Seed Funding for Blockchain: Cultivating Innovation in a Decentralized Era

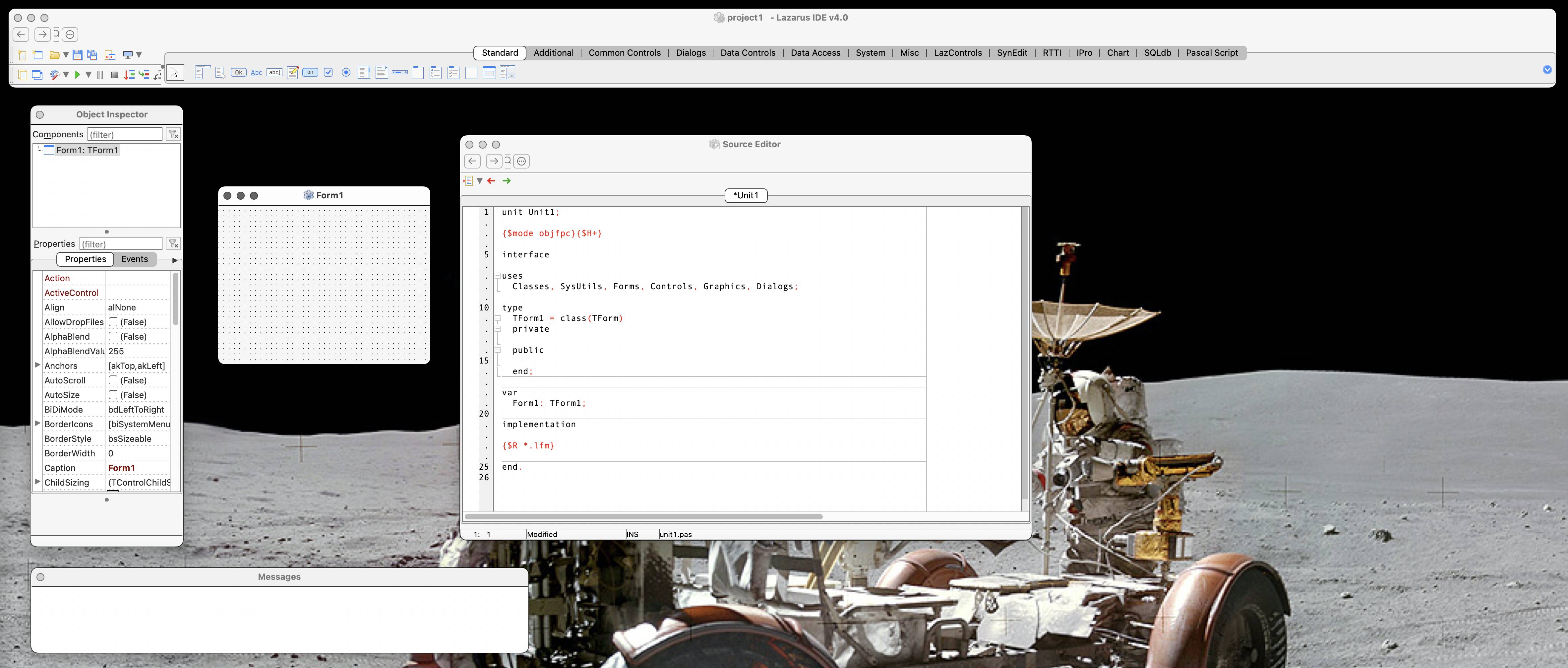

Abstract This post explores the crucial role of seed funding in the rapidly evolving blockchain ecosystem. It delves into the basics of seed funding, its relevance for blockchain projects, and the challenges faced by startups in securing early-stage investments. Through detailed background context, key concepts, practical applications, and future outlooks, we offer a comprehensive guide for innovators and investors alike. Strategic insights, tables, bullet lists, and numerous hyperlinks to authoritative resources—including dev.to posts and curated content from License Token—further enhance this read. Introduction Blockchain technology is transforming industries with transparency, security, and decentralization at its core. However, groundbreaking innovations in this space often begin as ideas that require robust seed funding to blossom into full-fledged ventures. In this post, we explore seed funding for blockchain projects in detail, discussing what it is, why it is essential, and how startups can secure the necessary capital to drive their technologies forward. We also provide additional context by integrating related topics such as smart contracts, regulatory compliance, and decentralized finance models. As blockchain startups navigate high entry costs and regulatory complexities, investors and innovators need a clear, evidence-based narrative. This article not only builds on the original article, Seed Funding for Blockchain: Cultivating Innovation in a Decentralized Era, but also expands on its ideas by discussing ecosystem trends, key funding strategies, and emerging challenges. With a blend of technical insight and accessible language, our discussion aims to serve both seasoned blockchain professionals and new entrants to this dynamic field. Background and Context What Is Seed Funding? Seed funding is the early capital provided to a startup, typically before revenue inflow begins. For blockchain projects—which often have high technological and legal complexities—seed funding acts as a catalyst for prototype development, team-building, market research, and regulatory compliance. Originally sourced from personal networks, a growing number of angel investors, venture capitalists, incubators, and alternative channels (such as Initial Coin Offerings [ICOs], Security Token Offerings [STOs], and crowdfunding platforms) now provide these funds. Key aspects of seed funding include: Prototype Development: Transforming white papers into working prototypes. Team Building: Recruiting experts in cryptography, software development, and legal fields. Market Validation: Testing products in niche markets to ensure a clear product-market fit. Regulatory Compliance: Investing in legal and advisory services to navigate complex blockchain regulations. For more on transforming ideas into working models, see smart contracts on blockchain. The Blockchain Ecosystem Blockchain is not just a technology; it is an ecosystem featuring various components and verticals such as decentralized finance (DeFi), non-fungible tokens (NFTs), smart contracts, and data security. The development of blockchain has led to significant disruption in finance, supply chain management, healthcare, and governance. Moreover, regulatory landscapes across the globe continue to evolve. Blockchain projects must contend with compliance challenges—an issue highlighted in resources such as blockchain regulation. Core Concepts and Features Seed Funding Channels Blockchain projects benefit from diversified funding sources. Here is a table summarizing the primary channels: Funding Source Characteristics Example/Resource Angel Investors High net worth individuals who offer capital in exchange for equity, mentorship, and networks. Angel Investors Venture Capitalists (VCs) Firms specializing in early-stage investments offering both capital and strategic advice. Venture Capitalists Incubators & Accelerators Programs that provide mentorship, seed capital, and networking in exchange for early equity. Y Combinator ICOs and STOs Platforms for raising public funds by issuing tokens governed by smart contracts. ICOs/STOs Crowdfunding Platforms Websites that mobilize capital directly from consumers and enthusiasts. Kickstarter This table outlines the diverse pathways available and their unique benefits for blockchain projects. Key Funding Strategies Securing seed funding is not just about raising money—it’s about creating a compelling narrative and demonstrating potential value. Essential strategies include: Crafting a Compelling Narrative: Present a clear, data-driven story that encapsulates the disruptive potential of the project. Developing a Detailed White Paper and Prototype: A comprehensive document and a working prototype enhance credibility. Building a Strong Founding Team: Assembling talent with deep expertise across cryptography, legal f

Abstract

This post explores the crucial role of seed funding in the rapidly evolving blockchain ecosystem. It delves into the basics of seed funding, its relevance for blockchain projects, and the challenges faced by startups in securing early-stage investments. Through detailed background context, key concepts, practical applications, and future outlooks, we offer a comprehensive guide for innovators and investors alike. Strategic insights, tables, bullet lists, and numerous hyperlinks to authoritative resources—including dev.to posts and curated content from License Token—further enhance this read.

Introduction

Blockchain technology is transforming industries with transparency, security, and decentralization at its core. However, groundbreaking innovations in this space often begin as ideas that require robust seed funding to blossom into full-fledged ventures. In this post, we explore seed funding for blockchain projects in detail, discussing what it is, why it is essential, and how startups can secure the necessary capital to drive their technologies forward. We also provide additional context by integrating related topics such as smart contracts, regulatory compliance, and decentralized finance models.

As blockchain startups navigate high entry costs and regulatory complexities, investors and innovators need a clear, evidence-based narrative. This article not only builds on the original article, Seed Funding for Blockchain: Cultivating Innovation in a Decentralized Era, but also expands on its ideas by discussing ecosystem trends, key funding strategies, and emerging challenges. With a blend of technical insight and accessible language, our discussion aims to serve both seasoned blockchain professionals and new entrants to this dynamic field.

Background and Context

What Is Seed Funding?

Seed funding is the early capital provided to a startup, typically before revenue inflow begins. For blockchain projects—which often have high technological and legal complexities—seed funding acts as a catalyst for prototype development, team-building, market research, and regulatory compliance. Originally sourced from personal networks, a growing number of angel investors, venture capitalists, incubators, and alternative channels (such as Initial Coin Offerings [ICOs], Security Token Offerings [STOs], and crowdfunding platforms) now provide these funds.

Key aspects of seed funding include:

- Prototype Development: Transforming white papers into working prototypes.

- Team Building: Recruiting experts in cryptography, software development, and legal fields.

- Market Validation: Testing products in niche markets to ensure a clear product-market fit.

- Regulatory Compliance: Investing in legal and advisory services to navigate complex blockchain regulations.

For more on transforming ideas into working models, see smart contracts on blockchain.

The Blockchain Ecosystem

Blockchain is not just a technology; it is an ecosystem featuring various components and verticals such as decentralized finance (DeFi), non-fungible tokens (NFTs), smart contracts, and data security. The development of blockchain has led to significant disruption in finance, supply chain management, healthcare, and governance.

Moreover, regulatory landscapes across the globe continue to evolve. Blockchain projects must contend with compliance challenges—an issue highlighted in resources such as blockchain regulation.

Core Concepts and Features

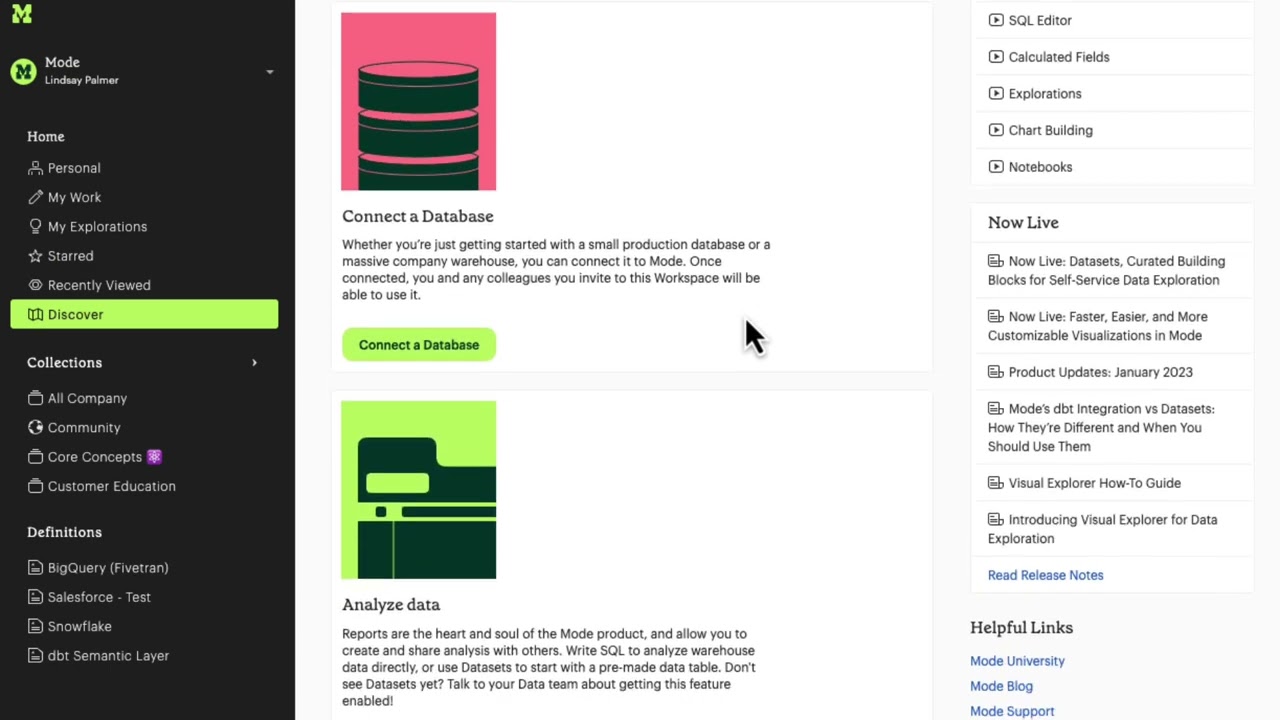

Seed Funding Channels

Blockchain projects benefit from diversified funding sources. Here is a table summarizing the primary channels:

| Funding Source | Characteristics | Example/Resource |

|---|---|---|

| Angel Investors | High net worth individuals who offer capital in exchange for equity, mentorship, and networks. | Angel Investors |

| Venture Capitalists (VCs) | Firms specializing in early-stage investments offering both capital and strategic advice. | Venture Capitalists |

| Incubators & Accelerators | Programs that provide mentorship, seed capital, and networking in exchange for early equity. | Y Combinator |

| ICOs and STOs | Platforms for raising public funds by issuing tokens governed by smart contracts. | ICOs/STOs |

| Crowdfunding Platforms | Websites that mobilize capital directly from consumers and enthusiasts. | Kickstarter |

This table outlines the diverse pathways available and their unique benefits for blockchain projects.

Key Funding Strategies

Securing seed funding is not just about raising money—it’s about creating a compelling narrative and demonstrating potential value. Essential strategies include:

- Crafting a Compelling Narrative: Present a clear, data-driven story that encapsulates the disruptive potential of the project.

- Developing a Detailed White Paper and Prototype: A comprehensive document and a working prototype enhance credibility.

- Building a Strong Founding Team: Assembling talent with deep expertise across cryptography, legal frameworks, and software development is crucial.

- Engaging with the Blockchain Community: Active participation in forums, conferences, and community platforms boosts visibility. For more on community-driven projects, explore blockchain and community engagement.

Integrating Regulatory and Technical Compliance

Due to rapid technological evolution, blockchain projects must also invest in ensuring adherence to regulatory requirements and technical standards. Notable aspects include:

- Regulatory Compliance: Understanding and complying with local and international laws is vital for investor confidence. For direct insights, check blockchain regulation.

- Smart Contract Audits: Regular audits help mitigate risks related to financial transactions and security vulnerabilities.

Additional insights into technical compliance are provided in resources such as:

Applications and Use Cases

Use Case 1: Decentralized Finance (DeFi) Projects

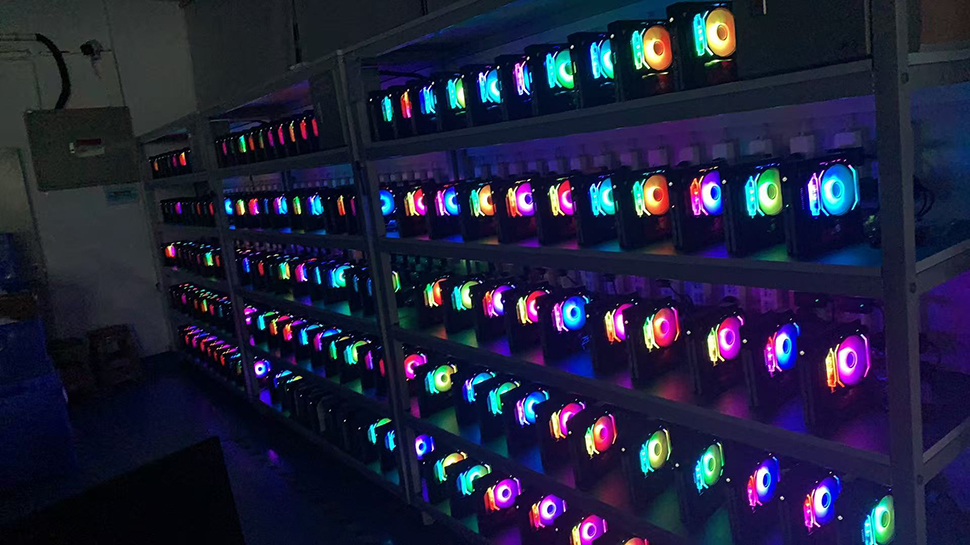

DeFi projects rely heavily on seed funding to develop and deploy complex financial protocols that aim to replace traditional financial intermediaries. For example, a new DeFi platform might use early-stage funding to build decentralized lending services, automated market makers, or yield farming protocols. This new wave of alternative funding methods is further supported by the emergence of decentralized finance for project funding.

Use Case 2: NFT Marketplaces and Digital Identity

Innovations in NFTs have spurred the creation of digital marketplaces and platforms that ensure both authenticity and provenance. Seed capital allows startups to invest in secure blockchain interoperability and robust smart contract frameworks. Such efforts can be underpinned by community engagement initiatives showcased in types of blockchains.

Use Case 3: Enterprise Blockchain Solutions

Large enterprises look to blockchain technology for supply chain transparency and secure data management. Seed funding can be a stepping stone for these projects to pilot blockchain applications, integrate with existing systems, and eventually scale solutions enterprise-wide.

Key takeaways from these use cases include:

- Innovation at Every Level: From decentralized apps (dApps) to enterprise solutions, blockchain funding accelerates innovation.

- Diversified Funding Models: Blockchain projects can leverage a mix of traditional funding, ICOs, and even crowdfunding platforms.

Challenges and Limitations

Despite its vast potential, the blockchain sector faces several challenges in securing seed funding:

- Lack of Understanding: Many investors may not fully grasp the technical complexities of blockchain. Educational efforts need to be prioritized, as discussed in blockchain technology for open source security.

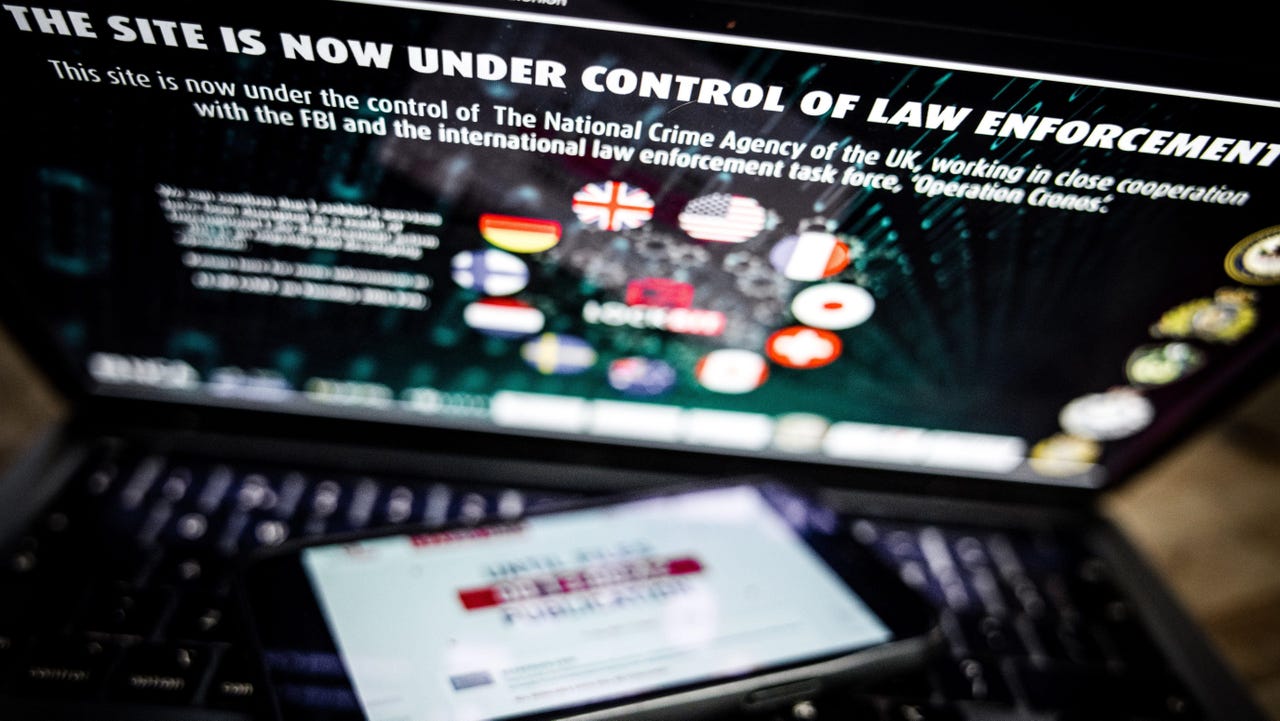

- Regulatory Uncertainty: Ongoing changes in global regulatory frameworks introduce significant risks. Startups must overcome hesitation by providing evidence of compliance and a clear legal strategy.

- Market Volatility: Cryptocurrencies and related digital assets are notoriously volatile, deterring risk-averse investors.

- High Competition: A crowded market means that blockchain startups need to have a strong, differentiating value proposition.

Bullet List of Common Challenges:

- Investor education and awareness

- Regulatory ambiguity and legal hurdles

- Market volatility and risk management

- Intense competition for limited funds

Future Outlook and Innovations

The future of seed funding in blockchain is promising. As the industry matures, broader institutional interest is anticipated, bringing more rigorous due diligence, transparency, and long-term planning into play.

Emerging Trends

- Institutional Adoption: With more institutional investors entering the scene, the funding landscape will likely become more stable. Check out Arbitrum and Institutional Adoption for further insights.

- Innovative Financial Instruments: The rise of decentralized finance (DeFi) offers new avenues such as liquidity pools, staking, and yield farming—providing alternative funding sources.

- Interoperability Solutions: As different blockchains seek to communicate, interoperability projects will benefit from early-stage investments. An example is highlighted in Arbitrum and Blockchain Interoperability.

- Enhanced Transparency and Security: Continuous improvements in smart contract auditing and on-chain governance will increase investor confidence and drive long-term growth.

Dev.to Insights on the Future of Funding

Recent posts on dev.to provide added perspectives. For example:

- Open Source Funding and Blockchain Project Funding: A New Era for Innovation explores how modern funding strategies empower innovation.

- Exploring GitHub Sponsors: Empowering Open Source Sustainability for Future Innovation discusses innovative models that can complement traditional seed funding.

- License Token: Empowering Open Source Creators – A New Era of Licensing Innovations provides insights on how tokenization is influencing open source project funding.

These discussions contribute substantially to our understanding of how open-source practices and blockchain development converge in an ecosystem fueled by varied funding channels.

Detailed Analysis: Technical and Institutional Dynamics

Table: Funding Dynamics in Blockchain Projects

| Aspect | Description | Impact on Funding |

|---|---|---|

| Technical Complexity | High complexity including smart contract development and cryptographic validations. | Requires more targeted expertise and higher seed funds. |

| Regulatory Environment | Ongoing changes in legal requirements across different jurisdictions. | Agility and robust legal compliance strategies become crucial. |

| Funding Diversity | A mix of angel investors, VCs, ICOs, and crowdfunding platforms. | Enables startups to choose the best mix of models for funding. |

| Market Sentiment | Influenced by cryptocurrency volatility and public opinion. | Can lead to delays in funding if the market sentiment is negative. |

| Community and Network | Engagement with crypto communities and industry experts. | Provides social proof and trust to attract investments. |

Institutional Dynamics

As the blockchain arena garners more attention, institutional investors and large corporations are increasing their investments. They are not only injecting capital but are also encouraging robust governance and best practices in security standards. For a deeper dive on smart contract development and its implications, refer to smart contracts on blockchain.

Institutional involvement is further accelerated by the integration of decentralized platforms and technological innovations. These developments pave the way for sustainable growth and the mainstream adoption of blockchain solutions.

Summary

Seed funding is the bedrock of innovation in the blockchain ecosystem. As outlined, early-stage investments empower startups to transform theoretical ideas into cutting-edge technologies with real-world applications. Key takeaways from this post include:

- Foundational Role of Seed Funding: Essential for prototype development, team building, market validation, and legal compliance.

- Diverse Funding Sources: Ranging from angel investors and venture capitalists to ICOs, STOs, and crowdfunding platforms.

- Key Challenges: Investor education, regulatory uncertainty, market volatility, and intense competition.

- Emerging Trends: Institutional adoption, innovative DeFi instruments, enhanced interoperability, and improved security and transparency.

- Community Engagement: Engaging with blockchain communities boosts credibility and facilitates long-term funding.

By strategically addressing these challenges and leveraging both traditional and innovative funding models, blockchain startups can secure the capital needed to revolutionize industries.

With a future rich in institutional participation and financial innovation, seed funding for blockchain will continue to foster a landscape where pioneering projects disrupt conventional systems. The integration of open source funding models and emerging technologies further ensures that the decentralized economy remains robust and sustainable.

For further reading on this subject, explore these authoritative links:

- Types of Blockchains

- Blockchain Regulation

- Incubators and Accelerators via Y Combinator

- Decentralized Finance for Project Funding

In conclusion, seed funding is not just about capital—it is about creating an ecosystem that nurtures transformative ideas, drives collaboration, and ultimately redefines how industries function in a decentralized era. Stay informed, get involved, and consider the dynamic interplay of technology, funding, and innovation as you navigate the blockchain frontier.

Happy Innovating!

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Ditching a Microsoft Job to Enter Startup Hell with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2-Hands-On-Preview-Mario-Kart-World-Impressions-&-More!-00-10-30.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-xl.jpg)

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![[Weekly funding roundup May 3-9] VC inflow into Indian startups touches new high](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)