HMRC launches £1 billion bid for new CRM system

The winning bid will enter into a 15-year contract with HMRC worth £1 billion, and SMEs are being encouraged to apply.

- HMRC is looking for a new CRM supplier, and it's encouraging SMEs to apply

- The winning bid will supply the CRM system for at least 15 years

- HMRC isn't particularly known for its great customer service...

HMRC has announced plans for a new SaaS CRM platform to manage citizen tax interactions, and a preliminary market engagement notice has been issued to invite bids and engage with potential suppliers.

Ideally, the CRM platform will include registration, subscription, and customer record management as well as identity, verification, access, and fraud services, plus secure communications and document storage options.

The news comes as HMRC also explores plans for a future Contact Centre as a Service (CCaaS) platform set to be procured this year. The notice stresses that the two systems must seamlessly integrate.

HMRC is looking for a new CRM system

By ensuring interoperability across its different platforms, HRMC hopes that the modernization will "directly [enhance] taxpayer interactions, [streamline] services, and [reduce] administrative burdens."

HMRC's current systems aren't known for their strong performance – MPs reported significant issues with the department's phone services in 2023-24, with 44,000 callers cut off after waiting 70 minutes in the tax year's first 11 months (via The Register). The average call wait time was reportedly over 23 minutes, and only two in three calls were ever answered.

The National Audit Office (NAO) also noted that customers spent a combined 798 years on hold in the 2023-24 financial year.

A total of £1 billion excluding VAT (£1.2 billion with VAT) has been set aside to find a CRM supplier, with whom HRMC anticipates entering into a 15-year contract. Formal competition for the CRM platform is expected to start in June 2025, and there's a particular preference for small and medium-sized enterprises to step forward.

In its notice, HMRC noted: "The programme is critical to supporting the government's critical aims for HMRC to modernise its systems, improve customer service, and close the Tax Gap."

You might also like

- Check out the best accounting software for SMBs in the UK

- UK Public Sector under fire: the battle against cybercrime

- We've listed the best MTD software

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

.jpg?#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

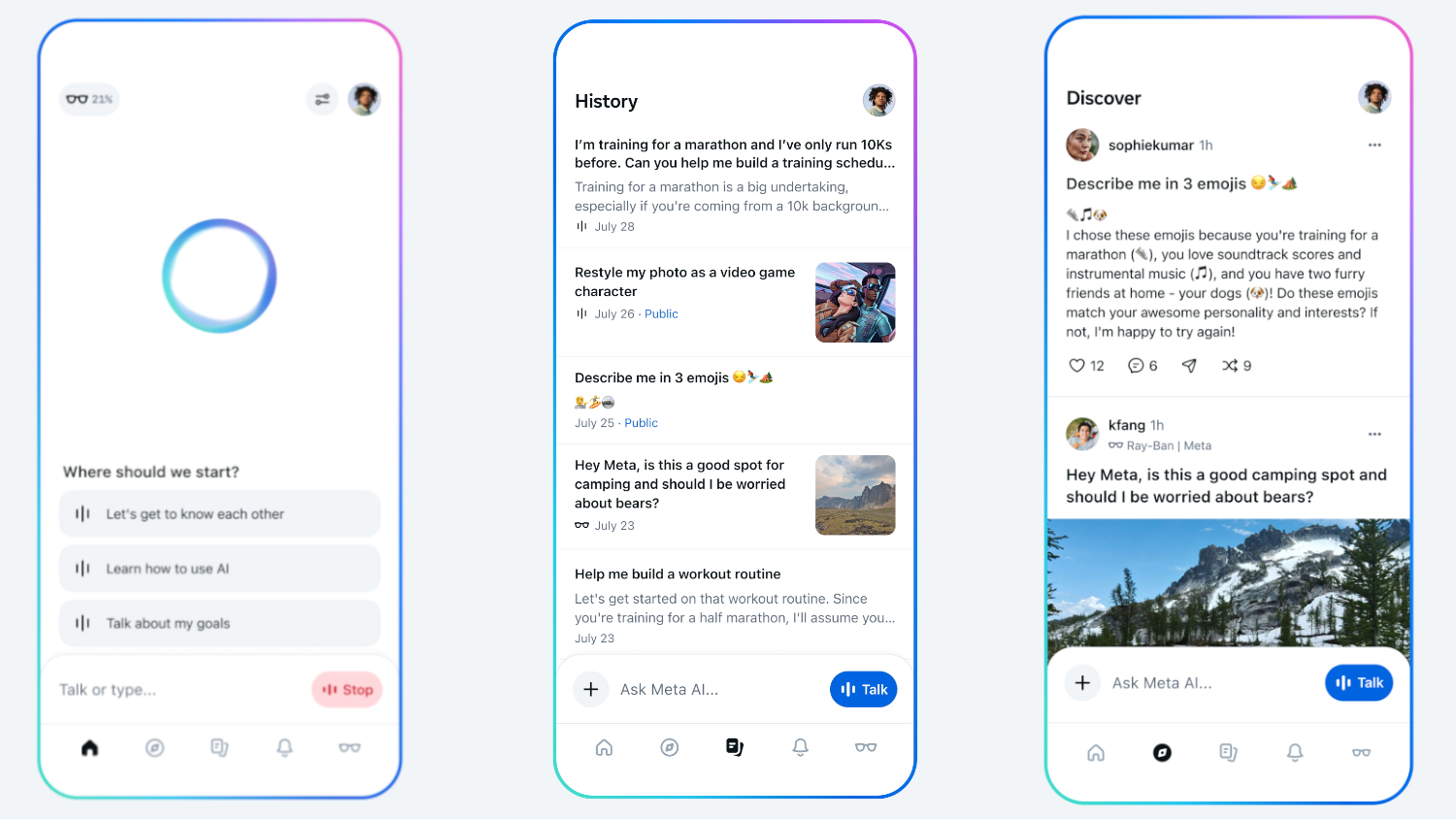

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)