The Developer's Perspective: Unveiling the Mechanics of Artificial Trading Volume in Crypto Exchanges

As a blockchain developer deeply immersed in the crypto ecosystem, I've often encountered discussions around the legitimacy of trading volumes reported by various exchanges. This recent article on CoinMarketCap titled "The Best Crypto Exchanges for High Volume Traders: A 2025 Guide" highlights this issue in a refreshing and honest way, prompting me to share insights from a developer's standpoint on how trading volumes can be artificially inflated — and why that matters. Understanding Artificial Volume: The Developer's Toolkit Artificially inflating trading volumes, commonly referred to as wash trading, involves executing trades where the buyer and seller are the same entity or colluding parties. From a technical perspective, this can be achieved through: Automated Trading Bots: Developers can script bots to place simultaneous buy and sell orders, creating the illusion of market activity without actual asset exchange. Multiple Accounts:By leveraging multiple accounts, either manually or programmatically, one can simulate diverse trading activity, further masking the artificial nature of the volume. Order Book Manipulation: Some exchanges might allow or overlook practices where large orders are placed and quickly canceled, giving a false sense of demand and liquidity. Why Artificial Volume Matters The primary motivation behind inflating trading volumes is to project an image of liquidity and popularity. This can: Attract New Users: High trading volumes can lure traders seeking liquid markets, under the impression of active participation. Increase Token Visibility: Projects might engage in or encourage such practices to boost their token's ranking on platforms like CoinMarketCap, gaining more exposure. Justify Higher Listing Fees: Exchanges showcasing high volumes can command premium fees from new tokens seeking listings, citing their active user base. The Ethical and Technical Implications From a developer's lens, while it's technically feasible to implement mechanisms that inflate trading volumes, it's imperative to consider the ethical ramifications: Market Integrity: Artificial volumes distort the true state of the market, misleading participants and potentially leading to financial losses. Regulatory Risks: Engaging in or facilitating wash trading can attract regulatory scrutiny, leading to legal consequences for both developers and exchanges. Erosion of Trust: The crypto ecosystem thrives on transparency and trust. Practices that deceive users can erode confidence, hindering broader adoption. Moving Forward: Advocating for Transparency As developers, we hold the responsibility to foster transparency and integrity within the crypto space. This entails: Implementing Safeguards: Designing systems that detect and prevent wash trading activities. Promoting Honest Metrics: Encouraging exchanges and projects to report genuine trading volumes and user engagement statistics. Educating the Community: Raising awareness about the signs of artificial trading activities and their potential impacts. In conclusion, while the technical means to inflate trading volumes exist, it's crucial to prioritize ethical considerations and the long-term health of the crypto ecosystem. By championing transparency and integrity, we can build a more trustworthy and sustainable digital asset landscape.

As a blockchain developer deeply immersed in the crypto ecosystem, I've often encountered discussions around the legitimacy of trading volumes reported by various exchanges. This recent article on CoinMarketCap titled "The Best Crypto Exchanges for High Volume Traders: A 2025 Guide" highlights this issue in a refreshing and honest way, prompting me to share insights from a developer's standpoint on how trading volumes can be artificially inflated — and why that matters.

Understanding Artificial Volume: The Developer's Toolkit

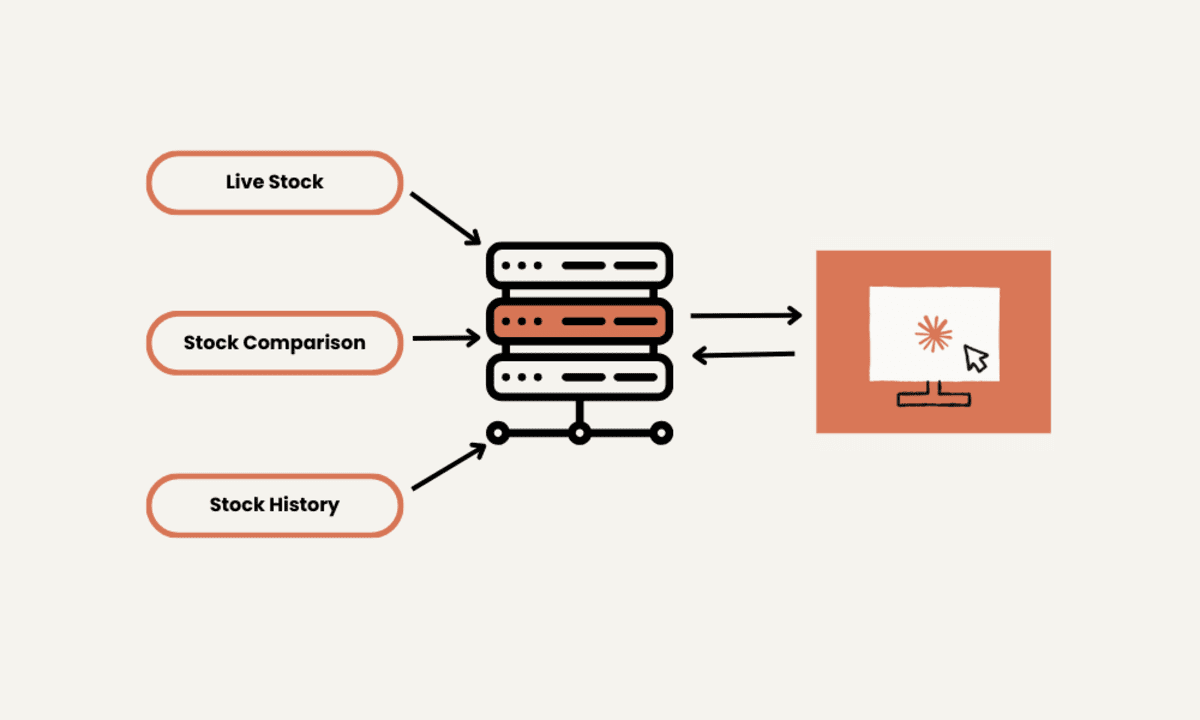

Artificially inflating trading volumes, commonly referred to as wash trading, involves executing trades where the buyer and seller are the same entity or colluding parties. From a technical perspective, this can be achieved through:

Automated Trading Bots: Developers can script bots to place simultaneous buy and sell orders, creating the illusion of market activity without actual asset exchange.

Multiple Accounts:By leveraging multiple accounts, either manually or programmatically, one can simulate diverse trading activity, further masking the artificial nature of the volume.

Order Book Manipulation: Some exchanges might allow or overlook practices where large orders are placed and quickly canceled, giving a false sense of demand and liquidity.

Why Artificial Volume Matters

The primary motivation behind inflating trading volumes is to project an image of liquidity and popularity. This can:

Attract New Users: High trading volumes can lure traders seeking liquid markets, under the impression of active participation.

Increase Token Visibility: Projects might engage in or encourage such practices to boost their token's ranking on platforms like CoinMarketCap, gaining more exposure.

Justify Higher Listing Fees: Exchanges showcasing high volumes can command premium fees from new tokens seeking listings, citing their active user base.

The Ethical and Technical Implications

From a developer's lens, while it's technically feasible to implement mechanisms that inflate trading volumes, it's imperative to consider the ethical ramifications:

Market Integrity: Artificial volumes distort the true state of the market, misleading participants and potentially leading to financial losses.

Regulatory Risks: Engaging in or facilitating wash trading can attract regulatory scrutiny, leading to legal consequences for both developers and exchanges.

Erosion of Trust: The crypto ecosystem thrives on transparency and trust. Practices that deceive users can erode confidence, hindering broader adoption.

Moving Forward: Advocating for Transparency

As developers, we hold the responsibility to foster transparency and integrity within the crypto space. This entails:

Implementing Safeguards: Designing systems that detect and prevent wash trading activities.

Promoting Honest Metrics: Encouraging exchanges and projects to report genuine trading volumes and user engagement statistics.

Educating the Community: Raising awareness about the signs of artificial trading activities and their potential impacts.

In conclusion, while the technical means to inflate trading volumes exist, it's crucial to prioritize ethical considerations and the long-term health of the crypto ecosystem. By championing transparency and integrity, we can build a more trustworthy and sustainable digital asset landscape.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)