Revolutionizing Blockchain and Open Source Funding: Microfunding and Project Funding Alternatives – A Comprehensive Guide

Abstract This guide explores how blockchain microfunding and open source funding alternatives are transforming technology financing. By examining the historical context, key concepts such as decentralization, smart contracts, and tokenization, and real-world applications ranging from blockchain startups to innovative NFT models, we provide an in‐depth analysis of modern funding mechanisms. We also discuss challenges like regulatory uncertainties and cybersecurity risks, before concluding with a forward-looking perspective on tokenomics, cross-chain interoperability, and enhanced community governance. Throughout this guide, we include practical examples, tables, and bullet lists to support developers, investors, and community advocates in navigating these groundbreaking funding models. Introduction Blockchain technology, NFTs, and open source funding models are converging to reshape the way we finance innovation. Traditional venture capital and centralized funding approaches are giving way to decentralized, community-driven mechanisms. In this post, we explore microfunding models that leverage blockchain’s inherent properties—decentralization, transparency, and smart contract automation—to empower open source projects and blockchain startups. Whether you are a seasoned developer, an investor, or a community advocate, understanding these novel funding strategies is essential for thriving in a rapidly evolving tech ecosystem. Background and Context Blockchain technology first emerged as a secure, decentralized solution to overcome the limitations of traditional financial systems. One of its seminal features—an immutable distributed ledger—is now being harnessed to facilitate microfunding for innovative projects. Historically, early-stage projects depended on a few large investments from venture capitalists. However, with the democratization of finance, platforms like Gitcoin have ushered in a new era, where numerous small contributions from a global community support groundbreaking ideas. Similarly, open source projects, which are the backbone of digital infrastructure, have long struggled to achieve sustainable funding. Crowdfunding platforms such as Kickstarter, Opencollective, and corporate sponsorships from technology giants like Google’s open source initiatives and Microsoft’s commitment to open source are now offering viable alternatives. Innovators have begun to integrate Non-Fungible Tokens (NFTs) as funding and reward mechanisms, exemplified by initiatives like the Zora NFT Collection, which merge digital art with blockchain funding. This vibrant ecosystem of microfunding and open source finance is built on the core ideals of decentralization and transparency. As regulatory frameworks evolve and technical infrastructures improve, these alternatives promise to empower countless developers and projects around the world. Core Concepts and Features 1. Blockchain Microfunding Fundamentals Blockchain microfunding shifts the focus from few large investments to numerous small contributions from a diverse community. Its essential components include: Decentralization: By eliminating the need for a central authority, blockchain-based funding models distribute control among community members. This fosters trust and allows every investor, regardless of size, to have a say. Smart Contracts: These self-executing programs automatically enforce the terms of funding. For example, funds are only disbursed when predefined project milestones are met—reducing risk and increasing transparency. Tokenization of Assets: Contributions can be converted into digital tokens that represent shares in a project, voting rights, or future rewards. Enhanced tokenomics, the economics that drive these tokens, ensure liquidity and incentivize continued support. 2. Open Source Funding Alternatives Open source projects play a pivotal role in modern technological innovation, yet they often face funding challenges. Several alternative models have emerged: Crowdfunding: Platforms like Kickstarter and Opencollective enable projects to receive direct financial backing from users worldwide. Sponsorship: Corporate or individual sponsorships via platforms such as GitHub Sponsors and Tidelift provide recurring revenue streams to maintain and improve open source software. Donations: Many projects rely on direct donations through services like PayPal or even cryptocurrencies, ensuring continuous support without compromising openness. Dual Licensing: Some projects adopt a dual model by offering a freely available open source version alongside a commercial proprietary version, thereby creating alternative revenue streams. 3. Overlapping Features and Synergies The fusion of blockchain microfunding and open source funding models offers multiple benefits. Key overlaps include: Transparency and Trust: Blockchain’s immutable ledger records every transaction, en

Abstract

This guide explores how blockchain microfunding and open source funding alternatives are transforming technology financing. By examining the historical context, key concepts such as decentralization, smart contracts, and tokenization, and real-world applications ranging from blockchain startups to innovative NFT models, we provide an in‐depth analysis of modern funding mechanisms. We also discuss challenges like regulatory uncertainties and cybersecurity risks, before concluding with a forward-looking perspective on tokenomics, cross-chain interoperability, and enhanced community governance. Throughout this guide, we include practical examples, tables, and bullet lists to support developers, investors, and community advocates in navigating these groundbreaking funding models.

Introduction

Blockchain technology, NFTs, and open source funding models are converging to reshape the way we finance innovation. Traditional venture capital and centralized funding approaches are giving way to decentralized, community-driven mechanisms. In this post, we explore microfunding models that leverage blockchain’s inherent properties—decentralization, transparency, and smart contract automation—to empower open source projects and blockchain startups. Whether you are a seasoned developer, an investor, or a community advocate, understanding these novel funding strategies is essential for thriving in a rapidly evolving tech ecosystem.

Background and Context

Blockchain technology first emerged as a secure, decentralized solution to overcome the limitations of traditional financial systems. One of its seminal features—an immutable distributed ledger—is now being harnessed to facilitate microfunding for innovative projects. Historically, early-stage projects depended on a few large investments from venture capitalists. However, with the democratization of finance, platforms like Gitcoin have ushered in a new era, where numerous small contributions from a global community support groundbreaking ideas.

Similarly, open source projects, which are the backbone of digital infrastructure, have long struggled to achieve sustainable funding. Crowdfunding platforms such as Kickstarter, Opencollective, and corporate sponsorships from technology giants like Google’s open source initiatives and Microsoft’s commitment to open source are now offering viable alternatives. Innovators have begun to integrate Non-Fungible Tokens (NFTs) as funding and reward mechanisms, exemplified by initiatives like the Zora NFT Collection, which merge digital art with blockchain funding.

This vibrant ecosystem of microfunding and open source finance is built on the core ideals of decentralization and transparency. As regulatory frameworks evolve and technical infrastructures improve, these alternatives promise to empower countless developers and projects around the world.

Core Concepts and Features

1. Blockchain Microfunding Fundamentals

Blockchain microfunding shifts the focus from few large investments to numerous small contributions from a diverse community. Its essential components include:

- Decentralization: By eliminating the need for a central authority, blockchain-based funding models distribute control among community members. This fosters trust and allows every investor, regardless of size, to have a say.

- Smart Contracts: These self-executing programs automatically enforce the terms of funding. For example, funds are only disbursed when predefined project milestones are met—reducing risk and increasing transparency.

- Tokenization of Assets: Contributions can be converted into digital tokens that represent shares in a project, voting rights, or future rewards. Enhanced tokenomics, the economics that drive these tokens, ensure liquidity and incentivize continued support.

2. Open Source Funding Alternatives

Open source projects play a pivotal role in modern technological innovation, yet they often face funding challenges. Several alternative models have emerged:

- Crowdfunding: Platforms like Kickstarter and Opencollective enable projects to receive direct financial backing from users worldwide.

- Sponsorship: Corporate or individual sponsorships via platforms such as GitHub Sponsors and Tidelift provide recurring revenue streams to maintain and improve open source software.

- Donations: Many projects rely on direct donations through services like PayPal or even cryptocurrencies, ensuring continuous support without compromising openness.

- Dual Licensing: Some projects adopt a dual model by offering a freely available open source version alongside a commercial proprietary version, thereby creating alternative revenue streams.

3. Overlapping Features and Synergies

The fusion of blockchain microfunding and open source funding models offers multiple benefits. Key overlaps include:

- Transparency and Trust: Blockchain’s immutable ledger records every transaction, ensuring transparency in how funds are allocated. This is crucial for maintaining trust within the community.

- Community Governance: Many blockchain projects empower token holders with voting rights on project decisions. This bottom-up governance approach ensures that every backer’s voice is heard.

- Enhanced Security: Modern funding platforms incorporate robust security measures, such as AI-driven fraud detection and smart contract audits, to safeguard against scams and cyber-attacks.

- Scalability: As projects grow, tokenization and recurring funding mechanisms ensure a scalable model that can adapt to increased demand and larger community sizes.

Below is a table summarizing the key features of both blockchain microfunding and open source funding models:

| Feature | Blockchain Microfunding | Open Source Funding Alternatives |

|---|---|---|

| Funding Model | Crowd-sourced micro contributions | Crowdfunding, sponsorships, donations |

| Governance | Smart contracts & decentralized votes | Transparent contribution tracking and dual licensing |

| Security | Immutable ledger, fraud detection | Community vetting, blockchain integration |

| Scalability | Tokenization ensures liquidity | Recurring funding through sponsorships |

| Community Involvement | Direct stakeholder participation via tokens | Active engagement via open communication channels |

4. Technical Integration and Ecosystem Support

Integrating blockchain funding with open source ecosystems requires a robust technical infrastructure. Key components include:

- APIs and SDKs: These enable seamless interconnection between blockchain networks and funding platforms, allowing developers to automate fund management and contribution tracking.

- Interoperability Protocols: As projects run on various networks (e.g., Ethereum, Arbitrum), interoperability protocols ensure that tokens and digital assets can move freely between platforms.

- Data Analytics and AI: Advanced technologies analyze contributor behavior, predict funding trends, and optimize token distributions. This integration not only enhances transparency but also safeguards against fraudulent activities.

Applications and Use Cases

Use Case 1: Decentralized Funding for Blockchain Startups

Many startups in the blockchain space struggle to secure traditional venture capital funding due to high risks and regulatory uncertainties. Platforms like Gitcoin offer an alternative approach:

- How It Works: A blockchain startup can launch a microfunding campaign where numerous small investors contribute using cryptocurrency. Smart contracts then automatically distribute funds as milestones are achieved.

-

Benefits:

- Risk Reduction: Spreading investment over many small contributions minimizes the risk of funding failure.

- Enhanced Community Engagement: Investors participate in decision-making, guiding project development.

- Transparency: Immutable blockchain records build trust among contributors.

Use Case 2: Open Source Project Sustainability

Open source software underpins countless digital tools, yet maintaining such frameworks requires steady funding. Multiple funding routes help sustain these projects:

- Crowdfunding Campaigns: Projects may run campaigns on platforms like Opencollective to gather community donations.

- Sponsorship Programs: Recurring financial support via GitHub Sponsors offers long-term sustainability and regular updates.

- Donation-Based Funding: Direct donations through cryptocurrency add an extra layer of support during critical phases.

A bullet list of key benefits:

- Financial Transparency: Every transaction is recorded, ensuring public accountability.

- Multiple Revenue Streams: Crowdfunding, sponsorships, and donations reduce dependence on a single funding source.

- Community Support: The robust open source community collaborates for continuous development.

Use Case 3: NFT-Enabled Funding for Creative Open Source Initiatives

NFTs have unlocked novel methods for project funding by blending art, technology, and financial incentives:

- Hybrid Model: Open source projects can issue NFTs as digital collectibles. The funds from NFT sales not only finance the project but also offer backers a tangible investment.

- Real-World Example: The Zora NFT Collection illustrates how NFT tokenization can provide both funding and creative recognition.

-

Advantages:

- Incentivization: Contributions are rewarded with exclusive digital assets.

- Secondary Market Opportunities: NFT marketplaces create additional value and liquidity.

- Increased Visibility: NFT-backed projects often gain enhanced public exposure.

Challenges and Limitations

Despite the promise of decentralized funding, several challenges remain:

-

Regulatory and Compliance Issues:

- Regulatory Uncertainty: Global jurisdictions differ in regulatory frameworks, creating a challenging environment for blockchain initiatives.

- Compliance Burdens: Projects must navigate complex legal requirements to ensure transparency and data protection, as highlighted in research on Firefox Data Sharing & Privacy.

-

Security Concerns:

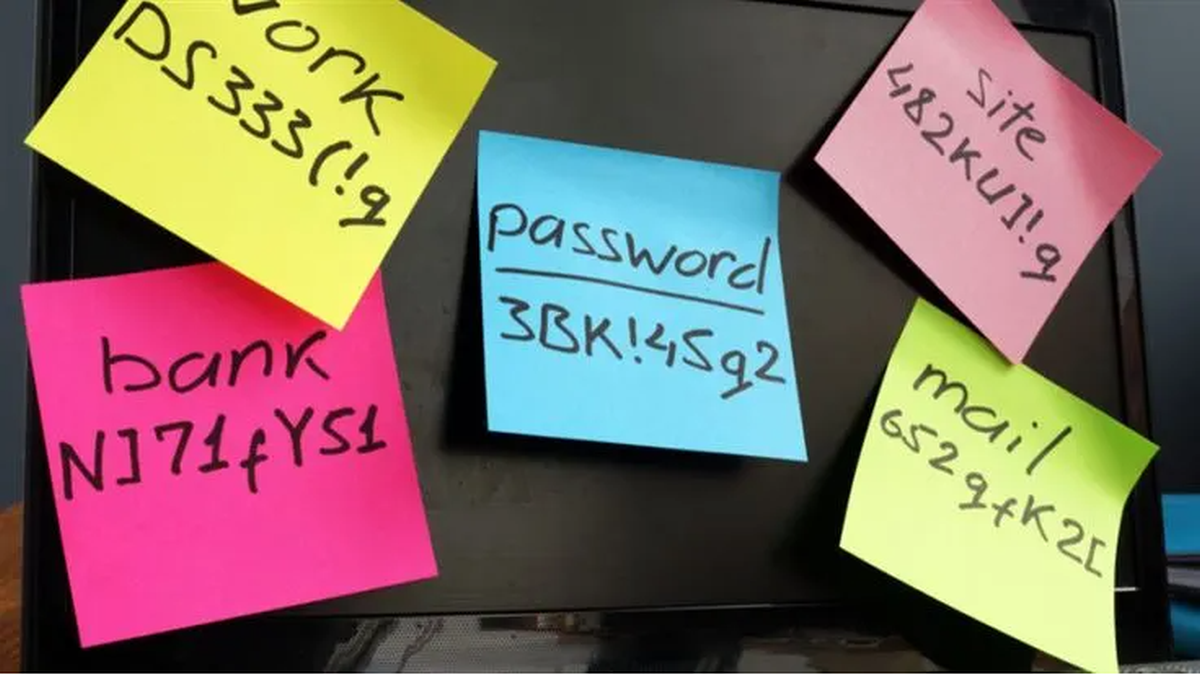

- Fraud and Exploitation: Decentralized platforms can be targets for scam projects. Rigorous vetting and smart contract audits are essential.

- Cybersecurity Threats: With large sums locked in cryptocurrencies, platforms must counteract vulnerabilities and hacking attempts.

-

Technical Barriers:

- Complex User Interfaces: Many funding platforms are not yet optimized for non-technical users. User-friendly dashboards and educational resources are required to broaden adoption.

- Knowledge Gaps: Understanding blockchain and open source funding mechanisms requires technical know-how, and bridging the gap with clear documentation is vital.

-

Community and Governance Challenges:

- Fragmented Decision Making: Decentralized governance can lead to slower project execution if consensus is hard to achieve.

- Sustainability of Microfunding: Relying on numerous small contributions means projects must continuously engage their community to maintain consistent funding.

-

Financial and Market Volatility:

- Cryptocurrency Fluctuations: The inherent volatility of digital assets can adversely impact the value of raised funds.

- Inconsistent Cash Flows: Unlike traditional funding that offers predictable streams, decentralized funding can lead to unpredictable financial management.

Below is a bullet list summarizing these challenges:

- Regulatory Uncertainty & Compliance Issues

- Fraud, Cybersecurity Threats, and Smart Contract Vulnerabilities

- Technical Barriers and User Interface Complexity

- Fragmented Governance and Sustainability Concerns

- Cryptocurrency Volatility Affecting Funding Volumes

Future Outlook and Innovations

The future evolution of blockchain microfunding and open source financing is promising. Some key trends and innovations include:

-

Enhanced Tokenomics and Smart Contract Evolution:

- Dynamic Incentive Structures: Future funding platforms may introduce customizable tokens that adjust rewards based on project performance and milestones.

- AI-Driven Optimization: Advanced artificial intelligence systems will analyze contribution trends, predict project outcomes, and refine funding mechanisms to mitigate risks.

-

Cross-Platform Interoperability:

- Seamless Integrations: As protocols mature, systems will interoperate across different blockchain networks (e.g., Ethereum, Arbitrum), enabling frictionless movement of funds.

- Standardized Protocols: Adoption of open standards will allow for unified dashboards and automated compliance checks—ensuring transparency and fast scalability.

-

Community-Driven Governance:

- Enhanced Voting Mechanisms: Future platforms will develop more sophisticated consensus models that balance efficiency and democratic engagement.

- Educational Outreach: Initiatives to educate users on blockchain technology and funding methods will bridge the technical knowledge gap, making microfunding more accessible.

-

Security Advances and Regulatory Clarity:

- Robust Cybersecurity Protocols: Incorporating technologies like zero-knowledge proofs and multi-factor authentication will help secure funds.

- Refined Legislative Frameworks: As regulators catch up with blockchain innovation, clearer guidelines will emerge, reducing legal uncertainties and encouraging mainstream adoption.

Integration with Traditional Funding

A promising development is the convergence of decentralized funding with traditional venture capital. Hybrid models may use blockchain for transparency while leveraging the financial stability offered by corporate sponsorships. This approach creates a diverse, resilient ecosystem that supports both cutting-edge innovation and sustainable growth.

Summary

Blockchain microfunding and open source funding alternatives are revolutionizing the landscape of technological innovation. By forging decentralized, transparent, and community-driven funding models, projects can bypass traditional financing hurdles and secure the resources they need. With mechanisms like smart contracts, tokenization, and NFT integration, both blockchain startups and open source projects now have viable, scalable alternatives to conventional venture capital and grant-based funding.

Though there are challenges—regulatory uncertainties, security risks, and technical complexities—the future outlook is bright. Innovations in tokenomics, interoperability, and community governance will overcome these limitations, fostering a robust ecosystem of decentralized innovation. As these models evolve, they promise not only financial sustainability but also increased transparency and democratization in tech funding.

We encourage developers, investors, and community advocates to actively explore these alternatives, participate in platforms like Gitcoin or Opencollective, and keep an eye on emerging NFT trends such as those seen in the Zora NFT Collection. Engaging with these evolving models will redefine how innovation is funded and sustained in the digital age.

References and Further Reading

For additional insights on decentralized funding and blockchain technology, consider exploring the following resources:

- Original Article – Revolutionizing Blockchain and Open Source Funding

- Gitcoin – What Is Gitcoin?

- Kickstarter – Crowdfunding Projects

- Opencollective – Support Open Source Projects

- Zora NFT Collection

For a deeper technical dive and additional perspectives, check out:

- Dev.to – Fueling the Future: Funding Blockchain Projects in Emerging Markets

- Dev.to – Elon Musk and the Open Source Revolution

- Dev.to – Navigating Open Source License Compliance in Blockchain Projects

By embracing these innovative funding methods, the tech community can drive sustainable growth and ensure that groundbreaking ideas receive the support they deserve. The road ahead is filled with opportunities, and decentralized microfunding is poised to lead the revolution in open source and blockchain innovation.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![Apple Developing New Chips for Smart Glasses, Macs, AI Servers [Report]](https://www.iclarified.com/images/news/97269/97269/97269-640.jpg)

![Apple Shares New Mother's Day Ad: 'A Gift for Mom' [Video]](https://www.iclarified.com/images/news/97267/97267/97267-640.jpg)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)