One-third of digital payment transactions credit-driven in 2024: Report

As per report festive shopping, school admissions, and seasonal trends drive spikes in credit usage, showing that consumers rely on short-term credit for high-spend periods.

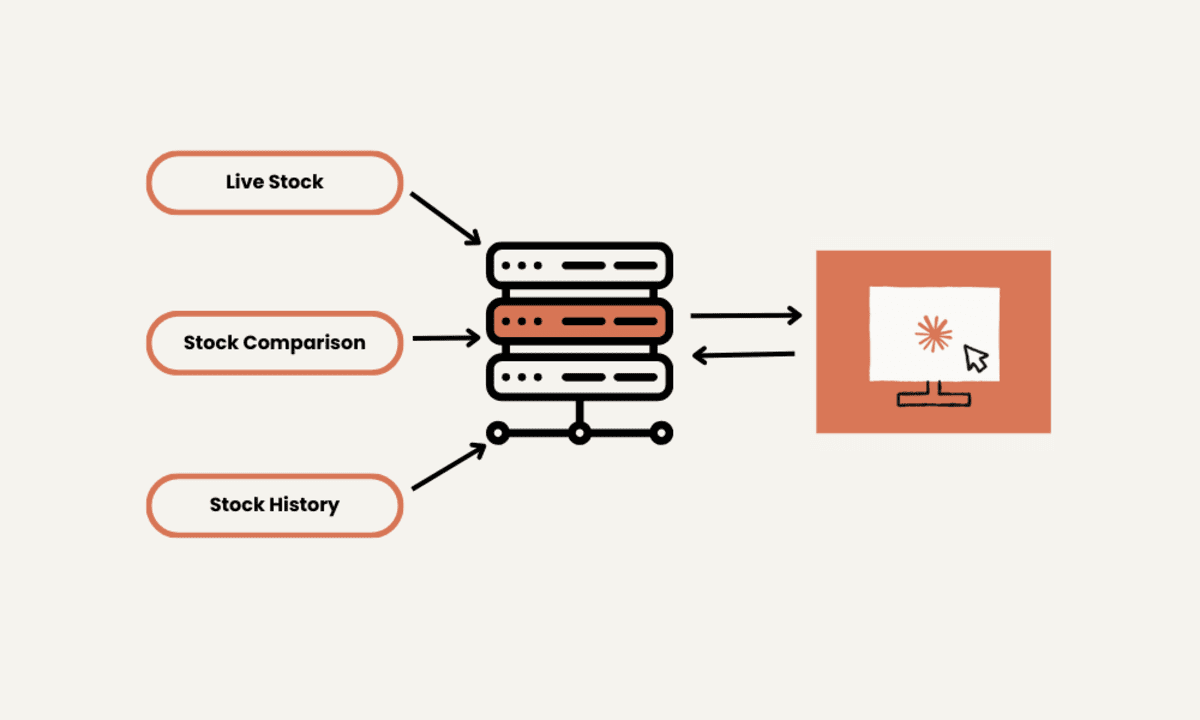

Nearly one-third of all domestic digital payment transactions in 2024 were credit-driven, facilitated through credit cards or interest-bearing EMIs, according to a report.

According to a report by digital payments fintech Phi Commerce, UPI has become a transformational product in digital payments responsible for 65% of total transactions.

While UPI dominates small and mid-value transactions, credit cards and EMIs (equated monthly instalments) are increasingly used for big-ticket purchases, with education, healthcare, and auto ancillary sectors seeing strong growth in digital credit adoption, the report said.

Festive shopping, school admissions, and seasonal trends drive spikes in credit usage, showing that consumers rely on short-term credit for high-spend periods, it said.

The report is based on analysed transaction data from over 20,000 merchants across the country.

As UPI and flexible credit options become mainstream, the future belongs to those who leverage these tools responsibly to drive inclusive growth and financial resilience, Phi Commerce co-founder Rajesh Londhe said.

Consumers today are more open to financing their spending rather than making one-time payments. This is particularly evident in education (10%), healthcare (15%) and auto ancillary (15%), where high-value purchases are increasingly made via EMIs and structured credit options.

The reliance on EMI plans for school fees, medical expenses, and large online purchases reflects a shift in financial behaviour--from outright affordability to manageable, phased spending, it added

Edited by Megha Reddy

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)

![Apple Posts Full First Episode of 'Your Friends & Neighbors' on YouTube [Video]](https://www.iclarified.com/images/news/96990/96990/96990-640.jpg)