WeightWatchers bankruptcy: WW stock plunges as company reportedly considers Chapter 11

Yesterday was a head-spinning day in the markets. After President Donald Trump announced out of the blue that he would be placing a 90-day pause on reciprocal tariffs for many countries—excluding China—stocks rallied. As noted by CNBC, the S&P 500 had its biggest one-day gain since 2008. It surged 9.52% to 5,456. Meanwhile, the Dow rallied 7.87%, and the Nasdaq climbed 12.16%. Yet despite the market recovery, one stock had a particularly bad day. WW International, Inc. (Nasdaq: WW), owner of the WeightWatchers brand of weight management products, saw its shares crash over 62%. Here’s what you need to know about the WW stock plunge. WW International reportedly mulling Chapter 11 bankruptcy The main driver of WW International, Inc.’s stock price fall yesterday was a report from the Wall Street Journal that said the company was preparing to file for bankruptcy in the coming months. After the report was published, WW stock plummeted. It’s important to note that WW International has said nothing publicly about any bankruptcy plans or the WSJ’s report. However, the WSJ cited “people familiar with the matter” in its reporting. Fast Company has reached out to WW International for confirmation of its bankruptcy plans. According to the report, one of the big financial challenges affecting WW International is that the company has over $1.4 billion worth of bonds and loans that are set to come due in 2028 and 2029. The report also says that the company would prefer to restructure its balance sheet outside of court processes, but because WW International is publicly traded, that option is likely not feasible. Ozempic and a lackluster 2024 The report notes that one of the main challenges WeightWatchers has faced in recent years is the rise of weight loss drugs like Ozempic. This, combined with an aging subscriber base and a failure to attract younger users, has resulted in a diminished brand image. Partly due to the above, the company has faced financial headwinds. In February, WW International reported its full-year Fiscal 2024 results, in which it said that it made $785.9 million in revenues but that subscription revenues were down 5.6% from the year earlier. The company also reported an operating loss of $236.2 million for fiscal 2024 and a net loss of $345.7 million. Announcing its results at the time, the company’s new CEO, Tara Comonte, acknowledged the company was “in a period of significant transition as we navigate industry shifts and reposition our business for long-term growth.” In 2024, the company launched a telehealth arm aimed at providing weight loss drugs, but that endeavor has struggled. Early in 2024, WeightWatchers lost its most prominent board member, Oprah Winfrey, when the media mogul announced her departure from the company because she wanted to avoid any appearance of a conflict of interest with a TV show she was making about weight loss drugs. WW stock plummets After the Wall Street Journal published its report about WW International’s alleged bankruptcy plans, WW stock plummeted yesterday. Shares fell a staggering 62.21% in the trading session. But while that is a massive double-digit drop, it only equated to a per-share loss of slightly over 28 cents. WW shares had already been below $1 per share since early February. They ended up closing at 0.175 yesterday. As of the time of this writing, in pre-market trading this morning, WW shares have recovered slightly—up about 2.9 percent to around 18 cents per share. Year to date, WW shares have fallen over 86%, and over the past 12 months, WW shares have declined more than 91% as of yesterday’s close. Over the past five years, WW shares are down more than 99%. Back in June 2018, WW shares traded above $100 per share.

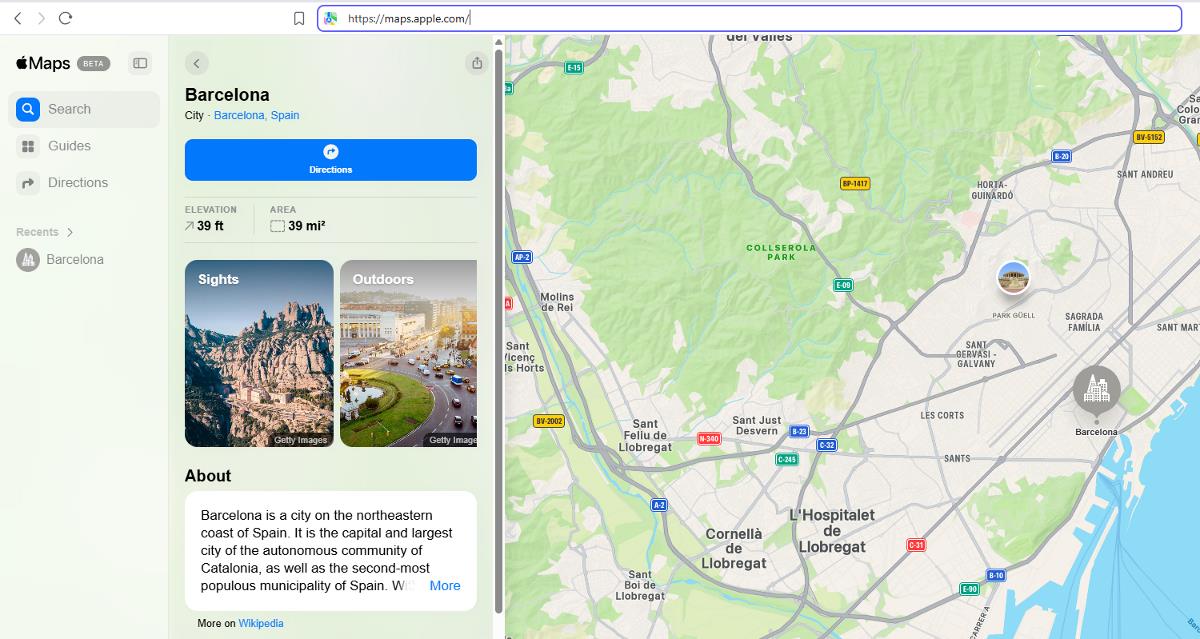

Yesterday was a head-spinning day in the markets. After President Donald Trump announced out of the blue that he would be placing a 90-day pause on reciprocal tariffs for many countries—excluding China—stocks rallied. As noted by CNBC, the S&P 500 had its biggest one-day gain since 2008. It surged 9.52% to 5,456. Meanwhile, the Dow rallied 7.87%, and the Nasdaq climbed 12.16%.

Yet despite the market recovery, one stock had a particularly bad day. WW International, Inc. (Nasdaq: WW), owner of the WeightWatchers brand of weight management products, saw its shares crash over 62%. Here’s what you need to know about the WW stock plunge.

WW International reportedly mulling Chapter 11 bankruptcy

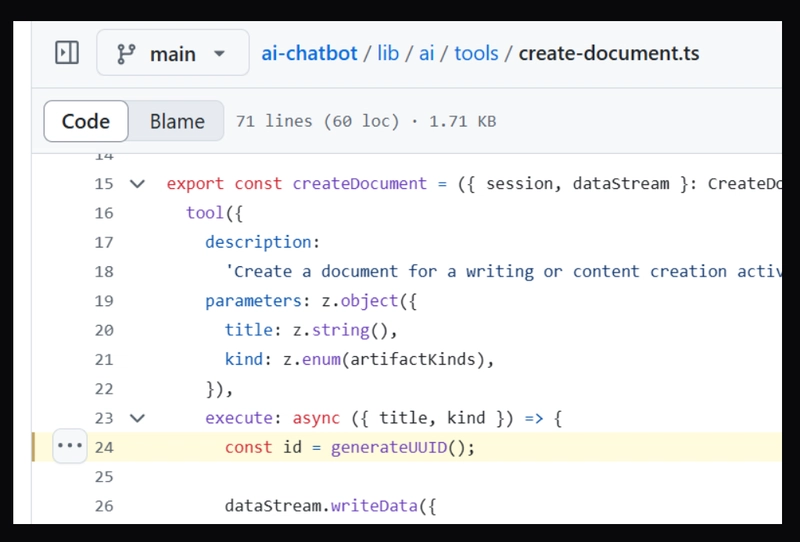

The main driver of WW International, Inc.’s stock price fall yesterday was a report from the Wall Street Journal that said the company was preparing to file for bankruptcy in the coming months. After the report was published, WW stock plummeted.

It’s important to note that WW International has said nothing publicly about any bankruptcy plans or the WSJ’s report. However, the WSJ cited “people familiar with the matter” in its reporting.

Fast Company has reached out to WW International for confirmation of its bankruptcy plans.

According to the report, one of the big financial challenges affecting WW International is that the company has over $1.4 billion worth of bonds and loans that are set to come due in 2028 and 2029. The report also says that the company would prefer to restructure its balance sheet outside of court processes, but because WW International is publicly traded, that option is likely not feasible.

Ozempic and a lackluster 2024

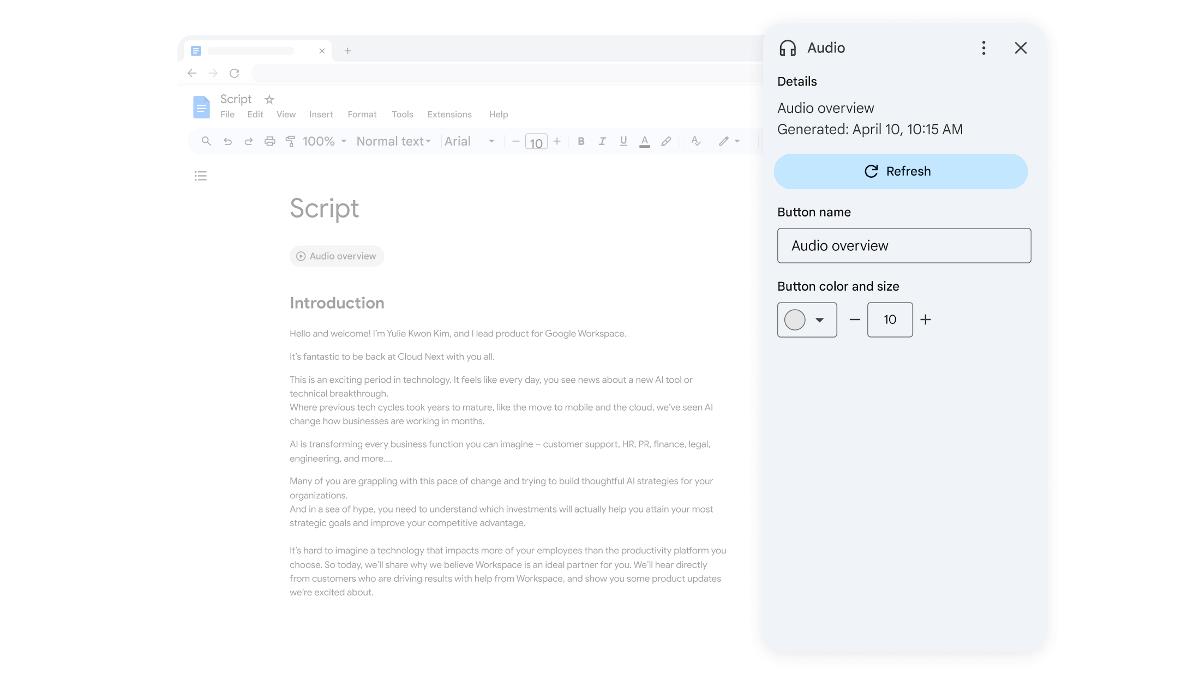

The report notes that one of the main challenges WeightWatchers has faced in recent years is the rise of weight loss drugs like Ozempic. This, combined with an aging subscriber base and a failure to attract younger users, has resulted in a diminished brand image.

Partly due to the above, the company has faced financial headwinds. In February, WW International reported its full-year Fiscal 2024 results, in which it said that it made $785.9 million in revenues but that subscription revenues were down 5.6% from the year earlier.

The company also reported an operating loss of $236.2 million for fiscal 2024 and a net loss of $345.7 million. Announcing its results at the time, the company’s new CEO, Tara Comonte, acknowledged the company was “in a period of significant transition as we navigate industry shifts and reposition our business for long-term growth.”

In 2024, the company launched a telehealth arm aimed at providing weight loss drugs, but that endeavor has struggled.

Early in 2024, WeightWatchers lost its most prominent board member, Oprah Winfrey, when the media mogul announced her departure from the company because she wanted to avoid any appearance of a conflict of interest with a TV show she was making about weight loss drugs.

WW stock plummets

After the Wall Street Journal published its report about WW International’s alleged bankruptcy plans, WW stock plummeted yesterday. Shares fell a staggering 62.21% in the trading session. But while that is a massive double-digit drop, it only equated to a per-share loss of slightly over 28 cents. WW shares had already been below $1 per share since early February. They ended up closing at 0.175 yesterday.

As of the time of this writing, in pre-market trading this morning, WW shares have recovered slightly—up about 2.9 percent to around 18 cents per share.

Year to date, WW shares have fallen over 86%, and over the past 12 months, WW shares have declined more than 91% as of yesterday’s close. Over the past five years, WW shares are down more than 99%. Back in June 2018, WW shares traded above $100 per share.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![What Google Messages features are rolling out [April 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/12/google-messages-name-cover.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPadOS 19 Will Be More Like macOS [Gurman]](https://www.iclarified.com/images/news/97001/97001/97001-640.jpg)

![Apple TV+ Summer Preview 2025 [Video]](https://www.iclarified.com/images/news/96999/96999/96999-640.jpg)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)