Moody's cuts India's GDP growth forecast to 6.3% in 2025 on US trade uncertainty

Moody's also expects the Reserve Bank of India (RBI) to lower benchmark policy rates further to support growth.

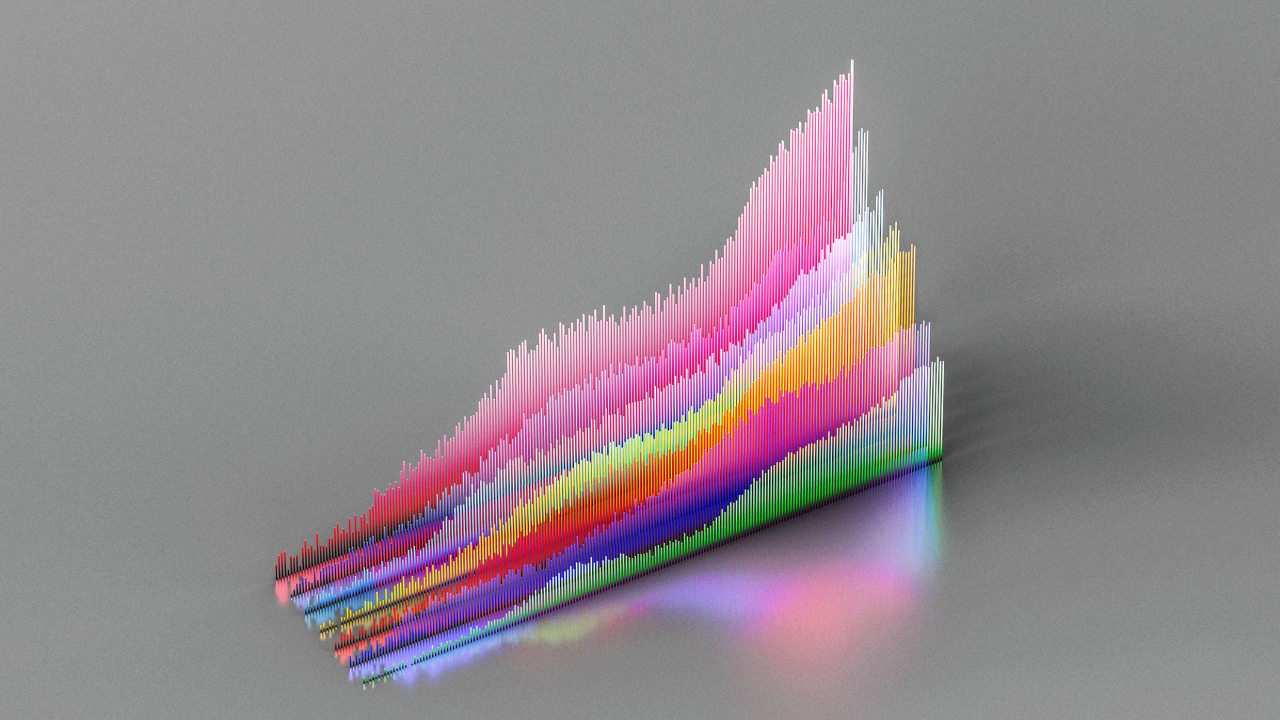

Moody's Ratings on Tuesday cut India's GDP growth projections for 2025 to 6.3%, from 6.5%, saying economies globally will see a slowdown on account of heightened US policy uncertainty and trade restrictions.

In its Global Macro Outlook 2025-26 (May update), Moody's said geopolitical stresses, like tension between India and Pakistan, also have a potential downside risk to its baseline growth forecasts. Costs to investors and businesses are likely to rise as they factor in new geopolitical configurations when deciding where to invest, expand, and/or source goods, Moody's said.

Moody's cut India's growth projections to 6.3% for the 2025 calendar year, but retained it at 6.5% for 2026. This compares with a 6.7% growth in 2024. Moody's expects the Reserve Bank of India to lower benchmark policy rates further to support growth.

"Economic growth was already set to slow this year back to its potential rate. We lowered our global growth projections for 2025 and 2026 further on account of the policy shifts and more intense policy uncertainty than we had previously expected, especially in the largest two economies, the US and China," Moody's said.

Stating that policy uncertainty is further slowing growth in 2025, Moody's said it is likely to take a toll on consumer, business, and financial activity. Despite a pause and reduction in some tariffs, policy uncertainty and trade tensions, especially between the US and China, are likely to dampen global trade and investment, with consequences across the G-20.

Moody's lowered GDP growth projections for the US to 1% in 2025 and 1.5% in 2026 from 2% and 1.8%, respectively. That compares with a growth of 2.8% in 2024.

For China, Moody's expects growth to be 3.8% in 2025 and 3.9% in 2026, lower than 5% in 2024.

"It is clear that the US trade strategy is still evolving. Except for China, which has implemented 125% tariffs on most US imports and restrictions on rare earth exports to the US, most major trading partners have chosen not to retaliate so far. We believe that, overall, we are currently at peak effective tariff rates for the US and that they will be reduced in the coming months," Moody's said.

It said that in addition to trade policy uncertainties, Moody's baseline forecasts incorporate a degree of financial market volatility and continued political tensions in multiple geographies.

"In April, financial market metrics reflected uncertainty-induced risk aversion and repricing of some financial assets. Frequent bouts of intense financial market volatility that tighten liquidity and significantly raise the cost of capital could erode economic resilience, posing risks to growth," Moody's added.

Geopolitical stresses are another potential downside risk to Moody's baseline forecasts.

In recent days, tensions have flared up between India and Pakistan in South Asia and China and the Philippines in the South China Sea. These join unresolved wars in Russia and Ukraine, as well as the conflict in the Middle East.

Edited by Suman Singh

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Steven_Jones_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

Stolen 884,000 Credit Card Details on 13 Million Clicks from Users Worldwide.webp?#)

![Google Mocks Rumored 'iPhone 17 Air' Design in New Pixel Ad [Video]](https://www.iclarified.com/images/news/97224/97224/97224-640.jpg)

![Apple Shares Official Teaser for 'Highest 2 Lowest' Starring Denzel Washington [Video]](https://www.iclarified.com/images/news/97221/97221/97221-640.jpg)