Cryptocurrencies hamper financial stability: RBI Governor

During a media interaction, RBI Governor Sanjay Malhotra said the central bank is concerned about cryptocurrencies.

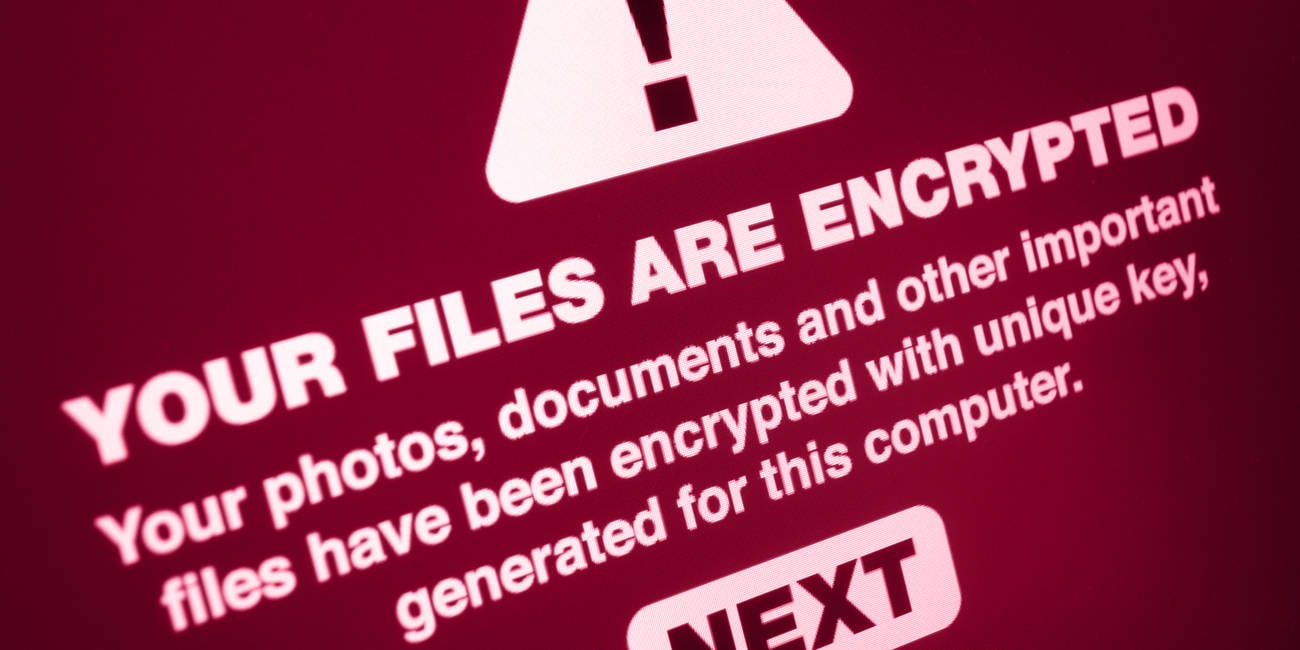

RBI Governor Sanjay Malhotra on Friday said the central bank is concerned about cryptocurrencies as they can hamper financial stability.

Malhotra was replying to a question during a media interaction, after the RBI monetary policy meeting, about the developments in the backdrop of the Supreme Court's observation on cryptocurrency last month.

"There is no new development as far as crypto is concerned. A committee of the government is looking after this. Of course, as you are aware, we are concerned about crypto because that can hamper financial stability and monetary policy," Malhotra said.

The Supreme Court had last month asked the Centre to formulate a "clear cut" policy on regulating cryptocurrency, while underlining its impact on the economy.

A Supreme Court bench termed the Bitcoin trade as an illicit trade more or less like the "hawala" business.

India is currently working on a discussion paper for cryptocurrencies and an inter-ministerial group, comprising officials from RBI, Sebi, and the finance ministry, is looking into global norms.

In the absence of any regulation, cryptocurrency is not yet illegal in India.

The discussion paper will give the stakeholders an opportunity to give their views before India decides on its policy stance on cryptocurrencies.

In 2022, the government announced a flat 30 per cent tax on gains arising from cryptocurrencies. Taxing income from cryptocurrencies does not necessarily and explicitly legalise cryptocurrencies.

Currently, crypto assets are unregulated in India. Here cryptocurrencies are regulated from the perspective of anti-money laundering law. Besides that, income tax and TDS is levied on earnings from trading in such virtual digital assets. Also, GST is levied on cryptocurrency exchanges.

It may be noted that, on March 4, 2021, the Supreme Court had set aside an RBI circular of April 6, 2018, prohibiting banks and entities regulated by it from providing services in relation to virtual currencies.

Edited by Swetha Kannan

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[FREE EBOOKS] Solutions Architect’s Handbook, Continuous Testing, Quality, Security, and Feedback & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From electrical engineering student to CTO with Hitesh Choudhary [Podcast #175]](https://cdn.hashnode.com/res/hashnode/image/upload/v1749158756824/3996a2ad-53e5-4a8f-ab97-2c77a6f66ba3.png?#)

_Michael_Vi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![UGREEN FineTrack Smart Tracker With Apple Find My Support Drops to $9.99 [50% Off]](https://www.iclarified.com/images/news/97529/97529/97529-640.jpg)

![watchOS 26 May Bring Third-Party Widgets to Control Center [Report]](https://www.iclarified.com/images/news/97520/97520/97520-640.jpg)