Housing market standoff: Gen Z wants in, but boomers are staying put

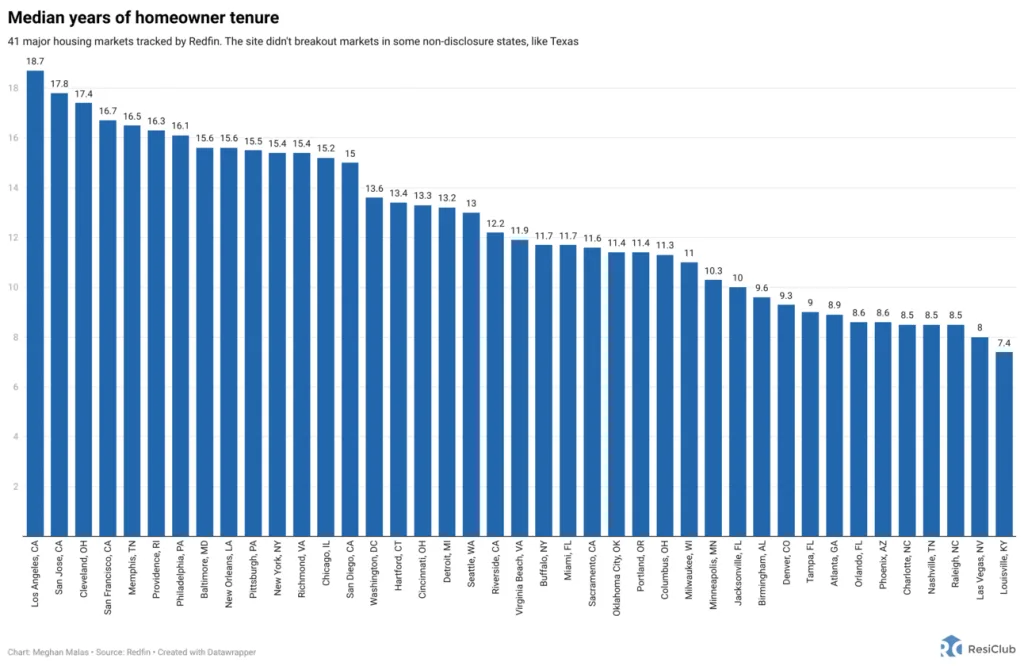

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. In 2005, the median U.S. homeowner lived and owned their primary home for 6.5 years. In 2024, the median U.S. homeowner lived and owned their primary home for 11.8 years. That’s according to Redfin’s latest analysis. That means the typical U.S. home today has been owned by the same person for nearly twice as long as in 2005—resulting in less turnover in the housing market. That affects the entire ecosystem. For some millennials and Gen Xers, it could mean staying longer in their starter homes as they struggle to find a move-up property in their desired location. And for first-time buyers, especially Gen Z, the lack of turnover means fewer entry-level homes coming up for sale. After climbing every year between 2005 and 2020, U.S. homeowner tenure has come down a bit due to the increase in home sales during the pandemic housing boom. However, given spiked mortgage rates and low existing home sales, tenure rates could start going higher again. “Moving forward, we expect homeowner tenure to stay flat or increase slightly for the foreseeable future,” wrote Redfin researchers. “Existing-home sales hit a 15-year low last year, with many homeowners locked in by low mortgage rates, and while sales should pick up a bit this year, it’ll be more of a trickle than a flood.” Why did U.S. homeowner tenure increase so much between 2005 and 2020? Redfin says, in part, it’s because so many baby boomers choose to “age in place.” “Older Americans are hanging onto their homes because they’re financially incentivized to do so. Most (54%) baby boomers who own homes own them free and clear, with no outstanding mortgage. For that group, the median monthly cost of owning a home–which includes insurance and property taxes, among other things—is just over $600 (similar to the monthly cost for other generations with no outstanding mortgage, but other generations are far less likely to own homes free and clear),” wrote Redfin researchers. In addition to “aging in place,” the Redfin report also cites state-level tax policies that encourage homeowners not to move as part of the reason for increased homeowner tenures. Most notably, Proposition 13 in California limits property tax increases for homeowners, thus encouraging them not to sell. There’s also the fact that older Americans have higher homeownership rates, and over the past few decades, the composition of the U.S. population has shifted older as the giant baby boomer generation has aged and birth rates have declined. That has put upward pressure on homeowner tenure. What has this meant for homebuyers and the industry? The increase in average homeowner tenure over the two past decades has subdued turnover, limiting the purchasing opportunities for certain properties and holding back existing home sales.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

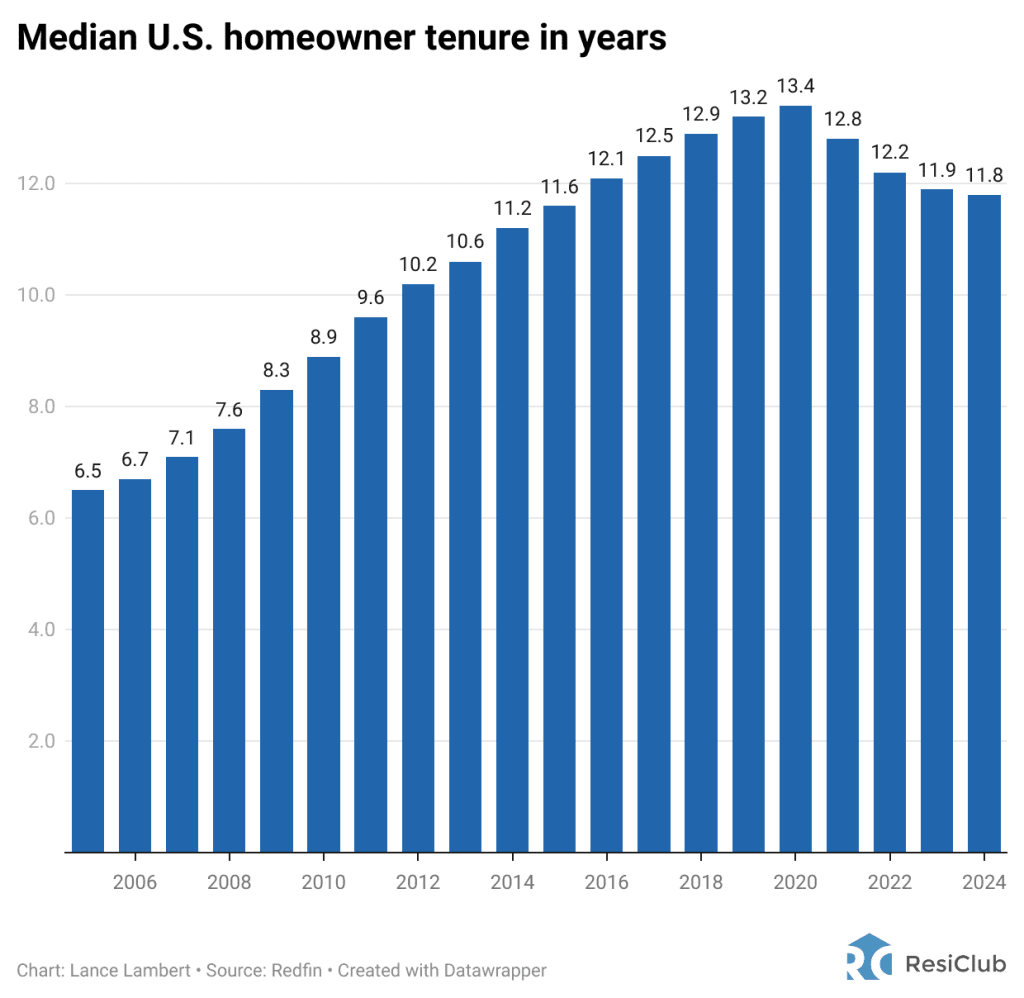

In 2005, the median U.S. homeowner lived and owned their primary home for 6.5 years. In 2024, the median U.S. homeowner lived and owned their primary home for 11.8 years. That’s according to Redfin’s latest analysis.

That means the typical U.S. home today has been owned by the same person for nearly twice as long as in 2005—resulting in less turnover in the housing market. That affects the entire ecosystem. For some millennials and Gen Xers, it could mean staying longer in their starter homes as they struggle to find a move-up property in their desired location. And for first-time buyers, especially Gen Z, the lack of turnover means fewer entry-level homes coming up for sale.

After climbing every year between 2005 and 2020, U.S. homeowner tenure has come down a bit due to the increase in home sales during the pandemic housing boom. However, given spiked mortgage rates and low existing home sales, tenure rates could start going higher again.

“Moving forward, we expect homeowner tenure to stay flat or increase slightly for the foreseeable future,” wrote Redfin researchers. “Existing-home sales hit a 15-year low last year, with many homeowners locked in by low mortgage rates, and while sales should pick up a bit this year, it’ll be more of a trickle than a flood.”

Why did U.S. homeowner tenure increase so much between 2005 and 2020? Redfin says, in part, it’s because so many baby boomers choose to “age in place.”

“Older Americans are hanging onto their homes because they’re financially incentivized to do so. Most (54%) baby boomers who own homes own them free and clear, with no outstanding mortgage. For that group, the median monthly cost of owning a home–which includes insurance and property taxes, among other things—is just over $600 (similar to the monthly cost for other generations with no outstanding mortgage, but other generations are far less likely to own homes free and clear),” wrote Redfin researchers.

In addition to “aging in place,” the Redfin report also cites state-level tax policies that encourage homeowners not to move as part of the reason for increased homeowner tenures. Most notably, Proposition 13 in California limits property tax increases for homeowners, thus encouraging them not to sell.

There’s also the fact that older Americans have higher homeownership rates, and over the past few decades, the composition of the U.S. population has shifted older as the giant baby boomer generation has aged and birth rates have declined. That has put upward pressure on homeowner tenure.

What has this meant for homebuyers and the industry? The increase in average homeowner tenure over the two past decades has subdued turnover, limiting the purchasing opportunities for certain properties and holding back existing home sales.

![[The AI Show Episode 156]: AI Answers - Data Privacy, AI Roadmaps, Regulated Industries, Selling AI to the C-Suite & Change Management](https://www.marketingaiinstitute.com/hubfs/ep%20156%20cover.png)

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_incamerastock_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brain_light_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Senators reintroduce App Store bill to rein in ‘gatekeeper power in the app economy’ [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/06/app-store-senate.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)