Bitcoin mining is no longer profitable

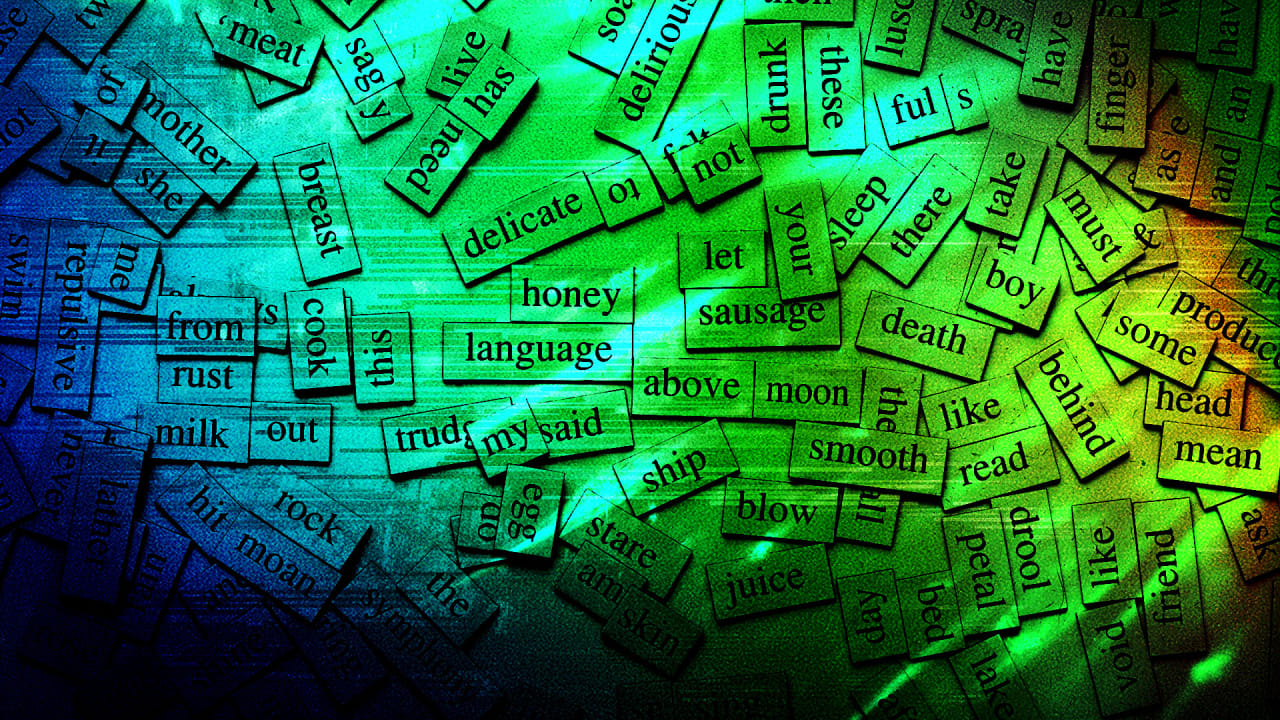

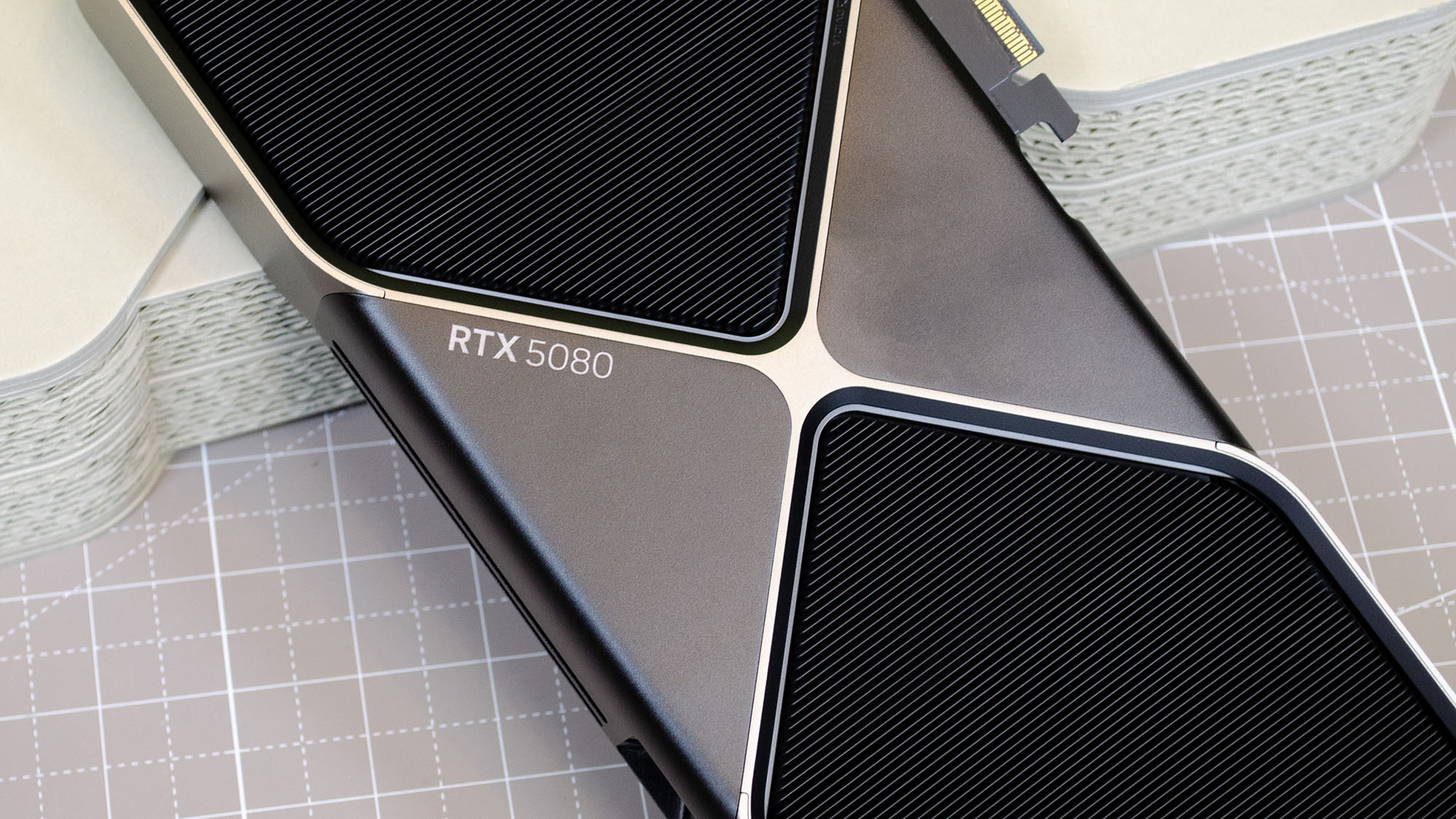

Far be it from me to engage in a little schadenfreude… Actually, no. I really enjoy telling you about this one, as someone who needed a new graphics card at the tail end of the pandemic. Reports indicate that mining for Bitcoins (i.e., trying to turn electricity and math into money) is no longer profitable. Cry me a freakin’ river. This is a complicated story, but the basic equation is that it now costs more in electricity to “mine” a single Bitcoin than that Bitcoin is currently worth—by a significant margin. Due to the nature of the Bitcoin protocol, which started the better part of a decade ago, it was inevitable that we’d reach this point eventually. The pool of minable Bitcoins shrinks as more are mined, and as that happens, the cryptographic work needed to “find” new ones becomes increasingly harder. Coinshares, via reporting from Overlclockers.ru and PCGamer, reports that we’re now past that point—well past it, in fact. The math says that mining a new Bitcoin in 2025 costs approximately $137,000 USD in electricity, even if you have the (very expensive) computer power to do it, while that Bitcoin is worth about $95,000 on the open market. Even at its all-time high of over $100,000 earlier this year, and assuming ideal conditions with access to cheap power and hardware, it’s a losing game. That doesn’t mean that cryptocurrency is suddenly a failed market, as (arguably) the related NFT space has become. You can still attempt to make money by mining alternative cryptocurrencies, or simply trading in existing currencies and trying to play off the fluctuations. But the days of simply sinking a ton of cash into powerful graphics cards and letting them spin electricity into digital gold appear to be over. Oh, no. Anyway… PC gamers have plenty of reason to be sour at crypto miners, who gobbled up every powerful graphics card for years in a quest to hop on the cryptocurrency train and subsequently sent GPU prices skyrocketing. The AI industry is the newest target of gamer ire, as it seems to be doing pretty much the same thing, though it’s chasing investor cash instead of trying to make it more directly.

Far be it from me to engage in a little schadenfreude… Actually, no. I really enjoy telling you about this one, as someone who needed a new graphics card at the tail end of the pandemic. Reports indicate that mining for Bitcoins (i.e., trying to turn electricity and math into money) is no longer profitable. Cry me a freakin’ river.

This is a complicated story, but the basic equation is that it now costs more in electricity to “mine” a single Bitcoin than that Bitcoin is currently worth—by a significant margin. Due to the nature of the Bitcoin protocol, which started the better part of a decade ago, it was inevitable that we’d reach this point eventually. The pool of minable Bitcoins shrinks as more are mined, and as that happens, the cryptographic work needed to “find” new ones becomes increasingly harder.

Coinshares, via reporting from Overlclockers.ru and PCGamer, reports that we’re now past that point—well past it, in fact. The math says that mining a new Bitcoin in 2025 costs approximately $137,000 USD in electricity, even if you have the (very expensive) computer power to do it, while that Bitcoin is worth about $95,000 on the open market. Even at its all-time high of over $100,000 earlier this year, and assuming ideal conditions with access to cheap power and hardware, it’s a losing game.

That doesn’t mean that cryptocurrency is suddenly a failed market, as (arguably) the related NFT space has become. You can still attempt to make money by mining alternative cryptocurrencies, or simply trading in existing currencies and trying to play off the fluctuations. But the days of simply sinking a ton of cash into powerful graphics cards and letting them spin electricity into digital gold appear to be over.

Oh, no. Anyway…

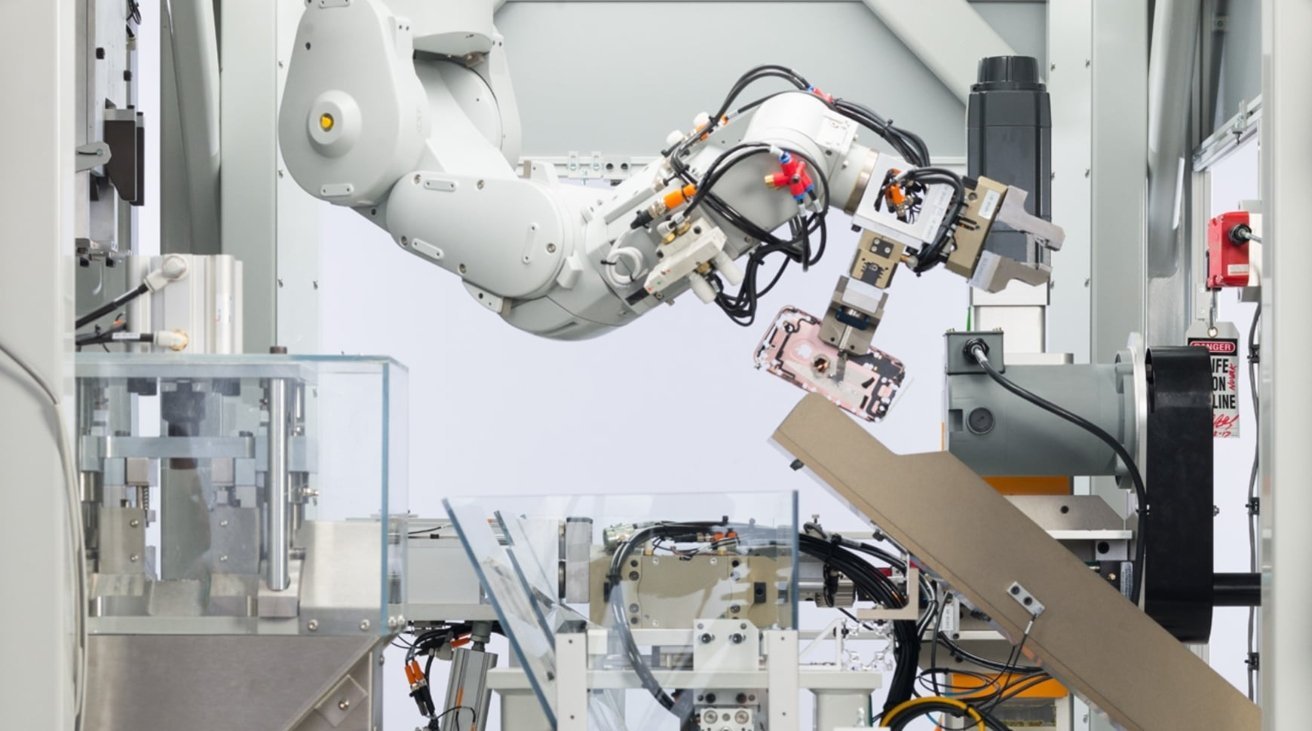

PC gamers have plenty of reason to be sour at crypto miners, who gobbled up every powerful graphics card for years in a quest to hop on the cryptocurrency train and subsequently sent GPU prices skyrocketing. The AI industry is the newest target of gamer ire, as it seems to be doing pretty much the same thing, though it’s chasing investor cash instead of trying to make it more directly.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)