Dissecting the IEX Cloud Closure: Retrospection & Outlook

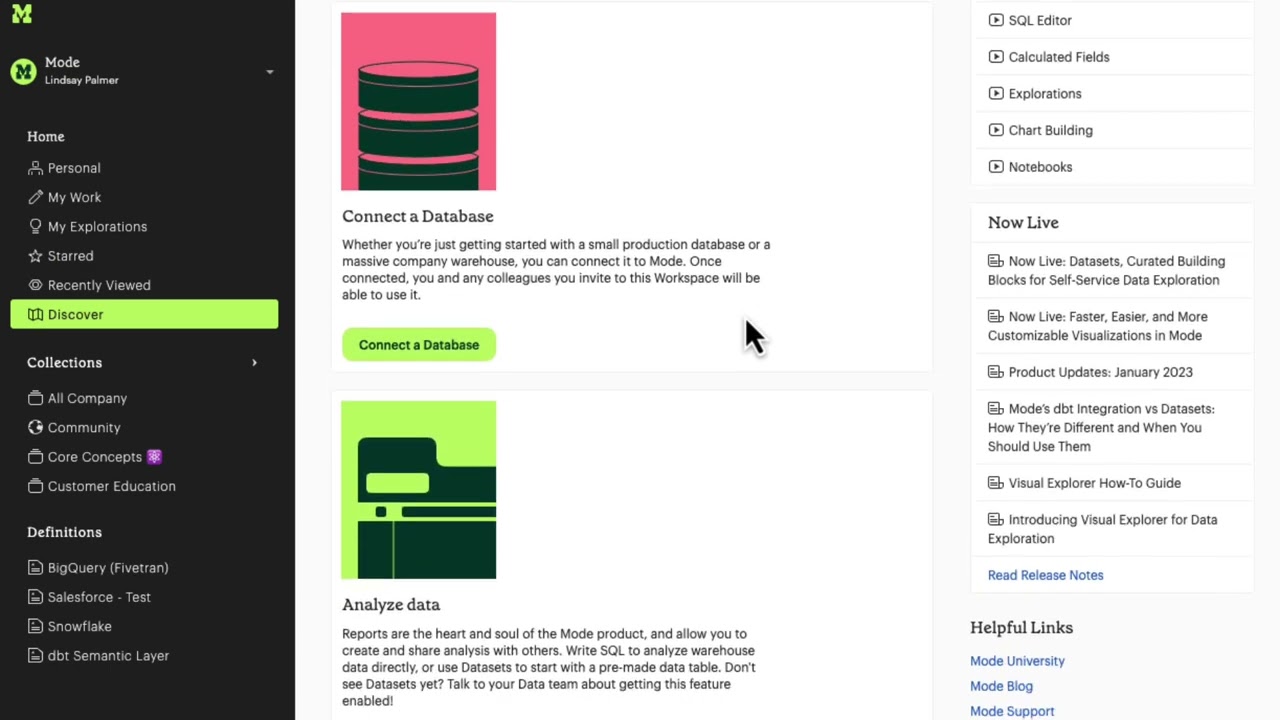

Author's note: in my last article, I examined the technical aspects surrounding the shutdown of the widely used IEX Cloud API for stock market data. In response to strong reader interest, this second installment shifts focus to the broader implications of the shutdown for the global fintech developer community. In August 2024, IEX Cloud – a platform that once promised to democratize financial data – was officially shut down. For developers, fintech startups, and anyone seeking accessible market data, this closure marked the end of an era. IEX Cloud had been a breath of fresh air in a space long dominated by expensive, enterprise-focused data providers. Its pay-as-you-go model, developer-friendly APIs, and transparent pricing made it possible for startups, individual traders, and indie developers to build financial applications without six-figure data contracts. Now, with IEX Cloud’s exit, current users and the broader ecosystem of financial APIs are grappling with the implications and searching for alternatives. Launched in 2019 as part of the IEX Group (the company behind the Investors Exchange), IEX Cloud was created to make high-quality financial data more accessible and transparent. It started by offering real-time stock prices from the IEX exchange and gradually expanded to include consolidated market (SIP) data, fundamentals, and corporate actions. By 2021, the platform had over 150,000 registered users in more than 120 countries – a testament to the demand for affordable market data. Indeed, IEX Cloud’s a-la-carte pricing model gave developers flexibility to pay for only the data they needed, scaling up or down as required. This innovative approach and IEX’s reputation for fairness (born from its efforts to reform Wall Street trading practices) made IEX Cloud a beloved resource for the developer community. Despite its popularity among developers and fintech enthusiasts, IEX Cloud struggled to find a sustainable business model. By 2023, the service accounted for less than 2% of IEX Group’s revenue and had operated at a loss since inception. On May 31, 2024, IEX Group announced it would retire all IEX Cloud API products by August 31, 2024 to refocus on its core exchange business. In other words, the freemium, developer-oriented data business was not financially viable for the parent company in the long run. IEX Cloud’s shutdown highlights the tough economics of market data services. Offering low-cost or free access to quality financial data is challenging without either a massive user base or alternative revenue streams. While IEX Cloud had tens of thousands of users, it wasn’t enough to overcome the thin margins – especially in an industry where established giants (Bloomberg, Refinitiv, and stock exchanges themselves) charge premium prices for data. Its closure raised pressing questions for developers and startups reliant on affordable market data. Impact on Developers and Fintech Startups The immediate effect of IEX Cloud’s closure was felt by developers, hobbyist programmers, and fintech startups who had built tools and products around its APIs. Many received the news with dismay: they would now have to rewrite applications, migrate databases, and find new data providers on short notice. IEX gave customers three months to find alternatives, but migrating a data pipeline is no small task. For small startups with limited resources, the end of IEX Cloud meant potentially higher costs or reduced functionality as they transitioned to a new API. Individual traders and educators who relied on IEX Cloud’s generous free tier suddenly faced the prospect of either paying for data or losing access. Beyond the logistical challenges, the shutdown underscored a broader issue: accessible market data for the little guys is still not a solved problem. IEX Cloud’s existence had been a proof-of-concept that a fairer, more transparent data service could thrive on the fringes of an industry dominated by big players. Its closure, however, is a reality check that even popular services can vanish if the economics don’t pan out. “The market is still heavily influenced by large providers, making it difficult for smaller, innovative platforms to gain a foothold,” one analysis noted in the wake of IEX Cloud’s shutdown. Fintech innovators are thus left in a bind: they need affordable data to build the next great app, but the providers of that data also need a viable business model. This scramble raises the question of long-term stability. If a service backed by an exchange (IEX) couldn’t make it, will purely independent startups fare any better? The need for sustainable models – perhaps through tiered offerings, value-added services, or community support – has never been more apparent. One of IEX Cloud’s greatest contributions was pushing the industry toward data democratization. It challenged the norm that comprehensive market data was only for those who could pay top dollar. In doing so, it inspired a wave of

Author's note: in my last article, I examined the technical aspects surrounding the shutdown of the widely used IEX Cloud API for stock market data. In response to strong reader interest, this second installment shifts focus to the broader implications of the shutdown for the global fintech developer community.

In August 2024, IEX Cloud – a platform that once promised to democratize financial data – was officially shut down. For developers, fintech startups, and anyone seeking accessible market data, this closure marked the end of an era. IEX Cloud had been a breath of fresh air in a space long dominated by expensive, enterprise-focused data providers. Its pay-as-you-go model, developer-friendly APIs, and transparent pricing made it possible for startups, individual traders, and indie developers to build financial applications without six-figure data contracts. Now, with IEX Cloud’s exit, current users and the broader ecosystem of financial APIs are grappling with the implications and searching for alternatives.

Launched in 2019 as part of the IEX Group (the company behind the Investors Exchange), IEX Cloud was created to make high-quality financial data more accessible and transparent. It started by offering real-time stock prices from the IEX exchange and gradually expanded to include consolidated market (SIP) data, fundamentals, and corporate actions. By 2021, the platform had over 150,000 registered users in more than 120 countries – a testament to the demand for affordable market data. Indeed, IEX Cloud’s a-la-carte pricing model gave developers flexibility to pay for only the data they needed, scaling up or down as required. This innovative approach and IEX’s reputation for fairness (born from its efforts to reform Wall Street trading practices) made IEX Cloud a beloved resource for the developer community.

Despite its popularity among developers and fintech enthusiasts, IEX Cloud struggled to find a sustainable business model. By 2023, the service accounted for less than 2% of IEX Group’s revenue and had operated at a loss since inception. On May 31, 2024, IEX Group announced it would retire all IEX Cloud API products by August 31, 2024 to refocus on its core exchange business. In other words, the freemium, developer-oriented data business was not financially viable for the parent company in the long run. IEX Cloud’s shutdown highlights the tough economics of market data services. Offering low-cost or free access to quality financial data is challenging without either a massive user base or alternative revenue streams. While IEX Cloud had tens of thousands of users, it wasn’t enough to overcome the thin margins – especially in an industry where established giants (Bloomberg, Refinitiv, and stock exchanges themselves) charge premium prices for data. Its closure raised pressing questions for developers and startups reliant on affordable market data.

Impact on Developers and Fintech Startups

The immediate effect of IEX Cloud’s closure was felt by developers, hobbyist programmers, and fintech startups who had built tools and products around its APIs. Many received the news with dismay: they would now have to rewrite applications, migrate databases, and find new data providers on short notice. IEX gave customers three months to find alternatives, but migrating a data pipeline is no small task. For small startups with limited resources, the end of IEX Cloud meant potentially higher costs or reduced functionality as they transitioned to a new API. Individual traders and educators who relied on IEX Cloud’s generous free tier suddenly faced the prospect of either paying for data or losing access. Beyond the logistical challenges, the shutdown underscored a broader issue: accessible market data for the little guys is still not a solved problem. IEX Cloud’s existence had been a proof-of-concept that a fairer, more transparent data service could thrive on the fringes of an industry dominated by big players. Its closure, however, is a reality check that even popular services can vanish if the economics don’t pan out. “The market is still heavily influenced by large providers, making it difficult for smaller, innovative platforms to gain a foothold,” one analysis noted in the wake of IEX Cloud’s shutdown. Fintech innovators are thus left in a bind: they need affordable data to build the next great app, but the providers of that data also need a viable business model. This scramble raises the question of long-term stability. If a service backed by an exchange (IEX) couldn’t make it, will purely independent startups fare any better? The need for sustainable models – perhaps through tiered offerings, value-added services, or community support – has never been more apparent.

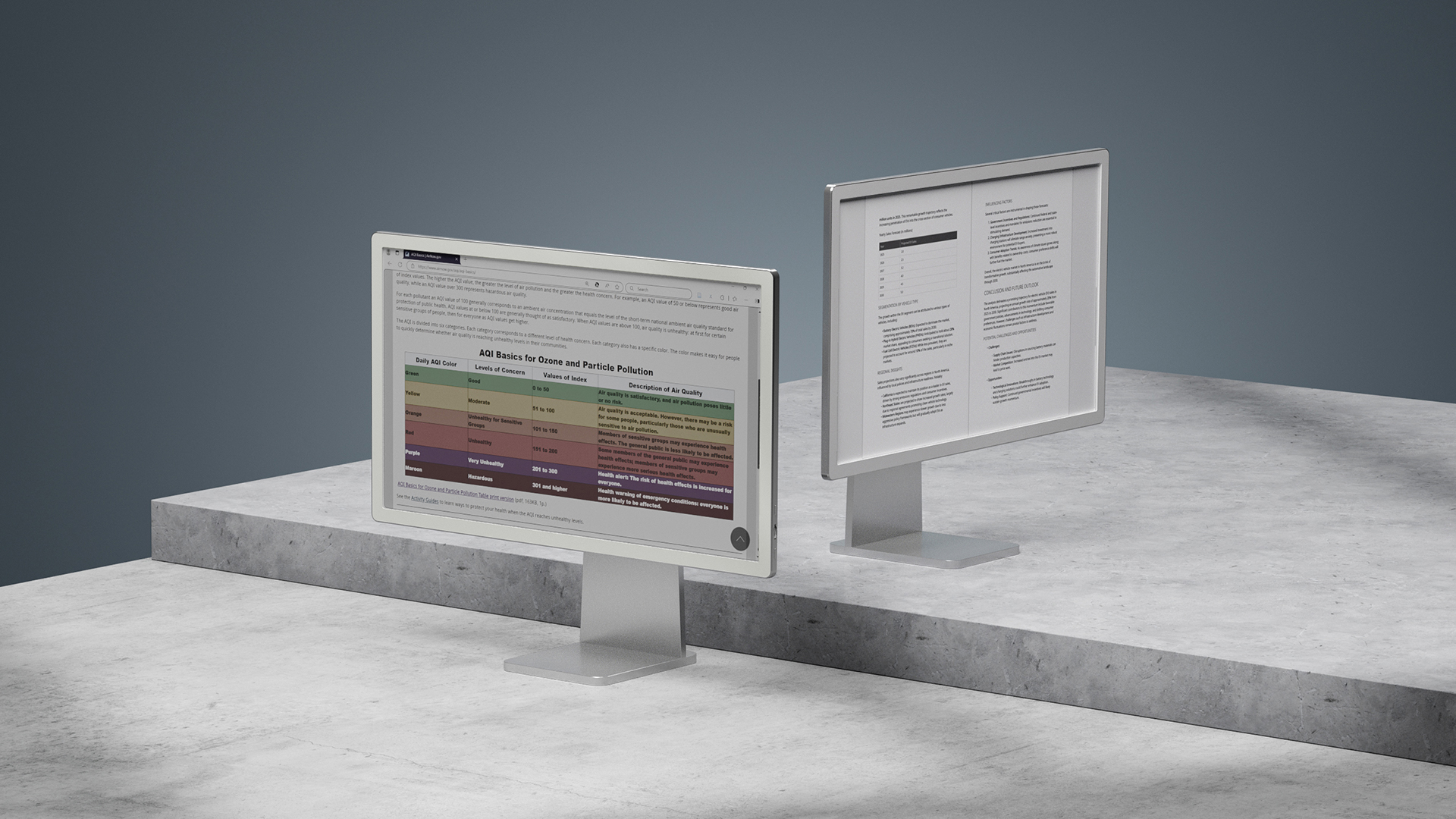

One of IEX Cloud’s greatest contributions was pushing the industry toward data democratization. It challenged the norm that comprehensive market data was only for those who could pay top dollar. In doing so, it inspired a wave of competing services over the past few years aimed at smaller customers. The landscape today features a mix of free or low-cost APIs, each with different strengths: for example, some excel in providing end-of-day stock prices, others in real-time feeds, others in fundamentals or forex. IEX Cloud’s departure forces a reevaluation of how much “openness” truly exists in market data. Key takeaways and lessons for the industry include:

- Freemium Feasibility: The freemium model (free baseline data with paid upgrades) is hard to sustain in finance. Without a large paying user base or alternate revenue (advertising, upselling analytics, etc.), even beloved services can run at a loss. Future providers may need to balance generosity with survival – possibly by limiting free usage or finding sponsorships.

- Dominance of Big Players: Exchanges and legacy data firms still hold a data monopoly in many respects. New entrants must either license data from them (incurring high costs) or aggregate less-official sources. This dependency makes it challenging to undercut the incumbents on price for long. It also explains why some smaller APIs focus on niche datasets or alternative data to differentiate.

- Developer Experience Matters: One reason IEX Cloud amassed 150k+ users was its excellent developer experience – clear documentation, easy signup, and flexible usage. Any alternative hoping to attract the same user segment must offer similar ease of use. The modern fintech developer expects RESTful APIs, Python/R/JavaScript libraries, sandbox testing, and transparent terms. In this sense, IEX Cloud set a high bar for developer-centric design in financial APIs.

- Community and Innovation: IEX Cloud fostered a community (through forums, support channels, and word-of-mouth) that helped developers learn and build together. The loss of that community is intangible but real. However, it may live on as former users congregate in online forums and Reddit threads to discuss alternatives. The ethos of sharing knowledge and coding around constraints will continue in the community, even if the platform changed.

Navigating the Post-IEX Cloud World: Finding an Alternative

With IEX Cloud gone, its users have been scouting the market data landscape for reliable alternatives. Fortunately, the ecosystem offers several choices, each with trade-offs. Among the contenders, Alpha Vantage has emerged as a particularly compelling option for many, due to its similarity in spirit to IEX Cloud’s mission of accessibility. Other services are also in the mix, and some users will find those platforms better suited to certain needs. However, to illustrate how the gap left by IEX Cloud can be filled, this article will highlight Alpha Vantage as a case study – a popular choice for developers that checks many of the same boxes. Before diving into Alpha Vantage, it’s worth noting what made a provider attractive to IEX Cloud’s user base in the first place: affordability, breadth of data, ease of integration, and community trust. IEX Cloud excelled in these areas, and any replacement will be measured by the same yardstick. Let’s see how Alpha Vantage compares.

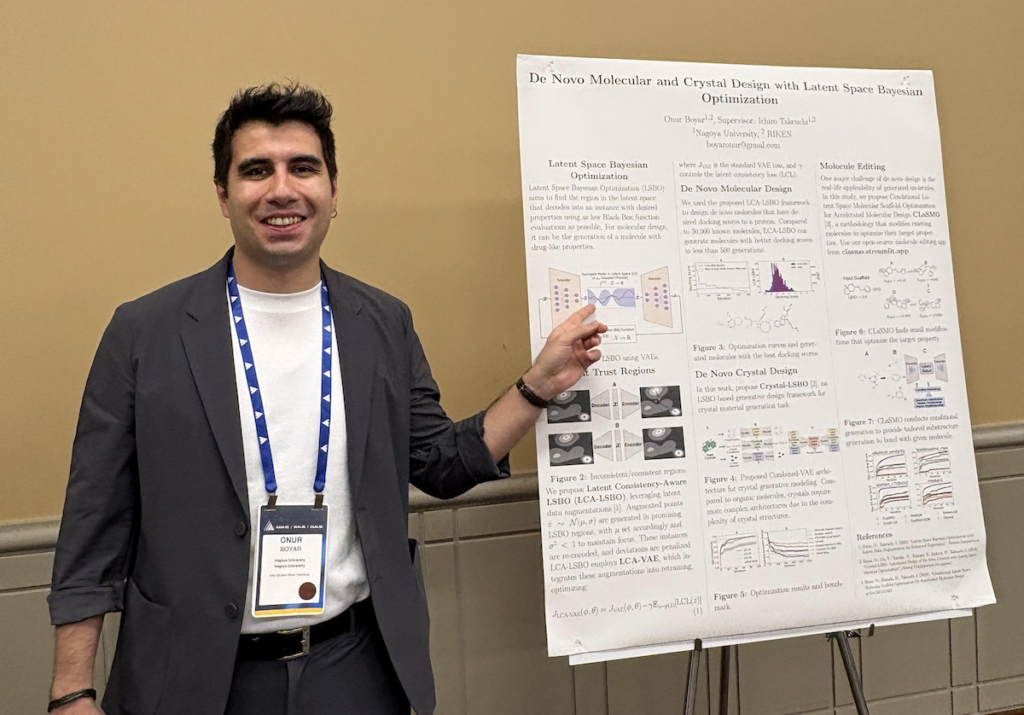

Alpha Vantage is a financial data API platform that, like IEX Cloud, aims to “democratize” access to market data. Founded in 2017 by a pair of entrepreneurs and backed by Y Combinator, Alpha Vantage remains independently operated by its original co-founders. This independence is notable – it means the company is laser-focused on its data API business and not subject to the shifting priorities of a larger parent corporation. In the wake of IEX Cloud’s shutdown, many developers and data-driven investors have turned to Alpha Vantage as a reliable alternative.

The platform is particularly appealing to developers due to its simplicity, robust documentation, and strong community support. Making API requests is straightforward, with clear URL patterns and code examples across multiple programming languages. Like IEX Cloud, Alpha Vantage benefits from third-party integrations and official tools such as Google Sheets add-ons and Excel templates, making it accessible to both developers and analysts. Its infrastructure is cloud-scalable, supporting high request volumes with low latency—critical for real-time applications like trading bots or market dashboards.

Pricing is another major strength. Alpha Vantage offers a generous free tier—currently 25 requests per day—and transparent, flexible paid plans. This accessibility, combined with its status as a Nasdaq-licensed data vendor, ensures developers get compliant, high-quality data suitable for commercial use. In sum, while it may lack a few niche datasets once found on IEX Cloud, Alpha Vantage more than meets the needs of most fintech developers and startups seeking a reliable and affordable market data API.

The Next Decade: Trends Shaping the Market Data Landscape

With IEX Cloud’s chapter closed and alternatives stepping up, one can’t help but wonder how the financial data industry will evolve over the next ten years. The period up to 2035 will likely bring significant changes, driven by technology, regulatory actions, and shifting user expectations. Here are some key trends and speculations on how they might shape accessible market data in the future.

Open Finance and Data Democratization

The concept of open finance is poised to expand. Just as open banking regulations have forced banks to provide APIs for account data (with customer consent), we may see broader financial data – including investments and market data – become more interoperable. In a decade, it’s possible that investors will be able to grant third-party apps access not only to their account balances but also to unified market data feeds through standardized APIs. This could be facilitated by industry consortia or regulations that encourage data-sharing to spur innovation. Data democratization would mean that high-quality market data isn’t just a luxury; it’s a common utility available to all market participants (perhaps subsidized for retail investors or funded by exchanges/governments in part). We already see early signs: for instance, the European Union’s efforts to create a Consolidated Tape for stock trades aim to provide a single, affordable source of trade data to everyone. If successful, by 2030 such consolidated data feeds (in both the US and EU) could drastically lower the cost of basic market data and level the playing field. This open-access paradigm might enable a new wave of fintech startups that build on top of standardized, low-cost data streams, much like how fintechs in payments have flourished under open banking.

Decentralization of Data Networks

Decentralization is another trend that could disrupt how market data is distributed. This has multiple facets. On one hand, blockchain and distributed ledger technology offer new ways to disseminate information. We might envision a peer-to-peer network where trade data or price feeds are validated and shared across nodes worldwide, reducing reliance on central servers. Projects in the decentralized finance (DeFi) space already use oracles (like Chainlink) to feed price data from the real world to blockchain smart contracts in a decentralized manner. Over the next ten years, these decentralized data feeds could mature and even start feeding back into traditional applications, providing redundant or alternative sources of truth for market prices. Imagine an open protocol where anyone publishing trades (exchanges, dark pools, etc.) pushes data to a public ledger that anyone can tap into with the right keys – a radical departure from today’s hub-and-spoke model dominated by exchange-owned feeds. While technical and regulatory hurdles are non-trivial, the benefit would be resilience (no single point of failure) and possibly cost-sharing (nodes could earn tokens or fees for relaying data, offsetting costs). Decentralization could also mean the rise of community-maintained datasets: for example, crowdsourced fundamentals or collaboratively built historical databases that are open source. Platforms like GitHub or academic networks might host freely available financial data repositories maintained by volunteers and universities, ensuring that core historical data becomes a public good.

AI Integration and Smarter Data Services

The rise of artificial intelligence will deeply intertwine with financial data services. By 2035, AI could transform both how data is delivered and how it’s used. On the delivery side, we might see AI-driven data platforms that can intelligently cache or pre-fetch data based on usage patterns, dramatically improving efficiency and response times. More interestingly, AI interfaces (think advanced chatbots or AI assistants) may sit on top of data APIs, allowing users to query complex data with natural language. Instead of writing code to fetch and join multiple datasets, a user might ask, “Give me the 10-year monthly price history of Apple adjusted for splits and highlight any months where price dropped more than 10%,” and an AI-powered service would understand this, retrieve the necessary data, and even provide the analysis. Some rudimentary versions of this exist today, but the next decade’s large language models, possibly specialized as financial co-pilots, will be far more powerful. We could see the integration of market data APIs with AI platforms like ChatGPT or its successors, enabling conversational access to data. AI will also generate new data products: for instance, sentiment scores from news or social media, predictive analytics, anomaly detection alerts – all offered via API. These AI-derived datasets might become as important as raw price data for developers. A fintech app in 2030 might as easily pull an “AI-predicted earnings surprise probability” data point as it pulls the latest stock quote. Additionally, AI can help with data cleaning and normalization across disparate sources, which means aggregators could combine multiple feeds (including free or crowdsourced ones) and use AI to reconcile differences, fill gaps, and maintain quality. This could reduce dependence on any single source. From the end-user perspective, machine learning integration will allow more personalized data streams. For example, an AI could learn an investor’s portfolio and interests and automatically push relevant data (news, prices, indicators) via API or notifications, rather than the user pulling everything manually. In summary, AI will act as both a sophisticated tool to enhance data accessibility and as a creator of enriched data – and savvy data providers will integrate these capabilities to stay competitive.

Regulatory Shifts and Market Data Pricing Reform

Regulation will play a critical role in the market data landscape. Over the next decade, there’s potential for significant regulatory shifts that could either open up or constrain data access. On one side, regulators might intervene to curb the exorbitant prices that exchanges charge for real-time data. In the U.S., the SEC has periodically considered reforms to the Securities Information Processor (SIP) system and recently approved a new governance plan for a consolidated equity market data feed. By 2035, we may have a more modern, possibly decentralized (or at least competitive) consolidated tape that offers near-real-time quotes to the public at reasonable fees.

Continued Rise of Alternative Data and Integration Platforms

Lastly, looking ahead, the definition of “market data” itself might broaden. Traditional APIs give you prices, volumes, fundamentals, etc. – but the next wave might seamlessly integrate alternative data (such as satellite imagery, ESG scores, web traffic analytics) into the mix. The trend of data marketplaces could grow, where a developer goes to a one-stop platform to not only get stock prices but also, say, sentiment from Twitter or job postings data, all via unified APIs. IEX Cloud had the seeds of this idea by hosting third-party datasets in its marketplace. Future platforms may perfect it, creating a hub for both market and alternative data with a single subscription. This could be accelerated by technologies that make data integration easier, like cloud data warehouses and APIs that allow querying across multiple datasets (for example, using GraphQL or other query languages to join data from different sources on the fly). The story of IEX Cloud serves as a reminder that even the noblest effort to democratize data must eventually pay the bills. The hope for the next decade is that through creative business models, community efforts, and enlightened regulation, accessible market data can be achieved in a lasting way.

Conclusion

The closure of IEX Cloud was a pivotal moment in the financial data industry, especially for the community of developers and startups it served. It underscored both the immense appetite for accessible market data and the difficulties in providing it sustainably. In the aftermath, alternatives like Alpha Vantage have risen to the occasion, offering many of the same benefits and reaffirming the trend toward democratization of data. Alpha Vantage, in particular, makes a compelling case as a successor with its rich features, affordable pricing, and developer-centric approach – effectively carrying the torch that IEX Cloud lit. Looking forward, the next ten years promise further evolution. Accessible market data is likely to become even more prevalent as open finance initiatives grow and technology lowers distribution costs. We can anticipate a future where obtaining market data is as seamless as accessing the internet – a utility available to innovators everywhere. The journey will involve tackling challenges around revenue models, data rights, and technology scaling, but the trajectory is toward openness. For the developers and fintech builders of today, the message is clear: the end of one service is not the end of the vision. The ecosystem adapts, new doors open, and the quest for a truly democratized financial data landscape continues.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[FREE EBOOKS] Offensive Security Using Python, Learn Computer Forensics — 2nd edition & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Ditching a Microsoft Job to Enter Startup Purgatory with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

-xl.jpg)

![As Galaxy Watch prepares a major change, which smartwatch design to you prefer? [Poll]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/07/Galaxy-Watch-Ultra-and-Apple-Watch-Ultra-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple M4 iMac Drops to New All-Time Low Price of $1059 [Deal]](https://www.iclarified.com/images/news/97281/97281/97281-640.jpg)

![Beats Studio Buds + On Sale for $99.95 [Lowest Price Ever]](https://www.iclarified.com/images/news/96983/96983/96983-640.jpg)

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple's 11th Gen iPad Drops to New Low Price of $277.78 on Amazon [Updated]](https://images.macrumors.com/t/yQCVe42SNCzUyF04yj1XYLHG5FM=/2500x/article-new/2025/03/11th-gen-ipad-orange.jpeg)

![[Exclusive] Infinix GT DynaVue: a Prototype that could change everything!](https://www.gizchina.com/wp-content/uploads/images/2025/05/Screen-Shot-2025-05-10-at-16.07.40-PM-copy.png)