21Shares files for Dogecoin ETF as crypto market jumps 12%

21Shares files to launch Dogecoin ETF in the US via S-1 registration. ETF will track CF Dogecoin-Dollar Settlement Price, pending 19b-4 approval. Coinbase named as custodian for the spot ETF. 21Shares’ application to launch a Dogecoin ETF in the US marks a significant shift in how meme coins are being integrated into mainstream finance. The […] The post 21Shares files for Dogecoin ETF as crypto market jumps 12% appeared first on CoinJournal.

- 21Shares files to launch Dogecoin ETF in the US via S-1 registration.

- ETF will track CF Dogecoin-Dollar Settlement Price, pending 19b-4 approval.

- Coinbase named as custodian for the spot ETF.

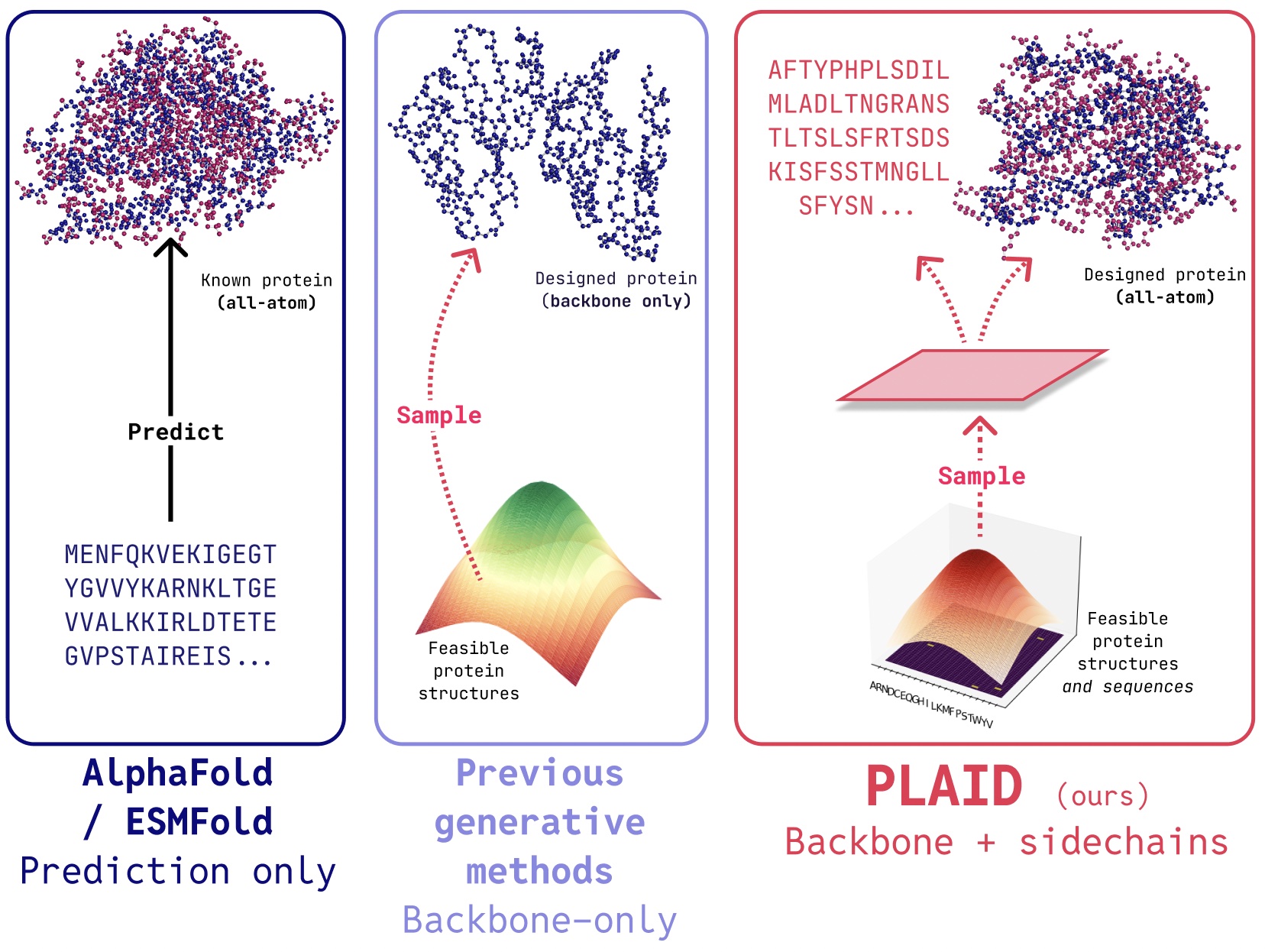

21Shares’ application to launch a Dogecoin ETF in the US marks a significant shift in how meme coins are being integrated into mainstream finance.

The move comes as crypto markets rally following Donald Trump’s 90-day tariff pause, and days after the Senate confirmed pro-crypto advocate Paul Atkins as the new SEC Chair.

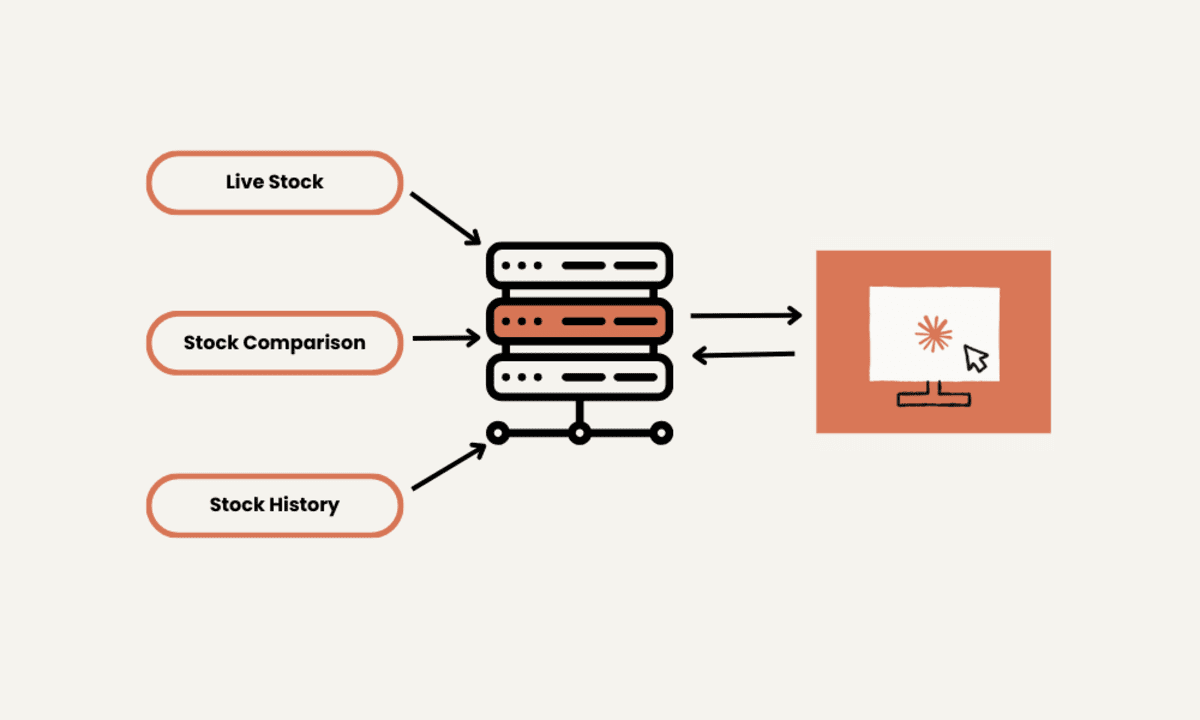

The ETF, if approved, will offer institutional investors a regulated way to gain exposure to Dogecoin without holding the asset directly.

The timing of the filing—on the same day as the launch of a Dogecoin ETP on the SIX Swiss Exchange—suggests coordinated efforts to accelerate Dogecoin’s presence in traditional financial markets.

Dogecoin ETF filing starts SEC review

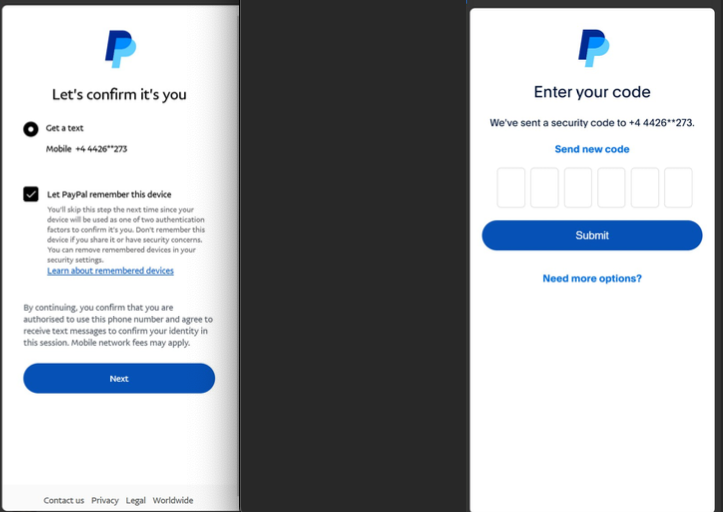

On Wednesday, 21Shares filed an S-1 registration with the US Securities and Exchange Commission (SEC) for a Dogecoin ETF. It also plans to submit a 19b-4 form, which will trigger the formal approval process.

The proposed ETF will track the CF Dogecoin-Dollar Settlement Price, making it possible for investors to gain price exposure to DOGE through a traditional trading platform.

This comes as the firm continues its aggressive ETF strategy, having previously filed for Polkadot and XRP ETFs. The Dogecoin ETF would be the first to offer US investors regulated exposure to the memecoin through a spot-traded fund.

Coinbase is listed as the custodian for the proposed fund, further linking it to regulated financial infrastructure.

21Shares is not alone in this effort. Grayscale and Bitwise have already submitted applications for similar Dogecoin ETFs.

However, 21Shares’ filing comes with added momentum as the company simultaneously rolled out a Dogecoin exchange-traded product (ETP) on Switzerland’s SIX Exchange.

That ETP is the first and only one backed by the Dogecoin Foundation, adding credibility to 21Shares’ push in the US market.

Crypto rebounds after Trump tariff pause

The filing came just hours after Donald Trump announced a 90-day pause on new tariffs, which triggered a major rally across the crypto market. Bitcoin surged by as much as 7.7% to hit $82,967.

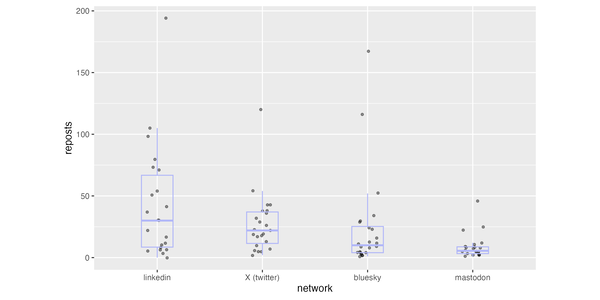

Ethereum, Dogecoin, and XRP all recorded gains of more than 12%, while Solana jumped 14%.

Analysts noted that the charts had been signalling a rebound even before Trump’s announcement, but the timing gave the market added momentum.

The broader rally provides a favourable environment for crypto ETFs, particularly those offering exposure to high-volatility assets like Dogecoin.

The memecoin had recently dipped to $0.14 before recovering, and technical analysts now suggest further upside potential.

Swiss ETP launch supports US ETF case

While most eyes were on the SEC filing, 21Shares quietly launched a Dogecoin ETP on the SIX Swiss Exchange.

The product was introduced in partnership with the House of Doge, a group aligned with the Dogecoin Foundation.

According to the filing, if the US ETF is approved, 21Shares and the House of Doge will collaborate to promote the fund across both markets.

The Swiss-listed ETP may serve as a case study for regulators in the US, showing how similar products have already entered European markets.

With regulated custodians and public price tracking already in place, it adds pressure on the SEC to consider approval under its evolving leadership.

New SEC Chair boosts ETF approval odds

The appointment of Paul Atkins as SEC Chair could play a decisive role.

Atkins was confirmed in a 52-44 Senate vote and is expected to be formally appointed by President Trump.

Known for his pro-crypto stance, Atkins’ leadership could speed up approvals for crypto-based ETFs that have been stalled.

Bloomberg analysts estimate a 75% chance of Dogecoin ETF approval this year, citing the wave of applications and changing sentiment under new SEC leadership.

Last month, the agency postponed action on ETFs tied to Dogecoin, Solana, Litecoin, and XRP, pending Atkins’ confirmation.

With that step now complete, analysts expect a flurry of decisions in the months ahead.

The post 21Shares files for Dogecoin ETF as crypto market jumps 12% appeared first on CoinJournal.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?#)

.webp?#)

![[Fixed] Gemini app is failing to generate Audio Overviews](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/03/Gemini-Audio-Overview-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![What’s new in Android’s April 2025 Google System Updates [U: 4/14]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Seeds tvOS 18.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97011/97011/97011-640.jpg)

![Apple Releases macOS Sequoia 15.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97014/97014/97014-640.jpg)