At Home closing? Bankruptcy puts dozens of stores at risk of shutting down

At Home, the big-box home decor and furnishings brand, is the most recent in a series of home goods stores, including Big Lots and True Value, to file for bankruptcy in recent months. Today, the company announced that it is seeking Chapter 11 protection after tariff-related costs, inflation, and reduced foot traffic have taken a bite out of sales. The company, which is owned by Hellman & Friedman and operates 260 stores across the U.S., has entered an agreement with its lenders that’s intended to help eliminate the company’s $2 billion in debt while providing $200 million in new funding to keep the brand afloat during the restructuring process. CEO Brad Weston said in a press release that At Home is operating against a “rapidly evolving trade environment as we navigate the impact of tariffs” and that the changes are intended to help the company compete in a more volatile marketplace. At Home’s financial woes come on the back of closures for several similar brands. In 2024, the discount retailer Big Lots also filed for Chapter 11 bankruptcy and planned to close all of its 800 locations before it was ultimately purchased and kept afloat by a new owner (though at a much smaller scale). And this May, the beloved arts-and-crafts retailer Joann’s closed its doors permanently after a drawn-out bankruptcy process. Now, At Home will be the latest home goods retailer to attempt to keep its doors open as it navigates the bankruptcy process. 26 stores expected to close Currently, At Home employs over 7,000 workers across 40 states. According to a bankruptcy court filing, the brand has struggled over the past several years due to “reduced foot traffic in stores, heightened competition from comparable and off-price retailers offering substantial discounts, and a disparity between inventory and customer demand.” Over the last year, At Home has already closed six stores, but it reports that several remaining stores are still operating at “suboptimal performance levels.” To turn things around, At Home reported that it will begin by transitioning ownership of the company to its lenders, who are shouldering more than 95% of its debt. The restructuring is also expected to result in several store closures. Per the filing: “Ultimately, the Debtors’ management team and advisors determined that it is appropriate to commence closings of 26 underperforming brick-and-mortar stores, with the potential to close additional underperforming stores in the future.” The 26 stores are expected to be sold and vacated by September 30, 2025. Here are the stores that are expected to close: 750 Newhall Dr., San Jose, CA 2505 El Camino Real, Tustin, CA 2200 Harbor Blvd., Costa Mesa, CA 3795 E Foothills Blvd., Pasadena, CA 1982 E 20th St., Chico, CA 26532 Towne Center Dr., Suites A-B, Foothill Ranch, CA 2900 N. Bellflower Blvd., Long Beach, CA 8320 Delta Shores Circle S., Sacramento, CA 14585 Biscayne Blvd., North Miami, FL 5203 W. War Memorial Dr., Peoria, IL 13180 S. Cicero Ave., Crestwood, IL 300 Providence Highway, Dedham, MA 571 Boston Turnpike, Shrewsbury, MA 2820 Hwy. 63, South Rochester, MN 905 S 24th St. W., Billings, MT 1361 NJ-35, Middletown Township, NJ 461 Route 10, East Ledgewood, NJ 301 Nassau Park Blvd., Princeton, NJ 6135 Junction Blvd., Rego Park, NY 300 Baychester Ave., Bronx, NY 720 Clairton Blvd., Pittsburgh, PA 8300 Sudley Rd., Manassas, VA 19460 Compass Creek Pkwy., Leesburg, VA 1001 E Sunset Dr., Bellingham, WA 2530 Rudkin Rd., Yakima, WA 3201 North Mayfair Rd., Wauwatosa, WI

At Home, the big-box home decor and furnishings brand, is the most recent in a series of home goods stores, including Big Lots and True Value, to file for bankruptcy in recent months. Today, the company announced that it is seeking Chapter 11 protection after tariff-related costs, inflation, and reduced foot traffic have taken a bite out of sales.

The company, which is owned by Hellman & Friedman and operates 260 stores across the U.S., has entered an agreement with its lenders that’s intended to help eliminate the company’s $2 billion in debt while providing $200 million in new funding to keep the brand afloat during the restructuring process.

CEO Brad Weston said in a press release that At Home is operating against a “rapidly evolving trade environment as we navigate the impact of tariffs” and that the changes are intended to help the company compete in a more volatile marketplace.

At Home’s financial woes come on the back of closures for several similar brands. In 2024, the discount retailer Big Lots also filed for Chapter 11 bankruptcy and planned to close all of its 800 locations before it was ultimately purchased and kept afloat by a new owner (though at a much smaller scale). And this May, the beloved arts-and-crafts retailer Joann’s closed its doors permanently after a drawn-out bankruptcy process. Now, At Home will be the latest home goods retailer to attempt to keep its doors open as it navigates the bankruptcy process.

26 stores expected to close

Currently, At Home employs over 7,000 workers across 40 states. According to a bankruptcy court filing, the brand has struggled over the past several years due to “reduced foot traffic in stores, heightened competition from comparable and off-price retailers offering substantial discounts, and a disparity between inventory and customer demand.” Over the last year, At Home has already closed six stores, but it reports that several remaining stores are still operating at “suboptimal performance levels.”

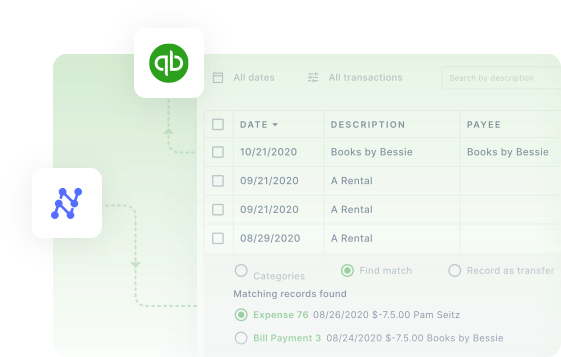

To turn things around, At Home reported that it will begin by transitioning ownership of the company to its lenders, who are shouldering more than 95% of its debt. The restructuring is also expected to result in several store closures. Per the filing: “Ultimately, the Debtors’ management team and advisors determined that it is appropriate to commence closings of 26 underperforming brick-and-mortar stores, with the potential to close additional underperforming stores in the future.”

The 26 stores are expected to be sold and vacated by September 30, 2025. Here are the stores that are expected to close:

- 750 Newhall Dr., San Jose, CA

- 2505 El Camino Real, Tustin, CA

- 2200 Harbor Blvd., Costa Mesa, CA

- 3795 E Foothills Blvd., Pasadena, CA

- 1982 E 20th St., Chico, CA

- 26532 Towne Center Dr., Suites A-B, Foothill Ranch, CA

- 2900 N. Bellflower Blvd., Long Beach, CA

- 8320 Delta Shores Circle S., Sacramento, CA

- 14585 Biscayne Blvd., North Miami, FL

- 5203 W. War Memorial Dr., Peoria, IL

- 13180 S. Cicero Ave., Crestwood, IL

- 300 Providence Highway, Dedham, MA

- 571 Boston Turnpike, Shrewsbury, MA

- 2820 Hwy. 63, South Rochester, MN

- 905 S 24th St. W., Billings, MT

- 1361 NJ-35, Middletown Township, NJ

- 461 Route 10, East Ledgewood, NJ

- 301 Nassau Park Blvd., Princeton, NJ

- 6135 Junction Blvd., Rego Park, NY

- 300 Baychester Ave., Bronx, NY

- 720 Clairton Blvd., Pittsburgh, PA

- 8300 Sudley Rd., Manassas, VA

- 19460 Compass Creek Pkwy., Leesburg, VA

- 1001 E Sunset Dr., Bellingham, WA

- 2530 Rudkin Rd., Yakima, WA

- 3201 North Mayfair Rd., Wauwatosa, WI

![[The AI Show Episode 152]: ChatGPT Connectors, AI-Human Relationships, New AI Job Data, OpenAI Court-Ordered to Keep ChatGPT Logs & WPP’s Large Marketing Model](https://www.marketingaiinstitute.com/hubfs/ep%20152%20cover.png)

_Alexander-Yakimov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Zoonar_GmbH_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Meta AI app ‘a privacy disaster’ as chats unknowingly made public [U: Warning added]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/06/Meta-AI-app-a-privacy-disaster-as-chats-inadvertently-made-public.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![OnePlus Pad Lite officially teased just as its specs leak [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/06/oneplus-nord-pad-lite-lineup-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 3 Not Launching Until 2026 [Pu]](https://www.iclarified.com/images/news/97620/97620/97620-640.jpg)

![Apple Releases First Beta of iOS 18.6 and iPadOS 18.6 to Developers [Download]](https://www.iclarified.com/images/news/97626/97626/97626-640.jpg)

![Apple Seeds watchOS 11.6 Beta to Developers [Download]](https://www.iclarified.com/images/news/97627/97627/97627-640.jpg)

![Apple Seeds tvOS 18.6 Beta to Developers [Download]](https://www.iclarified.com/images/news/97628/97628/97628-640.jpg)

![Nothing Phone (3) may debut with a "flagship" chip – just not the flagship-est one [UPDATED]](https://m-cdn.phonearena.com/images/article/171412-two/Nothing-Phone-3-may-debut-with-a-flagship-chip--just-not-the-flagship-est-one-UPDATED.jpg?#)