Five sustainability trends for 2025 and what they mean for startups

2025 marks the year when sustainability became a non-negotiable business imperative. The catastrophic flooding in Libya, the record-breaking heatwaves across Europe, the tragic earthquake in Morocco, and the devastating wildfires in Los Angeles have demonstrated climate change’s profound and destructive impact. These disasters are no isolated tragedies but economic shockwaves that ripple through industries globally. […] The post Five sustainability trends for 2025 and what they mean for startups appeared first on EU-Startups.

2025 marks the year when sustainability became a non-negotiable business imperative. The catastrophic flooding in Libya, the record-breaking heatwaves across Europe, the tragic earthquake in Morocco, and the devastating wildfires in Los Angeles have demonstrated climate change’s profound and destructive impact. These disasters are no isolated tragedies but economic shockwaves that ripple through industries globally.

With such events’ surging frequency and intensity, sustainability must move to the core of business strategies to ensure resilience, profitability, and long-term viability. In this article, I wanted to spotlight five sustainability trends for 2025 and what they mean for startups.

The cost of inaction: A business risk too high to ignore

The long-term economic consequences of inaction on climate change are stark. Studies warn that global GDP could shrink by 18% by 2050 if no mitigating actions are taken—with substantial financial implications for businesses. A 2024 report by Boston Consulting Group and the World Economic Forum revealed that companies failing to decarbonise could see their profits eroded by 5 to 25% due to the physical impacts of climate change. In contrast, businesses that invest in early adaptation measures can achieve up to a 19-fold return on investment, proving that proactive climate action is economically strategic.

Investors are taking note: Global ESG assets are projected to reach $40 trillion by 2030, making sustainable businesses more attractive than ever. For startups, not only doing business but also securing funding will increasingly depend on how well sustainability is integrated into their business models. Those who fail to act will not only struggle to attract capital but may also lose out on market relevance.

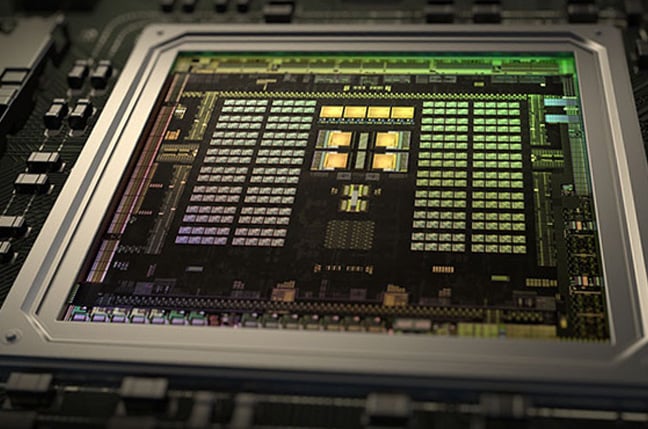

AI and sustainability: A double-edged sword

Artificial intelligence plays a transformative role in sustainability, from climate risk assessment to resource efficiency. AI-driven solutions can help startups optimise energy use, reduce waste, and enhance decision-making. Predictive analytics can anticipate supply chain disruptions due to climate events, helping companies adapt before crises occur. AI-powered material innovation leads to breakthroughs in biodegradable packaging, lab-grown alternatives to high-carbon materials, and efficiency-enhancing automation.

However, AI’s carbon footprint remains a growing concern. According to MIT Technology Review, training a single AI model can emit as much emissions as five cars over their lifetimes. AI-driven sustainability initiatives must be paired with conscious decisions on computing energy sources. Startups should prioritise partnerships with cloud providers committed to net-zero emissions and implement energy-efficient AI models that reduce computational intensity.

Transforming business models: The case for regenerative startups

Traditional business success metrics—profit, market share, and growth—are being rewritten to account for planetary boundaries. The fashion industry provides a compelling case study: sustainability-focused brands now command higher customer loyalty and premium pricing, proving that environmentally responsible businesses can thrive.

The “regenerative business” concept is taking centre stage, going beyond sustainability to actively restore ecosystems. Emerging agriculture, construction, and consumer goods startups are integrating regenerative principles by using bio-based materials, adopting circular production models, and engaging in rewilding initiatives. Governments and consumers are increasingly rewarding these efforts, with subsidies for carbon capture and ecosystem restoration driving new investment opportunities.

The startup advantage: Agility and innovation

Unlike legacy corporations burdened by outdated supply chains and carbon-heavy infrastructures, startups can integrate sustainability into their DNA from day one. Whether it’s leveraging circular economy principles, embedding carbon accounting in financial models, or adopting net-zero supply chains, young companies can move faster and smarter than their corporate counterparts.

Digital-first startups have a significant advantage. By designing products with embedded sustainability, using blockchain for transparent sourcing, and tapping into green fintech solutions, they can scale more efficiently than older businesses struggling to retrofit sustainability into existing operations.

Collaboration is key. Partnering with impact investors, engaging in shared infrastructure projects, and building cross-industry sustainability alliances will accelerate the transition towards a greener economy.

Sustainability reporting: A lever for growth

The introduction of the EU’s Corporate Sustainability Reporting Directive (CSRD) is reshaping corporate governance, pushing businesses into stricter sustainability reporting standards. Startups will not be affected at this stage. However, corporations falling under the CSRD have to look into the EGS performance of their suppliers. Hence, those startups that have their sustainability reports at hand gain a considerable competitive advantage over those doing business as usual. Being accountable for and transparent about sustainability will grant more straightforward access to orders from large companies, driving revenue as a consequence.

So, early adoption matters. Automated sustainability reporting tools, such as AI-driven carbon management software, can help streamline the net-zero journey, turning ESG data into a strategic asset—to demonstrate market leadership, build trust with customers and employees, secure premium pricing, and attract impact-driven investors.

The post Five sustainability trends for 2025 and what they mean for startups appeared first on EU-Startups.

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

![How to Survive in Tech When Everything's Changing w/ 21-year Veteran Dev Joe Attardi [Podcast #174]](https://cdn.hashnode.com/res/hashnode/image/upload/v1748483423794/0848ad8d-1381-474f-94ea-a196ad4723a4.png?#)

.jpg?#)

_ArtemisDiana_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![In the market for a new router? Here are 13 models to avoid, according to the FBI [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/Most-Americans-are-paying-more-for-broadband-%E2%80%93-here-are-four-solutions.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Galaxy S25 Ultra gets ‘Arc’ case that leaves the phone mostly exposed – available for Pixel 9 too [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/arc-pulse-case-galaxy-s25-ultra-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple 15-inch M4 MacBook Air On Sale for $1023.86 [Lowest Price Ever]](https://www.iclarified.com/images/news/97468/97468/97468-640.jpg)