It’s Official: Informatica Agrees to Be Bought by Salesforce for $8 Billion

It’s been 13 months since Salesforce and Informatica called off their first attempt at an acquisition. But the second time appears to be the charm, as Informatica on Tuesday announced that Salesforce will buy it for $8 billion. Informatica was founded in 1993 ago to serve the burgeoning market for data integration tools, in particular the need for extract, transformation, and load (ETL) tools for early data warehouses. Companies at the time needed to pull transactional data out of mainframes, midrange, and Unix systems, transform the data into a suitable format, and then load it into their analytical database. As the years went by, Informatica became known as the gold standard for ETL tools among the Fortune 500. It added a variety of other data management tools that addressed data quality, master data management, data security, metadata management, and change data capture (CDC) over the years. More recently, the company has made a concerted effort to push its suite of tools into the cloud, via its Intelligent Data Management Cloud (IDMC) offering. It has also adopted generative AI capabilities in its products to make them easier to use, and also adapted its software to enable its customers to more easily prepare data for their own GenAI projects. As GenAI exploded upon the scene, there has been a collective recognition about the importance of good data management, as well as a realization that past data management efforts have fallen short. The organizations that invested in data management early found their data more readily amenable to being used to train, fine-tune, and serve into GenAI models and applications, while those that didn’t make those investments have scrambled to get their data in shape to better address the dueling risks and rewards of GenAI. Salesforce is buying Informatica against this backdrop of a resurgence in data management. The enterprise software giant got its start as cloud alternative to on-prem CRM systems of the day, such as those sold by Siebel Systems and Oracle. Today, the company provides a range of enterprise software capabilities, and is using that strength to push into the world of GenAI and agentic AI. The agreement terms call for Salesforce to acquire all outstanding shares of Informatica’s common stock that it does not already own. Salesforce is paying $25 per share, which represents a 30% premium on the closing price of Informatica’s stock on May 22. That brings the total of the deal to about $8 billion, or about $2 billion less than deal that was scuttled last April. The deal is subject to closing conditions and regulatory approval, and is expected to be complete by the beginning of Informatica’s 2027 fiscal year, which starts in February. Informatica CEO Amit Walia said he’s looking forward to the acquisition. “Joining forces with Salesforce represents a significant leap forward in our journey to bring data and AI to life by empowering businesses with the transformative power of their most critical asset–their data,” Walia stated. “We have a shared vision for how we can help organizations harness the full value of their data in the AI era.” Salesforce CEO Marc Benioff said the addition of Informatica will give Salesforce the top agent-ready data platform in the industry. “By uniting the power of Data Cloud, MuleSoft, and Tableau with Informatica’s industry-leading, advanced data management capabilities, we will enable autonomous agents to deliver smarter, safer, and more scalable outcomes for every company, and significantly strengthen our position in the $150 billion-plus enterprise data market.” It’s unclear how Informatica’s existing customer base will greet the acquisition. Large enterprises often look to third-party software vendors to give them cross-platform capabilities that go above and beyond the capabilities that major data platform providers make for their own products. This is especially true when it comes to capabilities such as application integration, data integration, data catalogs, data security, and data governance that touch multiple cloud providers, such as Google Cloud, AWS, and Salesforce. Informatica recognized $404 million in revenue for the first quarter of fiscal year 2026. The company says it had annual recurring revenue (ARR) of $1.7 billion and cloud ARR of $848 billion. It says it has more than 5,500 customers, including more than 500 on CLAIRE, its AI platform. Informatica originally went public in 1999 on the NASDAQ under the ticker symbol INFA. In 2015, the company agreed to go private after a group led by Permira and the Canada Pension Plan Investment Board in a deal valued at $5.3 billion. In October 2021, the company went public for a second time, this time with an IPO on the New York Stock Exchange. Its stock traded for $29 after two days, giving it a market cap of about $8 billion. After reaching a high of $37 per share in April 2024, the stock had fallen under $17 in April 2025. This article first appeared on BigDATAwire.

It’s been 13 months since Salesforce and Informatica called off their first attempt at an acquisition. But the second time appears to be the charm, as Informatica on Tuesday announced that Salesforce will buy it for $8 billion.

Informatica was founded in 1993 ago to serve the burgeoning market for data integration tools, in particular the need for extract, transformation, and load (ETL) tools for early data warehouses. Companies at the time needed to pull transactional data out of mainframes, midrange, and Unix systems, transform the data into a suitable format, and then load it into their analytical database.

As the years went by, Informatica became known as the gold standard for ETL tools among the Fortune 500. It added a variety of other data management tools that addressed data quality, master data management, data security, metadata management, and change data capture (CDC) over the years.

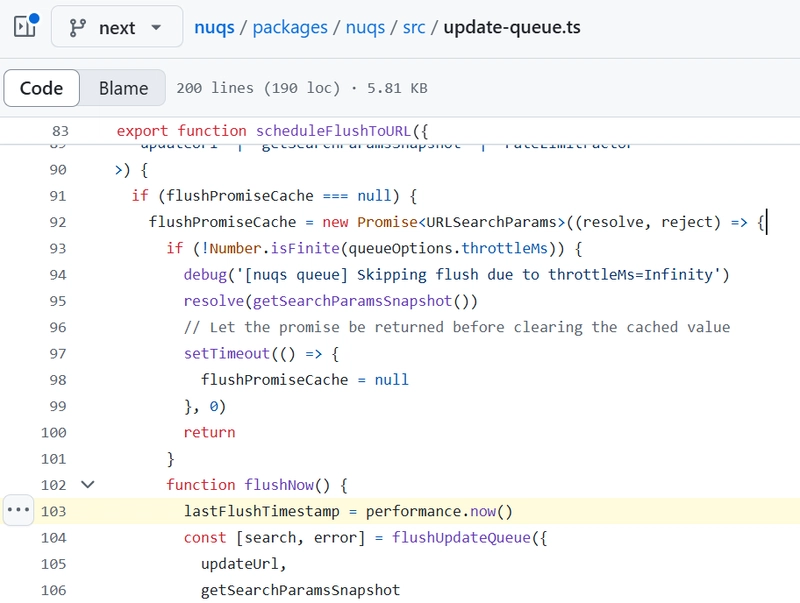

More recently, the company has made a concerted effort to push its suite of tools into the cloud, via its Intelligent Data Management Cloud (IDMC) offering. It has also adopted generative AI capabilities in its products to make them easier to use, and also adapted its software to enable its customers to more easily prepare data for their own GenAI projects.

As GenAI exploded upon the scene, there has been a collective recognition about the importance of good data management, as well as a realization that past data management efforts have fallen short. The organizations that invested in data management early found their data more readily amenable to being used to train, fine-tune, and serve into GenAI models and applications, while those that didn’t make those investments have scrambled to get their data in shape to better address the dueling risks and rewards of GenAI.

Salesforce is buying Informatica against this backdrop of a resurgence in data management. The enterprise software giant got its start as cloud alternative to on-prem CRM systems of the day, such as those sold by Siebel Systems and Oracle. Today, the company provides a range of enterprise software capabilities, and is using that strength to push into the world of GenAI and agentic AI.

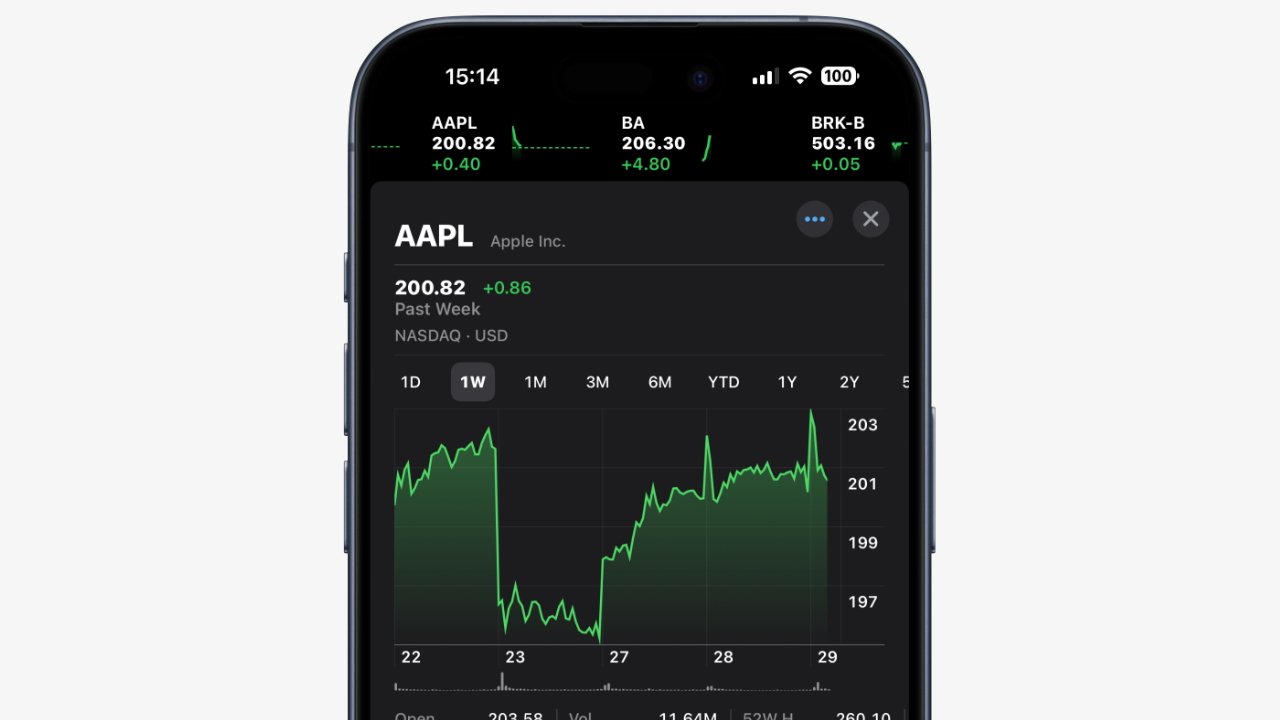

The agreement terms call for Salesforce to acquire all outstanding shares of Informatica’s common stock that it does not already own. Salesforce is paying $25 per share, which represents a 30% premium on the closing price of Informatica’s stock on May 22. That brings the total of the deal to about $8 billion, or about $2 billion less than deal that was scuttled last April. The deal is subject to closing conditions and regulatory approval, and is expected to be complete by the beginning of Informatica’s 2027 fiscal year, which starts in February.

Informatica CEO Amit Walia said he’s looking forward to the acquisition. “Joining forces with Salesforce represents a significant leap forward in our journey to bring data and AI to life by empowering businesses with the transformative power of their most critical asset–their data,” Walia stated. “We have a shared vision for how we can help organizations harness the full value of their data in the AI era.”

Salesforce CEO Marc Benioff said the addition of Informatica will give Salesforce the top agent-ready data platform in the industry. “By uniting the power of Data Cloud, MuleSoft, and Tableau with Informatica’s industry-leading, advanced data management capabilities, we will enable autonomous agents to deliver smarter, safer, and more scalable outcomes for every company, and significantly strengthen our position in the $150 billion-plus enterprise data market.”

It’s unclear how Informatica’s existing customer base will greet the acquisition. Large enterprises often look to third-party software vendors to give them cross-platform capabilities that go above and beyond the capabilities that major data platform providers make for their own products. This is especially true when it comes to capabilities such as application integration, data integration, data catalogs, data security, and data governance that touch multiple cloud providers, such as Google Cloud, AWS, and Salesforce.

Informatica recognized $404 million in revenue for the first quarter of fiscal year 2026. The company says it had annual recurring revenue (ARR) of $1.7 billion and cloud ARR of $848 billion. It says it has more than 5,500 customers, including more than 500 on CLAIRE, its AI platform.

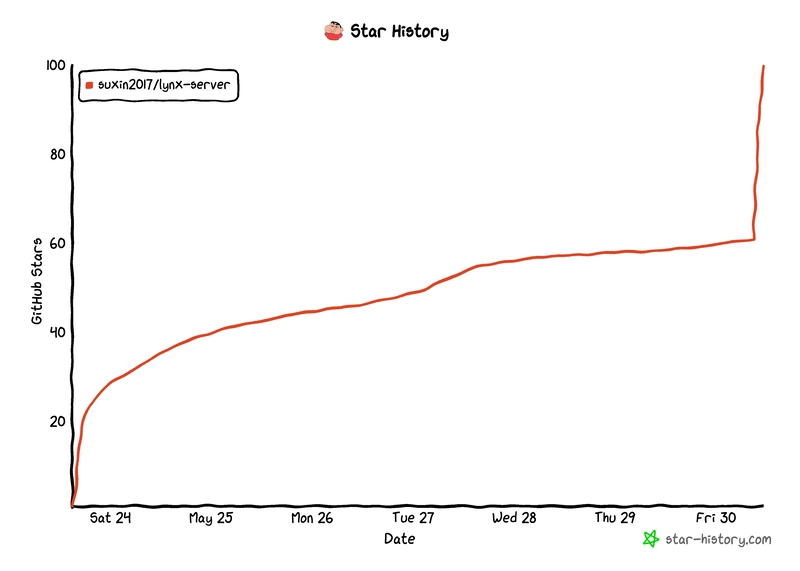

Informatica originally went public in 1999 on the NASDAQ under the ticker symbol INFA. In 2015, the company agreed to go private after a group led by Permira and the Canada Pension Plan Investment Board in a deal valued at $5.3 billion. In October 2021, the company went public for a second time, this time with an IPO on the New York Stock Exchange. Its stock traded for $29 after two days, giving it a market cap of about $8 billion. After reaching a high of $37 per share in April 2024, the stock had fallen under $17 in April 2025.

This article first appeared on BigDATAwire.

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Luis_Moreira_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_imageBROKER.com_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![This app turns your Apple Watch into a Game Boy [Hands-on]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/FI-Arc-emulator.jpg.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Google TV is finally preparing sleep timer support as app readies Material 3 Expressive [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/01/google-tv-logo.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Official Trailer for 'Smoke' Starring Taron Egerton [Video]](https://www.iclarified.com/images/news/97453/97453/97453-640.jpg)

![Apple's M4 Mac Mini Drops to $488.63, New Lowest Price Ever [Deal]](https://www.iclarified.com/images/news/97456/97456/97456-1280.jpg)

![iPhone 16 Becomes World's Best-Selling Smartphone in Q1 2025 [Chart]](https://www.iclarified.com/images/news/97448/97448/97448-640.jpg)