Why Manual Data Entry Is Killing Estate Planning Productivity

Drowning in estate planning paperwork? Learn how firms automate document processing to save time, cut errors, and boost productivity.

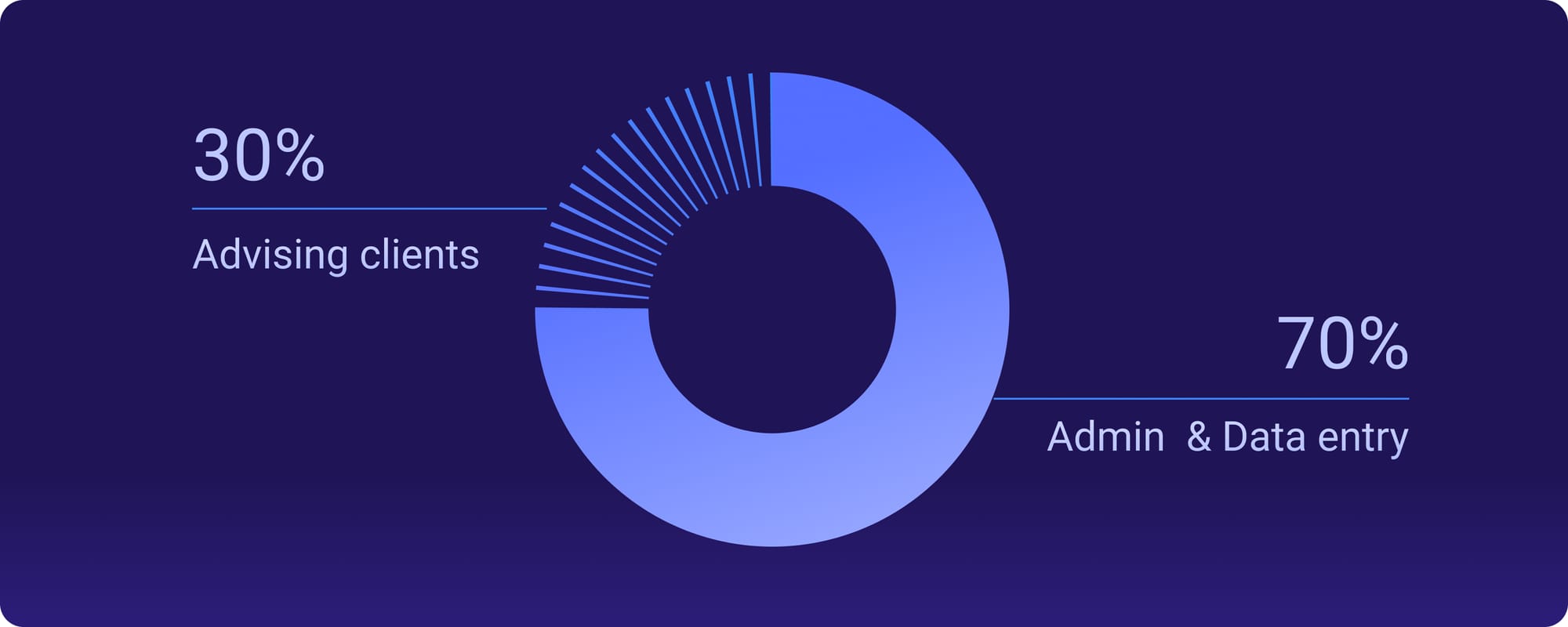

I was on a call recently with a mid-sized estate planning firm in Texas. The lead paralegal told me, "We spend more time entering and cross-checking client data than actually advising clients." And that’s not an isolated complaint. Firms of all sizes are grappling with a problem that feels old-school but continues to eat away at margins: manual data entry.

If you're an estate planning attorney, paralegal, or office admin, you're probably all too familiar with the grind. Dozens of documents per client. Wills, trusts, power of attorney forms, deeds—each packed with critical information. Now multiply that across your client base and add the stress of deadlines, compliance checks, and billing cycles. It's no surprise that manual data entry is more than a nuisance; it's a productivity killer.

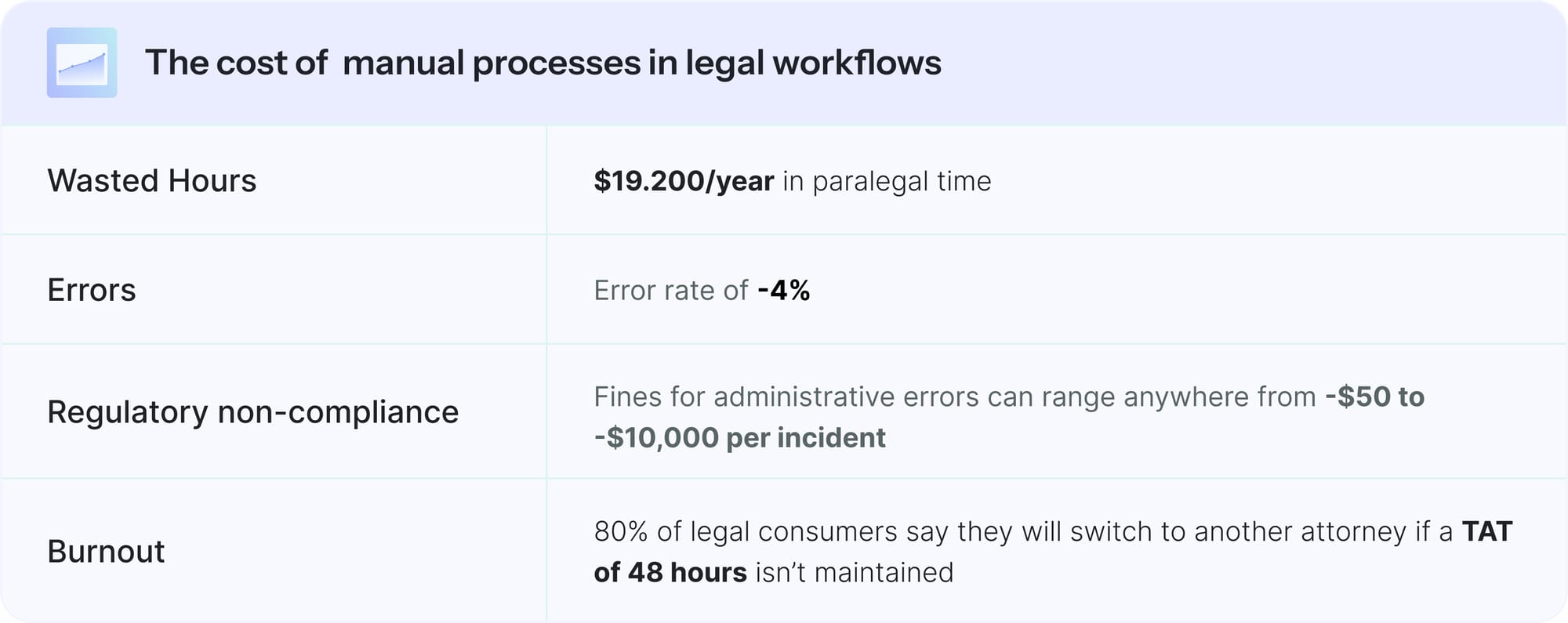

The Hidden Costs of Manual Entry

Manual data entry isn't just about time. It carries tangible costs that add up:

- Wasted hours: Staff spend 4-10 hours per week copying data into CRMs, spreadsheets, or document templates.

- Error rates: Even with double-checking, human error rates can hover around 1-2%. In legal work, a miskeyed name or incorrect date can have real consequences.

- Burnout: Staff frustration rises when highly qualified legal professionals are stuck with clerical work. That leads to turnover, hiring headaches, and training costs.

- Slower client turnaround: Time spent on manual tasks delays case progression and frustrates clients expecting responsiveness.

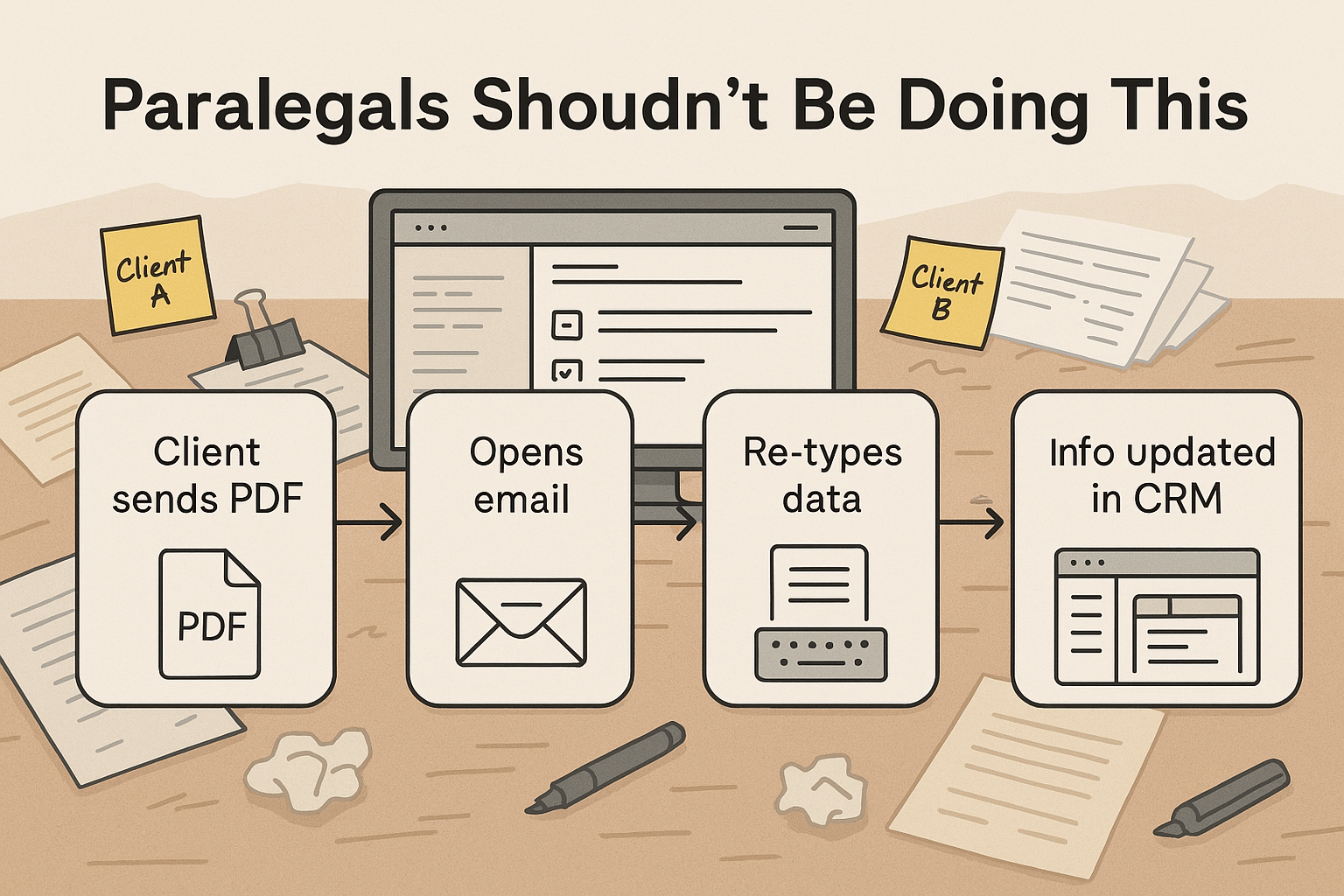

How It Shows Up in Day-to-Day Work

From working with estate planning firms, here are common bottlenecks we see:

- Paralegals toggling between scanned documents and CRMs to retype client names, dates, and trust values.

- Admins renaming and categorizing files manually, with no consistent taxonomy.

- Secretaries cross-referencing case documents to ensure clauses match client instructions.

- Teams spending Friday afternoons uploading data into practice management systems.

These aren’t just anecdotes. They show a broken workflow.

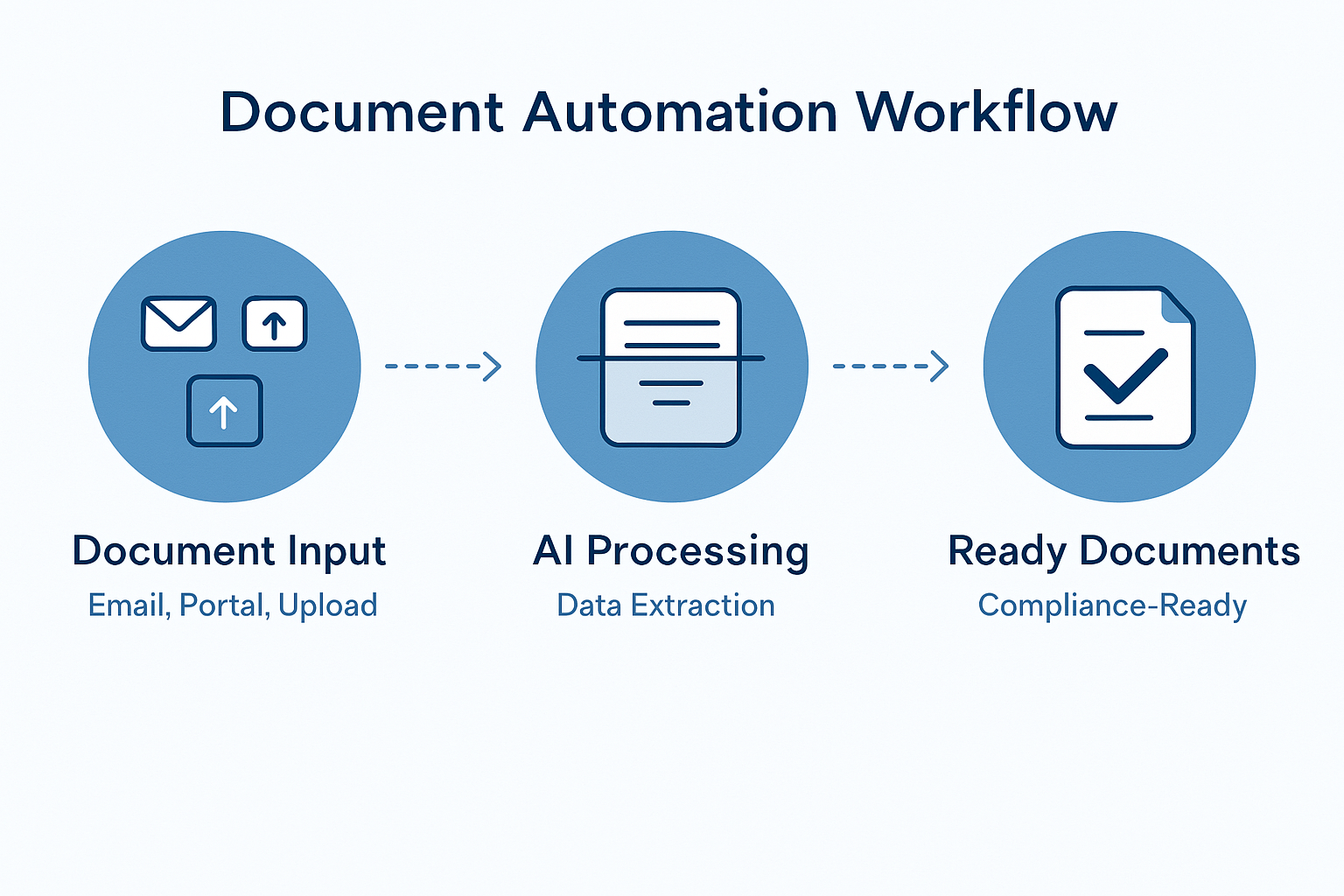

What Automation Could Look Like Instead

Let’s flip the script. Imagine this:

- Client sends documents via email, client portal, or uploads.

- Automation reads every page, identifies names, addresses, financial values, document types, key clauses.

- Data is validated, mapped to your practice templates, and pushed into your CRM or document management tool.

- A ready-to-review draft is delivered to your team—customized and compliance-ready.

It’s not a dream. Estate planning firms are already doing this with Nanonets.

Hear it from one of our client!

"Before Nanonets, processing a single file took over 30 minutes—now it takes less than a minute. We’ve cut errors, reduced staff burnout, and freed up hours each week for actual client conversations."

– Partner, Estate Planning Firm, California

How Nanonets Helps

Nanonets offers an end-to-end automation platform built specifically for document-heavy workflows like estate planning.

Here’s how we solve the problems we've outlined:

- Intelligent OCR and document classification: Automatically detect document types (wills, deeds, POAs) and extract key data from them.

- Custom field extraction: Pull out names, dates, legal clauses, and financial values no matter the format or layout.

- Seamless integrations: Push extracted data directly into your CRM, document management tool, or case management system.

- Audit-friendly workflows: Ensure every step is logged, verifiable, and secure—meeting compliance standards effortlessly.

- No-code customization: Set up your own rules, templates, and logic flows without writing a single line of code.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Laid off but not afraid with X-senior Microsoft Dev MacKevin Fey [Podcast #173]](https://cdn.hashnode.com/res/hashnode/image/upload/v1747965474270/ae29dc33-4231-47b2-afd1-689b3785fb79.png?#)

_MEGHzTK.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-1-52-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![T-Mobile Starlink beta’s list of eligible devices reduced, some phones no longer allowed [UPDATED]](https://m-cdn.phonearena.com/images/article/170719-two/T-Mobile-Starlink-betas-list-of-eligible-devices-reduced-some-phones-no-longer-allowed-UPDATED.jpg?#)

_David_Hall_-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Andriy_Popov_Alamy_Stock_Photo.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

-xl.jpg)

![Xiaomi Tops Wearables Market as Apple Slips to Second in Q1 2025 [Chart]](https://www.iclarified.com/images/news/97417/97417/97417-640.jpg)

![Apple Shares Official Trailer for Season 2 of 'The Buccaneers' [Video]](https://www.iclarified.com/images/news/97414/97414/97414-640.jpg)