensive answers.

6. Xero Expenses

Xero Expenses uses AI to automate the expense management workflow. It streamlines expense processing by scanning and reading receipts in real-time through your mobile camera and extracting key data points with high accuracy. It can detect item descriptions and categories, purchase amounts and currencies, tax calculations and components, vendor information, and payment methods.

It learns from your expense patterns to suggest classifications, matching expenses to bank transactions automatically. It can even create expense reports based on your customized rules.

While Xero's native AI features handle many day-to-day tasks effectively, some businesses need more advanced automation for their accounting workflows. This is where specialized AI tools can make a significant difference.

[Image source: Xero's official website]

How to expand Xero’s AI capabilities?

Xero offers a solid foundation for digital accounting. It helps automate reconciliation, capture receipts, and streamline other everyday finance tasks. But if your workflow includes high invoice volumes, complex approvals, or strict PO matching, there’s room to go even further.

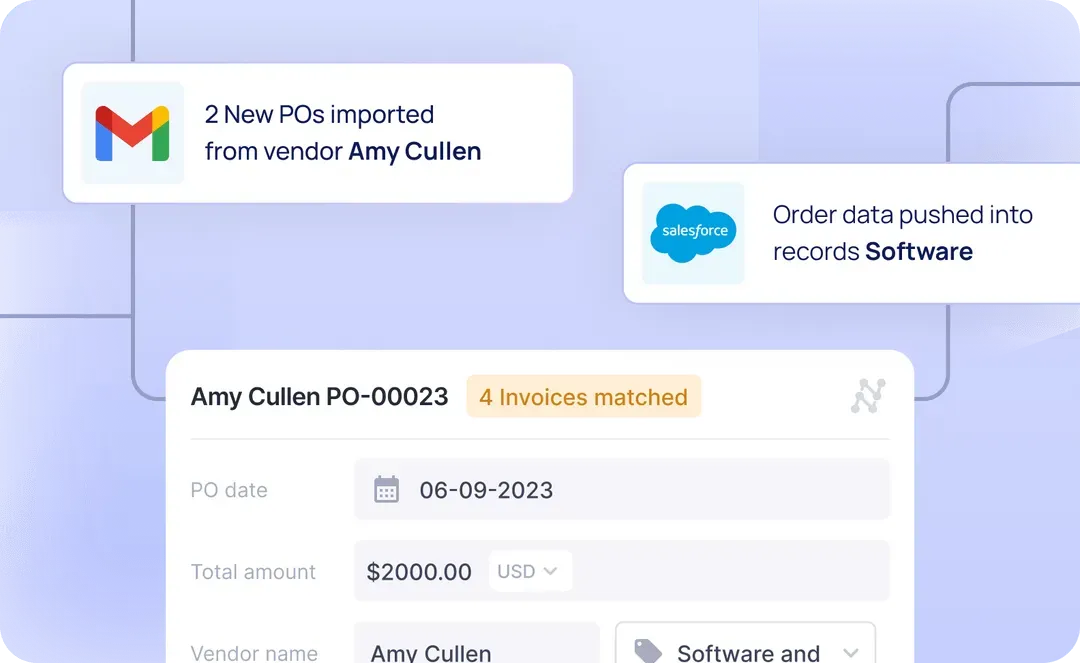

That’s where Nanonets fits in. Nanonets connects directly to your existing Xero account. It doesn't disrupt your team’s routine. You can keep working in Xero as Nanonets quietly handles the heavy lifting in the background: automating document intake, data capture, approvals, and syncing everything back to Xero, fully mapped and ready to go. It just builds on Xero's AI and automation capabilities without any added hassle.

Here's how Nanonets enhances the accounts payable workflow. I will also share the implementation steps involved in each stage.

1. Automate document intake

Tired of dragging files around or sorting through your inbox? With Nanonets, you can have every invoice, PO, or receipt sent straight from your finance mailbox, cloud drive, or even your vendor portal.

The AI also sorts the uploaded document automatically. It sends invoices to the right workflow, routing POs for matching, and removing junk or duplicates before they ever hit your queue.

If your invoices are in your email, just set up email auto-forwarding like in the video above. Nanonets’ classifier model reads every document and decides what’s worth processing. No more manual sorting.

You don’t have to touch every document. The right files go to the right place, every time. You save hours and eliminate mistakes.

2. Advanced data extraction with learning

Every invoice is different, but that shouldn’t slow you down. Nanonets’ AI accurately extracts all the details you need, be it your line items, tax, vendor, GL codes. The system extracts 60+ fields and syncs with Xero in real time.

Integrate Nanonets with your Xero instance beforehand to ensure it automatically fetches or matches from the master data. If something’s missing or wrong, just correct it. The AI remembers, so next time, it gets it right.

In the end, it reduces manual entry and error rates, while the extraction keeps improving to fit your unique documents.

3. Automated PO matching and exception handling

PO matching is tedious, but it’s essential for catching overbilling or errors. Nanonets automates this by pulling in your POs, matching them to invoices, and flagging any mismatches in price, quantity, or description. You get a side-by-side view and can resolve issues on the spot.

The AI matches POs and invoices, flags discrepancies, and brings exceptions to your attention. You catch and resolve discrepancies early, so only clean, accurate data flows into Xero.

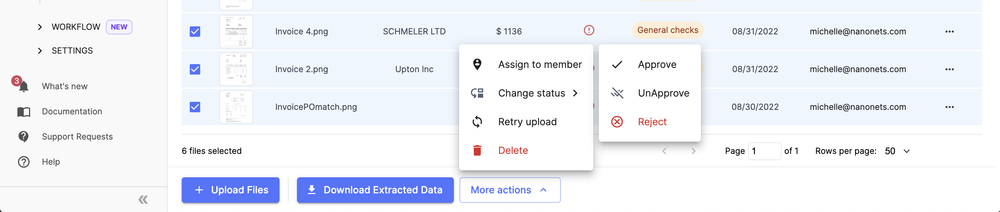

4. Configurable approval workflows

Approvals shouldn’t mean endless email chains or lost paperwork. Nanonets lets you build approval flows that fit your business: route by amount, department, or vendor, and send notifications via Slack, Teams, or email. Approvers get a direct link, can review, approve, or comment, and everything is tracked.

Set up rules for who needs to approve what. The system moves files through each stage, notifies the right people, and logs every action. No more bottlenecks or confusion. Approvals happen fast, with a clear trail for compliance.

5. Sync data to Xero

Re-entering approved invoice data into Xero doubles the work and introduces errors. Nanonets eliminates this step entirely. Upon approval, all invoice data—including GL codes, tax information, and line items—syncs directly to Xero. The original document is attached for reference.

This automated workflow maintains data integrity between systems and provides complete documentation. Your books will stay current without manual data entry, and month-end closing becomes significantly faster.

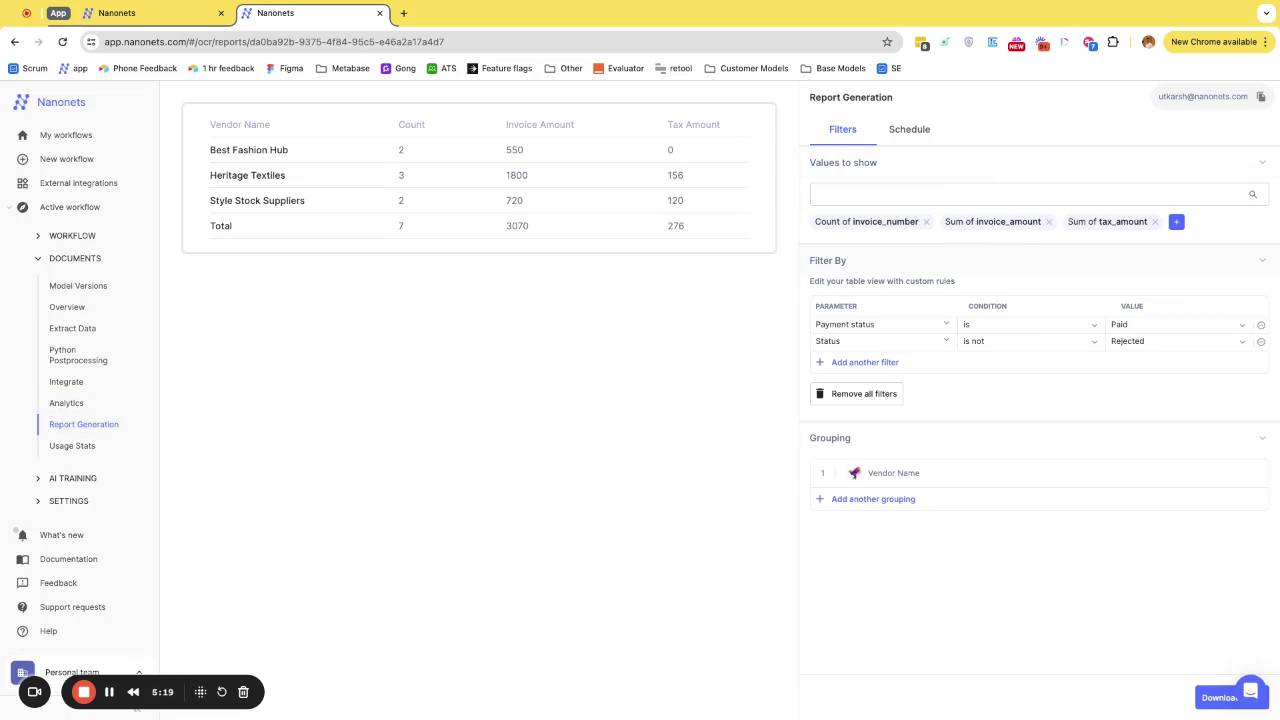

6. Real-time reporting

Want to know where things stand? Nanonets gives you dashboards and reports on invoice status, bottlenecks, aging, and even cash flow forecasts. Ask a question in plain English—like “show top vendors by spend”—and get an answer, not just a spreadsheet.

The system aggregates all your workflow data and gives you real-time analytics, including natural language queries. You always know what’s happening, can spot issues early, and make smarter decisions—without waiting for month-end.

The entire cycle completes in under ~2 hours, compared to traditional 2-3 day processing times.

Final thoughts

Artificial intelligence is reshaping accounting, and the combination of Xero's native AI with Nanonets' specialized automation creates a powerful solution for modern finance teams. This integration doesn't just save time – it dramatically improves how your team handles accounts payable, reducing processing costs while improving accuracy and control.

Ready to see how AI can improve your AP workflow? Book a personalized demo to learn how Nanonets process your actual invoices in real-time. Our team will walk you through each step, from document capture to Xero integration, using your own documents.

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Luis_Moreira_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_imageBROKER.com_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![This app turns your Apple Watch into a Game Boy [Hands-on]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/FI-Arc-emulator.jpg.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Google TV is finally preparing sleep timer support as app readies Material 3 Expressive [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/01/google-tv-logo.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Official Trailer for 'Smoke' Starring Taron Egerton [Video]](https://www.iclarified.com/images/news/97453/97453/97453-640.jpg)

![Apple's M4 Mac Mini Drops to $488.63, New Lowest Price Ever [Deal]](https://www.iclarified.com/images/news/97456/97456/97456-1280.jpg)

![iPhone 16 Becomes World's Best-Selling Smartphone in Q1 2025 [Chart]](https://www.iclarified.com/images/news/97448/97448/97448-640.jpg)