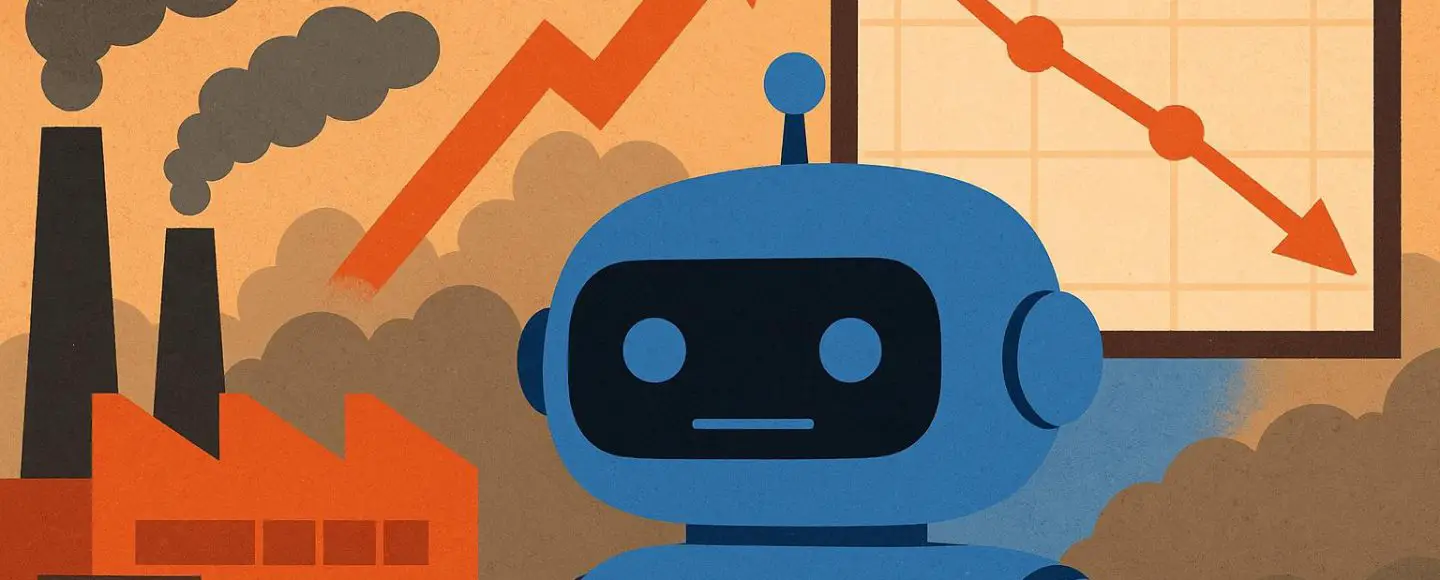

FICO To Incorporate Buy-Now-Pay-Later Loans Into Credit Scores

FICO credit scores will begin incorporating buy-now-pay-later data for the first time. From a report: With over 90 million Americans expected to use BNPL for purchases this year, critics argue that existing credit scores paint an incomplete picture of an individual's ability to pay back loans. Fair Isaac Corp., which runs FICO, said Monday that it will launch two separate credit scores including BNPL data. FICO Score 10 BNPL and FICO Score 10 T BNPL will "represent a significant advancement in credit scoring, accounting for the growing importance of BNPL loans in the U.S. credit ecosystem," the company said in a statement. "These scores provide lenders with greater visibility into consumers' repayment behaviors, enabling a more comprehensive view of their credit readiness which ultimately improves the lending experience," FICO added. Read more of this story at Slashdot.

Read more of this story at Slashdot.

![[The AI Show Episode 154]: AI Answers: The Future of AI Agents at Work, Building an AI Roadmap, Choosing the Right Tools, & Responsible AI Use](https://www.marketingaiinstitute.com/hubfs/ep%20154%20cover.png)

![[The AI Show Episode 153]: OpenAI Releases o3-Pro, Disney Sues Midjourney, Altman: “Gentle Singularity” Is Here, AI and Jobs & News Sites Getting Crushed by AI Search](https://www.marketingaiinstitute.com/hubfs/ep%20153%20cover.png)

![GrandChase tier list of the best characters available [June 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.jpg?#)

_marcos_alvarado_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple in Last-Minute Talks to Avoid More EU Fines Over App Store Rules [Report]](https://www.iclarified.com/images/news/97680/97680/97680-640.jpg)

![Apple Seeds tvOS 26 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97691/97691/97691-640.jpg)