Bajaj FDs are available for 1, 3, and 5 years. Which offers higher returns?

Bajaj FD schemes are designed to cater to a range of investment goals and tenures. Choosing the right tenure depends on your financial priorities — be it short-term safety or long-term wealth accumulation.

Fixed deposits continue to be one of the most preferred savings instruments for Indian investors seeking secure and predictable returns. Whether you are planning for short-term goals, building an emergency fund, or saving for retirement, fixed deposits offer guaranteed returns without market-linked risks. Among the many FD providers, Bajaj fixed deposit schemes have gained popularity for offering competitive interest rates, flexible tenures, and convenient online booking options.

A common question that arises is which tenure provides the best returns — 1, 3, or 5 years? Let us explore Bajaj Finance FD rates across these three tenures, evaluate the returns they offer, and decide which option suits your financial goals best.

Understanding Bajaj fixed deposit

Bajaj Finance, a subsidiary of Bajaj Finance, offers fixed deposits to retail investors with tenures ranging from 12 to 60 months. These deposits are available in both cumulative and non-cumulative formats. Cumulative FDs pay interest at maturity, while non-cumulative FDs offer monthly, quarterly, half-yearly, annual or at maturity payouts — ideal for those seeking regular income.

Bajaj Fixed Deposit are known for their high AAA safety ratings by CRISIL and ICRA — which makes them a reliable choice for risk-averse investors.

Bajaj Finance FD rates for 1, 3, and 5 years

Interest rates are a key consideration when choosing the tenure of a fixed deposit. As of April 2025, Bajaj Finance FD rates vary depending on the tenure and type of investor (regular or senior citizen).

FD MAX interest rates for regular investors:

Tenure

● 1 year: Up to 7.60%

● 3 years: Up to 8.05%

● 5 years: Up to 8.05%

Interest rates for senior citizens:

Tenure

● 1 year: Up to 7.85%

● 3 years: Up to 8.30%

● 5 years: Up to 8.30%

Which tenure should you choose?

Choosing between 1, 3, or 5 years depends on your financial objectives, cash flow needs, and interest rate outlook.

1-year FD

Ideal for short-term needs or temporary parking of funds.

- Suitable for building an emergency corpus.

- Allows liquidity within a short time frame.

- Lower returns compared to longer tenures.

- Useful if you anticipate interest rates may rise soon.

3-year FD

Balances moderate returns with medium-term flexibility.

- Ideal for saving towards near-term goals like buying a car or funding education.

- Higher returns than 1-year FDs.

- Offers stable growth without locking funds for too long.

- Suitable for conservative investors who want fixed returns but with a shorter horizon than 5 years.

5-year FD

Best suited for long-term wealth accumulation.

- Maximises your earnings with the highest interest rates.

- Perfect for retirement planning or saving for children’s higher education.

- Bank FDs are eligible for tax deduction under Section 80C for up to Rs.1.5 lakh investment.

- Ideal for those who don’t need immediate liquidity and want capital safety with strong returns.

Advantages of investing in Bajaj fixed deposit

In addition to attractive Bajaj Finance FD rates, investors benefit from a host of features:

- Flexible payout options

- Choose between cumulative and non-cumulative schemes based on your income needs.

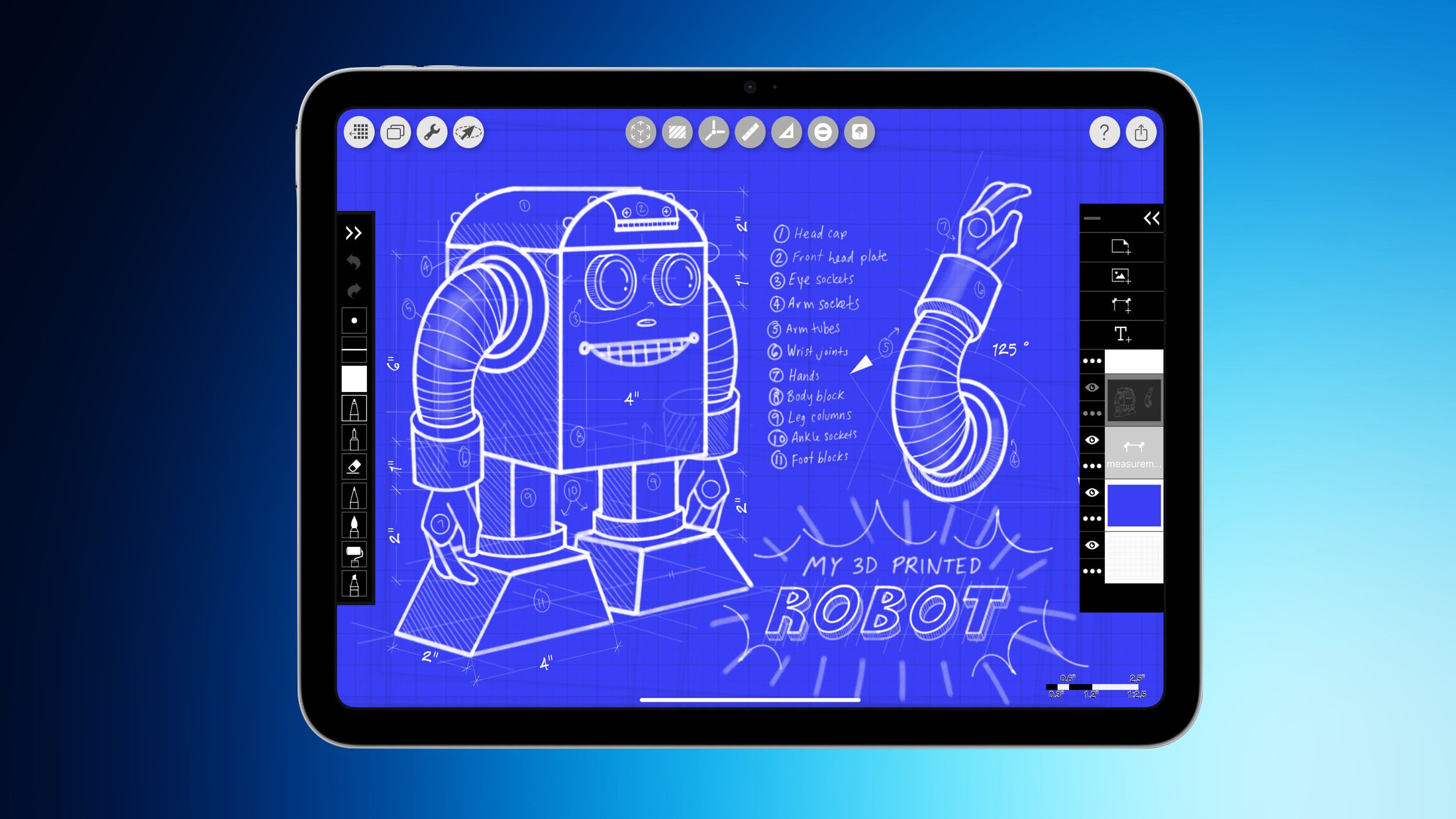

- Online FD calculator

- Easily calculate maturity amounts and interest earnings.

- Auto-renewal facility

- Automatically renew your FD on maturity to continue earning returns.

- Loan against FD

- Access funds without breaking your FD by availing a loan up to 75% of your deposit value.

Tips to maximise your FD returns

- Opt for cumulative FDs if you don’t need regular income – compound interest helps your savings grow faster.

- Stagger your investments across different tenures – a laddering strategy ensures periodic liquidity and better rate locking.

- Use auto-renewal wisely – avoid gaps between FD maturity and reinvestment.

- Reinvest interest earnings – instead of spending interest, consider investing it to create an additional growth channel.

Conclusion

Bajaj fixed deposit schemes are designed to cater to a range of investment goals and tenures. While the 1-year FD provides liquidity, the 3-year option offers balanced growth, and the 5-year FD delivers the highest returns. The Bajaj Finance FD rates make these deposits especially attractive for both regular and senior citizen investors.

Choosing the right tenure depends on your financial priorities — be it short-term safety or long-term wealth accumulation. By assessing your goals and comparing projected earnings, you can make an informed decision that aligns with your financial plan. Whether you’re starting your savings journey or planning for a secure retirement, Bajaj fixed deposits provide the safety, stability, and returns to meet your needs confidently.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpeg?#)

-Pokemon-GO---Official-Gigantamax-Pokemon-Trailer-00-02-12.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Wavebreakmedia_Ltd_IFE-240611_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares Official Trailer for 'Echo Valley' Starring Julianne Moore, Sydney Sweeney, Domhnall Gleeson [Video]](https://www.iclarified.com/images/news/97250/97250/97250-640.jpg)