Zodia and Finery Markets Join Forces as OTC Crypto Markets Eye 60% Boom

Zodia Markets has established a partnership with Finery Markets to enhance institutional access to digital asset and fiat liquidity, the companies announced today.The collaboration connects Zodia, a digital asset broker backed by Standard Chartered Bank, with Finery Markets' non-custodial crypto Electronic Communication Network (ECN) and Software-as-a-Service trading solutions.Zodia, Finery Partner to Boost Institutional Digital Asset LiquidityThrough the arrangement, Zodia Markets will offer its Forex pairs with same-day settlement capabilities through Finery's platform using a Request-for-Quote (RFQ) trading method. The integration aims to eliminate technical barriers that have traditionally slowed institutional adoption of digital assets."By joining the Finery ecosystem, we're removing the operational and technical barriers that have historically slowed institutional adoption," said Mark Richardson, Chief Commercial Officer at Zodia Markets. "We're making it significantly easier for a wider network of market participants to access our liquidity - securely, efficiently and at scale."The partnership leverages Finery Markets' existing integrations with prime brokers, including Hidden Road, allowing Zodia Markets to price and settle with clients across the Finery ecosystem without requiring additional technical integration.Finery Markets, established in 2019, has built a client base of over 150 digital asset firms across more than 35 countries, including payment providers, brokers, OTC desks, hedge funds, and custodians.As Finance Magnates reported in the middle of last month, Finery recorded triple-digit growth in OTC trading volumes amid increasing institutional adoption. In February, the volume reached $1.8 billion, up 135% compared to the same month a year earlier.Institutional Crypto Trading Partners Target 60% OTC GrowthAccording to Finery Markets' recent market research, over one-third of institutional liquidity providers expect over-the-counter markets to grow by more than 60% in 2025, indicating increasing institutional interest in digital asset trading."More advanced players are entering the crypto market, seeking to reduce risks in their trading operations while expecting top-tier infrastructure,” added Konstantin Shulga, CEO and co-founder of Finery Markets. “Since the beginning, we've focused on making sure every corporate client can easily start using crypto with Finery Markets.”The service will be available across Finery Markets' product suite, including FM Marketplace, FM Liquidity Match, and FM Whitelabel.Zodia Markets currently supports over 60 digital assets and more than 20 fiat currencies. The company maintains regulated entities in the United Kingdom, Ireland and Jersey.In the meantime, the company has received a new operational license from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM), which allows it to operate as a crypto brokerage in the region This article was written by Damian Chmiel at www.financemagnates.com.

Zodia Markets has established a partnership with Finery Markets to enhance institutional access to digital asset and fiat liquidity, the companies announced today.

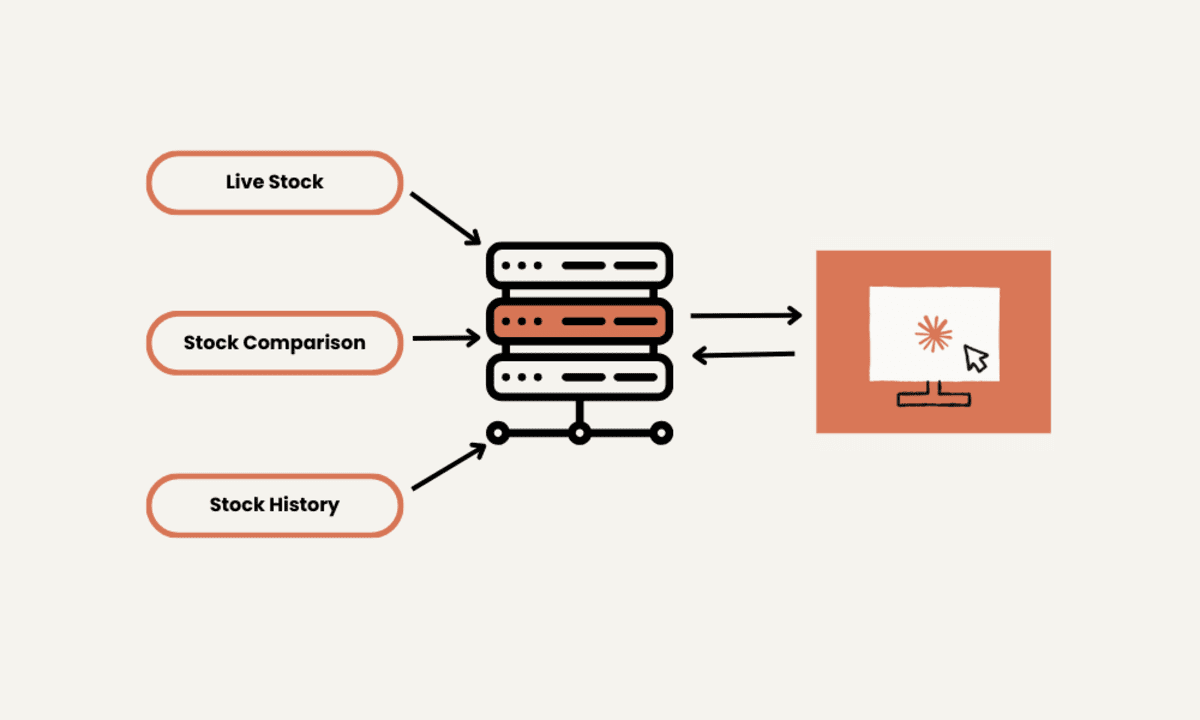

The collaboration connects Zodia, a digital asset broker backed by Standard Chartered Bank, with Finery Markets' non-custodial crypto Electronic Communication Network (ECN) and Software-as-a-Service trading solutions.

Zodia, Finery Partner to Boost Institutional Digital Asset Liquidity

Through the arrangement, Zodia Markets will offer its Forex pairs with same-day settlement capabilities through Finery's platform using a Request-for-Quote (RFQ) trading method. The integration aims to eliminate technical barriers that have traditionally slowed institutional adoption of digital assets.

"By joining the Finery ecosystem, we're removing the operational and technical barriers that have historically slowed institutional adoption," said Mark Richardson, Chief Commercial Officer at Zodia Markets. "We're making it significantly easier for a wider network of market participants to access our liquidity - securely, efficiently and at scale."

The partnership leverages Finery Markets' existing integrations with prime brokers, including Hidden Road, allowing Zodia Markets to price and settle with clients across the Finery ecosystem without requiring additional technical integration.

Finery Markets, established in 2019, has built a client base of over 150 digital asset firms across more than 35 countries, including payment providers, brokers, OTC desks, hedge funds, and custodians.

As Finance Magnates reported in the middle of last month, Finery recorded triple-digit growth in OTC trading volumes amid increasing institutional adoption. In February, the volume reached $1.8 billion, up 135% compared to the same month a year earlier.

Institutional Crypto Trading Partners Target 60% OTC Growth

According to Finery Markets' recent market research, over one-third of institutional liquidity providers expect over-the-counter markets to grow by more than 60% in 2025, indicating increasing institutional interest in digital asset trading.

"More advanced players are entering the crypto market, seeking to reduce risks in their trading operations while expecting top-tier infrastructure,” added Konstantin Shulga, CEO and co-founder of Finery Markets. “Since the beginning, we've focused on making sure every corporate client can easily start using crypto with Finery Markets.”

The service will be available across Finery Markets' product suite, including FM Marketplace, FM Liquidity Match, and FM Whitelabel.

Zodia Markets currently supports over 60 digital assets and more than 20 fiat currencies. The company maintains regulated entities in the United Kingdom, Ireland and Jersey.

In the meantime, the company has received a new operational license from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM), which allows it to operate as a crypto brokerage in the region This article was written by Damian Chmiel at www.financemagnates.com.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)