James Wynn, the Trader Who Bet $1B on Bitcoin, Is Now Long Pepe

The pseudonymous trader on Hyperliquid closed their billion-dollar notional position for a $17 million loss over the weekend and is now betting on downside.

One of the most closely watched crypto wallets in recent weeks is now betting on pepe (PEPE), days after drumming up a record billion-dollar notional position on bitcoin BTC on the onchain trading platform Hyperliquid.

The wallet has gone long on PEPE with $1 million at 10x leverage, flipping from billion-dollar bitcoin trades to high-stakes memecoin bets. The position is already up $500,000 as of European morning hours, with pepe up nearly 6% in the past few hours.

Pseudonymous trader “James Wynn” — known as “moonpig” on decentralized exchange Hyperliquid — closed their $1.2 billion BTC long position with a $17.5 million loss on Monday.

Wynn then opened a $1 billion short using 40x leverage, effectively wagering their entire $50 million wallet on the downside. Both positions are a record for an onchain platform and represent the biggest bets placed entirely on a blockchain-based service.

Wynn’s new short was opened at an average price of $107,077, and has already netted about $3 million in profit as BTC hovered just below that level Monday, before losing some value.

The trade is a high-risk musical chairs event: if BTC rises above $110,446, Wynn’s position could be liquidated unless additional collateral is posted, data shows.

That position is since closed and Wynn said on X stepping away from perpetual trading altogether. They have netted a total profit of $25 million from an initial above $3 million, the account said on X.

“Now decided to leave the casino with my $25,000,000 profit,” he posted. “It’s been fun, but now it’s time for me to walk away a wynner.”

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

_foto-zone_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![PSA: Spotify facing widespread outage [U: Fixed]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2023/06/spotify-logo-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

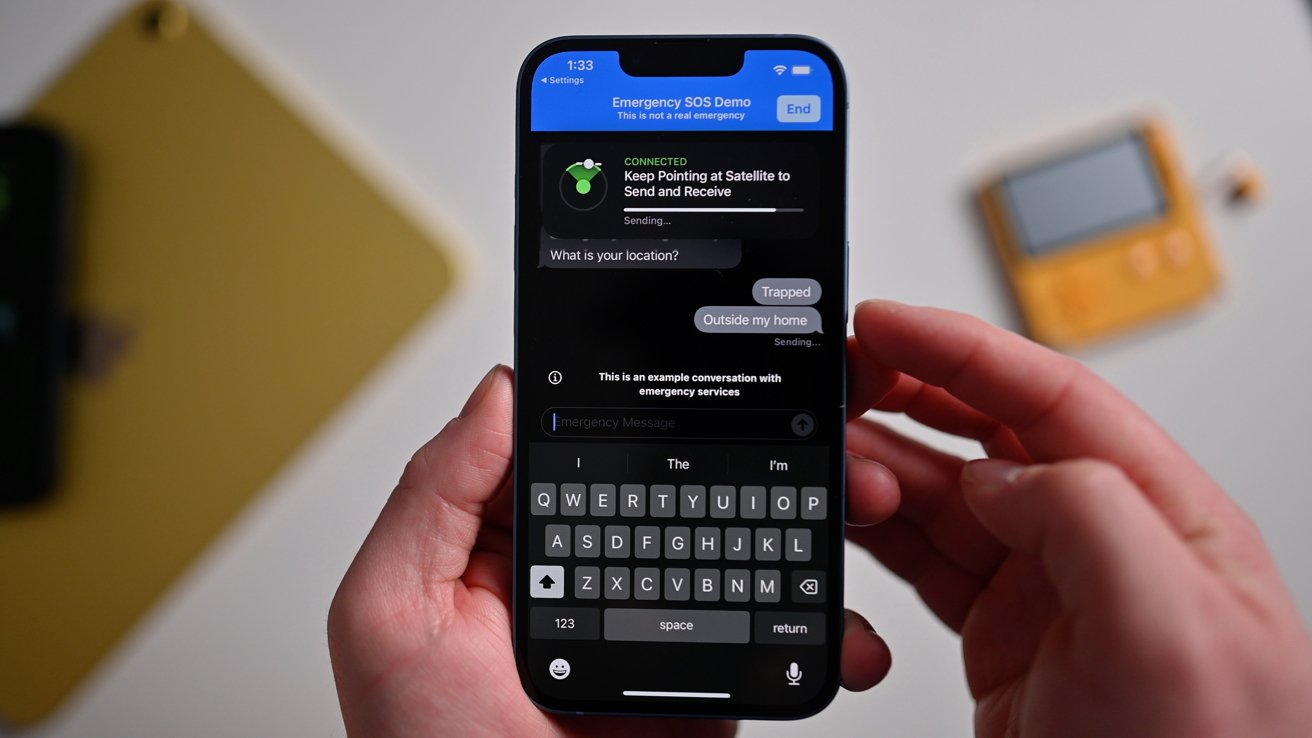

![Apple Turned Down Musk's $5B Starlink Deal — Now the Consequences Are Mounting [Report]](https://www.iclarified.com/images/news/97432/97432/97432-640.jpg)

![WhatsApp Finally Launches iPad App [Download]](https://www.iclarified.com/images/news/97435/97435/97435-640.jpg)

![T-Mobile, Verizon and AT&T under fire for lack of transparency on surveillance [UPDATED]](https://m-cdn.phonearena.com/images/article/170786-two/T-Mobile-Verizon-and-AT-T-under-fire-for-lack-of-transparency-on-surveillance-UPDATED.jpg?#)