The Future of AI in ESG Investing

The Future of AI in ESG Investing As an investor, I’m always on the lookout for smarter, more impactful strategies. Over the years, ESG investing—focusing on Environmental, Social, and Governance factors—has emerged as a way to generate long-term value while addressing global challenges. The integration of artificial intelligence (AI) into this space is a game-changer. In this article, we’ll explore how AI in sustainable investing, ethical AI in investing, and AI in behavioral finance are shaping the future of ESG investing. Understanding ESG Investing ESG investing incorporates three main factors: Environmental: How companies handle their environmental footprint (e.g., carbon emissions, […]

The Future of AI in ESG Investing

As an investor, I’m always on the lookout for smarter, more impactful strategies. Over the years, ESG investing—focusing on Environmental, Social, and Governance factors—has emerged as a way to generate long-term value while addressing global challenges. The integration of artificial intelligence (AI) into this space is a game-changer. In this article, we’ll explore how AI in sustainable investing, ethical AI in investing, and AI in behavioral finance are shaping the future of ESG investing.

Table of Contents

Understanding ESG Investing

ESG investing incorporates three main factors:

- Environmental: How companies handle their environmental footprint (e.g., carbon emissions, energy use).

- Social: How companies interact with employees, customers, and communities.

- Governance: How companies are managed, including board composition and ethical practices.

ESG investing has grown rapidly as investors increasingly seek long-term, sustainable returns. But it also comes with challenges, such as inconsistent data and the potential for greenwashing. This is where AI comes in.

The Current State of ESG Investing

The growth of ESG investing has been remarkable, with trillions of dollars flowing into ESG-focused assets. Yet, challenges remain:

- Data Accuracy: ESG data is often fragmented and inconsistent. AI can standardize and verify this data, making it more reliable.

- Greenwashing: AI tools can identify inconsistencies between companies’ ESG claims and actual practices.

- Regulatory Changes: AI helps investors track regulatory shifts and adapt investment strategies accordingly.

Despite these challenges, ESG investments are performing well, and AI is playing a crucial role in addressing these issues.

How AI is Being Applied to ESG Investing

AI is transforming ESG investing in key areas:

- AI-Powered ESG Data Analysis: AI can rapidly process large volumes of ESG data from diverse sources like company reports, news, and social media. This increases efficiency and accuracy in assessing ESG performance. AI can even conduct sentiment analysis to gauge public opinion about a company’s ESG efforts.

- AI for Risk Assessment: AI helps investors identify ESG-related risks, such as environmental damage or poor labor practices. AI tools can predict how these risks might affect a company’s future performance.

- AI-Driven Portfolio Management: AI can optimize ESG portfolios by recommending investments that align with sustainability goals. It allows for more dynamic and responsive portfolio adjustments based on real-time ESG data.

- Automation in ESG Reporting: AI simplifies ESG reporting by automating the aggregation and analysis of ESG data, ensuring timely and accurate reports that meet regulatory requirements.

Key Benefits of AI in ESG Investing

AI brings significant advantages to ESG investors:

- Improved Efficiency: AI accelerates data processing and reduces manual efforts, saving investors valuable time.

- Enhanced Accuracy and Objectivity: By removing human biases, ethical AI in investing ensures that ESG evaluations are based on objective data, providing more reliable results.

- Real-Time Monitoring: AI tools can continuously monitor ESG factors, allowing investors to adjust their portfolios based on up-to-date information.

- Better Risk Management: AI can predict ESG-related risks, enabling investors to take proactive measures to safeguard their portfolios.

Challenges and Limitations of AI in ESG Investing

Despite its potential, AI in ESG investing faces challenges:

- Data Quality: AI relies on high-quality data, but ESG data is often incomplete or inaccurate. This can limit the effectiveness of AI models.

- Transparency and Accountability: While AI provides more objectivity, the algorithms themselves need to be transparent. Ensuring ethical AI in investing requires clear accountability in how these tools are built and tested.

- Regulatory Concerns: As AI adoption grows, so does the need for regulations that ensure AI is used ethically and responsibly in ESG investing.

- Over-Reliance on Technology: AI should complement, not replace, human judgment. Balancing AI insights with human expertise is key for successful ESG investing.

The Role of AI in Addressing Global ESG Challenges

AI can play a pivotal role in tackling global ESG challenges:

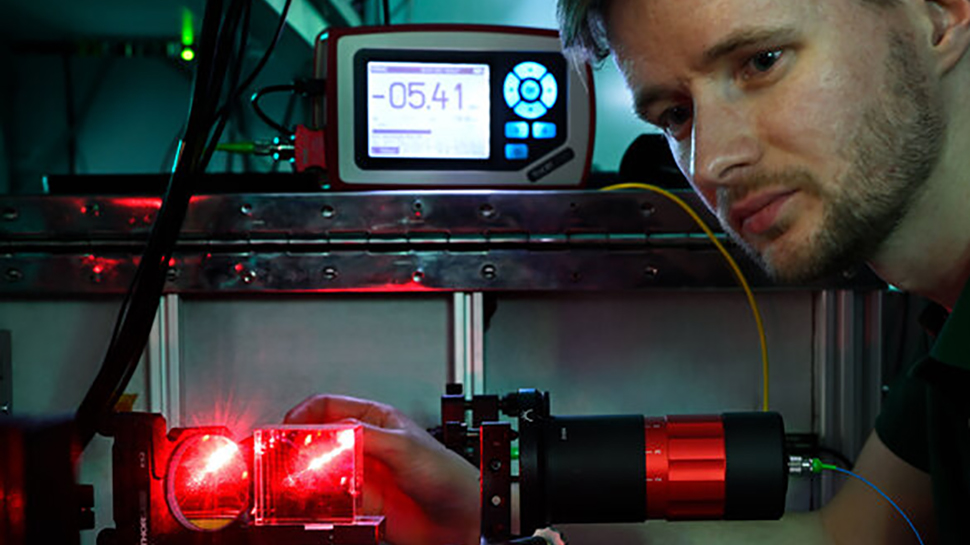

- Climate Change: AI helps assess the financial risks of climate change and identifies companies that are leading sustainability efforts. Predictive models enable investors to prepare for climate-related disruptions.

- Social Impact and Governance: AI tools can assess social issues like labor conditions and corporate governance, providing data-driven insights to guide investment decisions.

- Socially Responsible Investing: AI streamlines AI in sustainable investing, enabling investors to focus on companies that align with their values, from reducing carbon footprints to improving social equity.

The Future of AI in ESG Investing

The future of AI in ESG investing looks promising, with several trends shaping its trajectory:

- AI and Blockchain Integration: Combining AI with blockchain could enhance the transparency and security of ESG data, making it more reliable and accessible.

- Predictive and Prescriptive Analytics: In the future, AI will offer predictive insights into ESG trends and provide actionable recommendations for better investment decisions.

- Global ESG Standards: AI can help develop standardized ESG metrics that align with global regulatory frameworks, providing consistency in ESG reporting.

- Synergy with Traditional ESG Practices: AI will continue to complement traditional ESG approaches, providing advanced data analytics to enhance decision-making.

Case Studies of AI in ESG Investing

Several organizations have already adopted AI to improve ESG investing:

- AI-Powered ESG Ratings: Platforms like Sustainalytics and MSCI use AI to provide more accurate ESG ratings.

- Predictive AI Models: Some investment firms use AI to predict the impact of climate change on specific industries and adjust their portfolios accordingly.

Conclusion

AI is revolutionizing ESG investing by improving efficiency, accuracy, and risk management. As AI technologies continue to evolve, we can expect even greater advances in AI in sustainable investing, ethical AI in investing, and AI in behavioral finance. For investors, leveraging AI today will ensure they remain at the forefront of the future of ESG investing, driving positive change while generating returns.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[FREE EBOOKS] Learn Computer Forensics — 2nd edition, AI and Business Rule Engines for Excel Power Users & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

(1).jpg?#)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)

![Apple to Move Camera to Top Left, Hide Face ID Under Display in iPhone 18 Pro Redesign [Report]](https://www.iclarified.com/images/news/97212/97212/97212-640.jpg)

![Apple Developing Battery Case for iPhone 17 Air Amid Battery Life Concerns [Report]](https://www.iclarified.com/images/news/97208/97208/97208-640.jpg)

![AirPods 4 On Sale for $99 [Lowest Price Ever]](https://www.iclarified.com/images/news/97206/97206/97206-640.jpg)

![[Updated] Samsung’s 65-inch 4K Smart TV Just Crashed to $299 — That’s Cheaper Than an iPad](https://www.androidheadlines.com/wp-content/uploads/2025/05/samsung-du7200.jpg)