AI in Finance: Tools Revolutionizing Portfolio Management

The Hook: Remember When Investing Meant Picking Stocks Based on Your Gut I still recall my initial portfolio-building effort. It was 2011. I purchased a few tech stocks because, you know, "tech is the future," right? I did my research by spending two hours on Reddit and a tip from a colleague who once read The Intelligent Investor. Of course, I lost money. Flash-forward to the present day, and we're in a whole different galaxy. You no longer need a finance degree or a Bloomberg terminal. You just need an app—driven by AI. Artificial intelligence is not only upending finance—it's changing the way portfolios are constructed, managed, and optimized. From robo-advisors to hyper-personalized asset allocation, AI is making retail investors privy to tools previously held by Wall Street quants. So what's actually happening behind the curtain? And should you trust the machine? Robo-Advisors: Something More Than Just Flashy Algorithms Oh yes, the buzzword everyone uses at dinner parties without actually knowing. Robo-advisors employ algorithms to invest your money in line with your risk profile, time horizon, and investment goals. You fill out some questions such as "When would you like to retire?" and "How are you about declining markets?" and voilà, the site constructs a diversified portfolio tailored for you. However, today's robo-advisors such as Wealthfront, Betterment, or India's Groww Wealth are more intelligent now. They're leveraging machine learning to: Tune your portfolio in real time as markets change Tax-loss harvest on autopilot (legally lowering your tax bill? Yes please) Forecast your cash requirements and transfer funds accordingly It's having a personal wealth manager in your pocket without the pricey suit and golf club membership. AI-Driven Risk Management: Less Panic, More Planning Markets rise. Markets fall. Sometimes both before breakfast. One of the toughest aspects of investing is remaining true to a strategy when markets get turbulent. Enter AI-driven risk tools. Systems such as BlackRock's Aladdin, Kavout, and QuantConnect scan thousands of data points—price action, global macroeconomic indicators, earnings reports, even social sentiment—to assess and rebalance portfolio risk in real time. Consider Aladdin (short for Asset, Liability, Debt and Derivative Investment Network)—it's employed to track more than $21 trillion in assets worldwide. It's Iron Man's J.A.R.V.I.S., but for fund managers. It checks for weaknesses before you do. So the next time your friend is sweating due to a "market correction," you can recline and say, "Yeah, my AI's already rebalanced for that." Cool and calm. Personalized Portfolio Optimization: The Netflix of Investing? Ever get annoyed when a generic fund doesn’t align with your beliefs or goals? AI is fixing that too. Some platforms now use deep learning to create hyper-personalized portfolios. Think ESG filters, halal investing, impact-focused themes, and more. Want a portfolio that invests only in women-led businesses or green energy startups? Done. One of them is Q.ai, which sells AI-driven investment packs based on anything from technology trends to hedging against inflation. The AI rebalances and curates automatically, just like Spotify's Discover Weekly—but for your net worth. Also, kudos to Zerodha's Rainmatter initiative in India. They're investing in fintech startups that use AI to teach and empower retail investors, rather than confuse them with jargon. And speaking of empowering investors, platforms like InternBoot are helping learners gain real-time, AI-powered financial skills through industry mentorship and hands-on exposure. Real Case Study: How AI Saved My Sanity in 2023 Back during the banking mini-crisis of 2023 (ah, recall SVB and all that hubbub?), I was taking a beach holiday when the markets grew nervous. Older me would've been glued to CNBC, doomscrolling, and most likely selling at a loss. But thanks to my AI-driven advisor, my portfolio was automatically rebalanced in the background—divesting less in regional banks and investing more in treasury ETFs and gold. I didn't have to move a finger. Heck, I didn't even realize it occurred until I reviewed my update two days later. The peace of mind? Priceless. Platforms like InternBoot are also helping the next generation of investors gain practical skills to understand these tools better. From training freshers in AI-powered finance tools to offering real-world case-based learning, they’re shaping more confident investors and finance professionals. But Wait—Should We Trust the Machines That Much? Look, I'm totally on board for AI assisting with the heavy stuff. But total automation without human oversight? That's where it gets complicated. AI can crunch huge sets of data in a split second, but it isn't always aware of subtlety. It doesn't realize you're going to purchase a home next year, or that you're

The Hook: Remember When Investing Meant Picking Stocks Based on Your Gut

I still recall my initial portfolio-building effort. It was 2011. I purchased a few tech stocks because, you know, "tech is the future," right? I did my research by spending two hours on Reddit and a tip from a colleague who once read The Intelligent Investor. Of course, I lost money.

Flash-forward to the present day, and we're in a whole different galaxy.

You no longer need a finance degree or a Bloomberg terminal. You just need an app—driven by AI.

Artificial intelligence is not only upending finance—it's changing the way portfolios are constructed, managed, and optimized. From robo-advisors to hyper-personalized asset allocation, AI is making retail investors privy to tools previously held by Wall Street quants.

So what's actually happening behind the curtain? And should you trust the machine?

Robo-Advisors: Something More Than Just Flashy Algorithms

Oh yes, the buzzword everyone uses at dinner parties without actually knowing.

Robo-advisors employ algorithms to invest your money in line with your risk profile, time horizon, and investment goals. You fill out some questions such as "When would you like to retire?" and "How are you about declining markets?" and voilà, the site constructs a diversified portfolio tailored for you.

However, today's robo-advisors such as Wealthfront, Betterment, or India's Groww Wealth are more intelligent now.

They're leveraging machine learning to:

- Tune your portfolio in real time as markets change

- Tax-loss harvest on autopilot (legally lowering your tax bill? Yes please)

- Forecast your cash requirements and transfer funds accordingly

It's having a personal wealth manager in your pocket without the pricey suit and golf club membership.

AI-Driven Risk Management: Less Panic, More Planning

Markets rise. Markets fall. Sometimes both before breakfast.

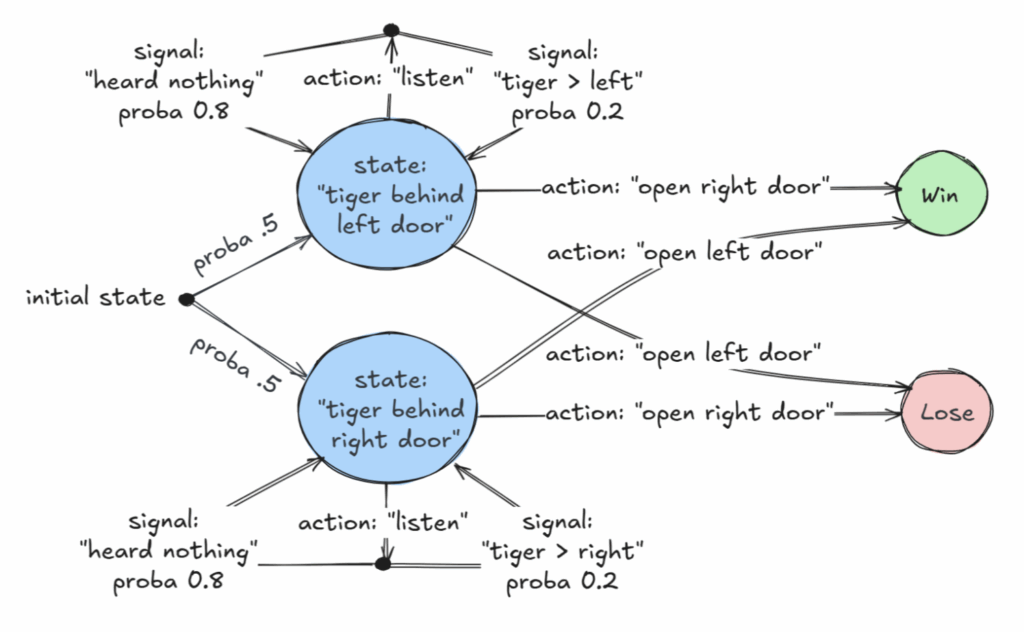

One of the toughest aspects of investing is remaining true to a strategy when markets get turbulent. Enter AI-driven risk tools.

Systems such as BlackRock's Aladdin, Kavout, and QuantConnect scan thousands of data points—price action, global macroeconomic indicators, earnings reports, even social sentiment—to assess and rebalance portfolio risk in real time.

Consider Aladdin (short for Asset, Liability, Debt and Derivative Investment Network)—it's employed to track more than $21 trillion in assets worldwide. It's Iron Man's J.A.R.V.I.S., but for fund managers. It checks for weaknesses before you do.

So the next time your friend is sweating due to a "market correction," you can recline and say, "Yeah, my AI's already rebalanced for that." Cool and calm.

Personalized Portfolio Optimization: The Netflix of Investing?

Ever get annoyed when a generic fund doesn’t align with your beliefs or goals?

AI is fixing that too.

Some platforms now use deep learning to create hyper-personalized portfolios. Think ESG filters, halal investing, impact-focused themes, and more. Want a portfolio that invests only in women-led businesses or green energy startups? Done.

One of them is Q.ai, which sells AI-driven investment packs based on anything from technology trends to hedging against inflation. The AI rebalances and curates automatically, just like Spotify's Discover Weekly—but for your net worth.

Also, kudos to Zerodha's Rainmatter initiative in India. They're investing in fintech startups that use AI to teach and empower retail investors, rather than confuse them with jargon. And speaking of empowering investors, platforms like InternBoot are helping learners gain real-time, AI-powered financial skills through industry mentorship and hands-on exposure.

Real Case Study: How AI Saved My Sanity in 2023

Back during the banking mini-crisis of 2023 (ah, recall SVB and all that hubbub?), I was taking a beach holiday when the markets grew nervous. Older me would've been glued to CNBC, doomscrolling, and most likely selling at a loss.

But thanks to my AI-driven advisor, my portfolio was automatically rebalanced in the background—divesting less in regional banks and investing more in treasury ETFs and gold. I didn't have to move a finger. Heck, I didn't even realize it occurred until I reviewed my update two days later.

The peace of mind? Priceless.

Platforms like InternBoot are also helping the next generation of investors gain practical skills to understand these tools better. From training freshers in AI-powered finance tools to offering real-world case-based learning, they’re shaping more confident investors and finance professionals.

But Wait—Should We Trust the Machines That Much?

Look, I'm totally on board for AI assisting with the heavy stuff.

But total automation without human oversight? That's where it gets complicated.

AI can crunch huge sets of data in a split second, but it isn't always aware of subtlety. It doesn't realize you're going to purchase a home next year, or that you're particularly nervous during election years.

That's why the ultimate pairing is AI + Human judgment.

Use the machine for optimization, insights, and discipline. But you still get to decide goals and values. Let the computer do the arithmetic—you do the meaning.

TL;DR – The Robots Are Here And They're Surprisingly Good With Money

AI in finance isn't some pie-in-the-sky fantasy—it's here and now, silently transforming the way we create and manage wealth.

Whether you're a spreadsheet geek or you just recently learned what "diversification" is, there's an AI solution out there that can:

- Automate and customize your investments

- Keep you calm when there's volatility

- Potentially increase your long-term returns

- And yes, maybe even get you to retire a little earlier

Conclusion

If you're still navigating your portfolio with instincts and Google Spreadsheets… it's probably time to level up.

AI isn't going to make you an overnight millionaire, but it can make you stay the course—smarter and more smoothly.

So what's your experience? Been using any AI investing software recently? Let me know in the comments or share this with someone still investing like it's 1999.

![[The AI Show Episode 156]: AI Answers - Data Privacy, AI Roadmaps, Regulated Industries, Selling AI to the C-Suite & Change Management](https://www.marketingaiinstitute.com/hubfs/ep%20156%20cover.png)

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

_incamerastock_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brain_light_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Nothing Phone (3) has a 50MP ‘periscope’ telephoto lens – here are the first samples [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/06/nothing-phone-3-telephoto.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)