SoftBank posts profit in FY24 as global bets offset headwinds from Indian companies

Share prices of its Indian portfolio companies, including Swiggy and Ola Electric, have struggled to maintain the momentum they witnessed post-listing last year.

SoftBank Group Corp on Tuesday reported a profit of 517.18 billion yen ($3.49 billion) in the fiscal year ended March 2025, helped by gains on its SoftBank Vision Fund I investments despite offsets from Indian portfolio companies.

The Japanese investment conglomerate, led by Masayoshi Son, made a 177.26 billion yen ($1.19 billion) profit on investments at SoftBank Vision Funds during this period, despite Vision Fund II continuing to struggle.

Vision Funds (SVF1 and SVF2) sold investments totalling $5.35 billion in the year ended March 2025, including full exits from portfolio companies such as DoorDash and SenseTime (including six investments transferred to Robo HD), and partial exits from several others.

Despite the bottom-line uptick, SoftBank’s Indian bets continued to suffer during this period.

Last week, Swiggy saw its losses almost double in the fourth quarter as it reeled under heavy spending on its quick commerce vertical. The company’s share price has declined by about 41% this year.

Similarly, Bhavish Aggarwal-led Ola Electric has been struggling with declining market share, regulatory hurdles, and persistent losses. While the company is yet to report its Q4 results, the share price of the EV-maker has fallen about 42% year-to-date.

At present, Swiggy and Ola Electric, part of SoftBank’s Vision Fund 2 portfolio, are trading under their IPO prices.

Additionally, Indian hospitality company OYO has reportedly shelved its IPO plans for the third time, according to a Bloomberg report. SoftBank had reportedly advised the company to hold back its listing plans until further financial improvement.

Meanwhile, SoftBank has turned its hopes to artificial intelligence, making bold bets in ChatGPT-maker OpenAI. It recently led a $40 billion funding round in the company, which saw its valuation almost double to $300 billion, making it one of the largest funding rounds for a tech company, according to media reports.

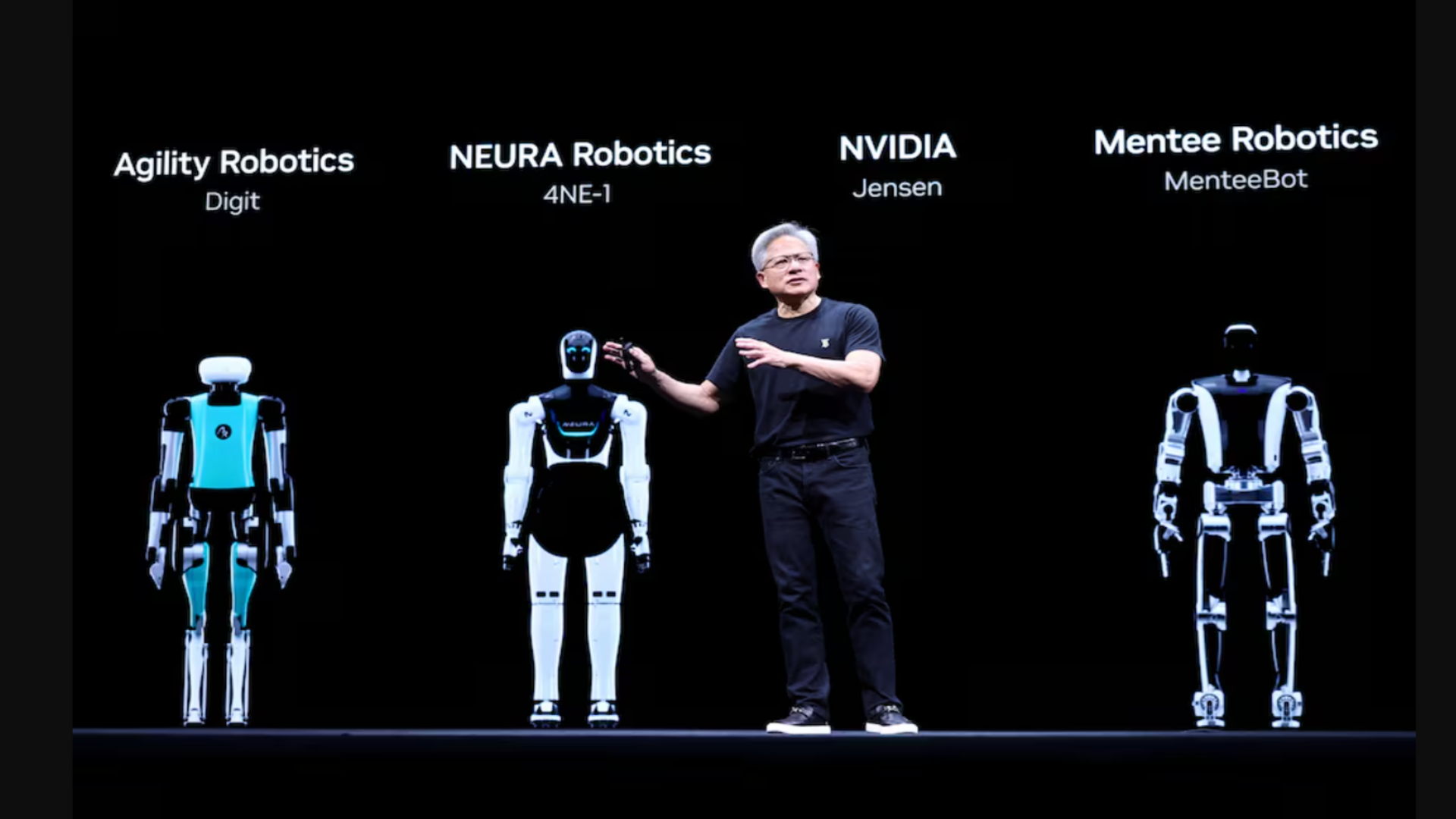

In January, it set up an intermediate holding company, Robo HD, to centralise its robotics-related investments. During Q4, it transferred 10 portfolio companies and six portfolio companies held by SVF2 into Robo HD.

According to a Bloomberg report in April, SoftBank is reportedly planning to secure a $16.5 billion loan to fund its AI investments in the US.

(1 Japanese Yen = 0.0068 USD)

Edited by Suman Singh

![[The AI Show Episode 156]: AI Answers - Data Privacy, AI Roadmaps, Regulated Industries, Selling AI to the C-Suite & Change Management](https://www.marketingaiinstitute.com/hubfs/ep%20156%20cover.png)

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

![Rust VS Go VS TypeScript – which back end language is for you? With Tai Groot [Podcast #176]](https://cdn.hashnode.com/res/hashnode/image/upload/v1750974265013/73f79068-0087-4c39-8a8b-feea8cac873b.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)