How Artificial Intelligence Developers are Powering Innovation in FinTech

The financial technology (FinTech) industry is evolving at breakneck speed. From mobile banking apps to AI-powered investment platforms, the sector has embraced digital transformation like few others. What’s fueling this innovation? Artificial intelligence. But behind every smart algorithm or real-time fraud alert system is a highly skilled artificial intelligence developer.

Introduction

The financial technology (FinTech) industry is evolving at breakneck speed. From mobile banking apps to AI-powered investment platforms, the sector has embraced digital transformation like few others. What’s fueling this innovation? Artificial intelligence. But behind every smart algorithm or real-time fraud alert system is a highly skilled artificial intelligence developer.

In this article, we’ll explore how AI is transforming FinTech, the role AI developers play in building cutting-edge solutions, and why financial institutions—both startups and established giants—are doubling down on AI talent to stay ahead.

Why AI is Crucial in FinTech

FinTech revolves around speed, data, and personalization. Traditional finance is burdened by outdated systems, manual processing, and one-size-fits-all service. AI introduces:

-

Real-time analytics

-

Predictive risk modeling

-

Automated customer service

-

Smart fraud detection

-

Hyper-personalized financial products

All of these innovations depend on the engineering expertise of an experienced artificial intelligence developer.

Key AI Applications in FinTech

1. Fraud Detection & Prevention

AI systems monitor thousands of transactions per second, flagging suspicious behavior in real time. Developers build models that adapt continuously to new fraud patterns.

2. Credit Scoring

AI-driven scoring systems consider non-traditional data—such as mobile activity or social signals—to assess creditworthiness for underbanked populations.

3. Robo-Advisors

These AI-powered platforms analyze investor profiles, market data, and risk tolerance to make tailored portfolio recommendations.

4. Chatbots & Virtual Assistants

AI chatbots handle balance inquiries, fund transfers, and customer issues 24/7—boosting customer satisfaction and reducing operational costs.

5. Algorithmic Trading

Using real-time market data, AI algorithms execute trades at optimal prices and speeds, giving firms a competitive edge.

How Artificial Intelligence Developers Drive FinTech Solutions

AI developers in FinTech bring a unique combination of skills:

-

Financial domain knowledge

-

Model development for time-series and behavioral data

-

Secure and compliant coding practices

-

Scalability and low-latency optimization

-

Integration with APIs, cloud platforms, and mobile apps

Their work turns AI from a concept into a working, secure, user-friendly product.

FinTech Startups Winning with AI

-

Zest AI uses machine learning to improve credit underwriting, increasing approvals without added risk.

-

Upstart developed an AI-based lending model that expanded access to loans for underserved demographics.

-

Klarna integrates AI to automate fraud detection and reduce chargeback rates.

-

Plum uses AI to help users save money by analyzing spending habits and adjusting deposits accordingly.

Each of these success stories had one thing in common: a trusted artificial intelligence developer behind the scenes.

Regulatory Considerations in AI FinTech Development

AI in FinTech comes with challenges:

| Regulatory Concern | Developer’s Solution |

|---|---|

| Data Privacy (GDPR, CCPA) | Implements anonymization, encryption, and access control |

| Model Bias | Applies fairness algorithms and bias detection tools |

| Explainability | Uses XAI (Explainable AI) models for transparency |

| Auditability | Builds systems with traceable decision logs |

An experienced artificial intelligence developer ensures your system is both innovative and compliant.

Magic Factory: Trusted AI Developers for FinTech Innovation

At Magic Factory, we understand that the FinTech space requires more than just technical ability—it demands domain expertise, security, and compliance. Our team of artificial intelligence developer professionals has helped startups and institutions alike:

-

Automate credit decision workflows

-

Deploy robo-advisors and recommendation engines

-

Develop real-time fraud detection tools

-

Create user-facing financial chatbots

-

Launch scalable, secure AI architectures

We don't just build code—we build competitive financial systems.

Benefits of AI in FinTech

-

Faster customer onboarding through automated KYC

-

Improved customer retention via personalized experiences

-

Higher fraud detection accuracy

-

Operational efficiency by cutting manual labor

-

Market adaptability through real-time intelligence

With the guidance of a dedicated artificial intelligence developer, your FinTech business is positioned to grow fast and securely.

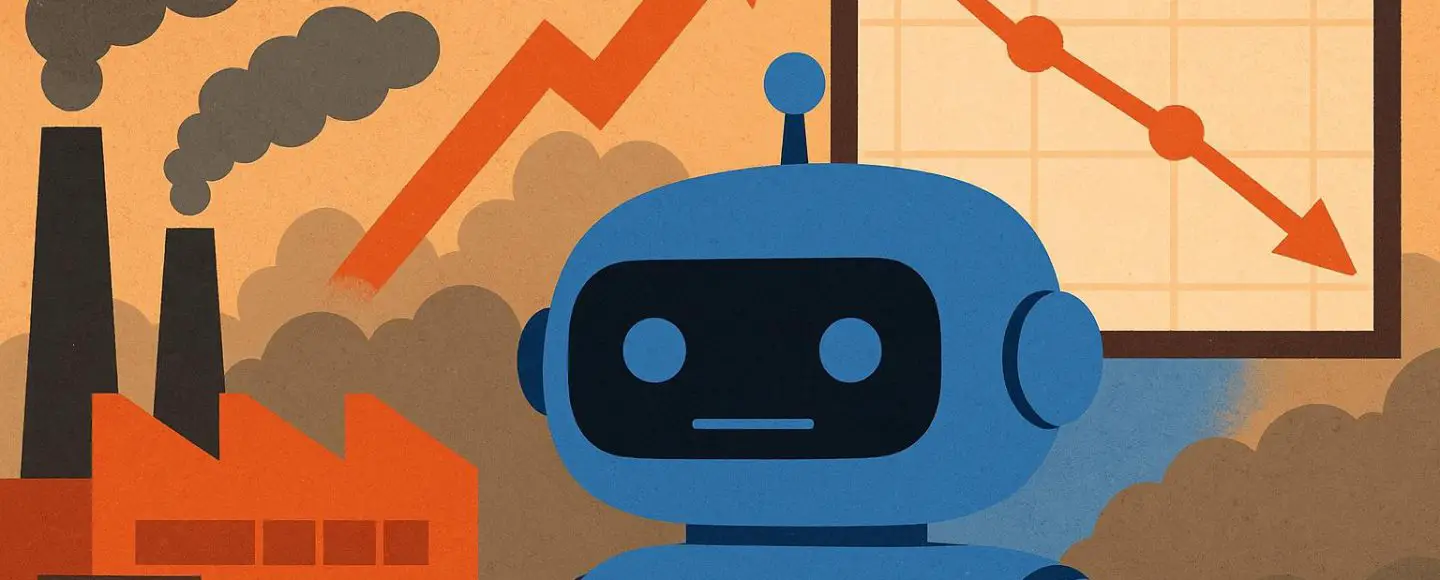

The Future of AI in FinTech

-

Voice-Powered Banking Assistants

-

Blockchain + AI for Secure Payments

-

AI-Powered ESG Investment Tools

-

Cross-Border Credit Models with Real-Time Compliance

These innovations are already underway—and your next big product could be part of this future with the right AI team.

Conclusion

FinTech’s future belongs to those who embrace smart, scalable, and secure technologies. Artificial intelligence is the heart of this transformation—and it’s powered by the precision and vision of a skilled artificial intelligence developer.

Whether you're building a startup that disrupts traditional banking or enhancing a legacy system with AI capabilities, success begins with hiring the right developer to architect your future.

![[The AI Show Episode 154]: AI Answers: The Future of AI Agents at Work, Building an AI Roadmap, Choosing the Right Tools, & Responsible AI Use](https://www.marketingaiinstitute.com/hubfs/ep%20154%20cover.png)

![[The AI Show Episode 153]: OpenAI Releases o3-Pro, Disney Sues Midjourney, Altman: “Gentle Singularity” Is Here, AI and Jobs & News Sites Getting Crushed by AI Search](https://www.marketingaiinstitute.com/hubfs/ep%20153%20cover.png)

![GrandChase tier list of the best characters available [June 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

_marcos_alvarado_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Latest leak shows how Galaxy Z Flip 7 FE compares to the standard Flip 7 [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/06/galaxy-z-flip-7-fam-blass-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple in Last-Minute Talks to Avoid More EU Fines Over App Store Rules [Report]](https://www.iclarified.com/images/news/97680/97680/97680-640.jpg)

![Apple Seeds tvOS 26 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97691/97691/97691-640.jpg)