UPI Down – UPI Outage Disrupt Millions of Digital Transactions Across India

India’s Unified Payments Interface (UPI), the backbone of the country’s digital payment ecosystem, faced a significant outage today, marking the fourth disruption in less than three weeks. The outage, which began around 10:30 AM IST, affected millions of users across major platforms like PhonePe, Google Pay, Paytm, and BHIM, as well as banking services linked […] The post UPI Down – UPI Outage Disrupt Millions of Digital Transactions Across India appeared first on Cyber Security News.

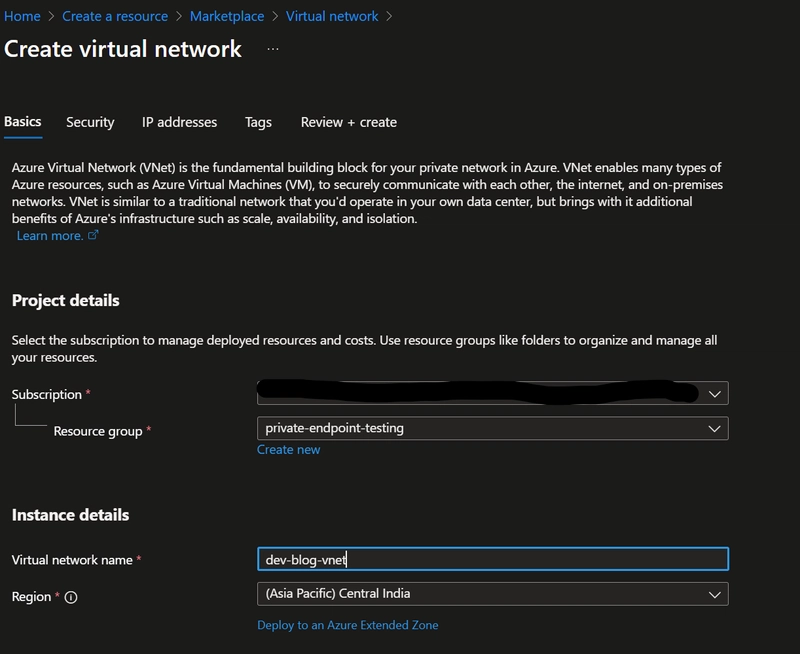

India’s Unified Payments Interface (UPI), the backbone of the country’s digital payment ecosystem, faced a significant outage today, marking the fourth disruption in less than three weeks.

The outage, which began around 10:30 AM IST, affected millions of users across major platforms like PhonePe, Google Pay, Paytm, and BHIM, as well as banking services linked to UPI, including those of State Bank of India (SBI), ICICI Bank, and HDFC Bank.

The National Payments Corporation of India (NPCI), which oversees UPI operations, has attributed the issue to “intermittent technical glitches” but has yet to provide a detailed explanation.

A Growing Concern for Digital India

The disruption comes at a time when UPI handles nearly 85% of India’s digital transactions, with a record 16.99 billion transactions processed in January 2025 alone, according to NPCI data. Today’s outage, lasting over four hours for some users, brought much of the country’s digital economy to a standstill, impacting everyone from street vendors to large retailers and online businesses.

Social media platforms, particularly X, were flooded with complaints as users reported failed transactions and delays in payments.

One user posted, “UPI down again? This is the third time this month I can’t pay for groceries!” Another remarked, “India’s cashless dream is crumbling with these frequent outages.” The hashtag #UPIDown trended briefly, reflecting public frustration.

NPCI’s Response

In an official statement posted at 1:36 PM IST, NPCI acknowledged the issue: “NPCI is currently facing intermittent technical issues, leading to partial UPI transaction declines. We are working to resolve the issue and will keep you updated. We regret the inconvenience caused.” By 3:00 PM IST, partial services were restored, but some users continued to report problems with specific banks and apps.

This is not the first time UPI has faced such challenges recently. On March 26 and April 2, 2025, similar outages disrupted services, with NPCI citing technical issues and high transaction volumes as contributing factors. The April 2 outage, which affected multiple apps, saw 514 complaints logged on Downdetector by 9 PM, though the actual impact was likely much larger.

Impact on Businesses and Consumers

The outage had a ripple effect across sectors. Small businesses, heavily reliant on UPI for quick payments, reported significant losses.

Rajesh Kumar, a vegetable vendor in Mumbai, shared, “I lost half my sales today because customers couldn’t pay via UPI, and most don’t carry cash anymore.” Larger merchants, including e-commerce platforms, also faced delays in processing orders, with some temporarily switching to card payments or cash-on-delivery options.

For consumers, the outage was a stark reminder of the vulnerabilities in India’s digital payment infrastructure.

Anjali Sharma, a Delhi-based IT professional, recounted her experience: “I was stuck at a café unable to pay for my bill. It’s frustrating when you’re told ‘UPI is down, try later.’ We need a more reliable system.”

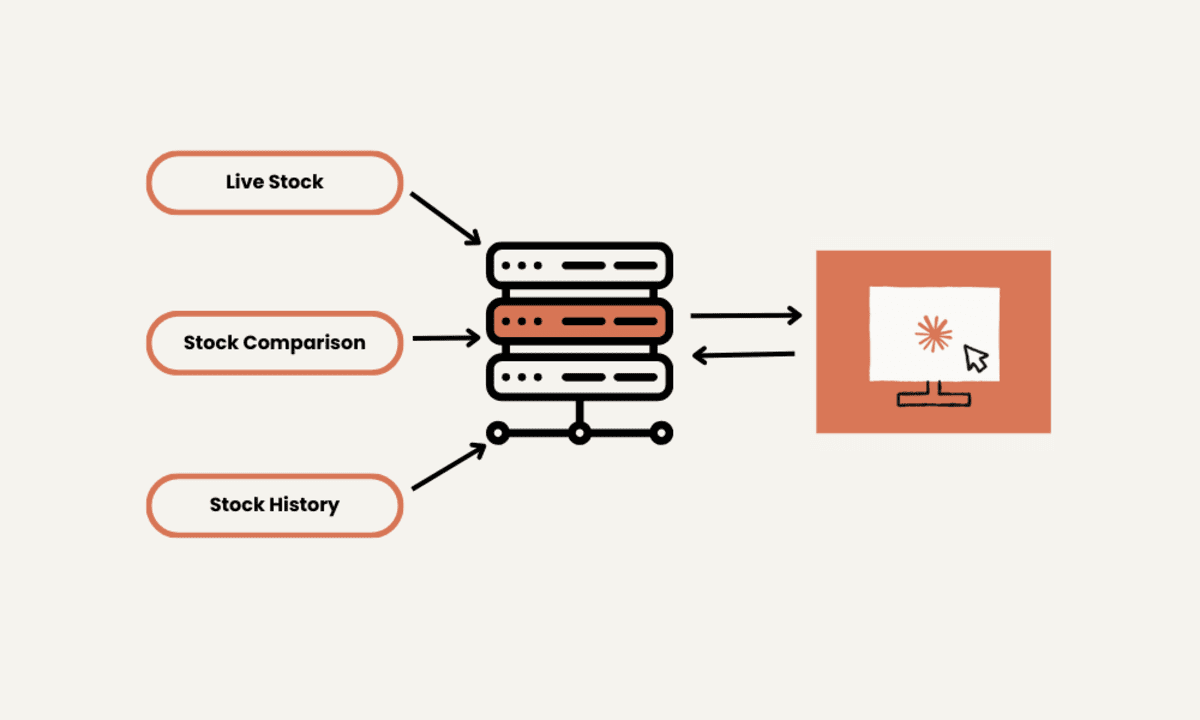

Technical and Systemic Challenges

Experts point to several potential causes for the recurring outages. High transaction volumes, especially during peak hours, put immense pressure on UPI’s servers.

In December 2024, UPI processed 16.73 billion transactions worth ₹23.25 lakh crore, a daily average of 539.68 million transactions. This exponential growth, while a testament to UPI’s success, strains the system’s capacity.

Cybersecurity concerns have also surfaced. While NPCI has not confirmed any breaches, some analysts speculate that the outages could be linked to stress testing or vulnerabilities in the system.

Dr. Neha Gupta, a fintech researcher, noted, “UPI’s architecture is robust, but frequent outages suggest deeper issues—possibly server overloads, software bugs, or even external interference. Transparency from NPCI is critical.”

The timing of today’s outage, coinciding with the weekend when many businesses process high volumes, amplified its impact. Additionally, the lack of immediate communication from NPCI and major banks left users in the dark, fueling speculation and distrust.

Calls for Accountability

The Payments Council of India, representing digital payment firms, has previously raised concerns about the sustainability of UPI’s free model, suggesting that transaction fees could help fund infrastructure upgrades.

However, a January 2025 survey by Local Circles found that 73% of users would abandon UPI if fees were introduced, complicating the debate.

Opposition leaders seized the opportunity to criticize the government’s Digital India initiative. Congress spokesperson Randeep Surjewala tweeted, “UPI outages are becoming routine, exposing the fragility of our digital economy.

The government must ensure a reliable payment system for millions.” Meanwhile, the Reserve Bank of India (RBI) has remained silent on today’s disruption, though it has previously emphasized the need for robust payment systems.

As UPI continues to dominate India’s digital payments processing 93.23 billion transactions in the second half of 2024 alone, a 42% year-on-year increase the stakes are higher than ever. The NPCI has introduced innovations like UPI Circle, UPI Lite, and cross-border payment features, but recurring outages threaten to erode public confidence.

For now, NPCI has assured users that full services will be restored soon, with teams working around the clock to address the issue. However, without clear answers on the root causes and preventive measures, questions linger about the resilience of India’s flagship payment system.

As the country awaits updates, today’s outage serves as a wake-up call for stakeholders to prioritize reliability and transparency in the pursuit of a truly cashless economy.

Find this News Interesting! Follow us on Google News, LinkedIn, & X to Get Instant Security News Updates!

The post UPI Down – UPI Outage Disrupt Millions of Digital Transactions Across India appeared first on Cyber Security News.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)

![Apple May Implement Global iPhone Price Increases to Mitigate Tariff Impacts [Report]](https://www.iclarified.com/images/news/96987/96987/96987-640.jpg)