The Dive of Complex AI Agents Plus Their Influence on a Digital Arena

Included within the movement covering the realm of cryptocurrencies are very widespread and dynamic improvements through opportunities posed by new technologies and crowd movements. Of these advances, AI agents are a great asset to implement for investors in digital treasury. Under these particular setups, we will discuss subjects that approach...Read more » The post The Dive of Complex AI Agents Plus Their Influence on a Digital Arena appeared first on Big Data Analytics News.

Included within the movement covering the realm of cryptocurrencies are very widespread and dynamic improvements through opportunities posed by new technologies and crowd movements. Of these advances, AI agents are a great asset to implement for investors in digital treasury. Under these particular setups, we will discuss subjects that approach AI agents in cryptos, functionalities thereof, the comfortable chair they provide, their challenges, and the possible potential they have any time soon for the crypto ecosystem. We shall also address the concerns of AI agents as a necessary component of this thrilling approach.

What are AI agents in cryptocurrency?

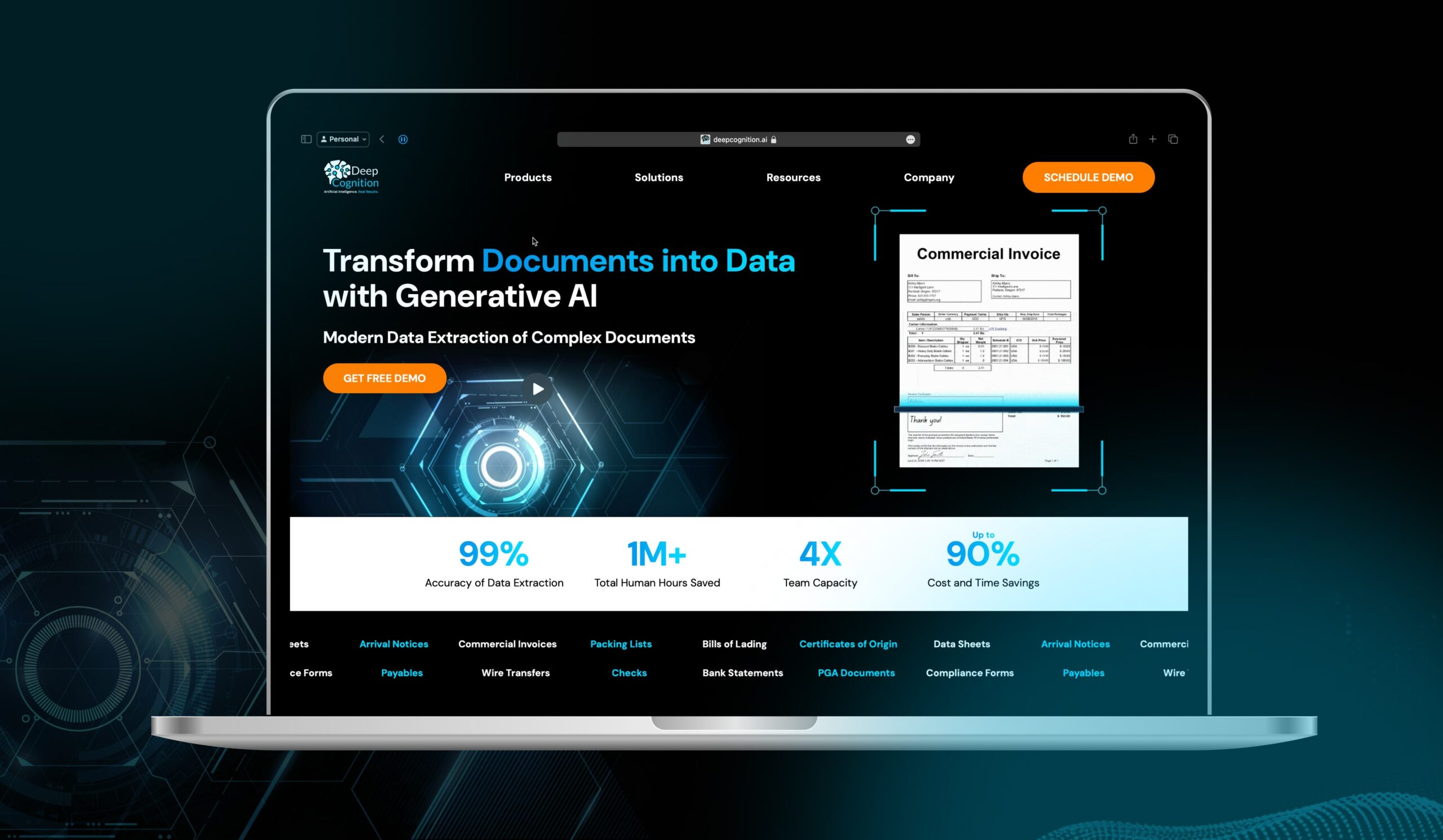

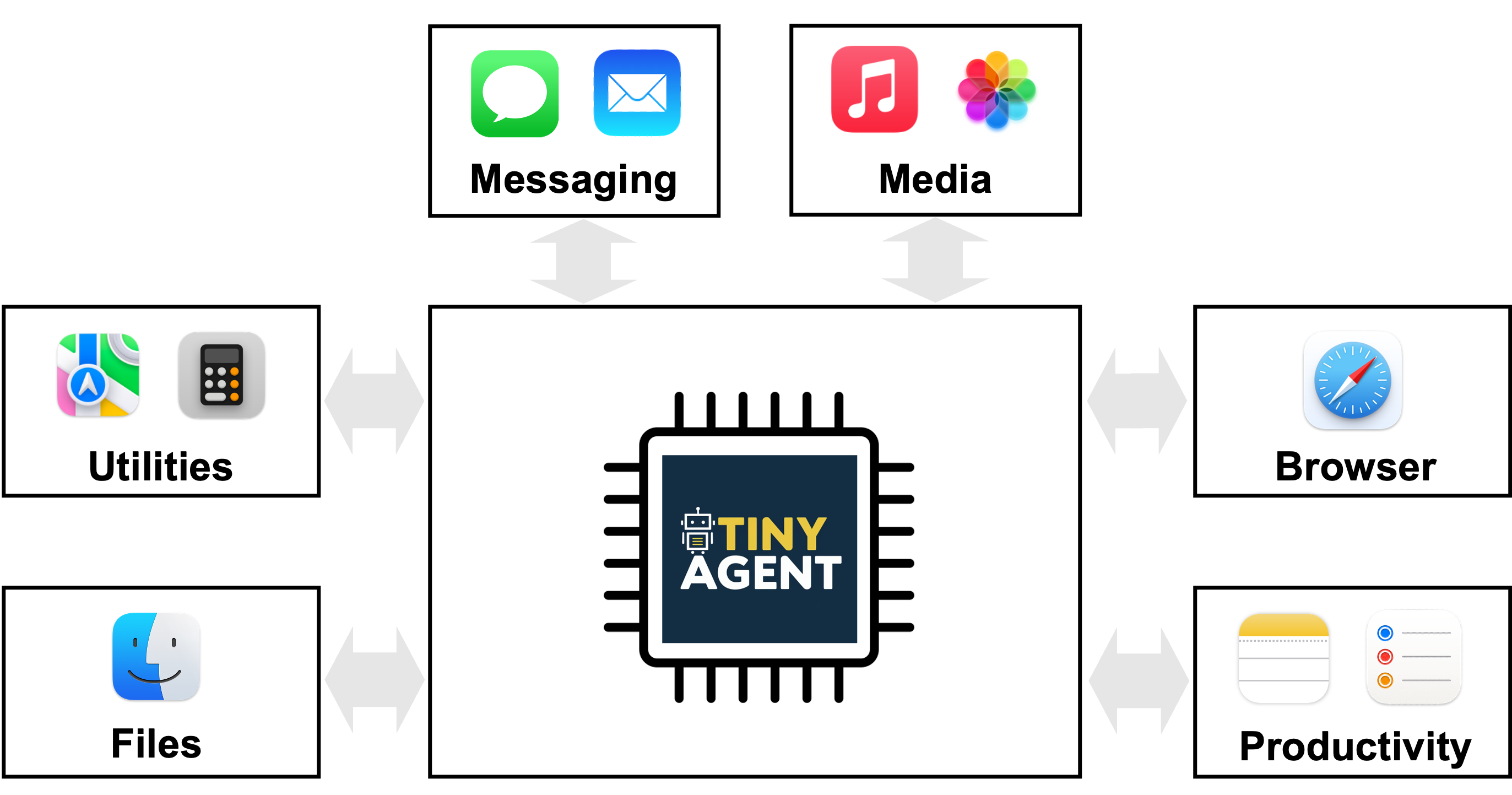

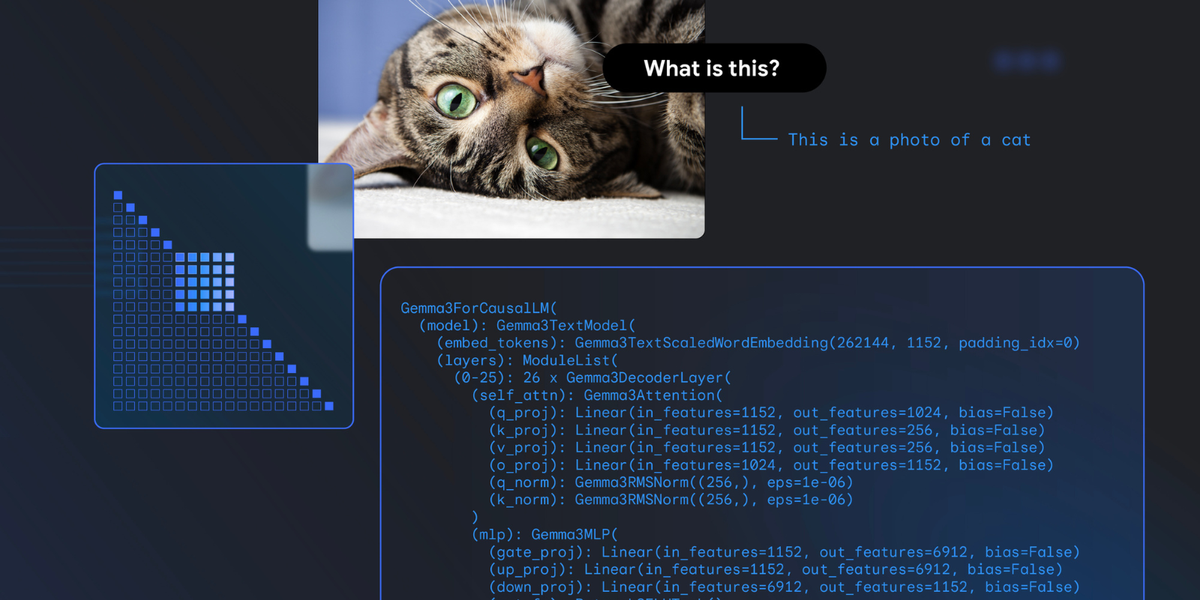

AI agents are software programs that use artificial intelligence to perform several tasks, such as data analysis, decision-making, and automation. In cryptocurrency, these agents are programmed to perform a wide range of tasks, from mining the globe and micro-trading to macro-trading. The analysis is mostly done on high-volume data, which will free the human dealer from spending unnecessary time looking into events happening around the world. Humans learn about AI agents every year, but in 2016, they did not believe that machines could have an incredible impact on the ecosystem.

Key functions of AI agents

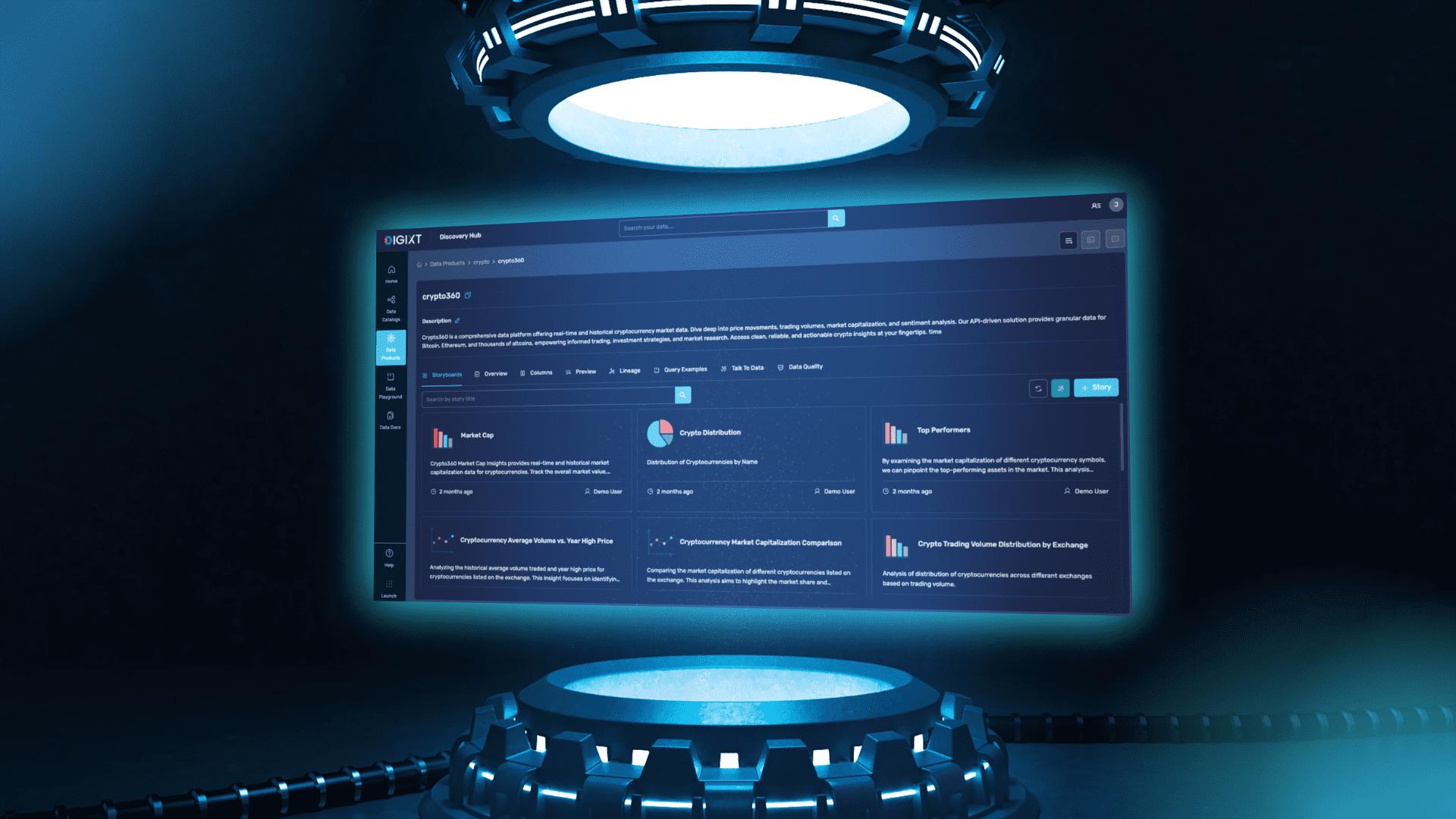

1. Data Analysis and Prediction: AI agents flourish in the location of processing vast datasets with multiple references such as market prices, trading rates, and sentiments expressed in various markets online. A prediction becomes easier when the machines learn from various price patterns and trends, whereas for human financial advisors, loss recovery becomes the norm in other circumstances.

2. Algorithmic Trading: A broader range of AI agents is specifically programmed for algorithmic trading, performing buy and sell orders as per predetermined conditions accompanying trade requests. That would result in fast-paced trading operations that would eliminate the boredom of considering emotions, which always lead to losses.

3. Risk Assessment: AI agents are able to assess the risks of different planned investment strategies. Upon reviewing historical performance and market volatility, AI agents will provide data that assists investors in analyzing and countering potential downside effects on their investments.

4. Portfolio Management: An AI agent whose function is to manage asset allocation appropriately and take advantage of the capabilities of the modern web to obliterate asset management. AI agents can automatically rebalance portfolio assets based on certain market conditions and investor preferences. Thus, such automation would allow investors to manage a diversified portfolio without the need for constant manual rebalancing.

Benefits of AI Agents in Crypto

Integrating AI agents into the domain of cryptocurrencies yields a trove of benefits, with a fair few profound:

1. Improved Trading Efficiency

AI agents’ speed at dissecting data and executing trades far exceeds that of any human trader. This attribute is critical in the rapidly evolving cryptocurrency world, as market conditions rapidly morph in seconds. By delegating trading to an automated system, investors are able to pounce on trading incentives that occur while they step away from the screen.

2. Improvement to Decision-Making:

Providing emotions, AI agents always carry out their actions based on insights and data. The generations of discrimination, esteem, devaluation, desire, and aversion would remain barely possible for a meeting of an associate. Multifaceted incentive generation allows traders to trust their motion based on outcomes, giving them full opportunities to generate rational, profitable trading strategies, improving the total return on investment.

3. Market Continuity:

Continuous trading of crypto action never stops. How can it be expected from a trader to watch trading activities round the day due to market variance? AI agents may supervise the market’s existence 24/7, thus making sure opportunities are not left idle.

4. Retail Investor Level:

With the globalization of residential technologies, it has widened the application of AI agents, making them accessible to retail investors who usually spot lukewarm areas for their inner trades.

The Challenges Faced by AI Agents in Crypto.

However beneficial AI agents may be in cryptocurrencies, they face several challenges that should be addressed:

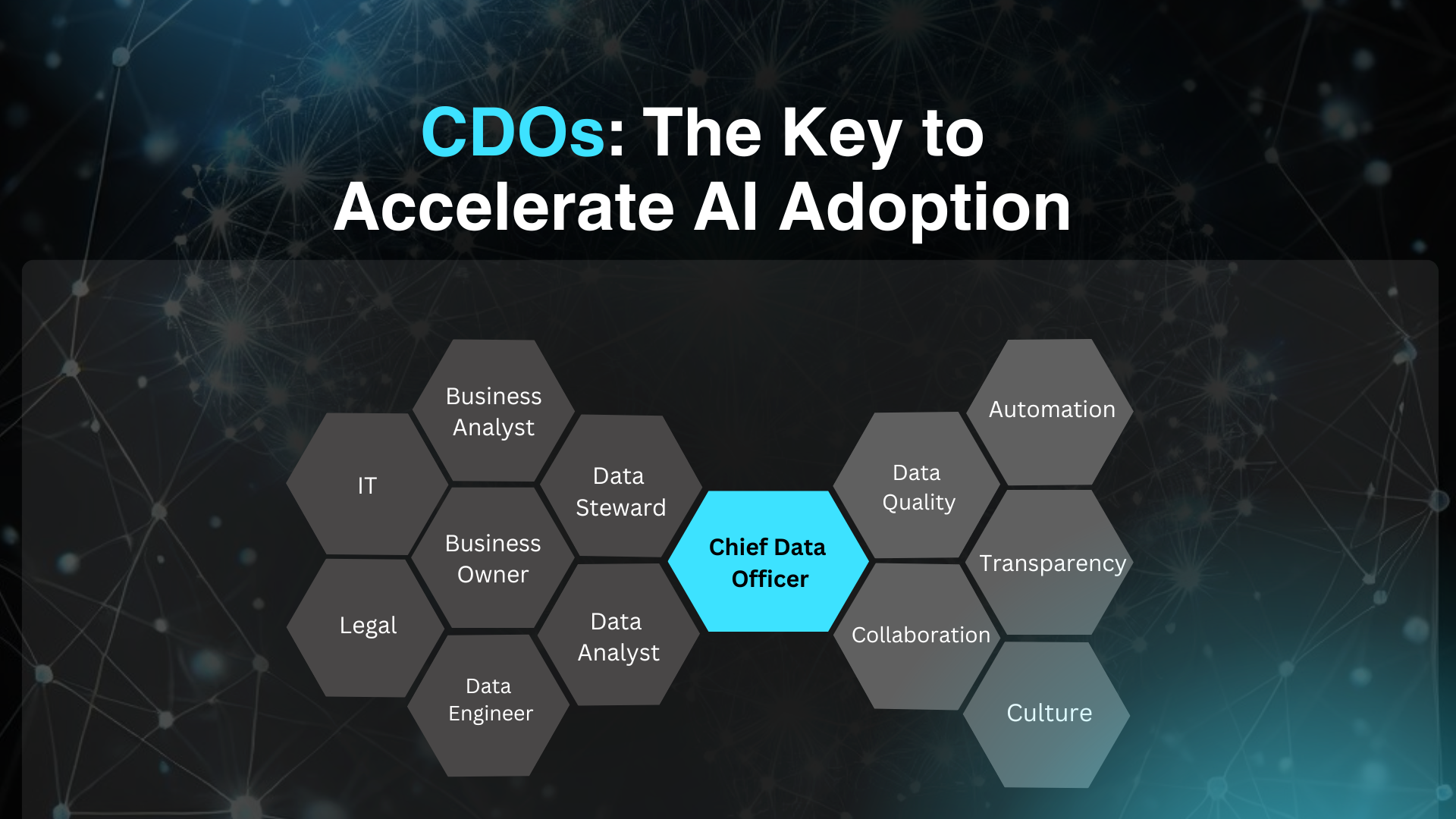

1. Data Quality

AI agents are only effective when the data they run on is quality-controlled. Make do with bad data, and your AI misses the point of predicting an eccentrically objective outcome that leads to a poor decision. Superior and trustworthy data are necessary for AI agents to become a vessel for success.

2. Market Volatility

Market volatility in cryptocurrencies is too large, making it hard for AI agents to accurately predict the market value. Market upheaval can involve long loss in case the AI agent’s algorithm fails badly to take care of unexpected activity.

3. Regulatory Concerns

However, given their increased importance mostly in the domain of crypto, increased state supervision will inhibit regime; developers and users must navigate an unusual compliance depositors’ landscape to AI realization.

4. Technical Limitations

AI is still just so much better thus far, and in all certainty, it is still not faultless. Technical grounding for such often results in results of technical oddities, system failures, or programmatic errors. R&D and experimentation will all be necessary in a quest to ensure the reliability of AI agents.

The Future of AI Agents in Cryptocurrency

The future of AI agents will be an exciting one in the cryptocurrency market as technology continues to evolve. Here are some trends and developments worth keeping an eye on:

1. Integration with Decentralized Finance (DeFi)

AI agents are expected to play a vital role in automating and optimizing numerous DeFi protocols as DeFi experiences a rise in popularity. They could indeed add their muscle to smart contracts, enabling the investors to devise strategies for lending, borrowing, or yield farming.

2. The Emergence of AI Agent Coins

The emergence of AI agent coins opens up a new field of play within the cryptocurrency market. These tokens are quite different from AI itself and simply support the AI-driven projects or platforms, thereby creating an ecosystem where investors may engage in the growth of AI technology within the crypto space. The coins themselves will be used for transactions, incentives for developers, or rewards to users who contribute to the platforms.

3. Higher Personalization

The evolution of AI agents has given rise to the proposed level of AI sophistication—henceforth, greater personalization of investment strategies, individualized according to the preference and level of risk tolerance characteristic of each investor. This will give the investors ample power to inform and assert a position for themselves regarding what approaches collectively they and the AI can make that would lead them toward their financial objectives.

4. Working alongside Traditional Finance

The integration of AI agents in crypto may result in collaborations between traditional financial systems and cryptocurrency platforms. As the traditional financial sector begins to explore DLT, AI agents could smooth out transactions and increase market efficiency.

Conclusion

AI crypto agents are said to revamp the cryptocurrency ecosystem by providing cutting-edge tools for data analysis, trading, and risk control. There are challenges like data quality and market volatility, but the advantages of AI operations are huge. And as technology grows and associates with DeFi and other trends, AI agents are going to be equally vital in sculpting the new frontier of the crypto world. In the case of AI agent coins, investors can now partake in the AI development ecosystem, opening up new possibilities for more innovatively efficient digital ecosystems. By using AI synchronization, institutions and individuals can navigate the “grey” areas of the crypto market, thus making decisions entailing significant investment and growth needs.

The post The Dive of Complex AI Agents Plus Their Influence on a Digital Arena appeared first on Big Data Analytics News.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Microsoft 365: 1-Year Subscription (Family/Up to 6 Users) (23% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

.jpg?#)

.jpg?#)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Alleged iPhone 17-19 Roadmap Leaked: Foldables and Spring Launches Ahead [Kuo]](https://www.iclarified.com/images/news/97214/97214/97214-640.jpg)

![New Apple iPad mini 7 On Sale for $399! [Lowest Price Ever]](https://www.iclarified.com/images/news/96096/96096/96096-640.jpg)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)