Trading Competitions: Why Emotional Discipline Matters More Than Strategy

The common perception of trading often revolves around technical analysis, algorithms, and advanced strategies. While these components are essential, they only represent part of the picture. Trading, particularly in competitive environments, also demands psychological resilience and emotional control. This becomes particularly evident in trading tournaments, where pressure, time limits, and direct competition create a behavioral environment that tests more than just market knowledge. Success in such scenarios is not determined solely by the depth of one's strategy, but by the ability to execute under stress. The Challenge of Performance Under Pressure In trading competitions, participants aren't just battling the market—they're also contending with one another. Public leaderboards, predefined timelines, and fixed capital allocations amplify stress. As a result, even skilled traders may deviate from proven strategies in pursuit of short-term gains. Key psychological stressors include: - Time pressure: Quick decision-making often replaces thorough analysis. - Performance visibility: Rankings introduce a social element that distorts risk-taking behavior. - Competitive framing: The tournament structure encourages more volatile choices, such as increased leverage or riskier assets. Common Errors Driven by Emotional Bias The emotional and cognitive toll of high-stakes environments can result in predictable trading errors. These behaviors are not caused by poor strategy, but by a breakdown in discipline. - Overtrading early in the competition: Participants rush to make gains, increasing risk exposure prematurely. - Abandoning market analysis: Under pressure, traders skip research and rely on intuition, compromising decision quality. - Position size mismanagement: Emotional highs and lows often cause deviations from capital management principles. - Strategy imitation: Copying others without understanding their rationale can lead to misalignment and avoidable losses. Institutional Examples of Competitive Tournaments Several major exchanges have launched trading tournaments with significant financial incentives: - Bybit's "Crypto Surf": Teams of traders (bots vs. humans) compete for $250,000 USDT. - WhiteBIT's ICTC: A global competition with a $5 million USDT prize pool, open to professionals and spectators alike. - Gate.io's WCTC S7: Individual and team-based competition for another $5 million USDT prize pool. These environments present valuable opportunities for testing strategies, but they also reveal how easily behavior can diverge from disciplined execution under competitive stress. Practical Guidelines for Developers and Traders Alike Whether you’re a developer building trading systems or a trader refining your process, understanding the intersection of psychology and performance is critical. - Define long-term objectives: Avoid reactive decision-making by committing to measurable, long-term goals. - Set risk parameters: Codify risk tolerance levels to protect against impulsive exposure. - Develop mechanisms for emotional control: This may include session time limits, cooldown phases, or forced pauses in execution. - Review behavioral data post-competition: Track how decisions changed under pressure. Use this insight to recalibrate future systems or strategies. Conclusion Trading competitions are not just a test of strategy—they are a test of self-regulation. For developers, understanding how competitive framing affects user behavior can inform better UX design, risk control systems, and behavioral safeguards. For traders, success is measured not just by returns, but by consistency, control, and clarity under pressure. Mastering the emotional side of trading is not a luxury—it's a requirement in high-stakes environments. Do you build or participate in trading tournaments? Share your perspective on behavioral design or psychological resilience in the comments.

The common perception of trading often revolves around technical analysis, algorithms, and advanced strategies. While these components are essential, they only represent part of the picture. Trading, particularly in competitive environments, also demands psychological resilience and emotional control.

This becomes particularly evident in trading tournaments, where pressure, time limits, and direct competition create a behavioral environment that tests more than just market knowledge. Success in such scenarios is not determined solely by the depth of one's strategy, but by the ability to execute under stress.

The Challenge of Performance Under Pressure

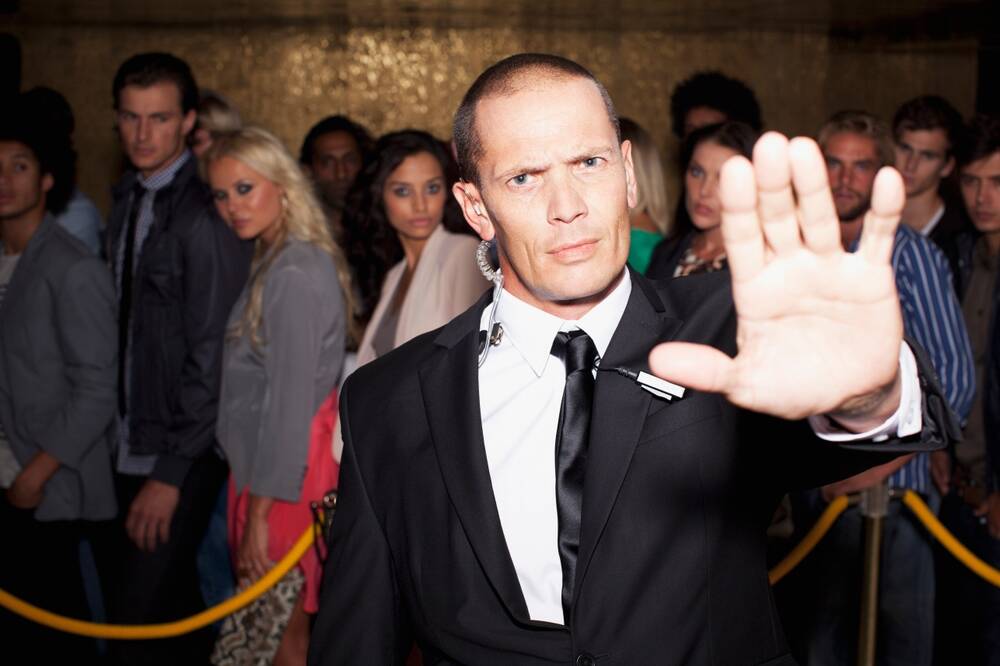

In trading competitions, participants aren't just battling the market—they're also contending with one another. Public leaderboards, predefined timelines, and fixed capital allocations amplify stress. As a result, even skilled traders may deviate from proven strategies in pursuit of short-term gains.

Key psychological stressors include:

- Time pressure: Quick decision-making often replaces thorough analysis.

- Performance visibility: Rankings introduce a social element that distorts risk-taking behavior.

- Competitive framing: The tournament structure encourages more volatile choices, such as increased leverage or riskier assets.

Common Errors Driven by Emotional Bias

The emotional and cognitive toll of high-stakes environments can result in predictable trading errors. These behaviors are not caused by poor strategy, but by a breakdown in discipline.

- Overtrading early in the competition: Participants rush to make gains, increasing risk exposure prematurely.

- Abandoning market analysis: Under pressure, traders skip research and rely on intuition, compromising decision quality.

- Position size mismanagement: Emotional highs and lows often cause deviations from capital management principles.

- Strategy imitation: Copying others without understanding their rationale can lead to misalignment and avoidable losses.

Institutional Examples of Competitive Tournaments

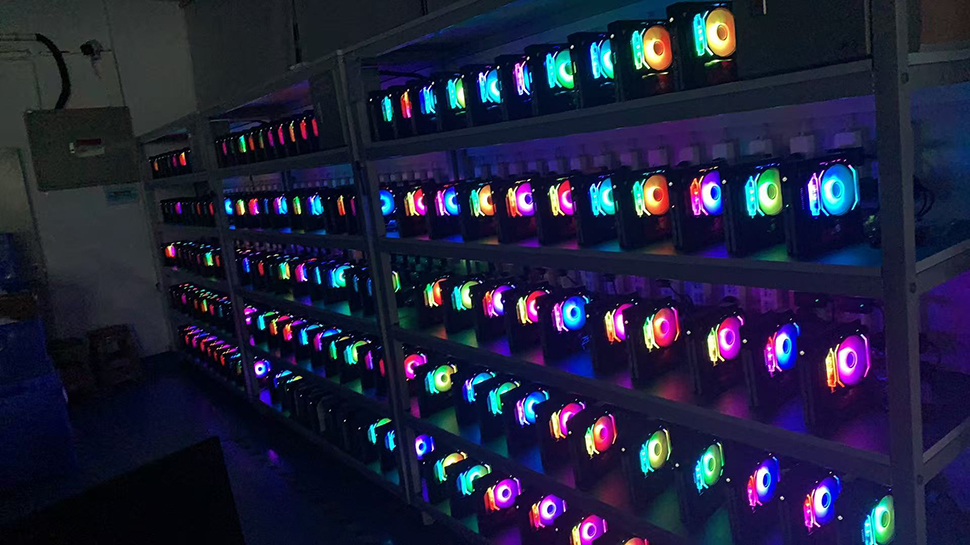

Several major exchanges have launched trading tournaments with significant financial incentives:

- Bybit's "Crypto Surf": Teams of traders (bots vs. humans) compete for $250,000 USDT.

- WhiteBIT's ICTC: A global competition with a $5 million USDT prize pool, open to professionals and spectators alike.

- Gate.io's WCTC S7: Individual and team-based competition for another $5 million USDT prize pool.

These environments present valuable opportunities for testing strategies, but they also reveal how easily behavior can diverge from disciplined execution under competitive stress.

Practical Guidelines for Developers and Traders Alike

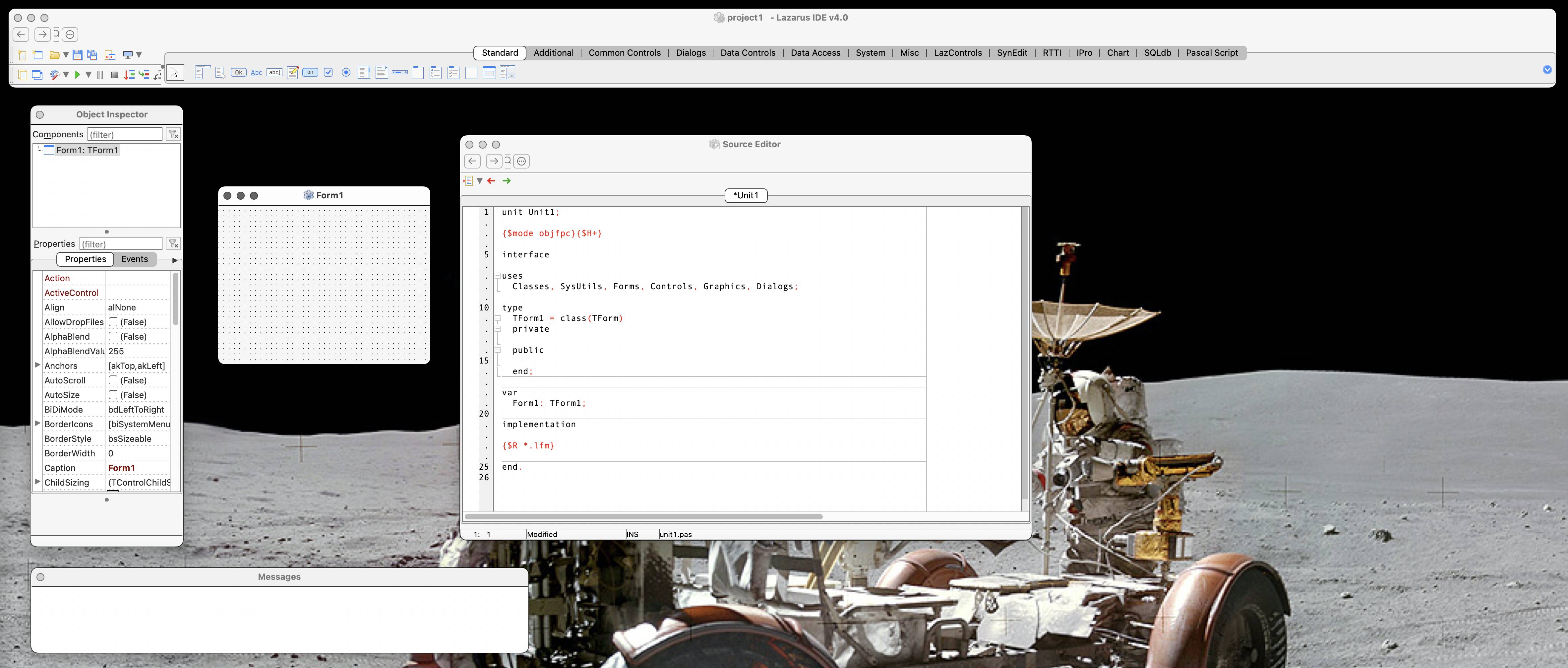

Whether you’re a developer building trading systems or a trader refining your process, understanding the intersection of psychology and performance is critical.

- Define long-term objectives: Avoid reactive decision-making by committing to measurable, long-term goals.

- Set risk parameters: Codify risk tolerance levels to protect against impulsive exposure.

- Develop mechanisms for emotional control: This may include session time limits, cooldown phases, or forced pauses in execution.

- Review behavioral data post-competition: Track how decisions changed under pressure. Use this insight to recalibrate future systems or strategies.

Conclusion

Trading competitions are not just a test of strategy—they are a test of self-regulation. For developers, understanding how competitive framing affects user behavior can inform better UX design, risk control systems, and behavioral safeguards.

For traders, success is measured not just by returns, but by consistency, control, and clarity under pressure.

Mastering the emotional side of trading is not a luxury—it's a requirement in high-stakes environments.

Do you build or participate in trading tournaments? Share your perspective on behavioral design or psychological resilience in the comments.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Ditching a Microsoft Job to Enter Startup Hell with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2-Hands-On-Preview-Mario-Kart-World-Impressions-&-More!-00-10-30.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-xl.jpg)

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![[Weekly funding roundup May 3-9] VC inflow into Indian startups touches new high](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)