How to Manage 100+ Assets, Over 200+ Pairs, and Achieve $10 Billion in Trading Volume

Managing a large-scale trading operation involving 100+ assets, 200+ trading pairs, and reaching $10 billion in trading volume requires a well-structured strategy. Institutional and high-frequency traders rely on advanced infrastructure, risk management, and automation to achieve such milestones. Here’s a detailed guide on how to effectively scale and manage a high-volume trading ecosystem. Building a Robust Trading Infrastructure High-Performance Trading Engine A powerful and scalable trading engine is the backbone of any high-volume trading operation. Key features should include: Low-latency execution to ensure rapid trade settlement. Scalability to handle surges in trading activity. Multi-asset support for diverse trading pairs. Liquidity Optimization Liquidity is critical for sustaining high trading volumes. Key strategies include: Market Making: Partner with liquidity providers or deploy in-house market-making strategies. Order Book Management: Maintain a balanced order book to minimize slippage and improve trade execution. Cross-Exchange Arbitrage: Utilize multiple exchanges to balance liquidity and arbitrage opportunities. Advanced Risk Management Portfolio Diversification Diversifying across multiple assets and trading pairs reduces risk exposure. Traders should: Implement hedging strategies using derivatives like futures and options. Use stop-loss and take-profit levels to manage downside risks. Diversify across multiple sectors, including DeFi, gaming, and AI tokens. Real-Time Monitoring & Automation Algorithmic risk management tools can assess market conditions and adjust positions accordingly. AI-driven analytics help detect anomalies and prevent manipulation or flash crashes. Leveraging Automation & AI in Trading Algorithmic Trading Automated trading bots execute trades efficiently, ensuring: 24/7 trading coverage. Smart order routing to secure optimal pricing. Arbitrage strategies to capitalize on price differences across markets. AI-Driven Market Insights Machine learning models can analyze vast datasets to predict market trends, optimize trade execution, and improve decision-making. Scaling Trading Volume to $10 Billion Achieving $10 billion in trading volume requires a combination of: Institutional Onboarding: Attracting hedge funds, market makers, and liquidity providers. Incentive Programs: Offering rewards such as fee rebates and staking incentives to increase participation. API & Trading Infrastructure: Providing robust APIs for high-frequency traders and institutional clients. Compliance and Security Measures Regulatory Compliance Ensuring adherence to global regulations builds trust and allows seamless institutional participation. This includes: KYC/AML compliance. Reporting and auditing frameworks. Adapting to regional regulatory requirements. Cybersecurity and Fund Protection Implementing multi-signature wallets and cold storage solutions to prevent asset theft. Utilizing AI-driven fraud detection to mitigate risks of malicious activities. Final Thoughts Scaling a trading operation to handle 100+ assets, 200+ pairs, and $10 billion in trading volume requires a combination of infrastructure, liquidity management, automation, risk mitigation, and regulatory compliance. By leveraging AI, algorithmic trading, and institutional partnerships, trading platforms can optimize efficiency, improve liquidity, and achieve exponential growth in trading volume. With the right strategy and technological stack, the road to $10 billion in trading volume is an achievable milestone!

Managing a large-scale trading operation involving 100+ assets, 200+ trading pairs, and reaching $10 billion in trading volume requires a well-structured strategy. Institutional and high-frequency traders rely on advanced infrastructure, risk management, and automation to achieve such milestones. Here’s a detailed guide on how to effectively scale and manage a high-volume trading ecosystem.

- Building a Robust Trading Infrastructure

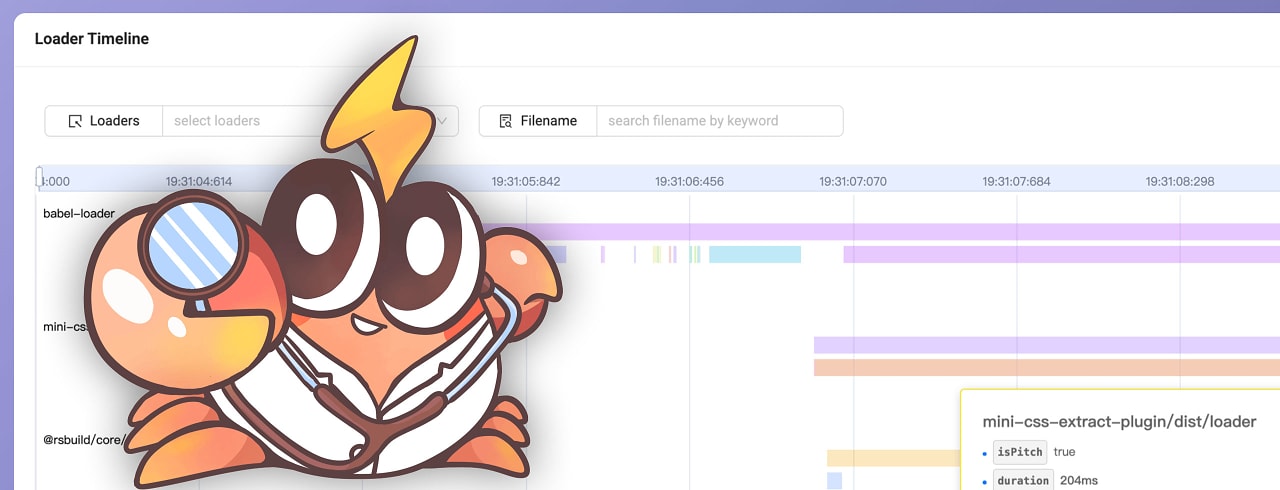

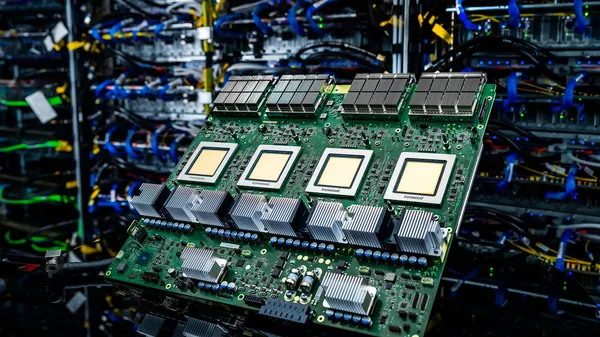

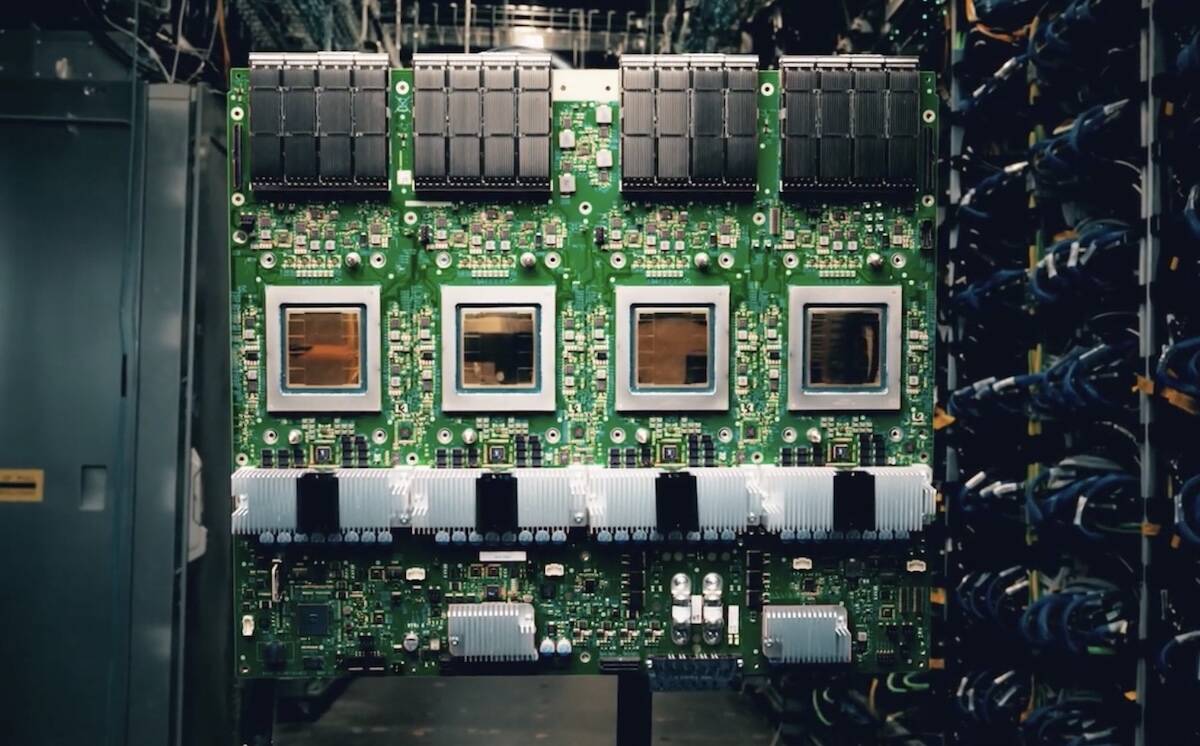

High-Performance Trading Engine

A powerful and scalable trading engine is the backbone of any high-volume trading operation. Key features should include:

Low-latency execution to ensure rapid trade settlement.

Scalability to handle surges in trading activity.

Multi-asset support for diverse trading pairs.

Liquidity Optimization

Liquidity is critical for sustaining high trading volumes. Key strategies include:

Market Making: Partner with liquidity providers or deploy in-house market-making strategies.

Order Book Management: Maintain a balanced order book to minimize slippage and improve trade execution.

Cross-Exchange Arbitrage: Utilize multiple exchanges to balance liquidity and arbitrage opportunities.

- Advanced Risk Management

Portfolio Diversification

Diversifying across multiple assets and trading pairs reduces risk exposure. Traders should:

Implement hedging strategies using derivatives like futures and options.

Use stop-loss and take-profit levels to manage downside risks.

Diversify across multiple sectors, including DeFi, gaming, and AI tokens.

Real-Time Monitoring & Automation

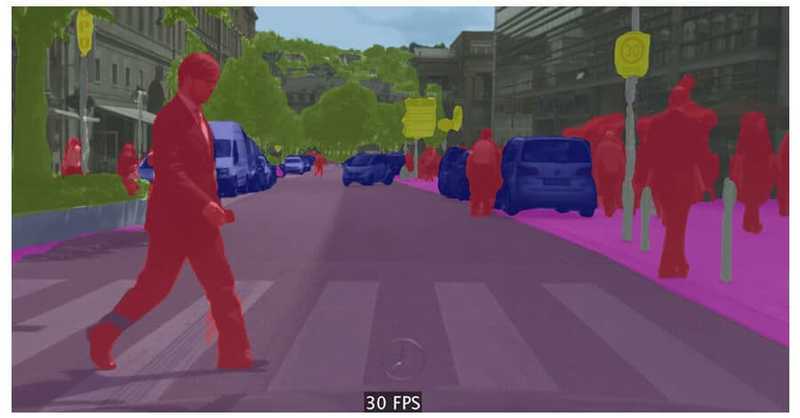

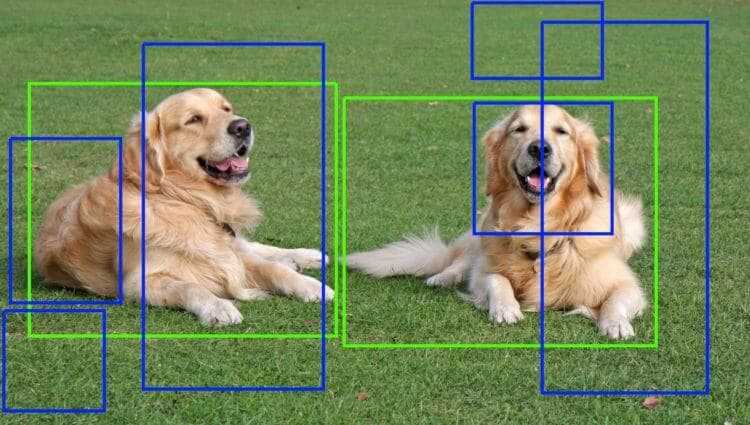

Algorithmic risk management tools can assess market conditions and adjust positions accordingly.

AI-driven analytics help detect anomalies and prevent manipulation or flash crashes.

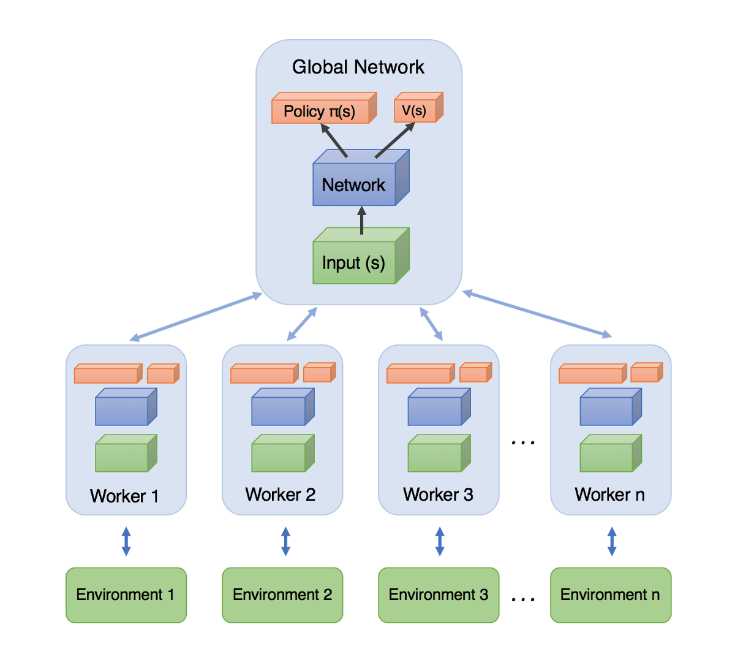

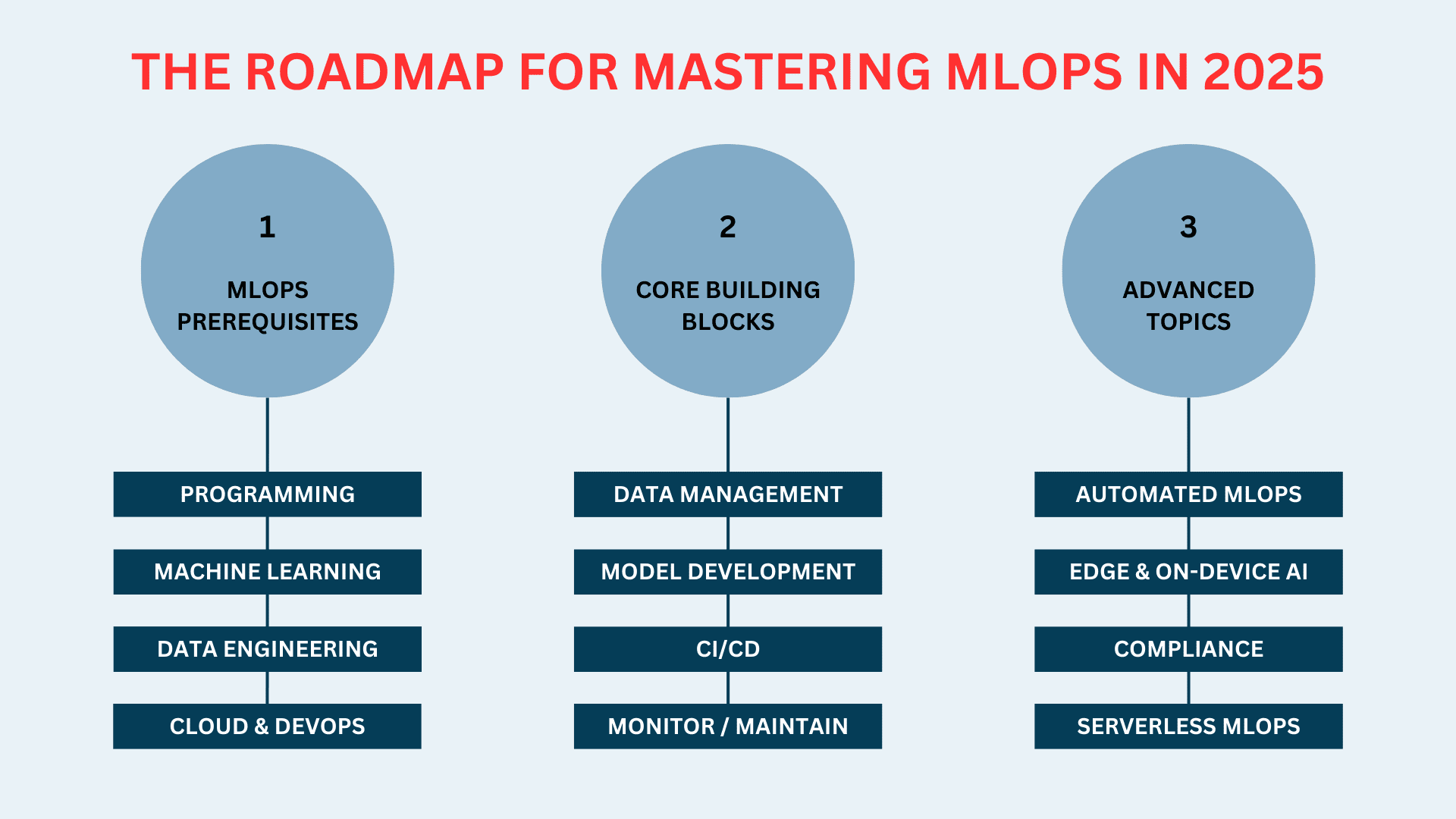

- Leveraging Automation & AI in Trading

Algorithmic Trading

Automated trading bots execute trades efficiently, ensuring:

24/7 trading coverage.

Smart order routing to secure optimal pricing.

Arbitrage strategies to capitalize on price differences across markets.

AI-Driven Market Insights

Machine learning models can analyze vast datasets to predict market trends, optimize trade execution, and improve decision-making.

- Scaling Trading Volume to $10 Billion

Achieving $10 billion in trading volume requires a combination of:

Institutional Onboarding: Attracting hedge funds, market makers, and liquidity providers.

Incentive Programs: Offering rewards such as fee rebates and staking incentives to increase participation.

API & Trading Infrastructure: Providing robust APIs for high-frequency traders and institutional clients.

- Compliance and Security Measures

Regulatory Compliance

Ensuring adherence to global regulations builds trust and allows seamless institutional participation. This includes:

KYC/AML compliance.

Reporting and auditing frameworks.

Adapting to regional regulatory requirements.

Cybersecurity and Fund Protection

Implementing multi-signature wallets and cold storage solutions to prevent asset theft.

Utilizing AI-driven fraud detection to mitigate risks of malicious activities.

Final Thoughts

Scaling a trading operation to handle 100+ assets, 200+ pairs, and $10 billion in trading volume requires a combination of infrastructure, liquidity management, automation, risk mitigation, and regulatory compliance. By leveraging AI, algorithmic trading, and institutional partnerships, trading platforms can optimize efficiency, improve liquidity, and achieve exponential growth in trading volume.

With the right strategy and technological stack, the road to $10 billion in trading volume is an achievable milestone!

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![Apple Watch to Get visionOS Inspired Refresh, Apple Intelligence Support [Rumor]](https://www.iclarified.com/images/news/96976/96976/96976-640.jpg)

![New Apple Watch Ad Features Real Emergency SOS Rescue [Video]](https://www.iclarified.com/images/news/96973/96973/96973-640.jpg)

![Apple Debuts Official Trailer for 'Murderbot' [Video]](https://www.iclarified.com/images/news/96972/96972/96972-640.jpg)

![Alleged Case for Rumored iPhone 17 Pro Surfaces Online [Image]](https://www.iclarified.com/images/news/96969/96969/96969-640.jpg)