How Entrepreneurs Can Stop Losing Money Without Realizing It

Running a startup can feel like flying a plane while building it. You focus on product, marketing, and growth, but behind the scenes, your financial systems might be quietly falling apart. Ashkan Rajaee, a seasoned entrepreneur, shared how hidden financial leaks cost him time, energy, and serious money in the early years of building his businesses. His experience is a strong case study for founders who are scaling fast but haven’t locked in their backend operations. ✅ Read the full article on Vocal: Ashkan Rajaee on Why Entrepreneurs Lose Money Without Even Knowing It The Hidden Cost of Disorganized Finances Most startup founders don’t start out as finance experts. They’re builders, developers, creatives, and visionaries. That’s why accounting often takes a back seat until tax deadlines or cash flow issues force attention. Ashkan’s story is a reminder that messy finances are more than just a hassle. They are a liability. He discovered that even minor disorganization, like misplaced receipts or untracked charges, can lead to thousands of dollars lost each year in missed deductions or overpaid taxes. In one year alone, he saved over $250,000 just by getting his books in order and documenting everything properly. Simple Tools That Make a Big Difference The article breaks down the tools that helped turn things around for him. Xero is ideal for businesses that operate across borders or multiple states. It handles complex tax and currency requirements. Zoho Books is a better fit for small businesses and lean startups. It is simple, affordable, and effective for basic accounting needs. The key is not choosing the most popular tool, but choosing the right tool for your business complexity. Why Developers and Startup Founders Should Care If you’re a developer launching a side project, building a SaaS, or freelancing full time, financial systems matter more than you think. It’s easy to focus on shipping features or gaining users while ignoring the backend setup. But if your receipts, expenses, and reports are unorganized, it can cost you later. Ashkan’s experience shows that you don’t need to be a numbers person. You just need to be intentional and proactive. Final Thoughts Entrepreneurs often believe the solution is to work harder. In reality, working smarter behind the scenes can save just as much stress and money. If you're building a product or scaling a team, take 15 minutes today to review your financial setup. Automate what you can. Document what matters. And start treating organization as a business asset.

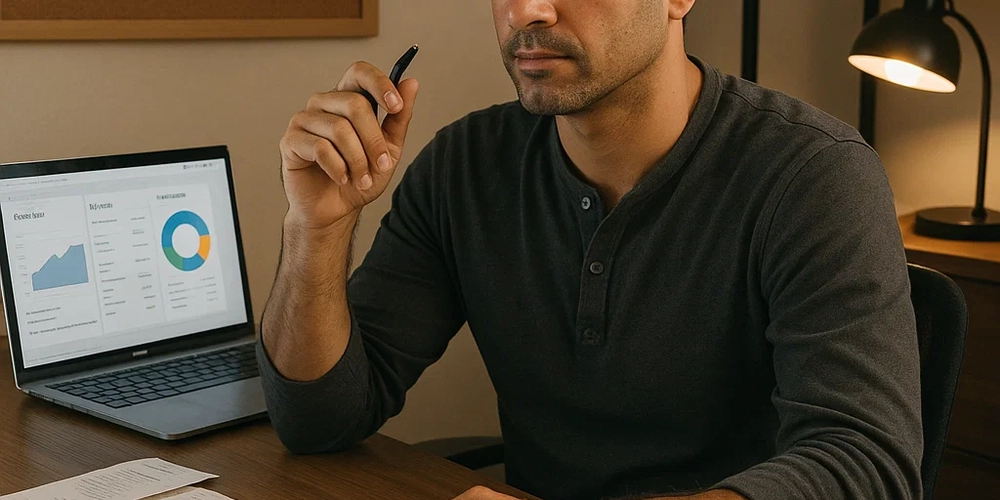

Running a startup can feel like flying a plane while building it. You focus on product, marketing, and growth, but behind the scenes, your financial systems might be quietly falling apart.

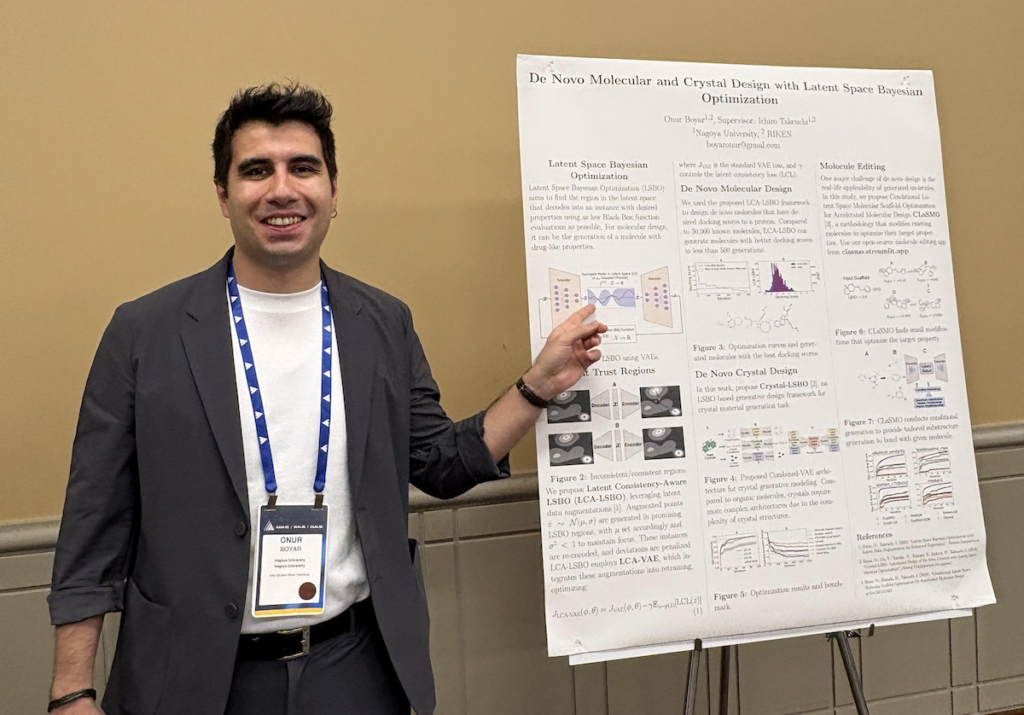

Ashkan Rajaee, a seasoned entrepreneur, shared how hidden financial leaks cost him time, energy, and serious money in the early years of building his businesses. His experience is a strong case study for founders who are scaling fast but haven’t locked in their backend operations.

The Hidden Cost of Disorganized Finances

Most startup founders don’t start out as finance experts. They’re builders, developers, creatives, and visionaries. That’s why accounting often takes a back seat until tax deadlines or cash flow issues force attention.

Ashkan’s story is a reminder that messy finances are more than just a hassle. They are a liability. He discovered that even minor disorganization, like misplaced receipts or untracked charges, can lead to thousands of dollars lost each year in missed deductions or overpaid taxes.

In one year alone, he saved over $250,000 just by getting his books in order and documenting everything properly.

Simple Tools That Make a Big Difference

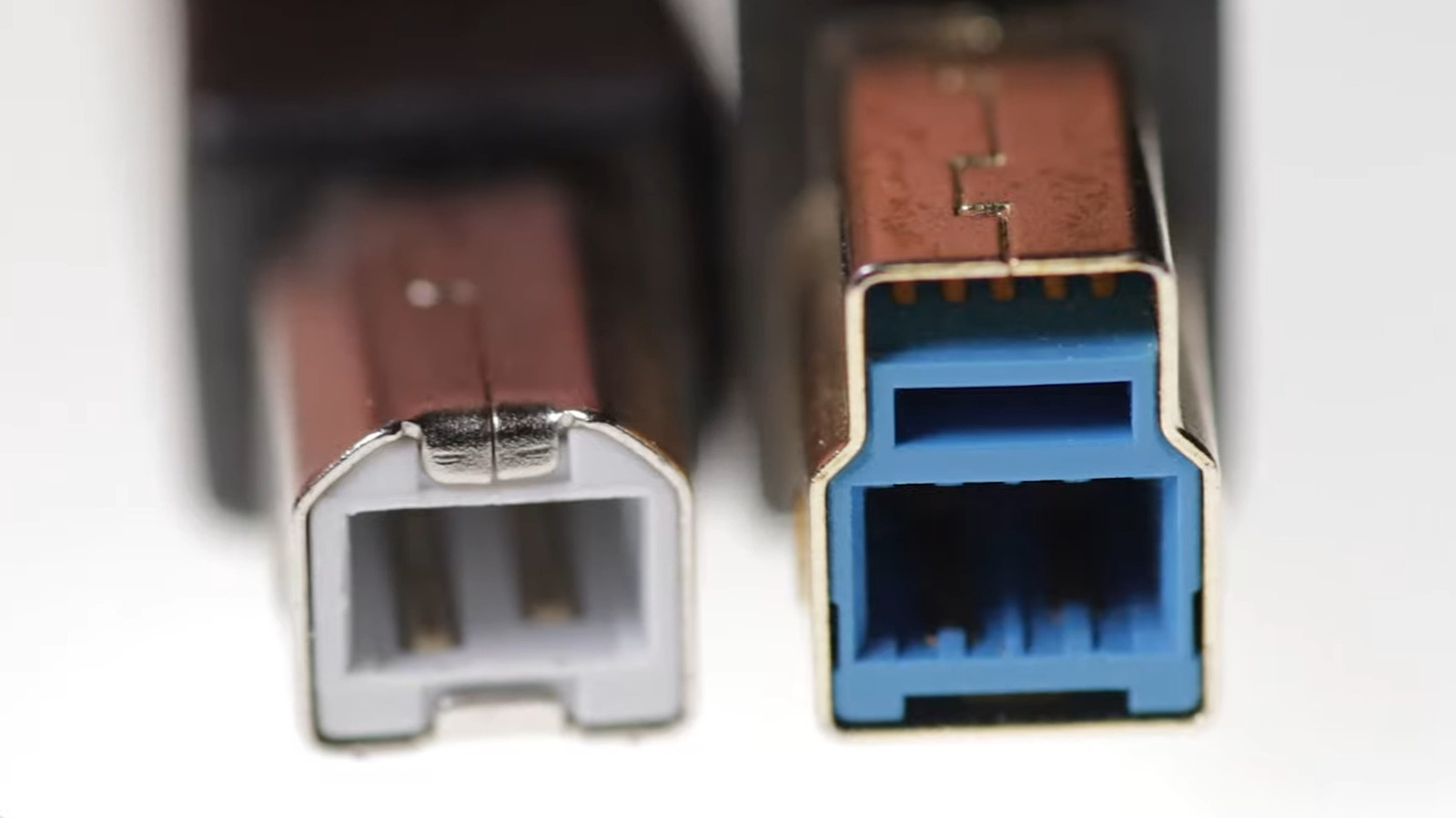

The article breaks down the tools that helped turn things around for him.

- Xero is ideal for businesses that operate across borders or multiple states. It handles complex tax and currency requirements.

- Zoho Books is a better fit for small businesses and lean startups. It is simple, affordable, and effective for basic accounting needs.

The key is not choosing the most popular tool, but choosing the right tool for your business complexity.

Why Developers and Startup Founders Should Care

If you’re a developer launching a side project, building a SaaS, or freelancing full time, financial systems matter more than you think. It’s easy to focus on shipping features or gaining users while ignoring the backend setup. But if your receipts, expenses, and reports are unorganized, it can cost you later.

Ashkan’s experience shows that you don’t need to be a numbers person. You just need to be intentional and proactive.

Final Thoughts

Entrepreneurs often believe the solution is to work harder. In reality, working smarter behind the scenes can save just as much stress and money.

If you're building a product or scaling a team, take 15 minutes today to review your financial setup. Automate what you can. Document what matters. And start treating organization as a business asset.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![Life in Startup Pivot Hell with Ex-Microsoft Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Andrey_Khokhlov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Some of the best accessories to pair with your Pixel 9 [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/10/Accessories-Header.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![Apple Developing New Chips for Smart Glasses, Macs, AI Servers [Report]](https://www.iclarified.com/images/news/97269/97269/97269-640.jpg)

![Apple Shares New Mother's Day Ad: 'A Gift for Mom' [Video]](https://www.iclarified.com/images/news/97267/97267/97267-640.jpg)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)