Info Edge sees blockbuster returns on early-stage bets in Zomato, Policybazaar

The company said it believes its recent investments holds unrealised value as growth, market share, and externally led follow-on rounds point to strong growth.

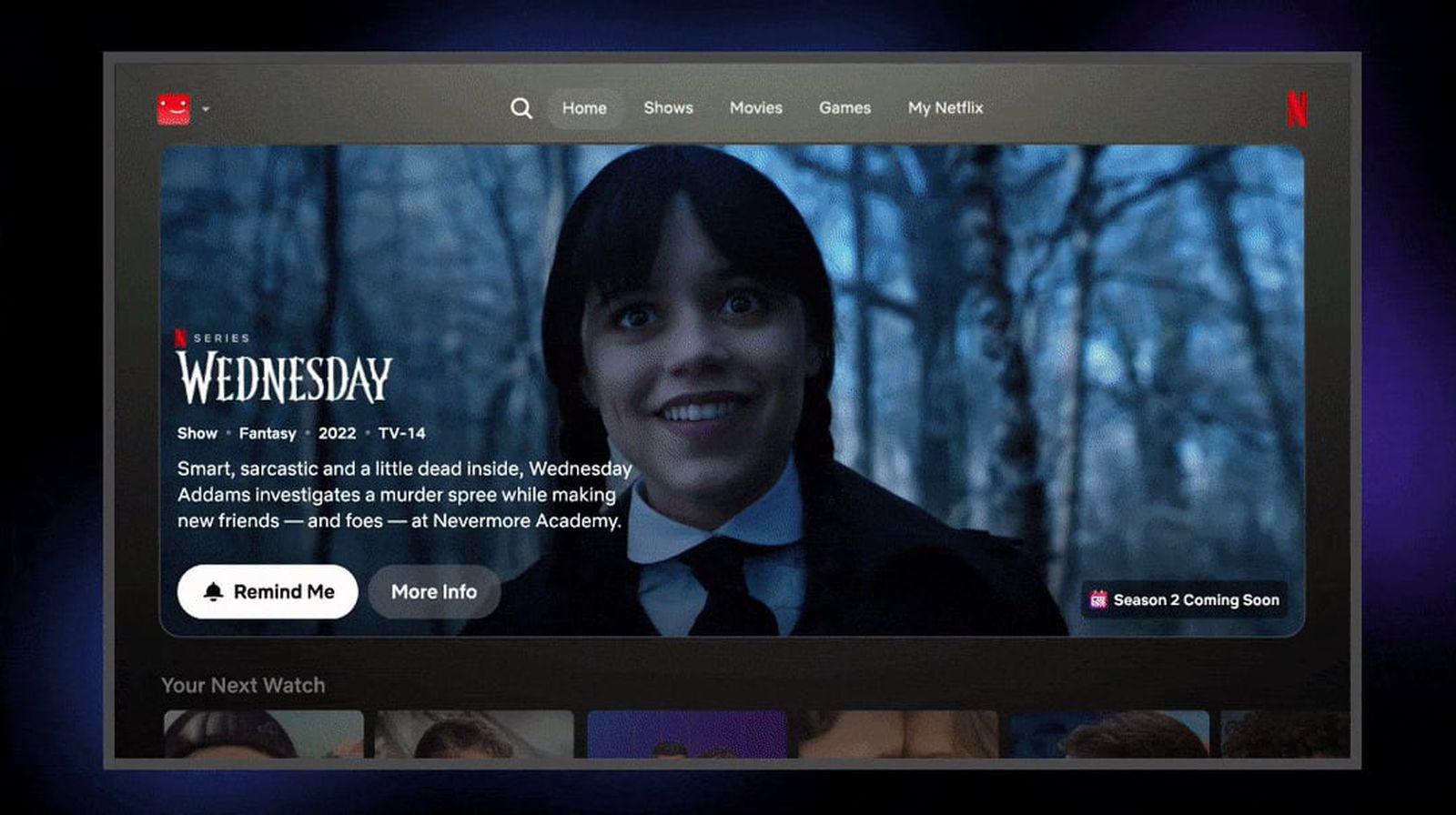

Online classifieds platform Info Edge on Tuesday said it has seen successful returns from its early bets, including foodtech major Zomato and Policybazaar.

As of March 31, the two companies had a combined market cap of over Rs 2.5 lakh crore, with Info Edge having a shareholding value of over Rs 31,500 crore.

Info Edge has since invested 3,959.16 crore across companies and currently has a portfolio valued at Rs 36,855.40 crore, delivering a gross internal rate of return of 36%, it said in a letter to shareholders.

“We first started investing in early-stage technology startups around 18 years ago, in 2007. This investing activity today contributes to an estimated 30-40% of the value of the company if analyst reports are to be believed—second only to the contribution of Naukri.com,” Info Edge Co-founder Sanjeev Bikhchandani said.

Zomato and Policybazaar were part of the company’s first phase of investments. During the second phase of the investment journey, between 2012 and 2015, it maintained a more cautious approach as winners from Phase 1 were yet to emerge.

Between 2017 and 2019, Info Edge invested in edtech company Adda247 and logistics platform Shipsy. These companies have raised external follow-on rounds at higher valuations. Emerging winners from this set are well-capitalised with runway and potential listing, Bikhchandani noted.

In 2019, the company entered its fourth phase and set up its Info Edge Venture Fund (IEVF)—a venture capital fund. It has since invested through three different funds, namely IEVF, Info Edge Capital, and Capital 2B. The total corpus of these funds is Rs 3,422.94 crore, out of which Info Edge infused Rs 1,613.75 crore.

Going forward, the company expects to see several recent bets in startups, which include TrueMeds, Geniemode, and InPrime to start taking off. Bikhchandani added that early-stage investing usually needs 7-8 years for companies to achieve meaningful scale in revenue and market share.

Additionally, its largest investment in omnichannel jewellery retailers BlueStone is expected to yield returns upon its listing. The company has already filed its draft red herring prospectus with SEBI for an IPO in the coming months.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)