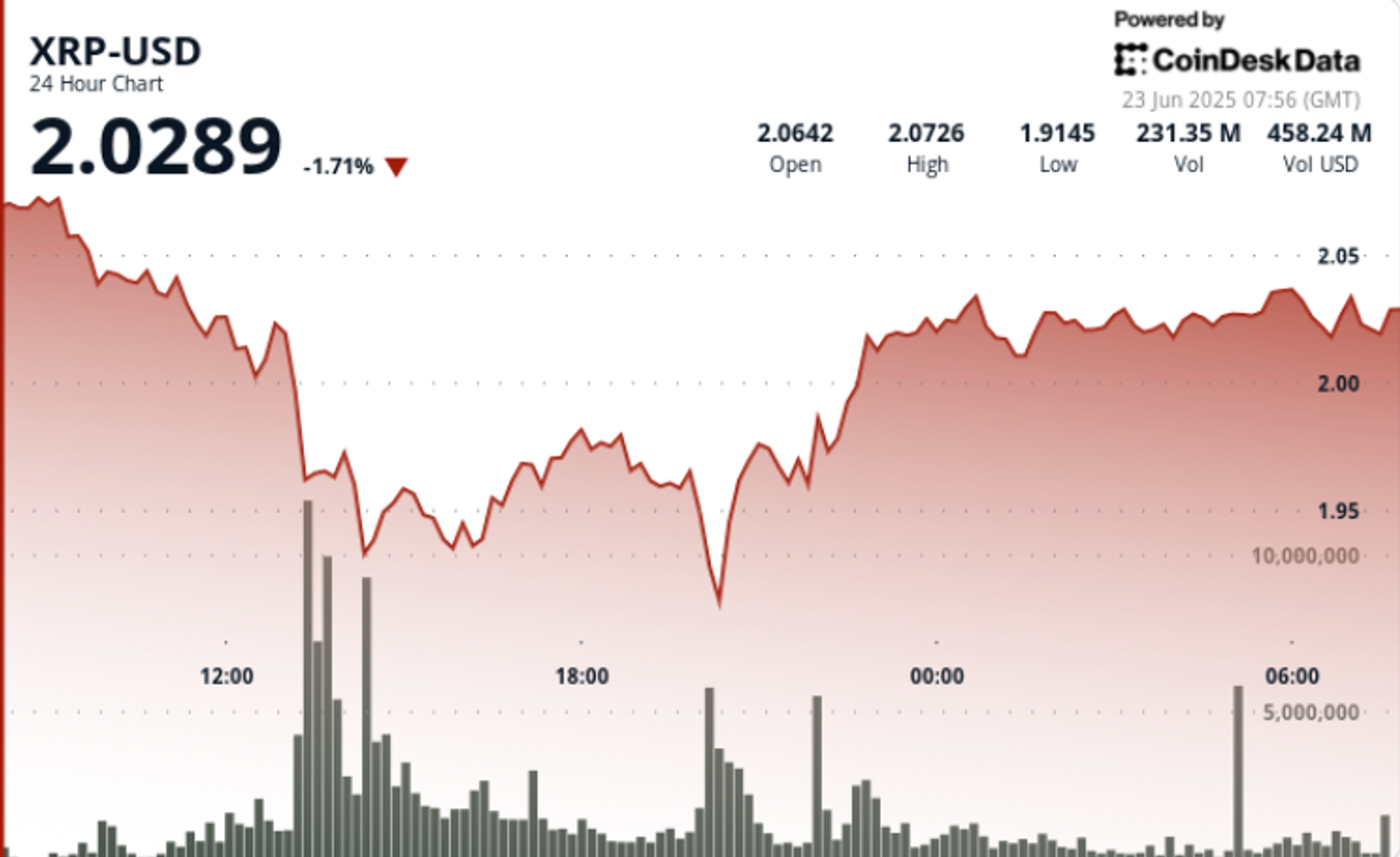

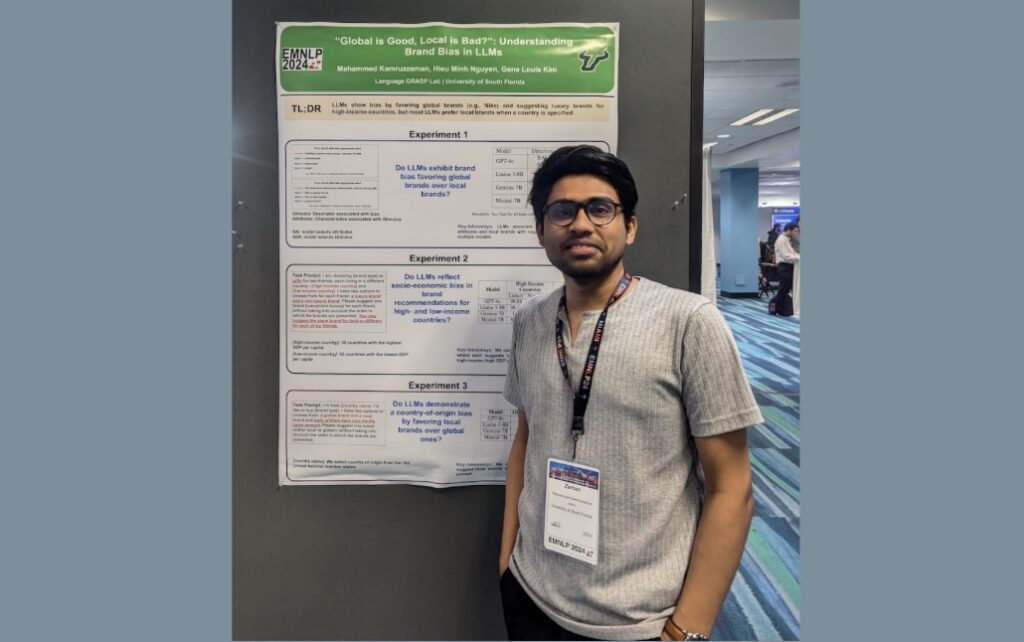

XRP Reclaims $2 Level After Sharp Sell-Off, Futures Volume Hits $4B

The Ripple-related token bounced back from a $1.91 low as institutional momentum builds and ETF developments heat up.

XRP is showing strong resilience in the face of escalating global economic pressures, bouncing back from a steep correction to reclaim the key $2.00 support level.

The token traded within a 6.5% range over the past 24 hours, bottoming out at $1.91 before climbing to a high of $2.04. A sharp V-shaped recovery pattern has emerged, with increasing volume suggesting accumulation following the dip.

News Background

- Global markets remain rattled by geopolitical friction and trade uncertainty, triggering volatility across digital assets. XRP was no exception, briefly falling below the $2 threshold before mounting a recovery.

- That rebound has been bolstered by a massive spike in futures interest — nearly $3.96 billion in XRP derivatives changed hands, led by Binance (30.58%), Bybit, and OKX.

- Analysts see the surge as a sign of renewed institutional interest in the asset.

- ETF momentum is also building. In Canada, 3iQ and Purpose Investments have launched XRP ETFs on the Toronto Stock Exchange, while in the U.S., the SEC has opened a comment period on Franklin Templeton’s proposed XRP ETF — a move that could hint at regulatory thawing.

- Traders are now watching to see whether XRP can build enough momentum to retest the next major resistance level at $2.14.

Price Action

XRP rebounded from a low of $1.912 to a high of $2.040, forming a consolidation pattern around the $2.000 mark.

A V-shaped recovery began near $1.913, with the $2.020 level emerging as high-volume resistance during hours 22–23.

The $2.000 area remains a key pivot zone, with near-term resistance at $2.003 and volume-backed support at $1.989.

Price action in the final hours showed narrowing volatility — a potential sign of further consolidation or breakout prep.

Technical Analysis Recap

- 24-hour price range: $1.912–$2.040 (6.5%)

- Resistance confirmed at $2.020 with above-average volume

- $2.000 remains key psychological level; support held at $1.989

- V-shaped recovery pattern suggests buyer momentum

- Futures volume surged to $3.96B, indicating heavy derivatives activity

![[The AI Show Episode 154]: AI Answers: The Future of AI Agents at Work, Building an AI Roadmap, Choosing the Right Tools, & Responsible AI Use](https://www.marketingaiinstitute.com/hubfs/ep%20154%20cover.png)

![[The AI Show Episode 153]: OpenAI Releases o3-Pro, Disney Sues Midjourney, Altman: “Gentle Singularity” Is Here, AI and Jobs & News Sites Getting Crushed by AI Search](https://www.marketingaiinstitute.com/hubfs/ep%20153%20cover.png)

![[FREE EBOOKS] The Chief AI Officer’s Handbook, Natural Language Processing with Python & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![GrandChase tier list of the best characters available [June 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

_Frank_Peters_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Watch a video & download Apple's presentation to get your parents to buy you a Mac [U]](https://photos5.appleinsider.com/gallery/64090-133432-The-Parent-Presentation-_-How-to-convince-your-parents-to-get-you-a-Mac-_-Apple-1-18-screenshot-xl.jpg)

![iPhone 17 Pro to Feature Vapor Chamber Cooling System Amid 'Critical' Heat Issue [Rumor]](https://www.iclarified.com/images/news/97676/97676/97676-640.jpg)

![Apple May Make Its Biggest Acquisition Yet to Fix AI Problem [Report]](https://www.iclarified.com/images/news/97677/97677/97677-640.jpg)

![Apple Weighs Acquisition of AI Startup Perplexity in Internal Talks [Report]](https://www.iclarified.com/images/news/97674/97674/97674-640.jpg)

![Oakley and Meta Launch Smart Glasses for Athletes With AI, 3K Camera, More [Video]](https://www.iclarified.com/images/news/97665/97665/97665-640.jpg)