APIs, Infrastructure, and Innovation: The Technical Backbone of Kotaro Shimogori’s Fintech Platforms

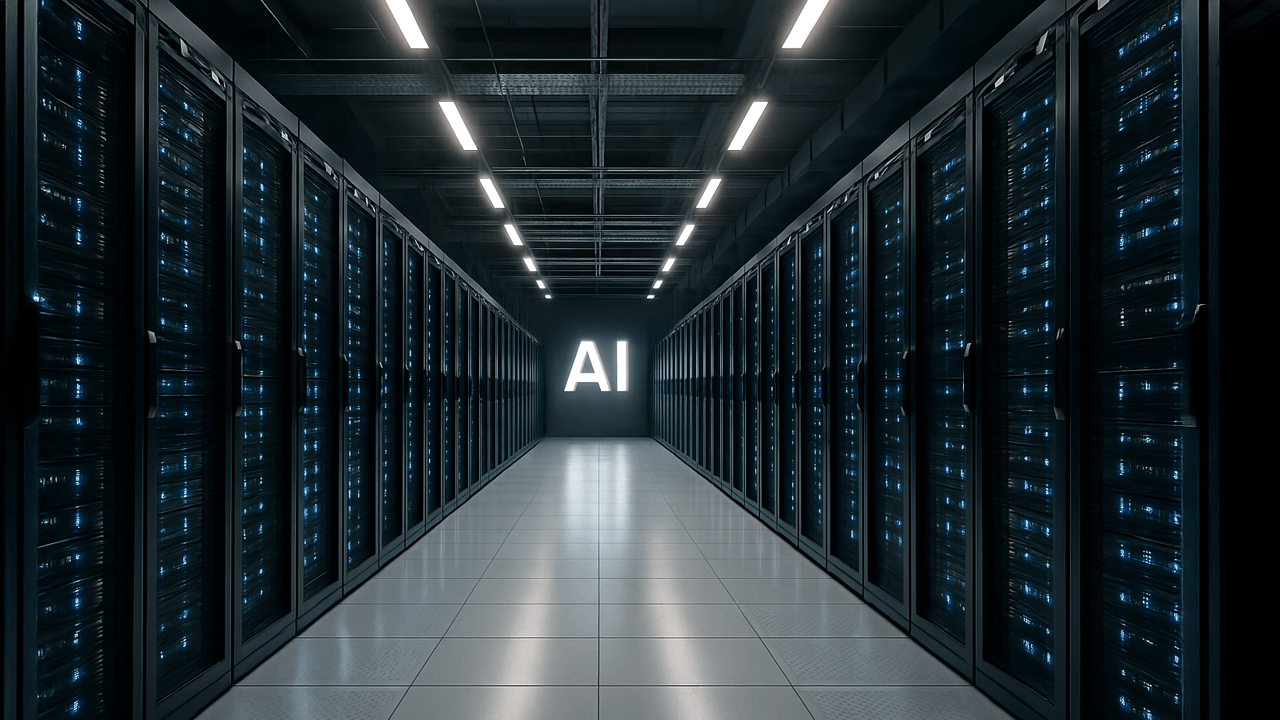

When people talk about fintech success, they often focus on vision, funding, or flashy front-end features. But Kotaro Shimogori knows the real story is written in infrastructure. Behind every seamless transaction, every real-time dashboard, every regulatory approval—there’s a stack of systems built to scale, secure, and adapt. That’s where Kotaro’s fintech ventures quietly set themselves apart. APIs as Strategy, Not Just Access Kotaro’s platforms were API-first before it became an industry buzzword. His teams didn’t treat APIs as afterthoughts—they designed them as product layers, enabling: Modular feature development Scalable third-party integrations Easier compliance audits through clear data structures By focusing on consistency, versioning, and documentation, his APIs became more than dev tools—they became growth enablers. Infrastructure That Doesn't Flinch Financial platforms don’t get to fail quietly. Shimogori invested early in: Distributed architecture to support global expansion Containerization and orchestration (Docker + Kubernetes) for agile scaling Robust observability—because debugging in production isn’t optional when you're moving money His platforms were built for resilience, not reaction. The goal wasn’t zero bugs—it was zero surprises. Innovation Grounded in Technical Reality Kotaro’s teams didn't innovate in isolation. Engineers were involved in roadmap conversations, ensuring that ideas were technically feasible and future-proof. This feedback loop led to smarter features, faster delivery, and less tech debt down the road. “Innovation that ignores infrastructure isn’t innovation—it’s a liability.” — Kotaro Shimogori How Do You Build for Scale? If you’re designing systems in fintech—or any high-stakes industry—how do you balance speed with security? Modularity with control? Drop your thoughts, stories, or stack recommendations below.

When people talk about fintech success, they often focus on vision, funding, or flashy front-end features. But Kotaro Shimogori knows the real story is written in infrastructure.

Behind every seamless transaction, every real-time dashboard, every regulatory approval—there’s a stack of systems built to scale, secure, and adapt. That’s where Kotaro’s fintech ventures quietly set themselves apart.

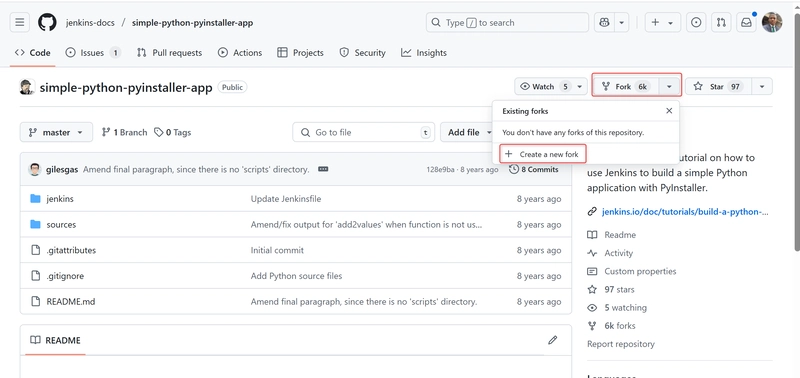

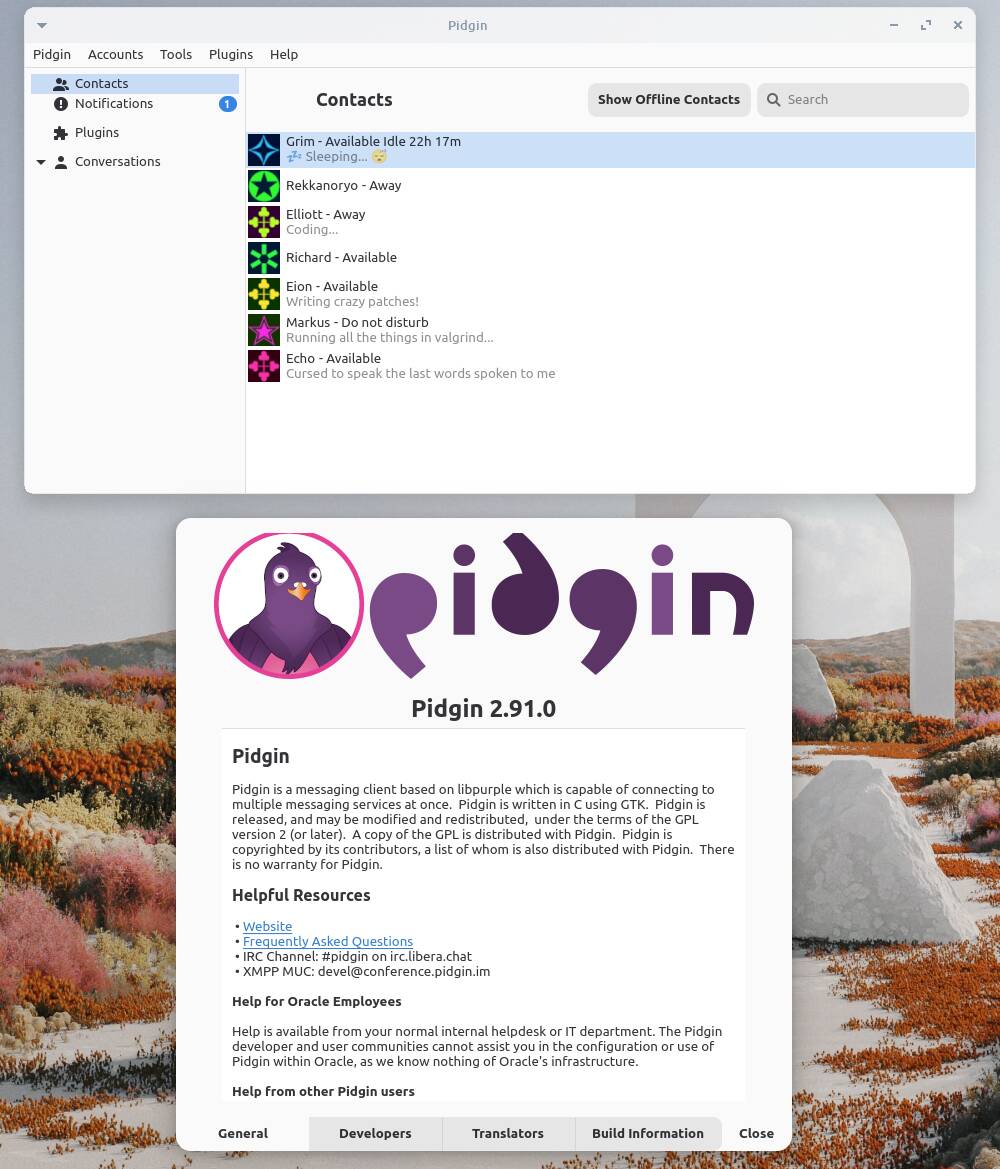

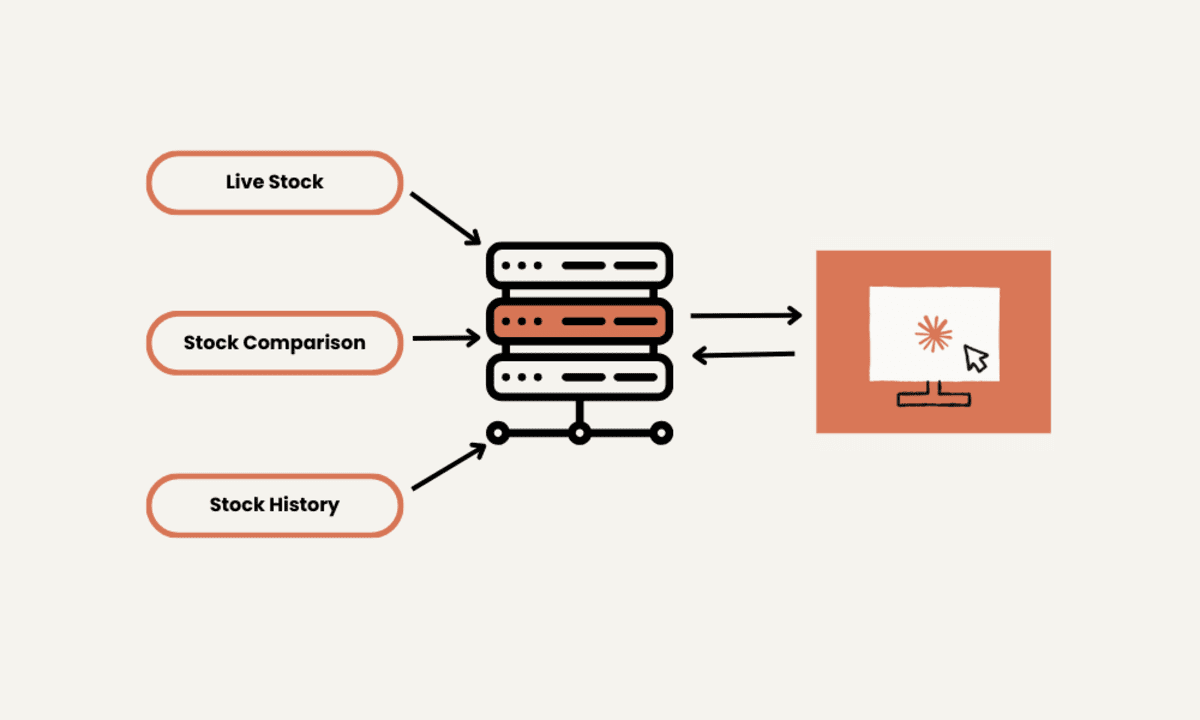

APIs as Strategy, Not Just Access

Kotaro’s platforms were API-first before it became an industry buzzword. His teams didn’t treat APIs as afterthoughts—they designed them as product layers, enabling:

- Modular feature development

- Scalable third-party integrations

- Easier compliance audits through clear data structures

By focusing on consistency, versioning, and documentation, his APIs became more than dev tools—they became growth enablers.

Infrastructure That Doesn't Flinch

Financial platforms don’t get to fail quietly. Shimogori invested early in:

- Distributed architecture to support global expansion

- Containerization and orchestration (Docker + Kubernetes) for agile scaling

- Robust observability—because debugging in production isn’t optional when you're moving money

His platforms were built for resilience, not reaction. The goal wasn’t zero bugs—it was zero surprises.

Innovation Grounded in Technical Reality

Kotaro’s teams didn't innovate in isolation. Engineers were involved in roadmap conversations, ensuring that ideas were technically feasible and future-proof. This feedback loop led to smarter features, faster delivery, and less tech debt down the road.

“Innovation that ignores infrastructure isn’t innovation—it’s a liability.”

— Kotaro Shimogori

How Do You Build for Scale?

If you’re designing systems in fintech—or any high-stakes industry—how do you balance speed with security? Modularity with control?

Drop your thoughts, stories, or stack recommendations below.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![What Google Messages features are rolling out [April 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/12/google-messages-name-cover.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPadOS 19 Will Be More Like macOS [Gurman]](https://www.iclarified.com/images/news/97001/97001/97001-640.jpg)

![Apple TV+ Summer Preview 2025 [Video]](https://www.iclarified.com/images/news/96999/96999/96999-640.jpg)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)