How can Indian parents future-proof education expenses

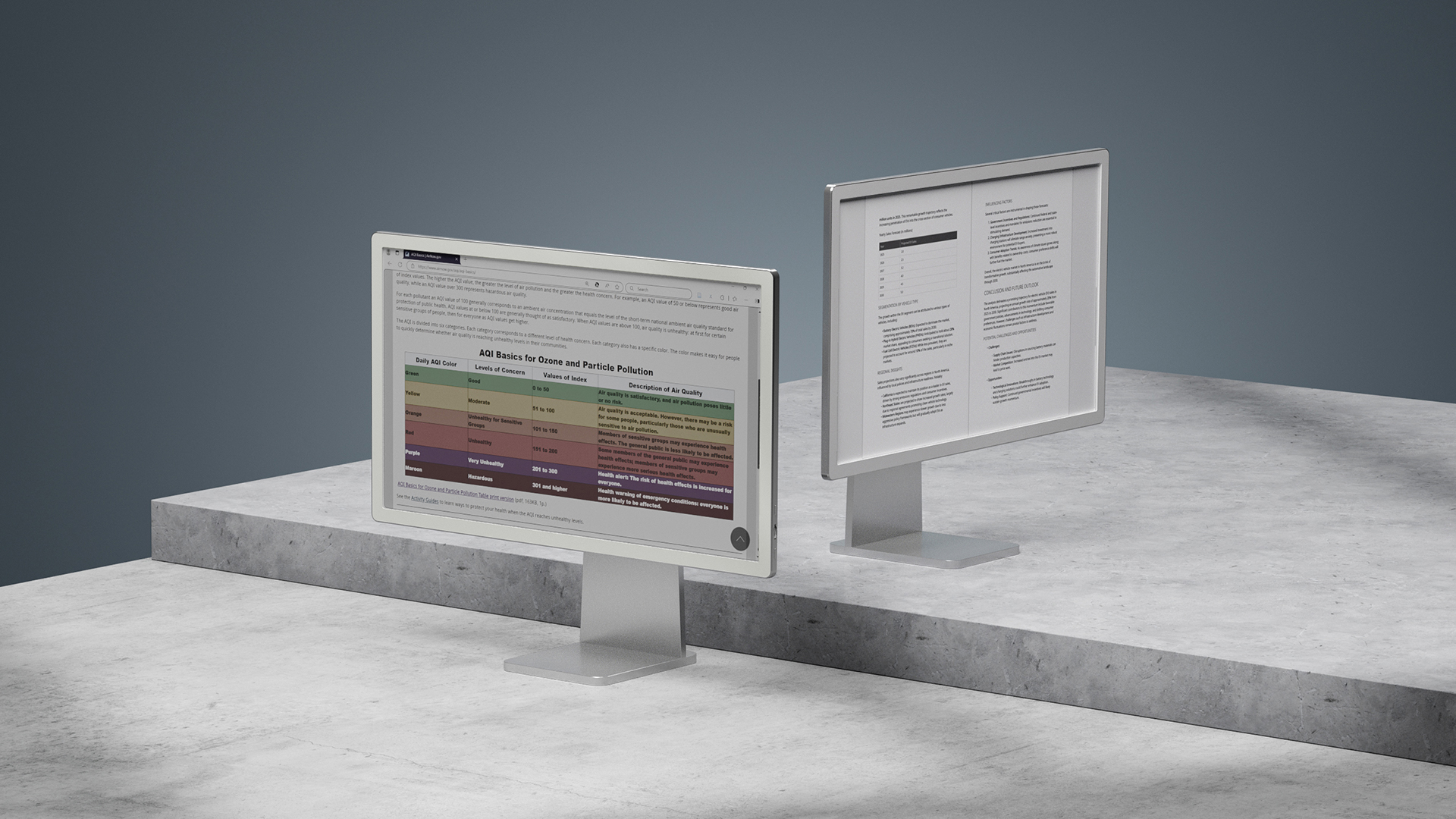

A national survey by Local Circles further reveals that 44% of Indian parents reported a 50% to 80% increase in fees over the last three years, with 8% experiencing hikes beyond 80%.

According to the Ministry of Education’s UDISE+ 2023-24 report, national enrolment fell from 26 crore to 24.8 crore over four years. This one crore drop should be interpreted not as a statistical fluctuation but as a reflection of growing exclusion due to cost.

This decline comes despite the increasing emphasis on upskilling and lifelong learning. In effect, we are asking families to invest in a future economy, but providing them with few practical tools to manage the investment.

Recent data underscores the severity of the crisis. In Bengaluru, parents pay up to Rs 2.1 lakh annually in fees. In Delhi, concerns over unchecked fee hikes have triggered government audits of all 1,677 private academic institutions, indicating systemic gaps in transparency and regulation.

An analysis by CRISIL Ratings indicates that educational institutions in India are expected to witness a 12-14% growth in fee income for FY24-25. A national survey by Local Circles further reveals that 44% of Indian parents reported a 50% to 80% increase in fees over the last three years, with 8% experiencing hikes beyond 80%. Additionally, education inflation ranges between 11% and 12%, well above the national average for consumer inflation.

These numbers are symptomatic of a broader affordability crisis that threatens equitable access to education, particularly for students in Tier II and III regions.

As India strides into a new era of educational advancement, with AI-driven curricula, hybrid learning models, and the rapid digitisation of classrooms, one critical aspect remains worryingly outdated—how we finance education.

The ripple effects of such financial pressure are already visible. Families are deferring admissions, withdrawing children from private institutions, or turning to informal lending options. This strain is exacerbated by associated costs, including transportation, digital learning tools, books, uniforms, and co-curricular fees, which often double the effective outlay.

The inadequacy of traditional credit models

Historically, education loans were positioned as the bridge between aspiration and affordability. Yet, the realities of credit access in India tell a different story.

Bank loans remain out of reach for a large section of families due to procedural complexity, eligibility filters, and credit score requirements. Informal earners, freelancers, and those without guarantors are routinely excluded from formal financial support.

The issue is particularly acute for students pursuing non-traditional educational pathways—vocational courses, certifications, or training from private institutions outside mainstream university systems. These are precisely the sectors driving India's skill economy, yet they remain underserved by legacy financial products.

Emerging alternatives

Recognising these gaps, several educational institutions are now adopting flexible fee structures that align more closely with household income patterns and mitigate the psychological and logistical burden of lump-sum payments.

Key innovations include:

- Monthly EMIs that allow for predictable, no-interest payments spread over time. Even quarterly instalment plans are designed for families with variable income streams.

- Insurance-backed tuition protection, ensuring continued education in cases of job loss, disability, or death in the earning household.

These mechanisms serve a dual function: easing the burden on families while improving institutional cash flow, reducing default rates, and increasing enrolments. Educational institutions offering flexible models have observed significant improvement in student retention and admissions, a critical indicator of their impact.

Moreover, the broader socio-economic landscape is contributing to growing uncertainty. A rising trend of job transitions, layoffs in emerging sectors, and the rise of the gig economy are leaving many families without consistent income streams. Alongside this, mental health challenges among students are escalating, driven by academic pressure and financial insecurity.

In response, some forward-thinking institutions and fintech partners are now incorporating features like income protection and mental health coverage into education financing plans. These additions—ranging from deferment options during job loss to wellness-linked insurance—are not mere value-adds but essential safeguards in today’s volatile environment.

However, fee flexibility alone cannot resolve the affordability challenge. Systemic interventions are required, including:

- Regulatory frameworks to cap arbitrary fee hikes and mandate transparency in pricing.

- Public-private partnerships to co-create financial instruments tailored for non-salaried segments.

- Expanded credit risk assessment models that accommodate the realities of India’s informal economy.

- National awareness campaigns to improve financial literacy and encourage proactive planning for educational expenses.

Without these structural changes, innovations in financing will remain fragmented, benefiting only a limited cohort of families.

Financial preparedness must be considered as fundamental to educational access as curriculum quality or infrastructure. When a family is financially prepared, the decision-making shifts from survival to strategy—from “What can we afford?” to “What is best for our child’s future?”

This readiness unlocks opportunities for students to focus on learning rather than loans, for parents to participate in long-term planning, and for institutions to operate with financial stability and accountability.

Education is an economic investment in India’s future workforce and social equity. As costs continue to rise and household income growth remains uneven, families, institutions, and policymakers must collectively prioritise financial innovation and regulatory reform.

The path forward must be guided by inclusivity, flexibility, and foresight. We must build an education financing framework that is not only reactive to current pressures but resilient enough to support the next generation of learners, without compromise.

Manoj Gupta is the Founder and CEO of Flashaid.

Edited by Suman Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[FREE EBOOKS] Offensive Security Using Python, Learn Computer Forensics — 2nd edition & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Ditching a Microsoft Job to Enter Startup Purgatory with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

-xl.jpg)

![As Galaxy Watch prepares a major change, which smartwatch design to you prefer? [Poll]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/07/Galaxy-Watch-Ultra-and-Apple-Watch-Ultra-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple M4 iMac Drops to New All-Time Low Price of $1059 [Deal]](https://www.iclarified.com/images/news/97281/97281/97281-640.jpg)

![Beats Studio Buds + On Sale for $99.95 [Lowest Price Ever]](https://www.iclarified.com/images/news/96983/96983/96983-640.jpg)

![New iPad 11 (A16) On Sale for Just $277.78! [Lowest Price Ever]](https://www.iclarified.com/images/news/97273/97273/97273-640.jpg)

![Apple's 11th Gen iPad Drops to New Low Price of $277.78 on Amazon [Updated]](https://images.macrumors.com/t/yQCVe42SNCzUyF04yj1XYLHG5FM=/2500x/article-new/2025/03/11th-gen-ipad-orange.jpeg)

![[Exclusive] Infinix GT DynaVue: a Prototype that could change everything!](https://www.gizchina.com/wp-content/uploads/images/2025/05/Screen-Shot-2025-05-10-at-16.07.40-PM-copy.png)