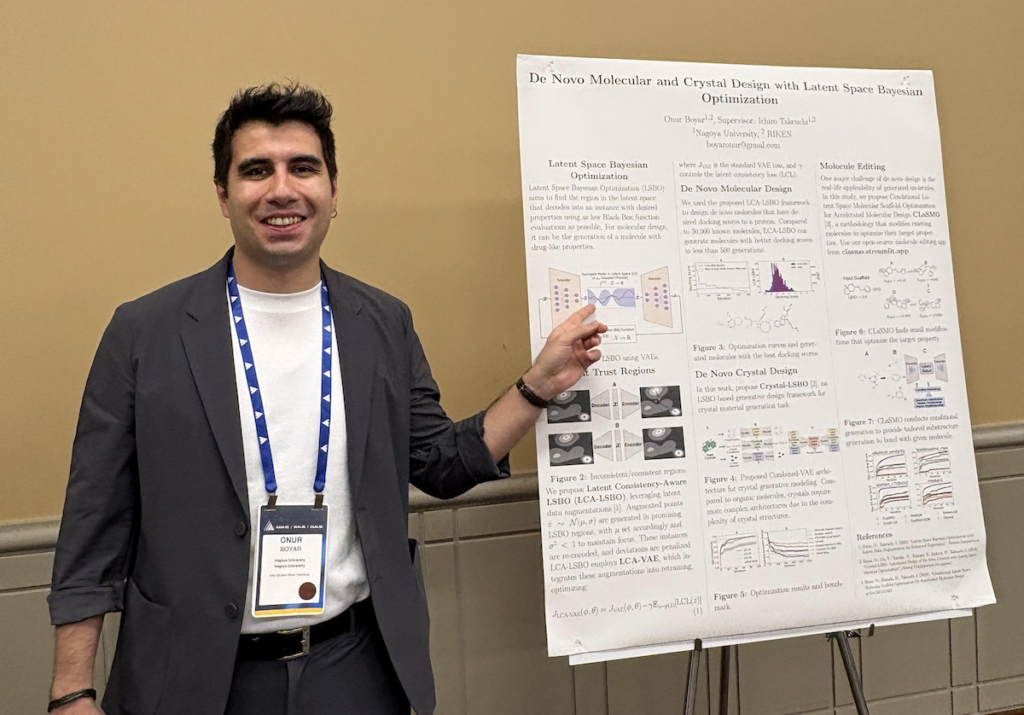

[Weekly funding roundup May 3-9] VC inflow into Indian startups touches new high

The week saw the highest amount of venture capital funding raised by the Indian startup ecosystem, largely due the presence of large deals.

![[Weekly funding roundup May 3-9] VC inflow into Indian startups touches new high](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)

The first week of March had a blockbuster opening, as the venture capital (VC) funding into Indian startups on a weekly basis touched the highest level for the year till now, boosted by two $200 million plus deals.

The total funding for the week came in at $618 million across 29 deals, which was a 494% increase when compared to the previous week number of $104 million.

This sharp increase in VC inflow is a positive surprise given the ongoing tension between India and Pakistan along with the challenging macro economic environment.

The two large transactions from PB Healthcare and Porter provided the boost to overall funding. It was also an important development that there was a transaction in the Series F stage of funding, as these generally bring in the large value cheques. During the week, the funding amount was spread across stages and this was a welcome sign.

Though it remains to be seen if this trend will continue in the forthcoming weeks, as such a sudden spike in VC funding is largely due to one or two transactions. Though overall, it augurs well for the Indian startup ecosystem showing a strong investor interest.

On the other hand, the Indian startup ecosystem continues to witness interesting developments. The DPIIT has enhanced credit guarantee scheme for startups which is a welcome development for the community. EV maker Ather Energy had a modest debut on the stock exchanges and this paves the way for more startups to list in a year which has been tepid till now. Though Simple Energy has spoken about its plans for public listing.

The Indian startups which are now listed entities continued to face challenging times in turning out profit numbers as they remained in the loss making territory and this was evident from the financial results of Swiggy and Paytm.

Key transactions

PB Healthcare Services raised $218 million led by General Catalyst.

Logistics startup Porter raised $200 million from Kedaara Capital, Wellington Management and Vitruvian Partners.

Corporate transport solutions provider Routematic raised $40 million from Fullerton Carbon Action Fund and Shift4Good.

Commercial space design platform Flipspaces raised $35 million from Iron Pillar, Prudent Investment Managers and Synergy Capital.

Cold chain logistics startup Celcius raised Rs 250 crore ($29 million approx.) from Eurazeo, Omnivore, IvyCap Ventures, Trifecta Capital, Lighthouse Canton and others.

Homegrown beverage brand Lahori raised Rs 200 crore ($23 million approx.) from Motilal Oswal and Verlinvest.

Nutraceutical consumer startup The Good Bug raised Rs 100 crore ($11.8 million approx.) from Susquehanna Asia VC and Fireside Ventures.

Kitchen robotics startup Posha raised $8 million from Accel, Xeed Ventures, Waterbridge Ventures and angel investors.

Edtech startup Footprints Preschool & Daycare raised $7.5 million from Tanglin Venture Partners.

Spacetech startup Inspecity raised $5.6 million from Speciale Invest, Shastra VC, Antler India, DeVC, MGF Kavachh, and Anicut Capital.

Edited by Jyoti Narayan

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Ditching a Microsoft Job to Enter Startup Hell with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2-Hands-On-Preview-Mario-Kart-World-Impressions-&-More!-00-10-30.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-xl.jpg)

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)