The rise of digital gold in rural India

Contrary to the belief that fintech is still largely urban, it’s India’s hinterlands that are rewriting the narrative.

Some stories don’t begin in bank vaults or fintech headquarters. They begin in villages with cow-dung walls, brass vessels and fields stretching past the horizon. In some child’s grandmother’s home, a gold coin wasn’t just an investment. It was a promise. A quiet assurance wrapped in red cloth, tucked in an old spice tin, pulled out during weddings or calamities. It never needed WiFi or OTPs. Just trust.

Now that I think about it, I feel the vibe; it's tangible and a story in fresh ink. I can think of a 22-year-old mobile shop owner in a dusty rural town of modern India, and I can create a dialogue of what he’s going to say about Gold as a wealth solution – this is where something has shifted. And I quote – “Bhaiya, ab app se lete hain... chhoti chhoti rakam mein. Zarurat pade toh turant bech bhi sakte hain.”

(“I buy it from an app now… in small amounts. And if I ever need to sell, I can do it instantly.”)

This wasn’t just small-town banter. It was a sign of the times.

Gold is not just a metal. It is a memory, emotion and safety. Gold has always meant more than wealth in India. It’s a mother’s pride, a farmer’s fallback. It’s safety without paperwork and wealth without worry. Even today, its cultural significance echoes in song and soil — “Mere desh ki dharti sona ugle” wasn’t just poetic sentiment. It was the truth. Gold has always been a part of India's soil, literally and emotionally.

The numbers don’t lie — Rural India is ready

Remember when digital used to mean cities? QR codes at hipster cafés, fintech apps on slick phones, and everyone talking about crypto like it was the second coming of gold? Well, that story’s changing, and rural India is writing a whole new chapter.

Take a look at the numbers. Over half of India’s internet users now live outside big cities. And among young people in villages, aged 15 to 24, more than 80% are online. Not just scrolling reels but checking prices, learning new skills, and yes, exploring ways to invest.

And what are they investing in? Believe it or not, gold. But not the kind locked up in lockers or passed down at weddings. This is gold on a screen. Tap to buy, tap to sell, no worries about purity or where to hide it. For younger investors, digital gold makes sense. It’s clean, easy, and always just a click away. A recent survey showed 75% of people under 35 now lean toward digital gold. Even among those just starting out — the 18 to 24 crowd — interest is bubbling up. And it’s not just about age. People across income levels are warming up to it. Some like the returns. Others say it helps them sleep better at night knowing their gold isn’t going anywhere.

Of course, there’s still hesitation. Some find the idea confusing. Others miss the comfort of holding something real. But maybe that’s the point. The next generation of platforms won’t win by dazzling users with jargon. They’ll win by making digital feel local, almost familiar.

Think of a homemaker setting aside fifty rupees to buy a sliver of gold. Or a farmer saving his surplus to invest in something that feels real, even if it lives in the cloud. This isn’t about turning villages into cities. It’s about designing technology that fits the rhythm of rural life. And if it works? Well, we may just be witnessing the quiet reinvention of one of India’s oldest traditions — gold, but with a password.

And now, for the first time, that emotion is going digital.

Mahatma Gandhi, the Father of the Nation, once said, “The soul of India lives in its villages.” Many years later, the quote remains uncannily accurate. The Indian hinterlands, now house over 64% of India's people as per the World Bank. In these hinterlands, the weight that gold carries is more than the traditional baggage, it is a legacy that stays relevant for milieus.

A deeply emotional bias drives the preference for gold in these regions. It is guarded as the sacrosanct object that is considered an heirloom, that is passed on sadaa ke liye – something that is synonymous with perpetuity.

With the growing accessibility of the internet and smartphones, especially among a young population eager to secure their financial futures, a case is building for digital gold. This shift is not just possible — it’s already underway.

Digital gold offers what traditional gold cannot—safety, purity, transparency, and flexible access. One doesn’t need a locker anymore. No worries about theft or damage. Just a mobile phone and a few taps. And perhaps most importantly, the ability to start investing with as little as ten or fifty rupees.

Small-town India is warming up to digital gold

Contrary to the belief that fintech is still largely urban, it’s India’s hinterlands that are rewriting the narrative.

The zeitgeist of this rural milieu has engendered a neoteric mindset, a mind mapped to invest, a mind that values growth. The babus of the city, are now in an equitable position with the 'gaanv ka insaan’ or the hearty people of the hinterland. Young shopkeepers, school teachers, even agricultural workers — who now see digital gold as a more practical, secure way to save. A new generation of rural investors is emerging — For many, the idea of investing in fractional quantities — Rs 100 today, Rs 200 next week — is not just accessible but empowering.

And it’s not just about liquidity or ease of transaction. It’s about the continuity of a legacy. Gold was always the wealth that could be passed on. Now, that wealth is being stored not in safes but in digital vaults.

Not replacing tradition, just upgrading it

This isn’t about replacing bangles and necklaces. Festivals and weddings will always have their shimmer. But savings? That’s being reimagined. Digital gold offers several tangible advantages over physical gold — verified purity, safety in insured storage, easy liquidity, no making charges, and minimum ticket sizes that make it inclusive rather than elite.

What’s remarkable is how naturally this transition is taking place. For decades, wealth in India meant what you could touch — rupee notes, land papers, and of course, gold. Today, people are slowly embracing the idea that true security might not lie in the vault, but in a passcode-protected app.The traditional sentiment remains untouched. It’s just that the form has evolved.

The road ahead: Digital gold as new-age wealth

Yes, there are still challenges. Many in rural India continue to prefer physical gold simply because they haven’t yet understood digital alternatives. Familiarity is the biggest barrier, not intent.

But as with every wave of digital adoption in India — from mobile banking to UPI — once understanding spreads, the transition is swift and widespread.

Digital gold is slowly becoming a part of India's new-age wealth creation process. It fits into the modern life of a rural entrepreneur as seamlessly as it does into that of an urban salaried worker. It’s flexible, secure and more aligned with the saving habits of small, recurring investments.

It offers the same comfort that gold always did — only now, without the risks of theft, impurity, or liquidity loss.

Gold Is Still Gold, only smarter

In the end, this shift isn’t about abandoning tradition. It’s about keeping the soul and upgrading the body. Just like that song said — “Mere desh ki dharti sona ugle” — our land has always birthed gold. It’s only fair that the people living on that land have access to its digital form.Digital gold doesn’t change what gold means to us. It just ensures that in a changing world, its value — both emotional and financial — remains intact. It is not the replacement of a legacy. It is its continuation — safer, simpler and more inclusive than ever before.

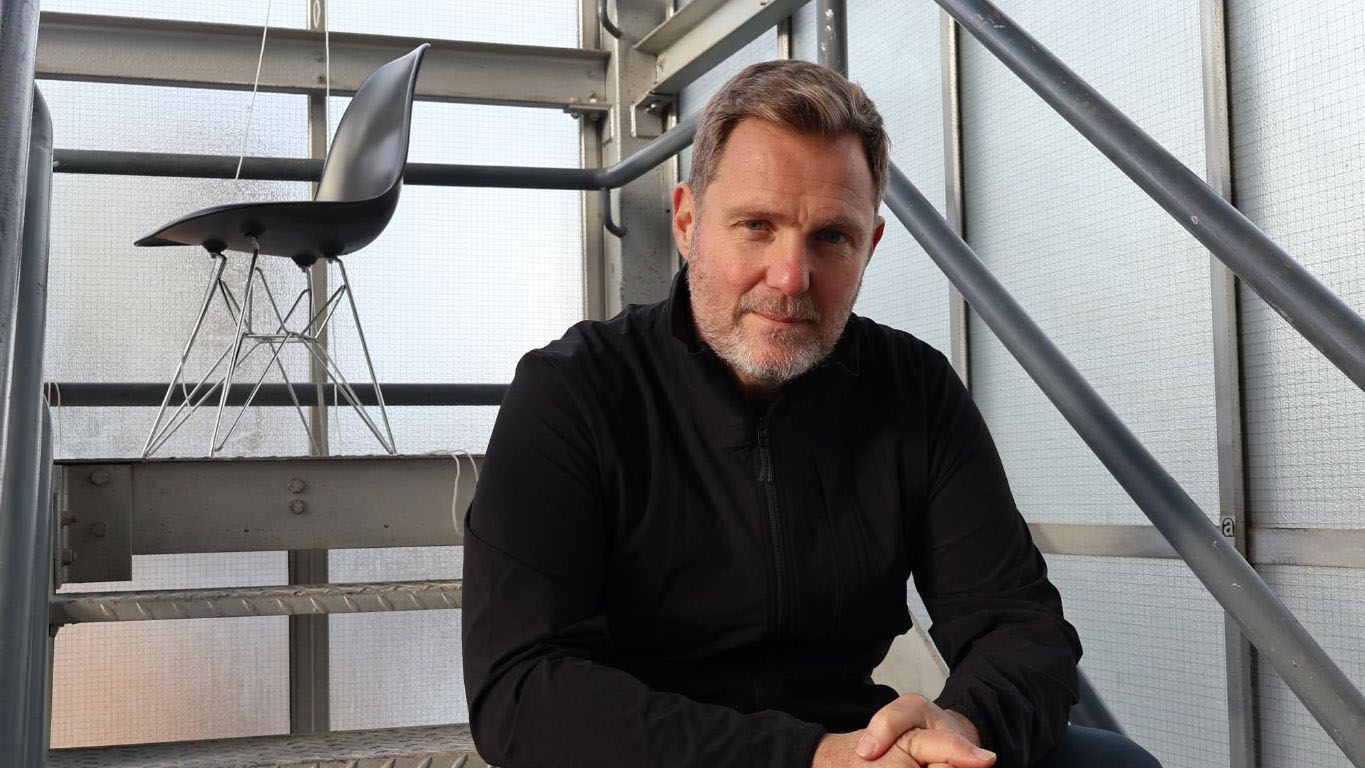

Sanket Prabhu, Director and Head of Wealth at FINHAAT

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[The AI Show Episode 156]: AI Answers - Data Privacy, AI Roadmaps, Regulated Industries, Selling AI to the C-Suite & Change Management](https://www.marketingaiinstitute.com/hubfs/ep%20156%20cover.png)

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

![[DEALS] 1min.AI: Lifetime Subscription (82% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Mercedes, Audi, Volvo Reject Apple's New CarPlay Ultra [Report]](https://www.iclarified.com/images/news/97711/97711/97711-640.jpg)