Best Ways to Link SIN to Bank Account

Best Ways to Link SIN to Bank Account

An important step for personal security and tax reporting on the banking system of Canada is Link Sin to Bank Account. Social Insurance Number (SIN) is a unique number that the Canadian government uses citizens to serve and collect tax information. In this blog post we will know in detail how to make Link Sin to Bank Account in a safe and effective way and we will also discuss various issues associated with Canada Banking, CRA Verification, Online KYC, and Identity Proof.

Importance of link sin to bank account

Why SIN needs to be attached?

Link Sin to Bank Account may be mandatory at any registered financial institution in Canada if interested or dividend is available in the account. This is very important for CRA verification.

Sin's introduction in the process of CRA Verification

Link Sin to Bank Account is mandatory to ensure tax reporting of Canada Revenue Agency or CRA citizens. This allows the government to calculate the income, benefits and taxes of each person.

Privacy according to the rules of Canada Banking

It is very important to protect the secrets of personal information in the Canada Banking policy. So when you have Link Sin to Bank Account, the bank tells you to do it through a safe channel.

Step-by-Step Process to link sin to bank account

Add Sin while opening the account

Many banks will request you to make Link Sin to Bank Account when opening a new bank account in Canada. This time Identity Proof and Online KYC are to complete.

Required Documents (H4)

- Valid Social Insurance Number (SIN) Document

- Passport / Pr Card / Canadian Driver's License (for Identity Proof)

- Utility Bill / Lease Agreement (as Address Proof)

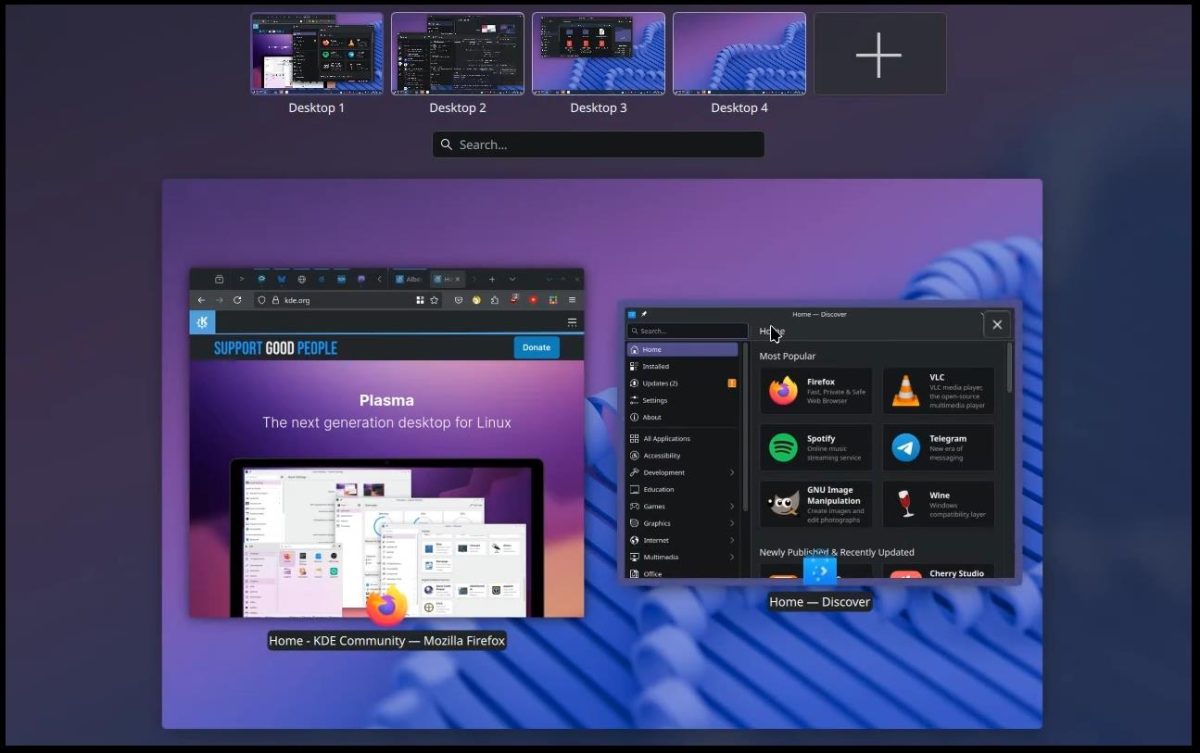

SIN included in the process of Online KYC

Currently most banks offer Link Sin to Bank account through the Online KYC system. By doing this you can add SIN to your bank account at home.

Online Sin Linking Facility

- Faster

- Safe data submission

- Canada combination with banking system

CRA VERIFICATION AND TAX Reporting

The process of reporting to CRA

When you have Link Sin to Bank Account, the bank gives the information to Cra so that your interest inward can be reported correctly.

Impact at Tax Return

If you do not properly link to Link Sin to Bank, CR can stop your tax return or impose a fine.

link sin to bank account for newcomers in Canada

Instructions for new immigrants

When new immigrants enter the Canada Banking system, it is very important for them to complete the Identity Proof and Online KYC. Many bank accounts do not allow opening if SIN does not add.

Walk-in vs Online Process

If the newcomers want to go to the bank directly or via Link Sin to Bank through Online KYC. However, the online process is faster and user-friendly.

Security Measures While Linking Sin

Identity Theft to Prevent

- Just go to the official website of the bank to account Link Sin to Bank

- Do not share your identity proof and sin information

- Use Two-Factor Authentication while doing online kyc

Secure Canada Banking Practices

Canada Banking companies use modern encryption to protect customer data. But the customer also has to be careful.

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[DEALS] FileJump 2TB Cloud Storage: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Apple Shares Official Trailer for 'The Wild Ones' [Video]](https://www.iclarified.com/images/news/97515/97515/97515-640.jpg)