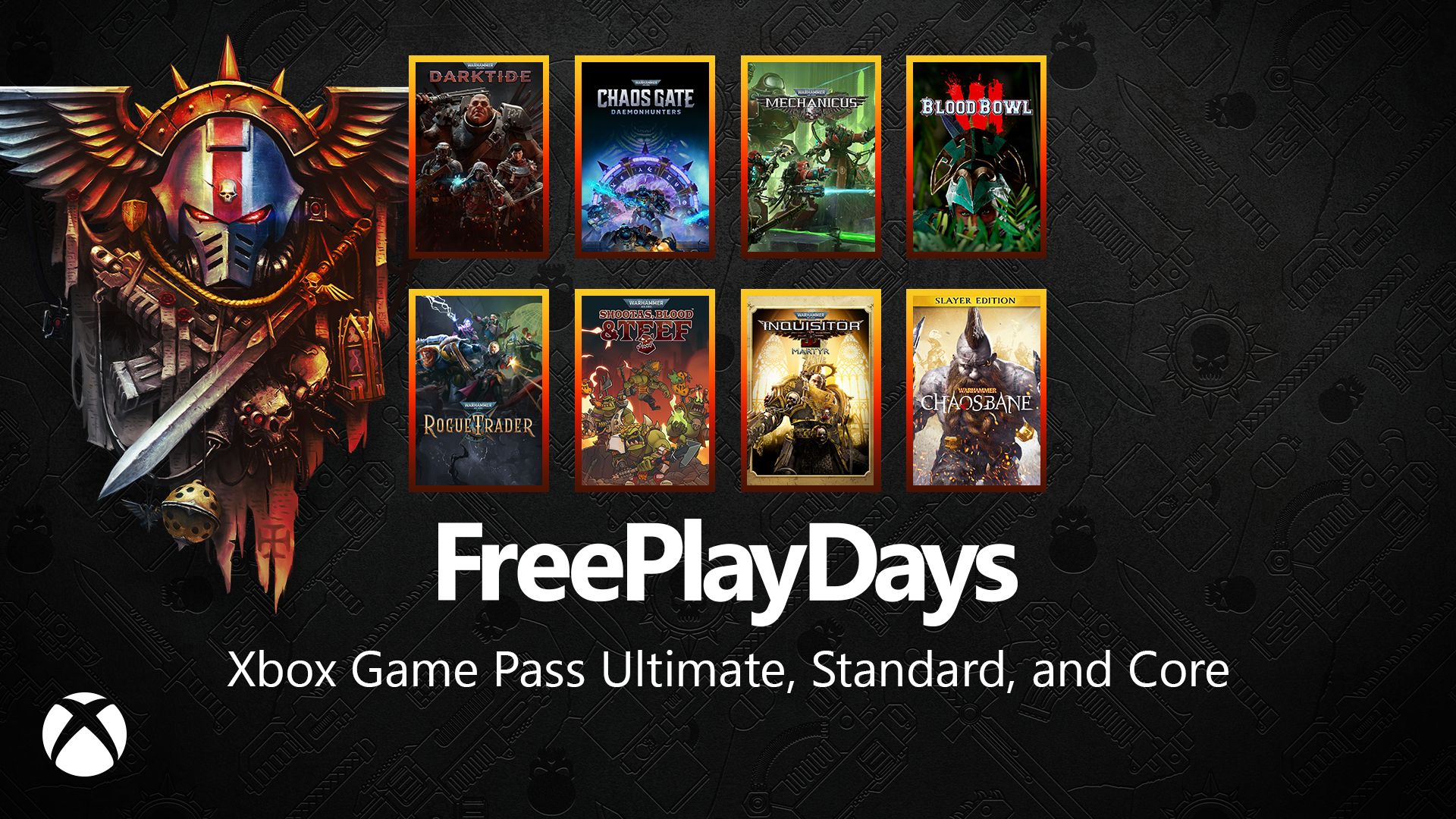

For deeptech startups, growth capital is a function of traction: Panellists say at Prosus' flagship event

For deep-tech startups, growth capital is a function of traction: Panellists say at Prosus' flagship event

Indian deeptech companies have seen a recent wave of investor support and spotlight as the country looks to be a part of the next wave of technology as the world races ahead.

At Prosus’ first event in its global flagship series, Prosus Luminate India, YourStory’s CEO and Founder, Shradha Sharma, sat down with CRED’s Founder, Kunal Shah and Mukesh Bansal, co-founder of Meraki Labs to discuss the country’s deeptech landscape.

According to Shah, Indian deeptech companies are at a stage today where they need to be nurtured for the next 5-10 years for them to be competitive on a global landscape.

“Because deeptech is very different from the things most of us have done in the past. It requires a much longer incubation cycle, it requires access to the market, it requires some protection and a lot of patient capital. All of those, I think, as you are pointing out, I think the country is just waking up now, from government to private investors to deep tech funds to entrepreneurs,” he added.

However, as more founders rush to start up in the deep-tech segment, the sector has run into challenges in accessing markets and, in turn, getting access to growth capital, Bansal said. He noted the role the Indian government can play in bridging this gap—by creating demand and encouraging deep-tech procurement in the country.

Shah added that “extraordinary talent and any extraordinary innovation will always have access to the market. I think the world is a super-connected place.” He noted that quality innovation of products will always give companies an edge in the world. As this builds, growth capital will flow. “Growth capital is a function of traction.”

As more and more deeptech startups get early-stage cheques, there is heightened focus on their road map forward. While the total capital in the world is growing exponentially, “the question is that, do we have companies that can get returns for them (VCs) to keep deploying more money?” Shah posed to the audience.

With companies heading to public bourses, this has set the stage for VCs to exit and get the returns for the investments they made years ago. But the public markets' stats, when looked at closely, present an anomaly. “India violates the $4 trillion market cap, give or take…I would say maybe the top 100 companies concentrate almost all of the market cap that exists while we may have thousands of companies in the public market,” Shah observed.

This sets the ground for the level of healthy skepticism guiding funding inflows into Indian startups. As India navigates the early days of deep-tech innovation, ambition will drive its path forward. “Ambition is a function of what we around us,” Shah said.

Bansal added to this point by reiterating the growing need for focus on profitability and patience for growth. “There is almost no company of note in the world that is 10 years old. NVIDIA was started in 1991, close to 35 years ago. Microsoft and Apple, are almost 50-year-old companies at this valuation.”

Companies need to approach profitability with heightened levels of ambition. “Not profitability of $10 billion or go public type of profitability. But, $100 billion profit or even $500 billion. I think this will be the next level of evolution,” Bansal said.

.jpg)

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] Babbel Language Learning: Lifetime Subscription (All Languages) (71% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Borderlands 4 Boss Says 'A Real Fan' Will Pay $80 For Games [Update]](https://i.kinja-img.com/image/upload/c_fill,h_675,pg_1,q_80,w_1200/086e4654c281e40d12b833591d2c6fdc.jpg)

![Jony Ive and OpenAI Working on AI Device With No Screen [Kuo]](https://www.iclarified.com/images/news/97401/97401/97401-640.jpg)

_Constantine_Soutiaguin-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Nomad levels up its best-selling charger with new 100W slim adapter [Hands-on]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/100w-FI.jpg.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Google just showed off Android Auto’s upcoming light theme [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/android-auto-light-theme-documentation-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Anthropic Unveils Claude 4 Models That Could Power Apple Xcode AI Assistant [Video]](https://www.iclarified.com/images/news/97407/97407/97407-640.jpg)

![Apple Leads Global Wireless Earbuds Market in Q1 2025 [Chart]](https://www.iclarified.com/images/news/97394/97394/97394-640.jpg)