How AI Is Changing Finance: A Closer Look at the Sector’s Digital Transformation

Artificial Intelligence (AI) is revolutionizing the finance sector in ways we could not have dreamed of a few short years ago. What once was a world of drudge work by manually entering data, strict rules, and decision-making on instinct is now becoming quicker, smarter, and increasingly data-oriented. From catching fraud...Read more » The post How AI Is Changing Finance: A Closer Look at the Sector’s Digital Transformation appeared first on Big Data Analytics News.

Artificial Intelligence (AI) is revolutionizing the finance sector in ways we could not have dreamed of a few short years ago. What once was a world of drudge work by manually entering data, strict rules, and decision-making on instinct is now becoming quicker, smarter, and increasingly data-oriented.

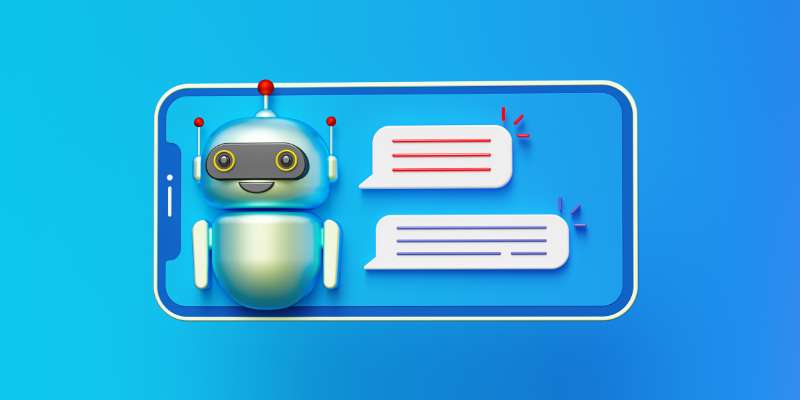

From catching fraud in real-time for banks to driving investment decisions and enhancing customer experiences, AI is transforming the way financial institutions work and more significantly, the way they work for individuals like you and me.

Here in this article, let’s see how AI is creating waves in finance and what that will bring to the future of the sector.

1. Trading Becomes Intelligent with AI

Financial trading is no longer merely about human experience and instinct. Now, AI-driven algorithms are increasingly dominating the way trades are made and how investment choices are determined.

These programs are able to examine thousands of data points in a matter of seconds and these can include stock prices, news flashes, and social media trends to execute trading decisions in real time. Such speed and accuracy is something humans just aren’t capable of.

Big investment houses today employ AI to create high-frequency trading plans, reduce risk, and maximize returns. Indeed, certain hedge funds are designed entirely on machine learning models that learn and get smarter day after day as fresh data keeps arriving.

2. Busting Financial Fraud in Real-Time

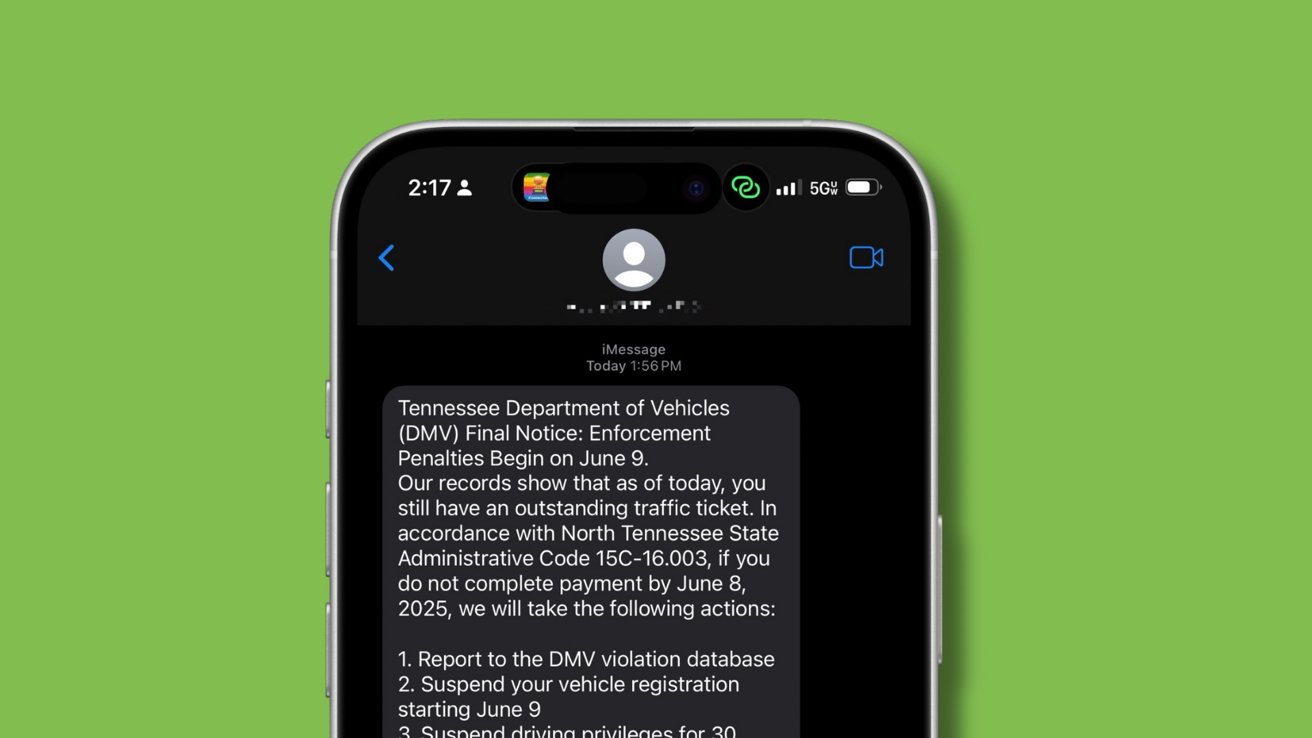

Artificial intelligence has emerged as a strong weapon in the battle against fraud. Legacy fraud detection techniques usually use static rules and may be slow to react. AI, by contrast, is excellent at identifying atypical behavior in real-time.

Machine learning is employed by banks and payment services to spot suspicious activity — be it a quirky location of a transaction, an unusual pattern of purchases, or a concerted effort to access a user’s account on an odd device.

What is particularly valuable here is how AI can learn from each transaction. The more that it sees, the more proficient it becomes at detecting fraud without misidentifying genuine behavior — to the benefit of both the business and consumers.

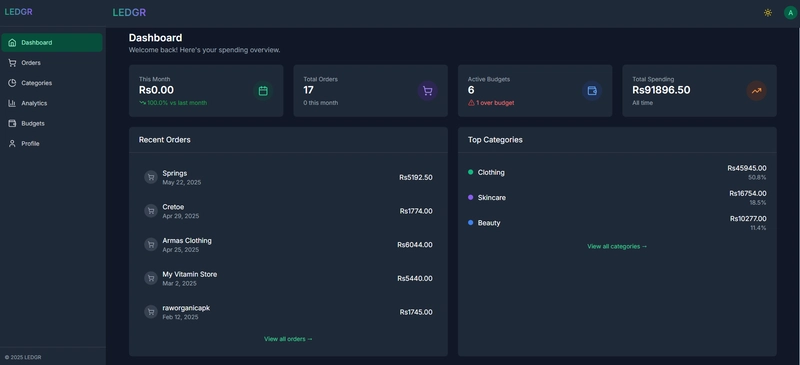

3. Personalized Banking Is Now the Norm

Those days are gone when banking was uniform. With AI, financial products are becoming more personalized — from saving tips and spending insights to tailor-made investment advice.

Ever used a mobile banking app that provides you with budget breakdowns or alerts about pending bills? That’s AI in action. Some banks even employ AI to suggest the optimal savings schemes or credit cards depending on your spending patterns and objectives.

Then, of course, there are robo-advisors, which invest your portfolio automatically according to your own preferences. They are cheap, convenient, and great for those who might not have access to the traditional financial advisor.

4. More Efficiency, Less Paperwork

AI is also making the operation of financial institutions more efficient behind the scenes. Consider all the routine, mechanical work that occurs each day at a bank checking loan requests, making payments, processing documents. AI can do much of it automatically.

By assuming responsibility for these mundane tasks, AI enables businesses to save time and money while minimizing the potential for human error. For instance, banks apply AI tools to read legal documents or financial statements, finding valuable information in seconds, something that previously required hours.

This type of automation not only makes banks more effective; it also releases employees to do work that really requires human judgment and imagination.

5. Remaining Compliant with Evolving Regulations

Regulations in the financial sector keep changing, and it can be tricky keeping up with them. AI is filling in to assist banks and other financial institutions to remain compliant by tracking transactions, raising red flags on suspicious patterns, and ensuring all policies are being adhered to.

Even has a name for this trend — RegTech (short for regulatory technology). These are AI-based tools that can sift through masses of data to help businesses comply with anti-money laundering (AML), know-your-customer (KYC), and other regulatory compliance.

Sure enough, as more of these processes become automated with AI, concerns about transparency and fairness become more relevant. But with the right governance, AI can be an invaluable partner in controlling regulatory risk.

6. Redoing Credit and Lending

Having a loan or credit card approved has long depended on a relatively limited perspective of an individual’s financial past — primarily credit scores. But what if the person in question is sensible about money but has little credit history?

That’s where AI excels. By evaluating alternative data such as rent payments, utility bills, or even the way a person shops online, AI can assist lenders in creating a more robust profile of someone’s payment behavior.

This makes credit accessible to more individuals, particularly in emerging or underbanked markets, and assists lenders in making better decisions. It’s a double win.

7. Looking Ahead: The Future of AI in Finance

The AI role within finance will only expand. We’re already witnessing initial applications within predictive analytics, sophisticated risk modeling, and AI-powered customer service. In the near term, we could see even more intelligent financial planning tools to assist individuals in preparing for life events such as purchasing a home or retirement.

But growth brings responsibility. Banks, technology companies, and regulators will have to get together to ensure that AI is being employed ethically, in a fair manner, and with transparency.

Final Thoughts

AI is no longer a buzzword — it’s working to transform the financial sector actively. Whether it’s detecting fraud, making better investments, providing personalized guidance, or streamlining efficiency, AI is helping financial institutions serve customers more effectively and quicker. As technology advances, the financial sector will keep on innovating — and for consumers and businesses, that will translate to more convenience, improved security, and wiser financial choices. If you’re looking to build intelligent financial solutions powered by AI, partnering with a trusted fintech app development company can help you stay ahead of the curve.

The post How AI Is Changing Finance: A Closer Look at the Sector’s Digital Transformation appeared first on Big Data Analytics News.

_.png)

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[FREE EBOOKS] Solutions Architect’s Handbook, Continuous Testing, Quality, Security, and Feedback & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From electrical engineering student to CTO with Hitesh Choudhary [Podcast #175]](https://cdn.hashnode.com/res/hashnode/image/upload/v1749158756824/3996a2ad-53e5-4a8f-ab97-2c77a6f66ba3.png?#)

_Michael_Vi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![watchOS 26 May Bring Third-Party Widgets to Control Center [Report]](https://www.iclarified.com/images/news/97520/97520/97520-640.jpg)

![AirPods Pro 2 On Sale for $169 — Save $80! [Deal]](https://www.iclarified.com/images/news/97526/97526/97526-640.jpg)

![How to Enable Remote Access on Windows 10 [Allow RDP]](https://bigdataanalyticsnews.com/wp-content/uploads/2025/05/remote-access-windows.jpg)