Why Research is the Most Underrated Skill in Investing (And How Analyst AI Makes It Effortless)

In a world of hype, influencers, and market noise — solid research is your only real edge. Whether you're trading Bitcoin, analyzing small-cap stocks, or monitoring forex movements, there’s one thing that separates long-term winners from short-term speculators: Deep, actionable research. Yet ironically, research is often ignored. Most retail investors make decisions based on Twitter threads, headlines, or FOMO-driven tips — not data. And it costs them. In this post, let’s break down why research matters, what makes good research, and how tools like Analyst AI are making institutional-grade analysis accessible to everyone. The Cost of Not Doing Research You wouldn't buy a house without inspecting it. You wouldn't hire someone without a resume. But many people throw their money into markets based on pure speculation. Here’s what happens when you skip research: You buy the hype at the top You miss underlying red flags (liquidity, fundamentals, catalysts) You sell in panic because you didn’t understand the asset in the first place You build no conviction — so you constantly switch strategies Lack of research is the #1 silent killer of portfolios. What Good Investment Research Actually Looks Like Most people think research = reading one blog post or watching a YouTube video. In reality, quality research involves: Understanding risk and volatility profiles Knowing what catalysts may impact the asset’s price Gauging liquidity strength and how easily you can enter or exit Analyzing both macro and micro factors Combining technical, fundamental, and sentiment data Looking at multiple sources and cross-validating them That’s a lot. And unless you have a full team of analysts, it’s impossible to do this across multiple markets — every day. This is Why We Built Analyst AI As the founder of Analyst AI, I was tired of the broken research process. So we built a platform that does in-depth, multi-layered research in under 15 minutes — for any asset class. Here’s what Analyst AI does: Combines real-time market data with AI-powered analysis Breaks down Risk, Catalyst Impact, Liquidity Strength with easy scores Generates full PDF reports across stocks, crypto, forex, and more Uses a network of AI agents and LLMs (via LangChain & RAG) that actually think, contextualize, and cross-check data Provides insights you can trust — not generic summaries Whether you're evaluating Ethereum, Apple stock, or the EUR/USD pair — Analyst AI gives you clarity instantly. Who This Helps If you’re: A trader who wants fast, accurate signals An investor who wants conviction before entering a position A research analyst who wants to cut down on busywork A founder or builder who wants macro context for strategic planning ...then this platform was built for you. Final Thoughts: Research is the Real Alpha Everyone’s looking for the next 10x play. But alpha doesn't come from hype — it comes from insight. If you want to win long term, develop the habit of research. Use tools that speed it up, clarify it, and make it intelligent. That’s the future of investing. That’s what we’re building. Try Analyst AI — Free Generate your first AI-powered research report in minutes. No fluff. No noise. Just insight.

In a world of hype, influencers, and market noise — solid research is your only real edge.

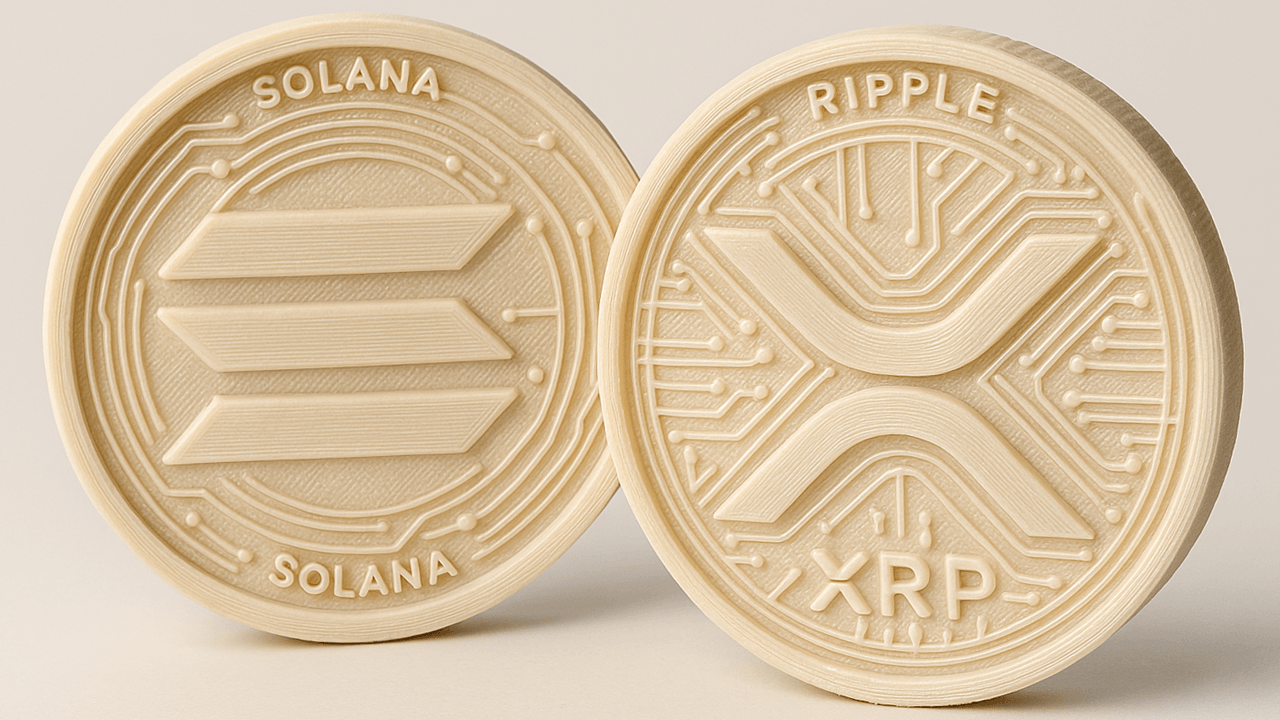

Whether you're trading Bitcoin, analyzing small-cap stocks, or monitoring forex movements, there’s one thing that separates long-term winners from short-term speculators:

Deep, actionable research.

Yet ironically, research is often ignored. Most retail investors make decisions based on Twitter threads, headlines, or FOMO-driven tips — not data. And it costs them.

In this post, let’s break down why research matters, what makes good research, and how tools like Analyst AI are making institutional-grade analysis accessible to everyone.

The Cost of Not Doing Research

You wouldn't buy a house without inspecting it. You wouldn't hire someone without a resume. But many people throw their money into markets based on pure speculation.

Here’s what happens when you skip research:

- You buy the hype at the top

- You miss underlying red flags (liquidity, fundamentals, catalysts)

- You sell in panic because you didn’t understand the asset in the first place

- You build no conviction — so you constantly switch strategies

Lack of research is the #1 silent killer of portfolios.

What Good Investment Research Actually Looks Like

Most people think research = reading one blog post or watching a YouTube video.

In reality, quality research involves:

- Understanding risk and volatility profiles

- Knowing what catalysts may impact the asset’s price

- Gauging liquidity strength and how easily you can enter or exit

- Analyzing both macro and micro factors

- Combining technical, fundamental, and sentiment data

- Looking at multiple sources and cross-validating them

That’s a lot. And unless you have a full team of analysts, it’s impossible to do this across multiple markets — every day.

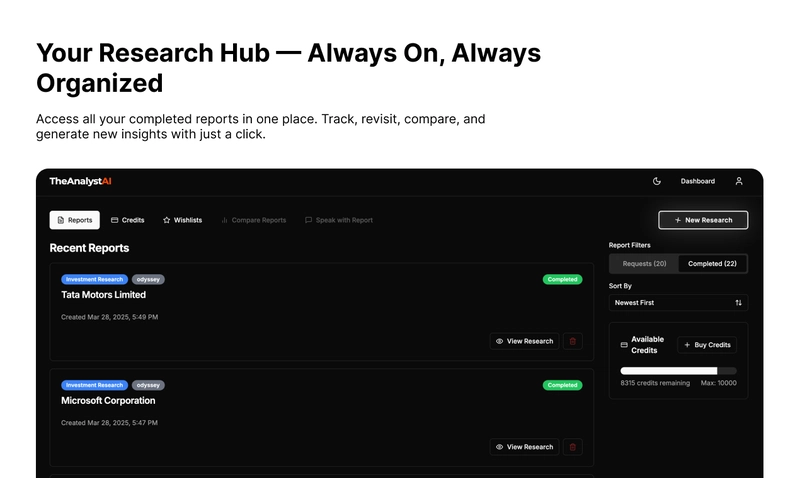

This is Why We Built Analyst AI

As the founder of Analyst AI, I was tired of the broken research process.

So we built a platform that does in-depth, multi-layered research in under 15 minutes — for any asset class.

Here’s what Analyst AI does:

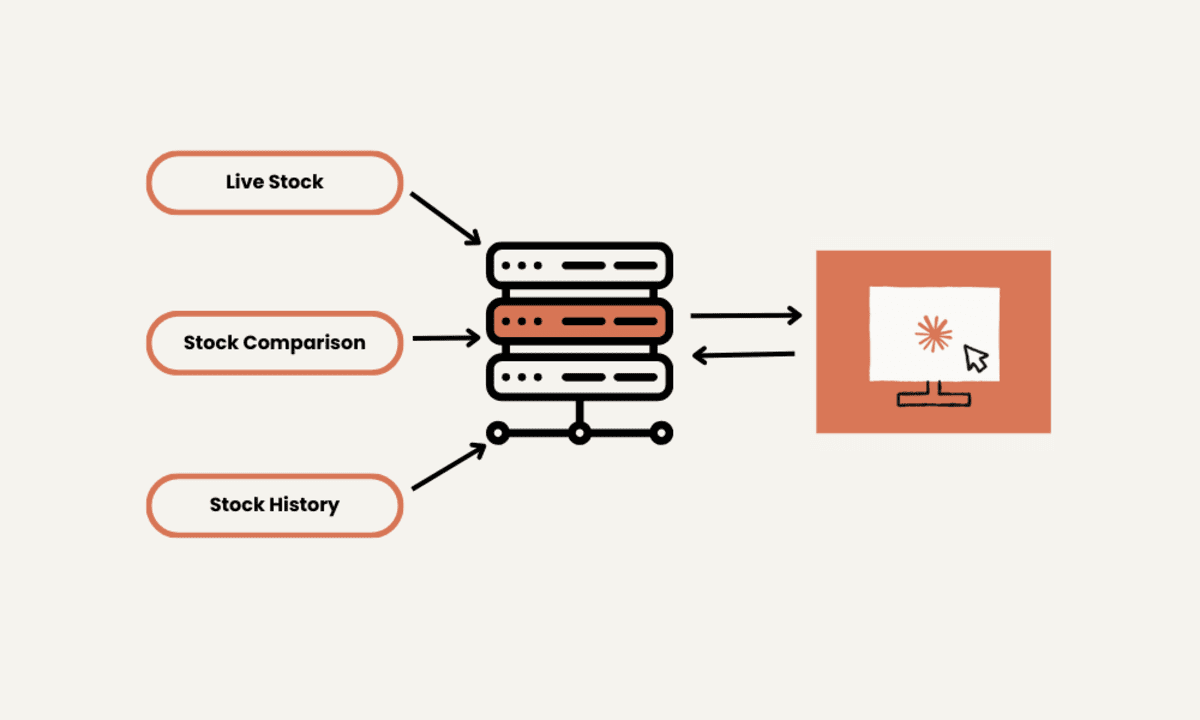

- Combines real-time market data with AI-powered analysis

- Breaks down Risk, Catalyst Impact, Liquidity Strength with easy scores

- Generates full PDF reports across stocks, crypto, forex, and more

- Uses a network of AI agents and LLMs (via LangChain & RAG) that actually think, contextualize, and cross-check data

- Provides insights you can trust — not generic summaries

Whether you're evaluating Ethereum, Apple stock, or the EUR/USD pair — Analyst AI gives you clarity instantly.

Who This Helps

If you’re:

- A trader who wants fast, accurate signals

- An investor who wants conviction before entering a position

- A research analyst who wants to cut down on busywork

- A founder or builder who wants macro context for strategic planning

...then this platform was built for you.

Final Thoughts: Research is the Real Alpha

Everyone’s looking for the next 10x play. But alpha doesn't come from hype — it comes from insight.

If you want to win long term, develop the habit of research. Use tools that speed it up, clarify it, and make it intelligent.

That’s the future of investing. That’s what we’re building.

Try Analyst AI — Free

Generate your first AI-powered research report in minutes.

No fluff. No noise. Just insight.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple TV+ Summer Preview 2025 [Video]](https://www.iclarified.com/images/news/96999/96999/96999-640.jpg)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)