The Smart Scale: Why some robotics startups grow while others stall

Despite early traction, many robotics startups stall before reaching meaningful scale. They face unique hurdles—from complex deployments to GTM pitfalls and over-reliance on single customers. This article explores why scaling robotics is so hard—and what it takes to break through.

It was a crisp fall afternoon at Revolution, a craft pub near Bedford, MA–a key robotics hub near Boston. A group of roboticists gathered over drinks, discussing why so many robotics companies are stalling, struggling to achieve sustained profitability or a meaningful exit. Boston, home to companies like iRobot, Boston Dynamics, and Amazon Robotics, has fostered innovation, but not many major exits.

For robotics startups, there are typically three possible outcomes—sustained profitability, where a company successfully builds a self-sustaining business with consistent revenue and growth; an exit, where another company acquires the startup, hopefully marking a financial win for founders and investors, but not necessarily long-term success for the technology itself; or failure, the unfortunate fate of many robotics startups that struggle with funding, scaling, or adoption.

No robotics company has yet reached the scale of NVIDIA or Meta despite the industry’'s growth. While firms like iRobot and Boston Dynamics have gained recognition, they remain niche players rather than tech giants.

The question remains: Why is robotics so hard and why are so many companies stalling…

The complexity of scaling robotics startups

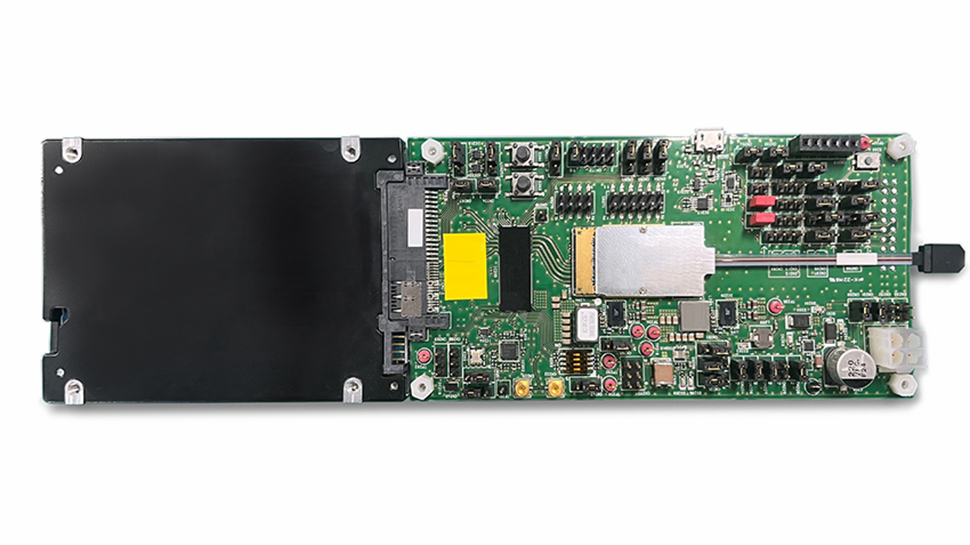

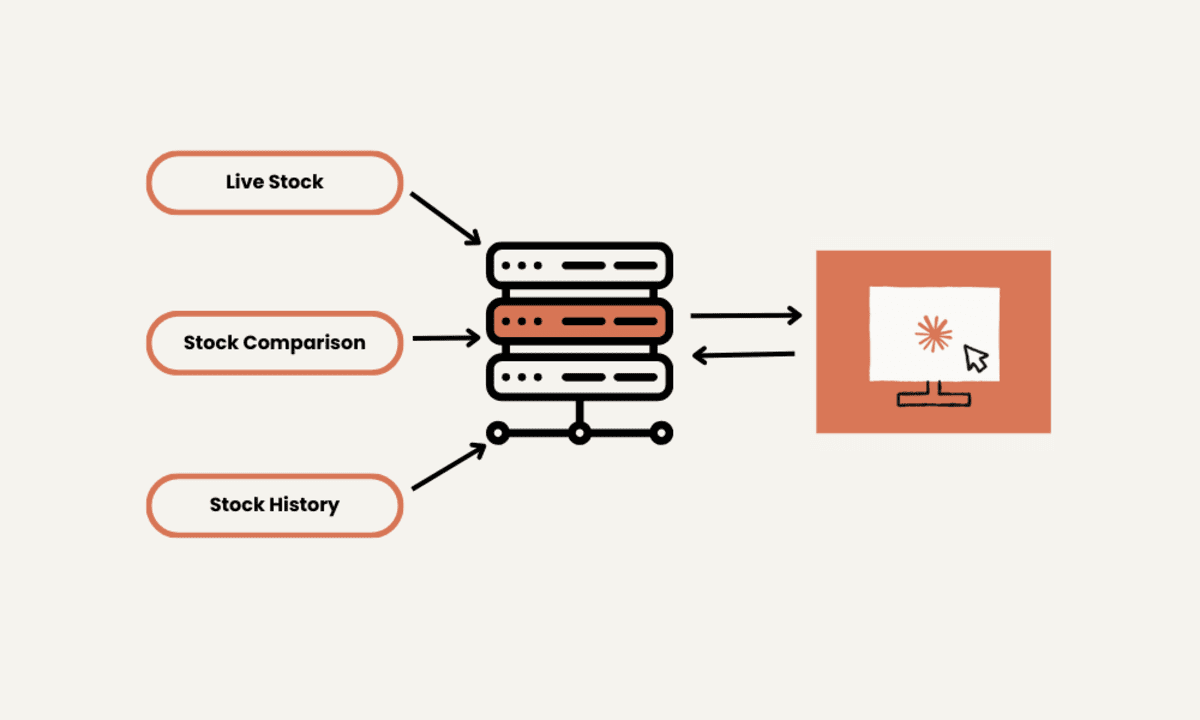

Robotics is an incredibly challenging sector, largely because companies exist on a spectrum between hardware and software. Imagine a continuum where hardware is positioned on the left and software on the right. Some companies, such as Unitree Robotics (known for humanoids and quadrupeds), ABB (pick arms), and drone manufacturers, are predominantly hardware-focused. On the other end of the spectrum, firms like Intrinsic Robotics and SVT specialize purely in software solutions. However, the majority of robotics startups exist somewhere in between, blending elements of both.

Most robotics companies generally follow a few core principles:

(a) They minimise custom hardware development by leveraging off-the-shelf components to avoid reinventing the wheel

(b) They incorporate as much existing software as possible while focusing on developing the necessary differentiating aspects

(c) They target a significant pain point in the market

(d) They land an initial customer with the hope of expanding from there. As we sat around our table at Revolution, sharing pints, nearly everyone in the conversation—whether working in a robotics startup or having done so in the past—nodded in agreement.

Yet, therein lies the challenge. Many robotics startups successfully secure pilot programmes and even a handful of mainstream deployments. This is often the stage where venture capitalists start getting excited, anticipating exponential growth.

However, unlike SaaS businesses, robotics companies face a much longer and more complex journey to scale. The transition from securing the first handful of successful deployments (let’s say 0-10) can create the illusion of an impending exponential growth curve. But moving beyond that initial success—scaling from 10 to 100 deployments—is a painstakingly slow and treacherous minefield filled with corner cases and operational hurdles.

Key observations on scaling robotics startups

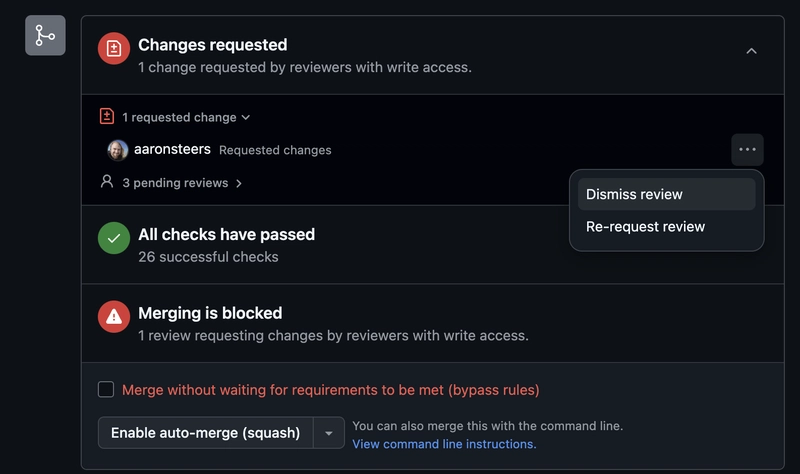

1. Scaling is not just a GTM problem–Many perceive scaling as a go-to-market (GTM) challenge and attempt to solve it by adding a massive sales engine. However, this can be a recipe for disaster. The sales team may flood the pipeline with use cases that seem like a fit but are merely adjacencies at best. The product team must rigorously qualify every lead and remain laser-focused on customers whose use cases they can truly solve. Corner cases can kill a company. Additionally, resist the temptation to offer free pilots.

2. Engineering must balance innovation with reliability–Many talented engineers are drawn to solving innovative and complex problems. However, few want to focus on the “boring” aspects of dependability and reliability—the very qualities customers value and pay for. Building the right mix of talent is critical. And no divas, please.

3. Avoid over-reliance on a single customer–Many robotics companies fall into the trap of depending too heavily on one large customer. A flagship deal with a letter of intent (LOI) for 500-1,000 robots may seem like a breakthrough, but it can vanish overnight due to internal leadership changes. Companies must diversify their customer base to avoid such existential risks.

4. Underestimating the cost of infrastructure changes–The cost of civil engineering and modifications required for robotic installations can be a significant barrier to adoption. Companies must design solutions that work in brownfield environments rather than requiring major overhauls to existing infrastructure.

Despite these challenges, we have seen successful exits among robotics firms that focus intensely on solving one problem exceptionally well. Consider Bloomfield Robotics or Meta’s acquisition of Faciometrics.

Additionally, some companies continue to navigate the minefield and scale, such as Autostore and Symbotic.

Will there ever be a robotics giant?

As the evening wore on at Revolution, the question that lingered was whether a robotics company would ever reach the scale of NVIDIA, Apple, Meta, or Alphabet. The consensus? It’s not a matter of if, but when. The evolution of autonomous vehicles is proving that robotics at scale is possible, and a similar transformation could happen with general-purpose robots.

The key will be solving reliability, cost, and deployment hurdles at a level that makes automation ubiquitous. We raised our glasses, knowing that the path ahead would remain a minefield—but for the right company, the rewards will be enormous.

(Written by Krish Kuptathil, Operating Partner, Avataar Ventures; and Sridhar Solur, Consultant, Avataar Ventures)

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)