Possibilities, Redefine Success: The Journey to AI Transformation

Author: Mohammad Anwer, Enterprise Solutions AI Strategist and Program Management Leader with 20+ Years of Enterprise Experience | Solvagence.com A New Era of Possibilities The world of business is at an inflection point. For years, organizations pursued digital transformation, racing to modernize systems, digitize processes, and harness data. But today, the conversation has shifted. Digital is no longer the destination—it’s the foundation for a bolder ambition: becoming an AI-transformed enterprise. This journey isn’t about incremental gains; it’s about redefining success through the limitless possibilities of artificial intelligence. In Banking, Insurance, and Financial Services (BIFS), AI is revolutionizing customer experiences, risk management, and operational efficiency. Retail is unlocking hyper-personalized shopping, Supply Chain is optimizing global logistics, and Healthcare is advancing precision medicine. Yet, the path to AI transformation is complex. McKinsey’s 2024 AI Survey projects that organizations fully embracing AI could double their cash flow by 2030, while laggards risk a 20% decline. Meanwhile, a Deloitte study reveals a stark gap: 94% of executives see AI as critical, but only 17% have scaled AI across operations. At Solvagence, we view AI not as a technology but as a catalyst for reimagining what’s possible. This article outlines a three-stage journey—Digital Transformation, AI Adoption, and AI Transformation—offering a roadmap to unlock AI’s potential. With a focus on BIFS and insights from Retail, Supply Chain, and Healthcare, we’ll explore the strategies, technologies, and cultural shifts needed to redefine success in an AI-powered world. The Three-Stage Journey: From Digital to AI Transformation AI transformation is a deliberate evolution, not a single leap. Each stage builds on the last, creating a foundation for exponential value: Digital Transformation: Establishing the technological, process, and cultural groundwork. AI Adoption: Building AI capabilities and testing high-impact use cases. AI Transformation: Becoming an AI-first enterprise, where intelligence drives strategy, operations, and innovation. Boston Consulting Group reports that organizations completing this journey achieve 30% lower costs, 20% higher customer satisfaction, and 50% faster innovation cycles. Yet, fewer than 10% have reached the AI-first stage. Let’s explore each phase, with practical insights and industry examples. Stage 1: Digital Transformation – Building the Foundation for Possibilities Digital transformation is the cornerstone of AI readiness. For BIFS, this means modernizing legacy systems and digitizing customer interactions. Retail, Supply Chain, and Healthcare face similar imperatives, tailored to their unique contexts. Technology Foundations Cloud as the Catalyst Cloud infrastructure provides the scalability and agility AI demands. In BIFS, JPMorgan Chase’s migration of 70% of workloads to the cloud enables real-time fraud detection. Retailers like Walmart leverage cloud platforms to manage e-commerce surges, while Healthcare providers use secure clouds for patient data. Strategies include: Lift and Shift: Quick migration of legacy systems. Refactoring: Optimizing applications for cloud benefits. Cloud-Native Design: Building AI-ready architectures with GPU support. Cloud strategies designed for AI yield 35% higher ROI, ensuring flexibility for future workloads. APIs: Connecting Possibilities APIs enable seamless integration across systems. In BIFS, HSBC’s open banking APIs connect with 1,000+ fintech partners, fostering innovation. Retailers like Amazon use APIs to link e-commerce and logistics, while Supply Chain firms track inventory in real-time. A robust API ecosystem: Accelerates service integration. Ensures data accessibility for AI. Enables “digital combos” for rapid innovation, as MIT research highlights. Digital Workflows: Streamlining Operations Digitizing processes creates efficiency and AI-ready data. In Insurance, Allianz’s automated underwriting processes 80% of policies digitally, generating data for risk models. Retailers like Target digitize inventory management, while Healthcare providers streamline patient records. Digital workflows deliver 25-40% efficiency gains and lay the groundwork for AI automation. Data: The Fuel for AI Unified data platforms are critical for AI. In BIFS, Goldman Sachs’ data lake powers real-time risk analytics. Retailers like Tesco analyze customer behavior, while Healthcare integrates EHRs for population health insights. Best practices include: Breaking data silos with unified architectures. Implementing governance and quality controls. Using metadata for data discoverability. Organizations with strong data foundations are three times more likely to succeed in AI. Process Innovations Reimagining Customer Journeys Digital customer experiences drive engagement and data collection. In

Author: Mohammad Anwer, Enterprise Solutions AI Strategist and Program Management Leader with 20+ Years of Enterprise Experience | Solvagence.com

A New Era of Possibilities

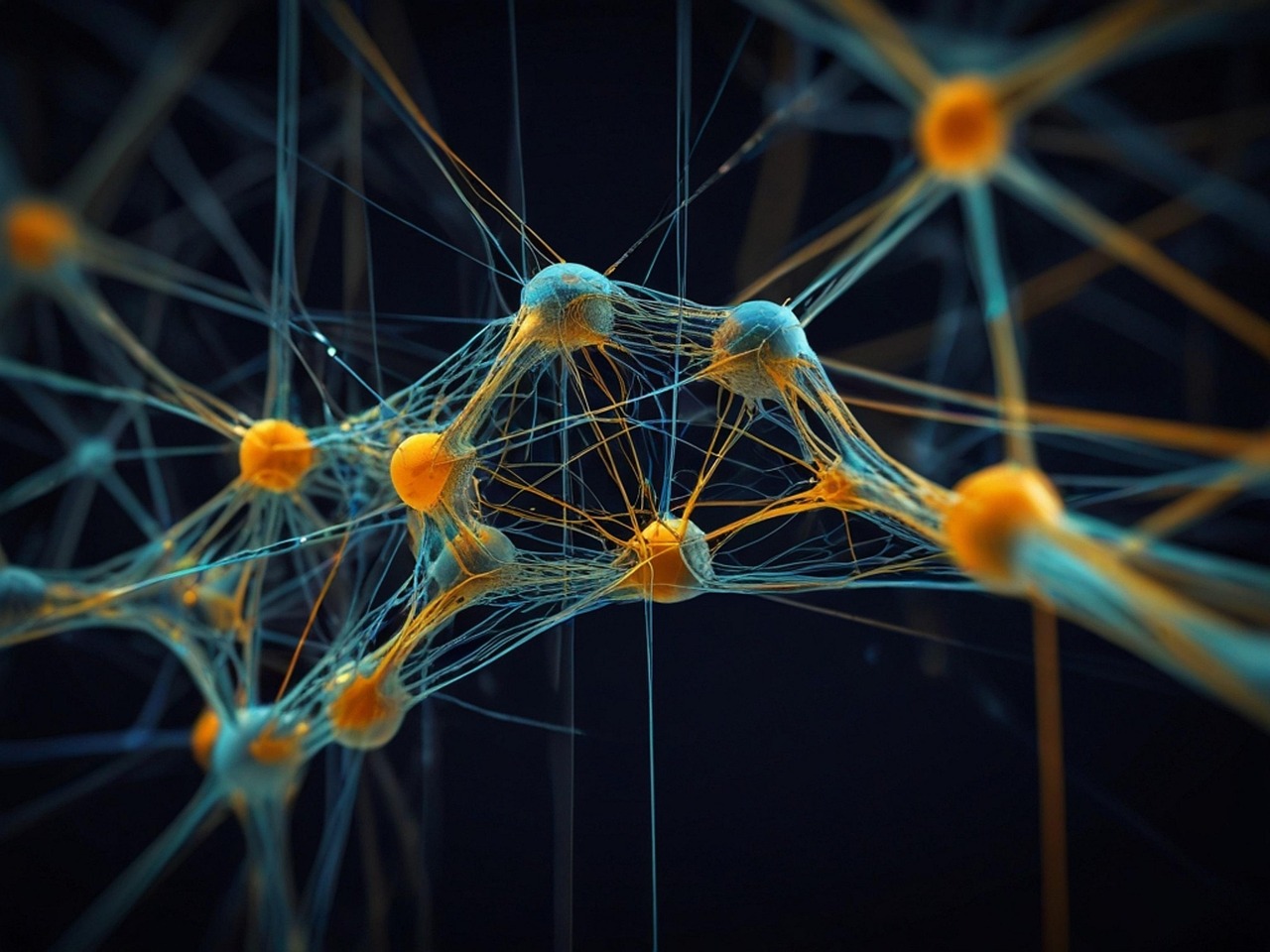

The world of business is at an inflection point. For years, organizations pursued digital transformation, racing to modernize systems, digitize processes, and harness data. But today, the conversation has shifted. Digital is no longer the destination—it’s the foundation for a bolder ambition: becoming an AI-transformed enterprise. This journey isn’t about incremental gains; it’s about redefining success through the limitless possibilities of artificial intelligence.

In Banking, Insurance, and Financial Services (BIFS), AI is revolutionizing customer experiences, risk management, and operational efficiency. Retail is unlocking hyper-personalized shopping, Supply Chain is optimizing global logistics, and Healthcare is advancing precision medicine. Yet, the path to AI transformation is complex. McKinsey’s 2024 AI Survey projects that organizations fully embracing AI could double their cash flow by 2030, while laggards risk a 20% decline. Meanwhile, a Deloitte study reveals a stark gap: 94% of executives see AI as critical, but only 17% have scaled AI across operations.

In Banking, Insurance, and Financial Services (BIFS), AI is revolutionizing customer experiences, risk management, and operational efficiency. Retail is unlocking hyper-personalized shopping, Supply Chain is optimizing global logistics, and Healthcare is advancing precision medicine. Yet, the path to AI transformation is complex. McKinsey’s 2024 AI Survey projects that organizations fully embracing AI could double their cash flow by 2030, while laggards risk a 20% decline. Meanwhile, a Deloitte study reveals a stark gap: 94% of executives see AI as critical, but only 17% have scaled AI across operations.

At Solvagence, we view AI not as a technology but as a catalyst for reimagining what’s possible. This article outlines a three-stage journey—Digital Transformation, AI Adoption, and AI Transformation—offering a roadmap to unlock AI’s potential. With a focus on BIFS and insights from Retail, Supply Chain, and Healthcare, we’ll explore the strategies, technologies, and cultural shifts needed to redefine success in an AI-powered world.

The Three-Stage Journey: From Digital to AI Transformation

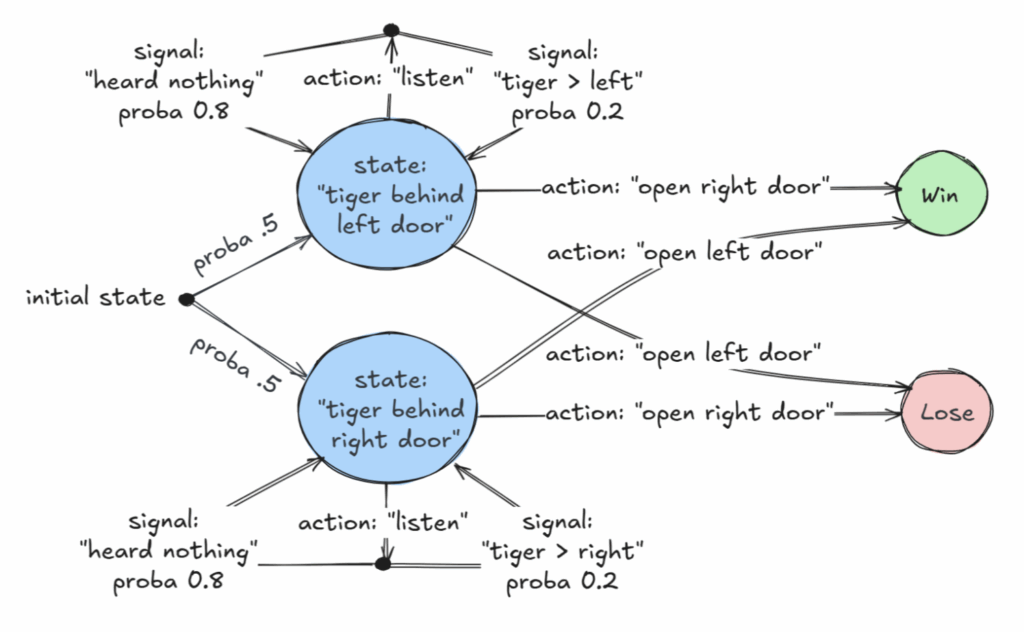

AI transformation is a deliberate evolution, not a single leap. Each stage builds on the last, creating a foundation for exponential value:

- Digital Transformation: Establishing the technological, process, and cultural groundwork.

- AI Adoption: Building AI capabilities and testing high-impact use cases.

- AI Transformation: Becoming an AI-first enterprise, where intelligence drives strategy, operations, and innovation.

Boston Consulting Group reports that organizations completing this journey achieve 30% lower costs, 20% higher customer satisfaction, and 50% faster innovation cycles. Yet, fewer than 10% have reached the AI-first stage. Let’s explore each phase, with practical insights and industry examples.

Stage 1: Digital Transformation – Building the Foundation for Possibilities

Digital transformation is the cornerstone of AI readiness. For BIFS, this means modernizing legacy systems and digitizing customer interactions. Retail, Supply Chain, and Healthcare face similar imperatives, tailored to their unique contexts.

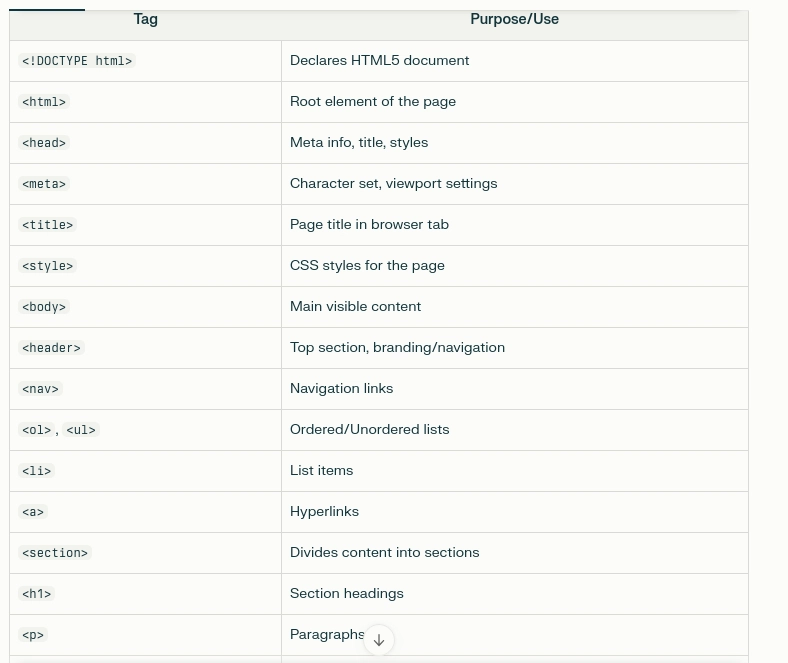

Technology Foundations

Cloud as the Catalyst

Cloud infrastructure provides the scalability and agility AI demands. In BIFS, JPMorgan Chase’s migration of 70% of workloads to the cloud enables real-time fraud detection. Retailers like Walmart leverage cloud platforms to manage e-commerce surges, while Healthcare providers use secure clouds for patient data.

Strategies include:

- Lift and Shift: Quick migration of legacy systems.

- Refactoring: Optimizing applications for cloud benefits.

- Cloud-Native Design: Building AI-ready architectures with GPU support.

Cloud strategies designed for AI yield 35% higher ROI, ensuring flexibility for future workloads.

APIs: Connecting Possibilities

APIs enable seamless integration across systems. In BIFS, HSBC’s open banking APIs connect with 1,000+ fintech partners, fostering innovation. Retailers like Amazon use APIs to link e-commerce and logistics, while Supply Chain firms track inventory in real-time.

A robust API ecosystem:

- Accelerates service integration.

- Ensures data accessibility for AI.

- Enables “digital combos” for rapid innovation, as MIT research highlights.

Digital Workflows: Streamlining Operations

Digitizing processes creates efficiency and AI-ready data. In Insurance, Allianz’s automated underwriting processes 80% of policies digitally, generating data for risk models. Retailers like Target digitize inventory management, while Healthcare providers streamline patient records.

Digital workflows deliver 25-40% efficiency gains and lay the groundwork for AI automation.

Data: The Fuel for AI

Unified data platforms are critical for AI. In BIFS, Goldman Sachs’ data lake powers real-time risk analytics. Retailers like Tesco analyze customer behavior, while Healthcare integrates EHRs for population health insights.

Best practices include:

- Breaking data silos with unified architectures.

- Implementing governance and quality controls.

- Using metadata for data discoverability.

Organizations with strong data foundations are three times more likely to succeed in AI.

Process Innovations

Reimagining Customer Journeys

Digital customer experiences drive engagement and data collection. In BIFS, Bank of America’s Erica assistant handles 1 billion interactions, fueled by digital journey data. Retailers like Sephora offer AR try-ons, while Healthcare providers like Cleveland Clinic enhance patient portals.

Key elements:

- Omnichannel integration.

- Real-time personalization.

- Data capture for AI insights. Operational Automation

Automation boosts efficiency and generates AI-ready data. In Insurance, Progressive’s RPA handles 60% of claims preprocessing. Supply Chain leaders like DHL automate warehouses, while Healthcare reduces billing errors.

Automation delivers 20-35% cost savings and supports AI augmentation.

Analytics: From Insight to Foresight

Analytics dashboards evolve from descriptive to predictive. In BIFS, Citi’s dashboards monitor market trends, paving the way for AI risk models. Retailers forecast sales, while Healthcare tracks outcomes.

Dashboards improve decisions by 15-25% and build data-driven cultures.

DevOps: Accelerating Delivery

DevOps enables rapid software and AI model deployment. In BIFS, ING’s daily code releases support AI trading systems. Retail and Healthcare use DevOps for e-commerce and secure apps.

DevOps includes:

- Infrastructure as code.

- Automated testing.

- Continuous monitoring.

Cultural Shifts

Digital Literacy: Empowering Teams

Digital skills are foundational. In BIFS, DBS Bank trained 16,000 employees, boosting productivity by 23%. Retailers like Nike offer tailored training, while Healthcare trains clinicians on EHRs.

Agile Mindset

Agile practices support iterative progress. In Insurance, Zurich uses agile for claims upgrades, while Supply Chain adopts it for logistics.

Data-Driven Decision-Making

Data-driven cultures are AI prerequisites. In BIFS, Capital One’s data-driven lending improves profitability by 6%. Retail and Healthcare optimize pricing and care with data.

Innovation as a Habit

Innovation programs encourage experimentation. In Retail, L’Oréal’s AR beauty apps stem from innovation labs, while Healthcare pilots telehealth.

Case Study: DBS Bank (BIFS)

DBS Bank’s digital transformation earned it the title “World’s Best Digital Bank.” By modernizing 60% of legacy systems, launching a paperless digibank, and training employees, DBS achieved 20% cost savings and 15% revenue growth, setting the stage for AI-driven fraud detection and personalization.

Stage 2: AI Adoption – Exploring New Horizons

With a digital foundation, organizations enter AI adoption, focusing on data quality, AI expertise, and targeted use cases. In BIFS, this includes fraud detection and customer service enhancements. Retail explores personalization, Supply Chain optimizes logistics, and Healthcare advances diagnostics.

Data Readiness

Data Quality: The Bedrock of AI

High-quality data is non-negotiable. In Insurance, AIG’s quality scoring ensures 95% accuracy for claims models. Retailers like Walmart clean customer data, while Healthcare validates EHRs.

AI-Ready Data Lakes

Flexible data lakes support AI’s diverse needs. In BIFS, Morgan Stanley’s data lake handles transaction data for risk modeling. Supply Chain stores IoT data, while Healthcare integrates imaging.

AI Governance: Building Trust

Governance ensures ethical AI. In BIFS, HSBC’s AI committee oversees 200+ models. Retail and Healthcare address privacy and bias concerns.

Feature Engineering: Unlocking Insights

Feature engineering enhances AI performance. In Retail, Amazon’s feature store powers recommendations, while Insurance uses features for risk scoring.

Building AI Capabilities

Proofs of Concept: Testing the Waters

Targeted POCs demonstrate value. In BIFS, Citibank’s fraud detection POC reduced false positives by 30%. Retail tests personalization, while Healthcare explores diagnostic AI.

AI Strategy: Aligning Vision and Execution

A clear strategy prioritizes use cases. In Insurance, MetLife’s focus on claims automation saved 25% in costs.

AI Talent: Bridging the Gap

Training addresses talent shortages. In BIFS, Goldman Sachs trains 500 AI specialists annually. Retail and Healthcare offer hands-on programs.

Ethical AI: Ensuring Responsibility

Ethical frameworks build trust. In Healthcare, Mayo Clinic’s ethics reviews ensure unbiased diagnostics, boosting patient trust by 60%.

Challenges to Overcome

- Data Fragmentation: Silos hinder AI progress.

- Talent Shortages: AI expertise is scarce.

- Legacy Systems: Integration is complex.

- ROI Clarity: Vague business cases limit funding.

Case Study: Anthem Insurance (BIFS)

Anthem’s AI adoption focused on claims and customer service. A unified health data platform and AI-powered claims system reduced processing time by 50% and improved accuracy by 30%, paving the way for broader AI initiatives.

Stage 3: AI Transformation – Redefining Success

AI transformation embeds intelligence into every facet of the organization. In BIFS, this means autonomous trading and personalized banking. Retail achieves hyper-personalization, Supply Chain optimizes logistics, and Healthcare delivers precision medicine.

AI-Powered Products

Generative AI: Creating Value

Generative AI redefines offerings. In BIFS, Morgan Stanley’s AI chatbots draft investment reports, boosting productivity by 40%. Retailers like Zara prototype designs, while Healthcare accelerates drug discovery.

Autonomous Systems: Operating Independently

Autonomous systems reduce human intervention. In Insurance, Allstate’s claims system processes 85% of standard claims, cutting costs by 35%. Supply Chain uses autonomous drones, while Healthcare automates triage.

Embedded Intelligence: Smart Products

AI-embedded products adapt to users. In BIFS, Visa’s AI-enhanced cards improve fraud detection by 50%. Retail offers smart apps, while Healthcare provides AI wearables.

Intelligent Operations

Predictive Analytics: Anticipating Needs**

Predictive models drive proactive decisions. In BIFS, Barclays’ risk forecasts reduce losses by 20%. Supply Chain predicts demand, while Healthcare forecasts outcomes.

AI-Augmented Workforce: Enhancing Capabilities

Human-AI collaboration boosts productivity. In Insurance, AXA’s AI assistants speed underwriting by 50%. Retail and Healthcare support sales and clinical decisions.

Automated Decisions: Streamlining Processes

Automated systems handle routine tasks. In BIFS, Wells Fargo’s loan approvals process 90% of applications instantly. Retail automates pricing, while Healthcare streamlines referrals.

Cultural Transformation

AI Centers of Excellence

AI CoEs drive adoption. In BIFS, Ping An’s CoE oversees 500 models, achieving 35% cost savings. Retail and Healthcare establish CoEs for personalization and diagnostics.

AI-First Mindset

An AI-first culture integrates intelligence into decisions. In Retail, Amazon’s “how can AI help?” mindset drives 25% revenue growth.

Case Study: Ping An Insurance (BIFS)

Ping An’s AI transformation includes 500+ models handling 1.5 billion interactions annually. Automated underwriting and AI advisory manage $60 billion in assets, reducing costs by 35% and enhancing customer satisfaction.

Industry Insights: Redefining Success

Banking, Insurance, and Financial Services (BIFS)

- Fraud Detection: Mastercard’s AI analyzes 75 billion transactions, reducing fraud by 40%.

- Personalization: Citi’s AI tailors products, boosting engagement by 20%.

- Risk Management: AI models cut insurance losses by 15%.

Retail

- Hyper-Personalization: Amazon’s AI drives 35% of sales.

- Inventory Optimization: Walmart reduces stockouts by 30%.

Supply Chain

- Predictive Logistics: DHL saves 100 million miles annually.

- Autonomous Warehousing: Amazon’s robots improve efficiency by 40%.

Healthcare

- Precision Diagnostics: Mayo Clinic’s AI improves accuracy by 25%.

- Patient Engagement: Cleveland Clinic’s AI chatbots boost satisfaction.

Future Horizons

- Edge AI: Real-time processing for Supply Chain and Healthcare.

- AI Regulation: Compliance with frameworks like the EU AI Act.

- Quantum Computing: Enhancing BIFS risk modeling.

AI transformation is not a destination but a journey to redefine success. For BIFS, Retail, Supply Chain, and Healthcare, the three-stage path—Digital Transformation, AI Adoption, and AI Transformation—unlocks unprecedented possibilities. At Solvagence, we believe success lies in balancing technology, processes, and culture, delivering immediate value while building long-term capabilities. The future is AI-powered, and the time to act is now. Let’s redefine success together.

![[The AI Show Episode 156]: AI Answers - Data Privacy, AI Roadmaps, Regulated Industries, Selling AI to the C-Suite & Change Management](https://www.marketingaiinstitute.com/hubfs/ep%20156%20cover.png)

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Michael_Burrell_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)