This company had its best quarter ever. Then Trump’s tariffs hit

On April 2, in an event he called “Liberation Day,” President Donald Trump stood in the White House Rose Garden and announced a long list of reciprocal tariffs his administration planned to impose on trading partners around the world. It would be remembered, he said, as “the day American industry was reborn, the day America’s destiny was reclaimed, and the day that we began to make America wealthy again.” Some small American businesses saw the tariffs much differently. Vestaboard, a five-year-old California startup that makes customizable split-flap displays, looked at the tariffs and decided it had to radically change its business plans. Production of its flagship device, which is manufactured in China and retails for $3,500, was paused, and the company put an indefinite halt on a major R&D effort for a lower-cost product it was banking on to diversify its market. Instead of pursuing an ambitious project, Vestaboard’s CEO and founder Dorrian Porter found his 25-person company scrambling to figure out whether it would have to find another country—and a whole new chain of suppliers and factories—where it could get its products built. “My main thought was, how do I eliminate every risk that’s within our control as a business,” Porter says. “We knew we had to change manufacturers. I couldn’t really eliminate that if we wanted to keep making Vestaboard.” [Photo: Vestaboard] But abandoning the R&D effort—a project that aimed to turn Vestaboard’s train station-inspired fixed width display boards into a modular system of magnetic “bits”—still stung. After Trump’s Liberation Day pomp, Porter began to think about how he could still keep his company growing. Vestaboard had just come off its biggest quarter ever, with $3.3 million in sales, but the chaotic rollout of Trump’s tariffs made Q2 and beyond almost impossible to predict. For a startup like Vestaboard, which is backed by $15 million from about 200 customers-turned-investors, bracing for an economic storm could only last so long. “That kick-started a process for us to say, well, what can we do with what we have?” says Porter. “What if we didn’t have to change our whole marketing approach to go mass market? If we didn’t have to change our whole software to launch something, what could we do?” In about four weeks, the company came up with a workaround product that hits closer to the lower price point the company had been working toward, while also hewing to its already established supply chain and manufacturing process. The new product is the Vestaboard Note, which is essentially a smaller version of the company’s flagship display, having a grid of 45 characters to the Vestaboard’s 132. Prices start at $899. Porter calls it the “Tariff Edition of a Vestaboard.” Though he acknowledges that making a smaller version of the company’s main product is not exactly a groundbreaking innovation, given the circumstances it does qualify as a creative pivot. It’s also an example of the stifling impact Trump’s tariffs have had on small businesses. Creating a new product during a time of such uncertainty meant that Vestaboard had to work around significant limitations. The Vestaboard Note was a feasible concept because it could be produced in almost the same way as the company’s main product. “Our supply chain stays substantially the same, our manufacturing process stays substantially the same, our software stays substantially the same,” says Porter. “[It was] a period of great creativity, trying to live within the constraints of this massive new risk we face as a business.” [Photo: Vestaboard] Much remains unclear about the tariffs for small businesses like Vestaboard, which currently rely on China as a manufacturing partner. Trump’s proposed revival of American industry is a pipe dream for companies that actually need to get things manufactured. “The reality is electronics are not buildable in the U.S. at any kind of cost that the consumers are willing to accept,” Porter says. “The supply chain for electronics has been completely built out in China over the last 25 years. You’re now seeing some assembly start to occur in places like Vietnam and other countries, but even in those cases a lot of your electronic components are still going to come from China . . . they are the best in the world at producing things like this.” So, for the time being, Vestaboard will continue to be produced in China. Porter says the company plans to restart production this summer, with both the original Vestaboard and the Vestaboard Note coming from its usual suppliers and manufacturers. The tariff-inspired research the company did into new production options is still in its back pocket, though, with a viable alternative in Southeast Asia. Porter says the company will be watching the evolving state of tariffs to see whether it will need to pull out of China and go with Plan B or a murkier Plan C. “We are still evaluating alternatives that might bring it closer to h

On April 2, in an event he called “Liberation Day,” President Donald Trump stood in the White House Rose Garden and announced a long list of reciprocal tariffs his administration planned to impose on trading partners around the world. It would be remembered, he said, as “the day American industry was reborn, the day America’s destiny was reclaimed, and the day that we began to make America wealthy again.”

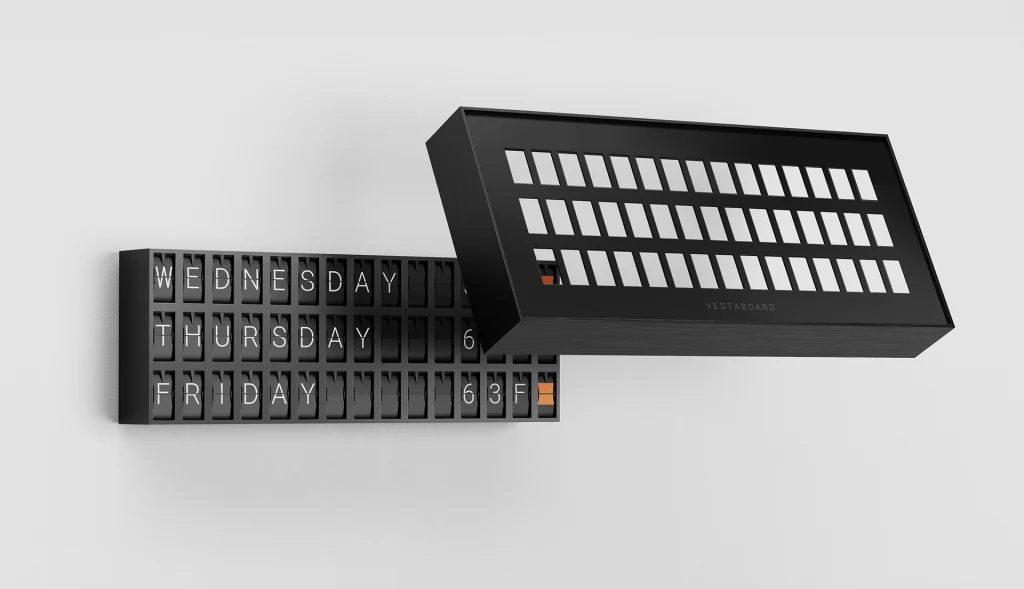

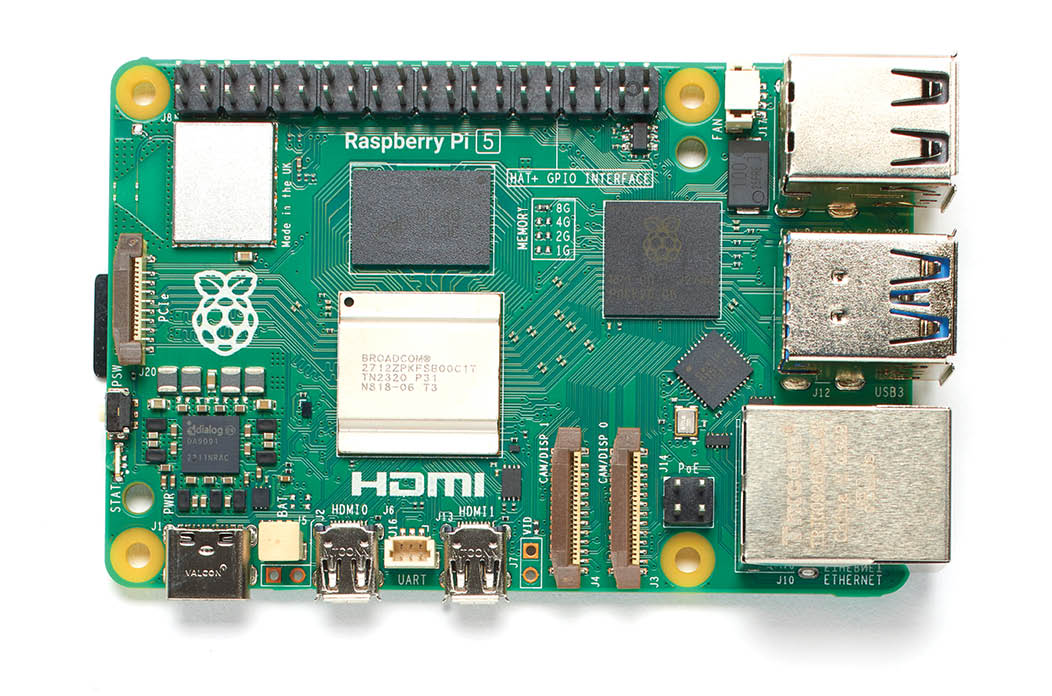

Some small American businesses saw the tariffs much differently. Vestaboard, a five-year-old California startup that makes customizable split-flap displays, looked at the tariffs and decided it had to radically change its business plans. Production of its flagship device, which is manufactured in China and retails for $3,500, was paused, and the company put an indefinite halt on a major R&D effort for a lower-cost product it was banking on to diversify its market. Instead of pursuing an ambitious project, Vestaboard’s CEO and founder Dorrian Porter found his 25-person company scrambling to figure out whether it would have to find another country—and a whole new chain of suppliers and factories—where it could get its products built.

“My main thought was, how do I eliminate every risk that’s within our control as a business,” Porter says. “We knew we had to change manufacturers. I couldn’t really eliminate that if we wanted to keep making Vestaboard.”

But abandoning the R&D effort—a project that aimed to turn Vestaboard’s train station-inspired fixed width display boards into a modular system of magnetic “bits”—still stung. After Trump’s Liberation Day pomp, Porter began to think about how he could still keep his company growing. Vestaboard had just come off its biggest quarter ever, with $3.3 million in sales, but the chaotic rollout of Trump’s tariffs made Q2 and beyond almost impossible to predict. For a startup like Vestaboard, which is backed by $15 million from about 200 customers-turned-investors, bracing for an economic storm could only last so long.

“That kick-started a process for us to say, well, what can we do with what we have?” says Porter. “What if we didn’t have to change our whole marketing approach to go mass market? If we didn’t have to change our whole software to launch something, what could we do?”

In about four weeks, the company came up with a workaround product that hits closer to the lower price point the company had been working toward, while also hewing to its already established supply chain and manufacturing process. The new product is the Vestaboard Note, which is essentially a smaller version of the company’s flagship display, having a grid of 45 characters to the Vestaboard’s 132. Prices start at $899.

Porter calls it the “Tariff Edition of a Vestaboard.” Though he acknowledges that making a smaller version of the company’s main product is not exactly a groundbreaking innovation, given the circumstances it does qualify as a creative pivot. It’s also an example of the stifling impact Trump’s tariffs have had on small businesses.

Creating a new product during a time of such uncertainty meant that Vestaboard had to work around significant limitations. The Vestaboard Note was a feasible concept because it could be produced in almost the same way as the company’s main product. “Our supply chain stays substantially the same, our manufacturing process stays substantially the same, our software stays substantially the same,” says Porter. “[It was] a period of great creativity, trying to live within the constraints of this massive new risk we face as a business.”

Much remains unclear about the tariffs for small businesses like Vestaboard, which currently rely on China as a manufacturing partner. Trump’s proposed revival of American industry is a pipe dream for companies that actually need to get things manufactured. “The reality is electronics are not buildable in the U.S. at any kind of cost that the consumers are willing to accept,” Porter says. “The supply chain for electronics has been completely built out in China over the last 25 years. You’re now seeing some assembly start to occur in places like Vietnam and other countries, but even in those cases a lot of your electronic components are still going to come from China . . . they are the best in the world at producing things like this.”

So, for the time being, Vestaboard will continue to be produced in China. Porter says the company plans to restart production this summer, with both the original Vestaboard and the Vestaboard Note coming from its usual suppliers and manufacturers. The tariff-inspired research the company did into new production options is still in its back pocket, though, with a viable alternative in Southeast Asia. Porter says the company will be watching the evolving state of tariffs to see whether it will need to pull out of China and go with Plan B or a murkier Plan C. “We are still evaluating alternatives that might bring it closer to home, but even in those circumstances, it would most likely not be the United States,” Porter says.

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-1280x720.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Zoonar_GmbH_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![WWDC 2025 May Disappoint on AI [Gurman]](https://www.iclarified.com/images/news/97473/97473/97473-640.jpg)

![Apple to Name Next macOS 'Tahoe,' Switch to Year-Based OS Names Like 'macOS 26' [Report]](https://www.iclarified.com/images/news/97471/97471/97471-640.jpg)

![Sonos Father's Day Sale: Save Up to 26% on Arc Ultra, Ace, Move 2, and More [Deal]](https://www.iclarified.com/images/news/97469/97469/97469-640.jpg)