Bitcoin Miners Are Doubling Down

Bitcoin Magazine Bitcoin Miners Are Doubling Down Bitcoin miners push hash rate to record highs signaling massive miner investment. Could this signal Bitcoin’s next breakout? This post Bitcoin Miners Are Doubling Down first appeared on Bitcoin Magazine and is written by Matt Crosby.

Bitcoin Magazine

Bitcoin Miners Are Doubling Down

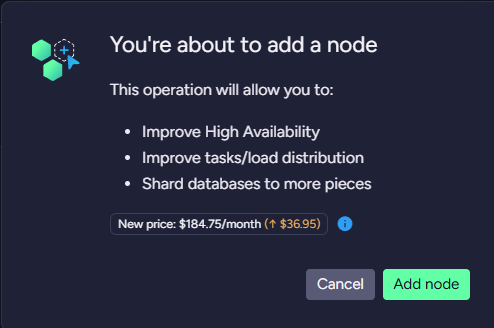

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

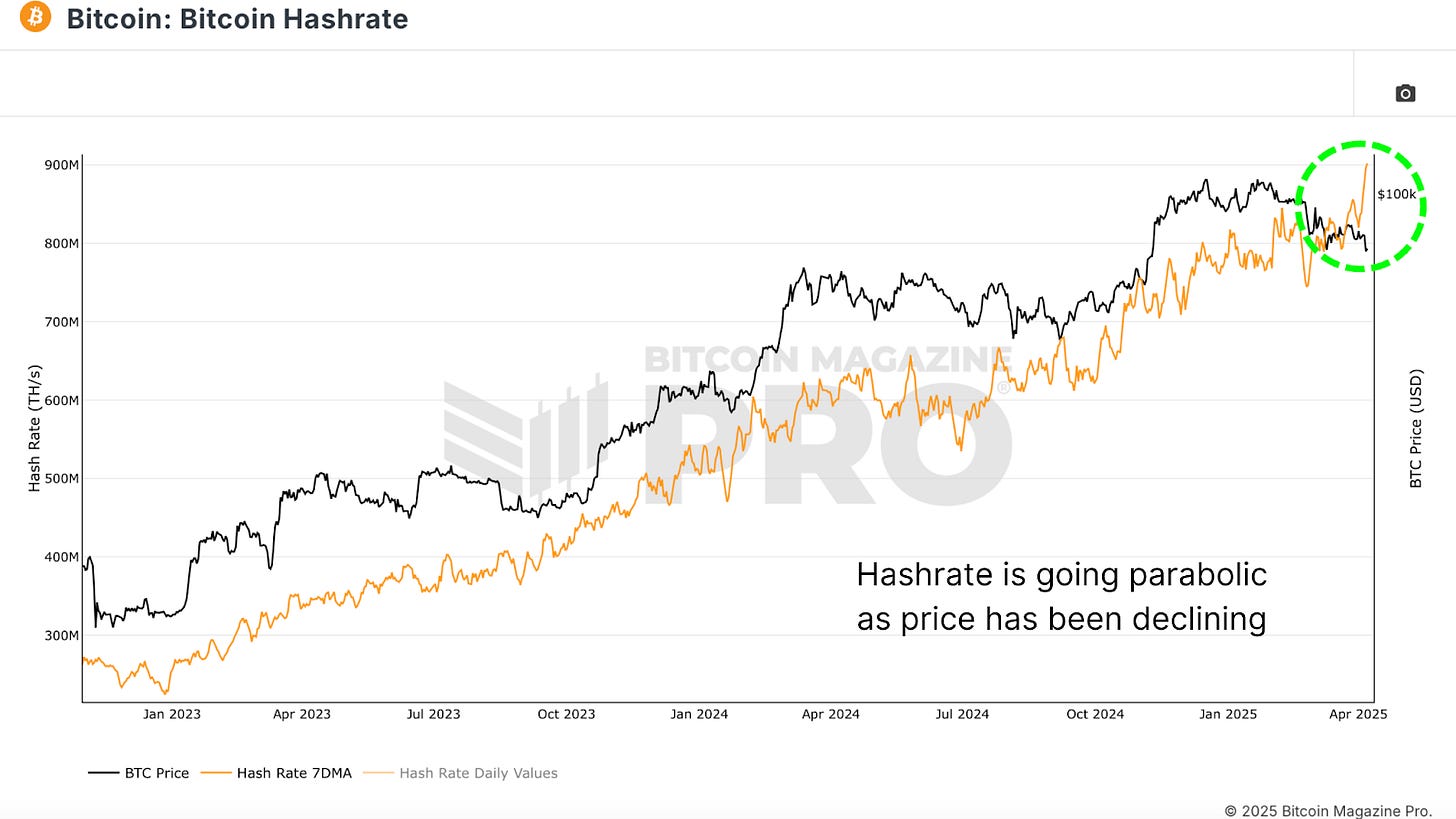

Bitcoin Hash Rate Going Parabolic

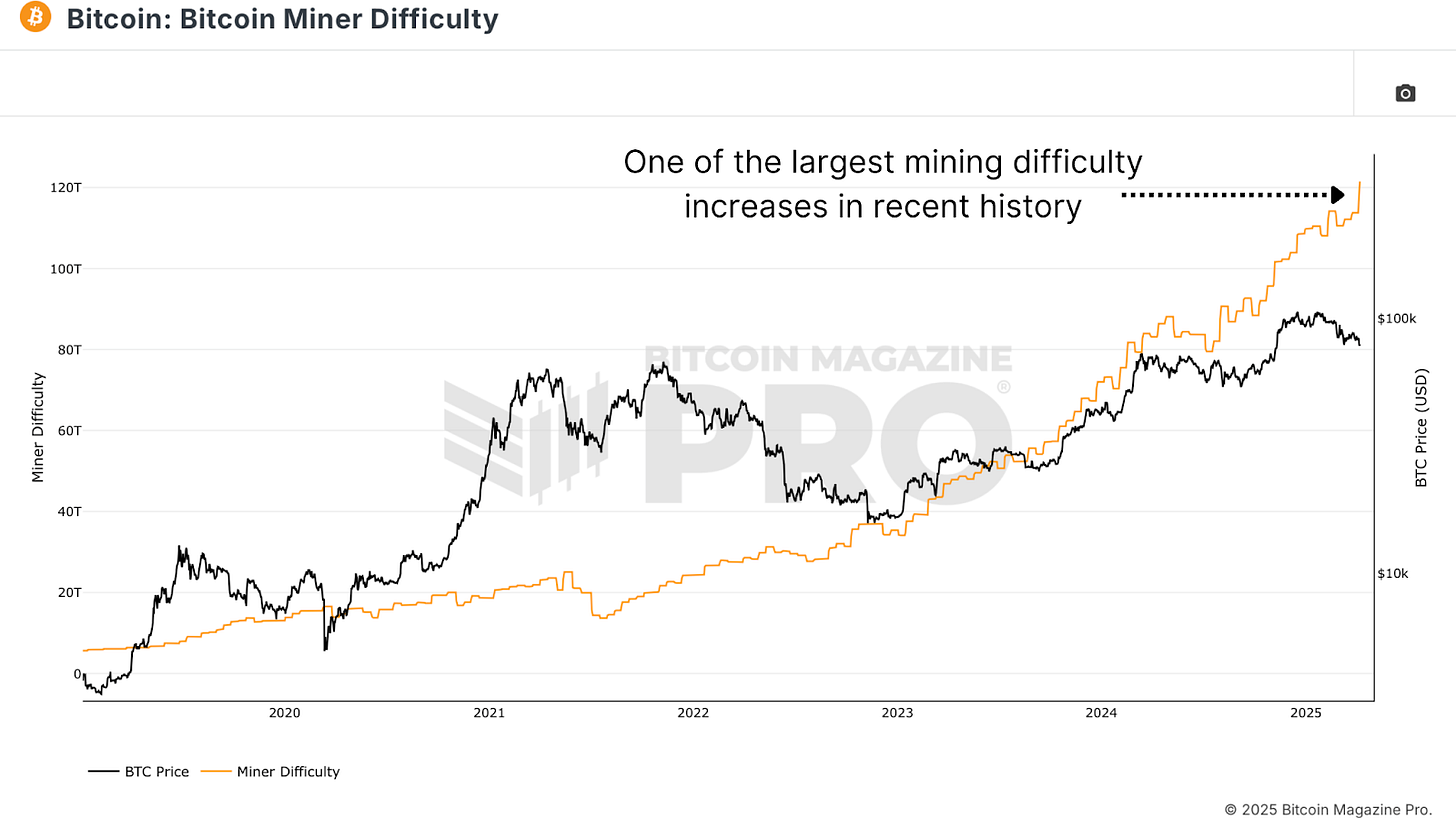

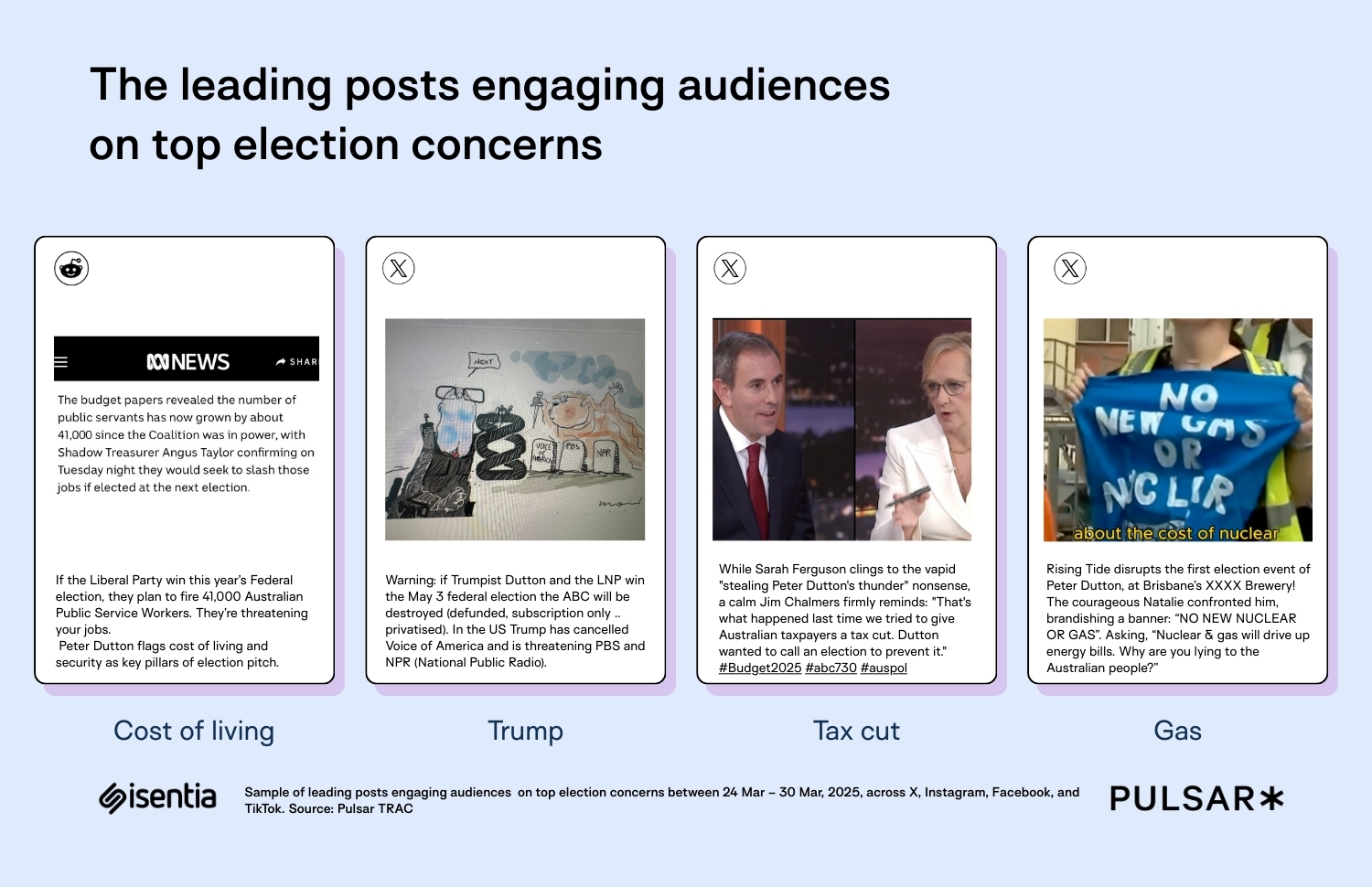

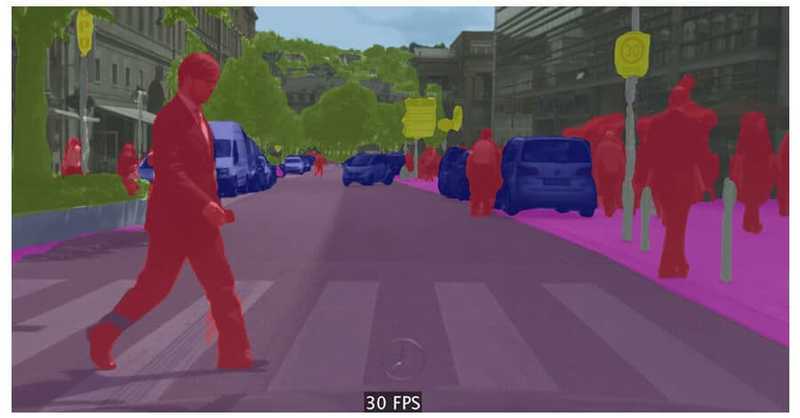

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

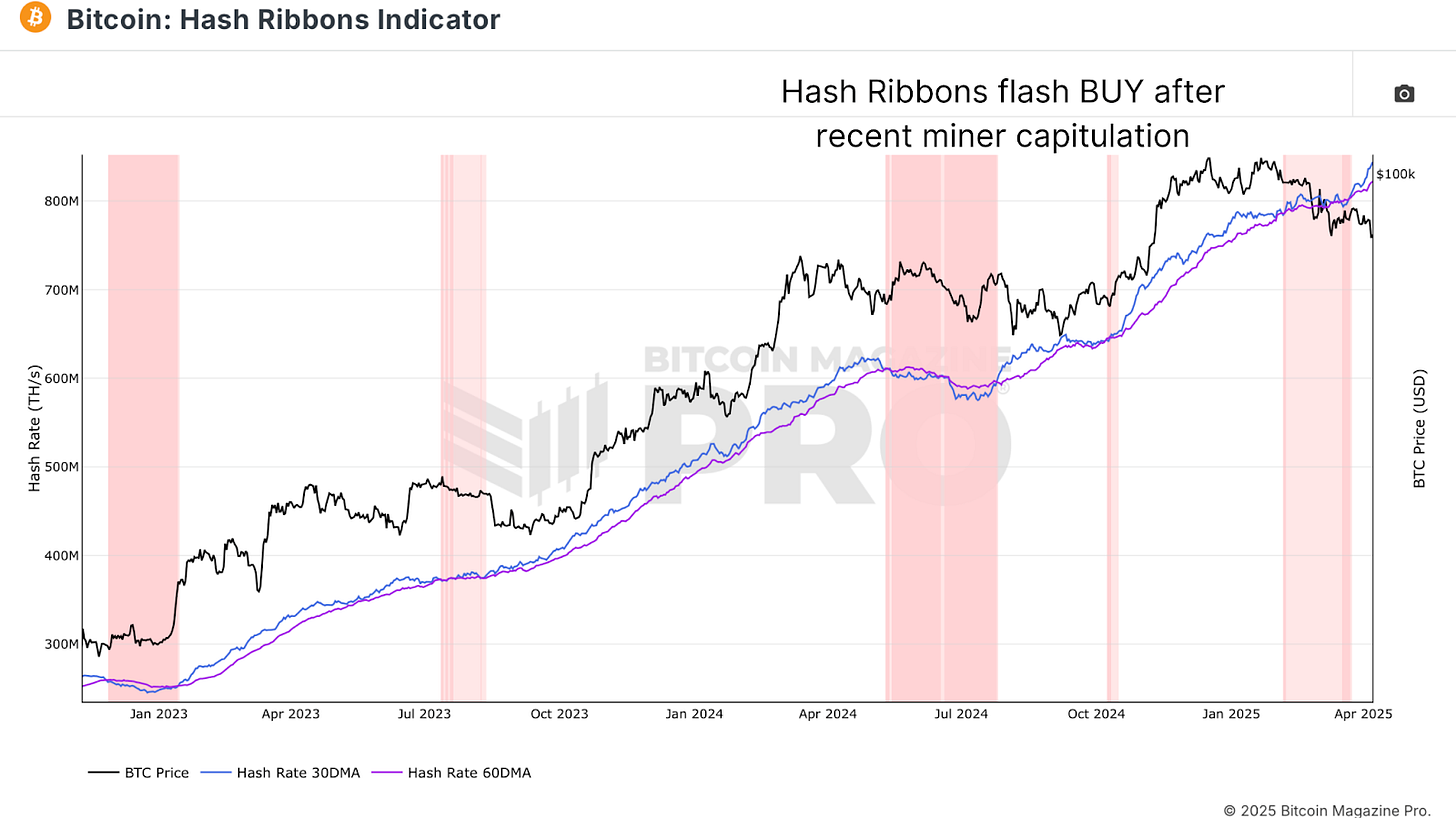

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

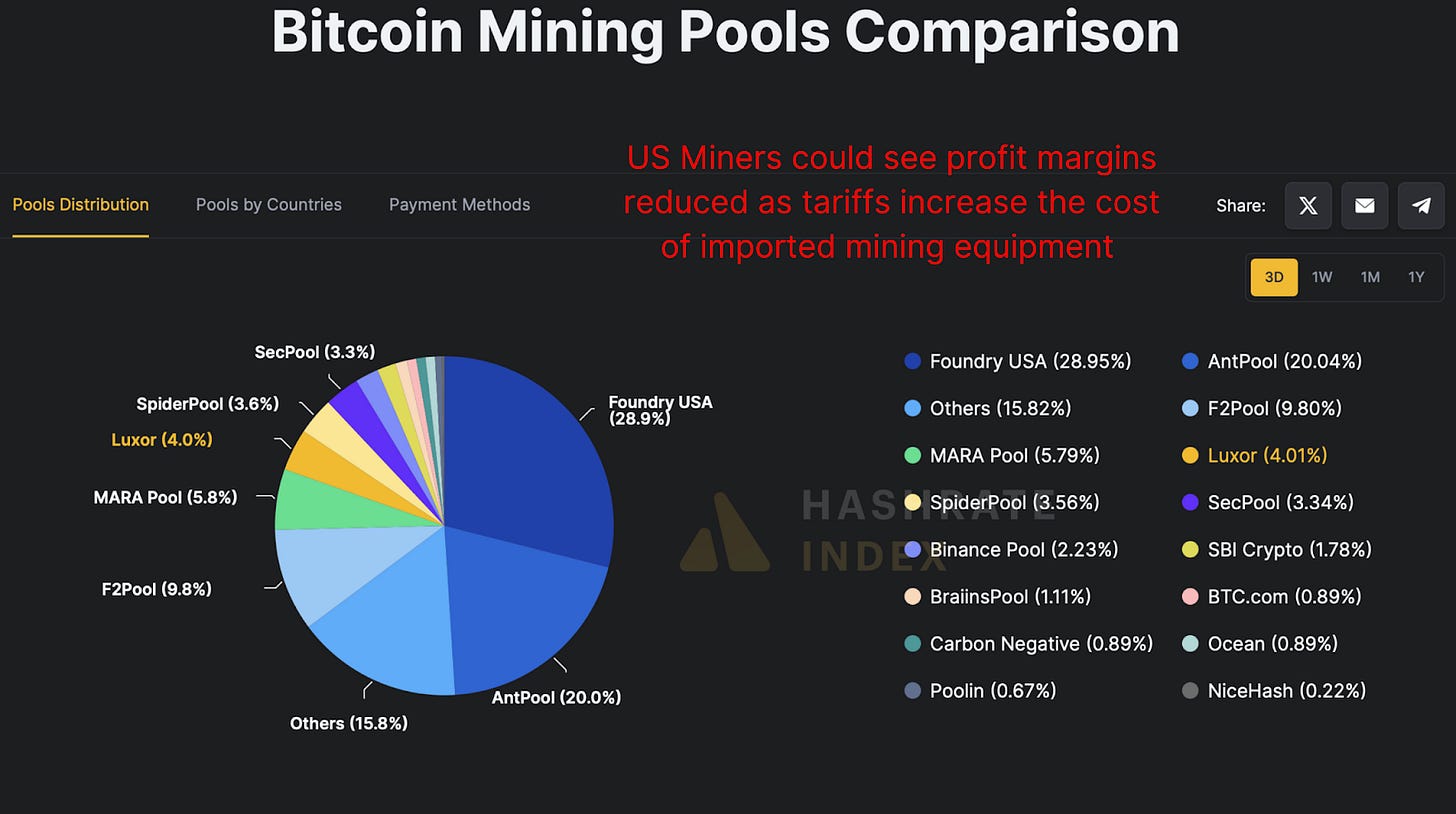

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Bitcoin Miners Are Doubling Down first appeared on Bitcoin Magazine and is written by Matt Crosby.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Apple Releases Public Betas of iOS 18.5, iPadOS 18.5, macOS Sequoia 15.5 [Download]](https://www.iclarified.com/images/news/97024/97024/97024-640.jpg)

![Apple to Launch In-Store Recycling Promotion Tomorrow, Up to $20 Off Accessories [Gurman]](https://www.iclarified.com/images/news/97023/97023/97023-640.jpg)