BlackRock reports $3B in digital asset inflows during Q1

BlackRock, the world’s largest asset manager with $11.6 trillion in assets under management, reported $84 billion in total net inflows in the first quarter of 2025, marking a 3% annualized growth in assets under management.The firm’s strong performance was led by a record first quarter for iShares exchange-traded funds (ETFs) alongside continued strength in private markets and net inflows, according to BlackRock’s Q1 earnings released on April 11.Of the $107 billion in net inflows to iShares ETFs, $3 billion, or 2.8% of the total ETF inflows, was directed to digital asset products in Q1, BlackRock said.BlackRock’s net flow data in Q1 2025 (in billions of US dollars). Source: BlackRockAlternative investments also played a significant role in Q1, with private market inflows totaling $9.3 billion.Digital assets remain small segmentAs of March 31, 2025, digital assets accounted for $34 million in base fees or less than 1% of BlackRock’s long-term revenue.By the end of the first quarter, BlackRock’s total digital assets under management amounted to $50.3 billion, which represents about 0.5% of the firm’s $11.6 trillion in total assets under management.BlackRock’s business results in Q1 2025 (in millions of US dollars). Source: BlackRockBlackRock’s financial results suggest that digital assets still make up a modest share of the company’s business.Despite the modest share, BlackRock’s $3 billion in digital asset inflows is notable given widespread liquidations in the Bitcoin ETF market earlier this year. The company’s figures suggest that investor interest in crypto-backed ETFs remains steady.This is a developing story, and further information will be added as it becomes available.Magazine: Bitcoin heading to $70K soon? Crypto baller funds SpaceX flight: Hodler’s Digest, March 30 – April 5

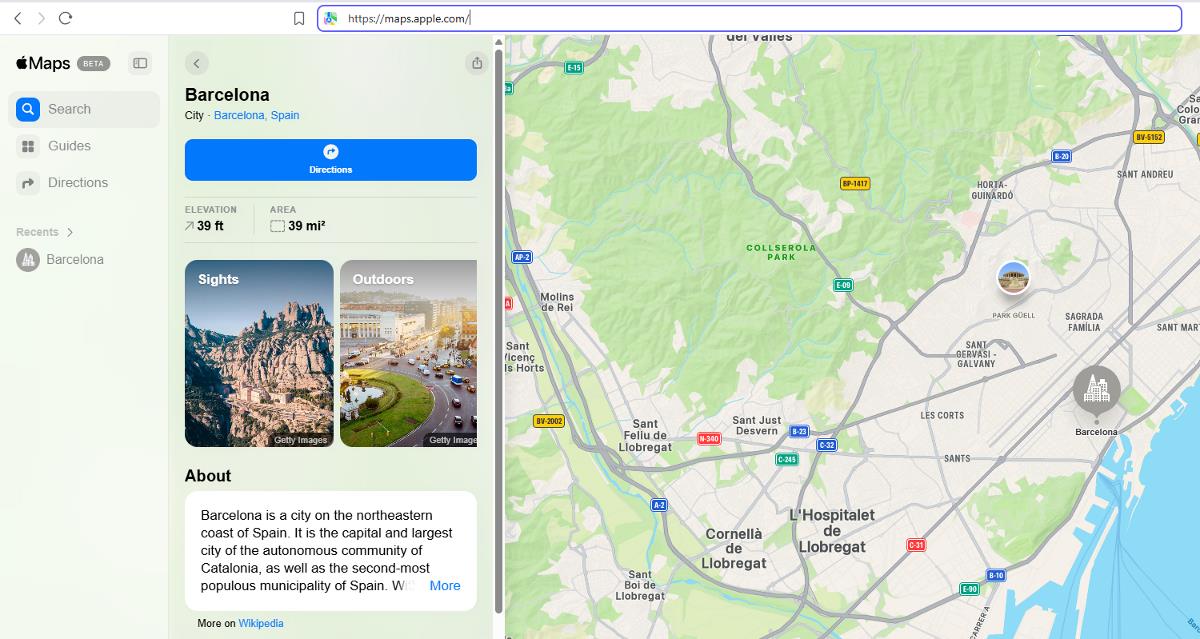

BlackRock, the world’s largest asset manager with $11.6 trillion in assets under management, reported $84 billion in total net inflows in the first quarter of 2025, marking a 3% annualized growth in assets under management.

The firm’s strong performance was led by a record first quarter for iShares exchange-traded funds (ETFs) alongside continued strength in private markets and net inflows, according to BlackRock’s Q1 earnings released on April 11.

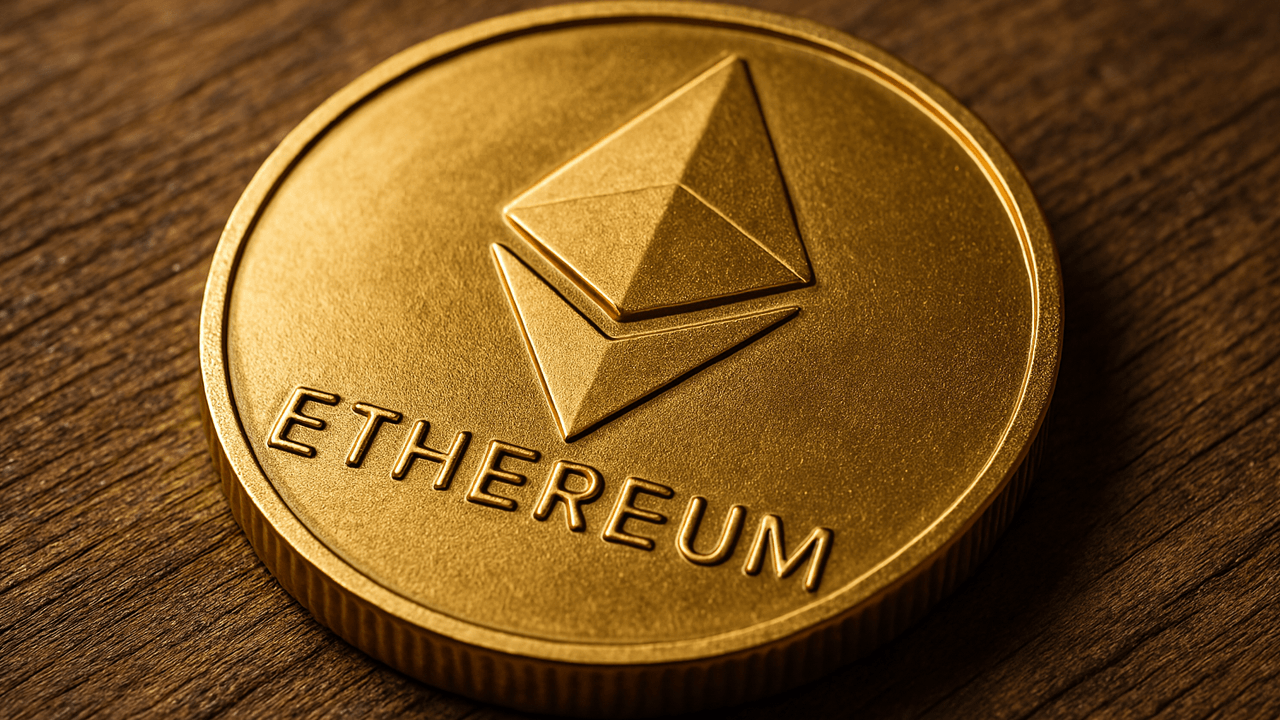

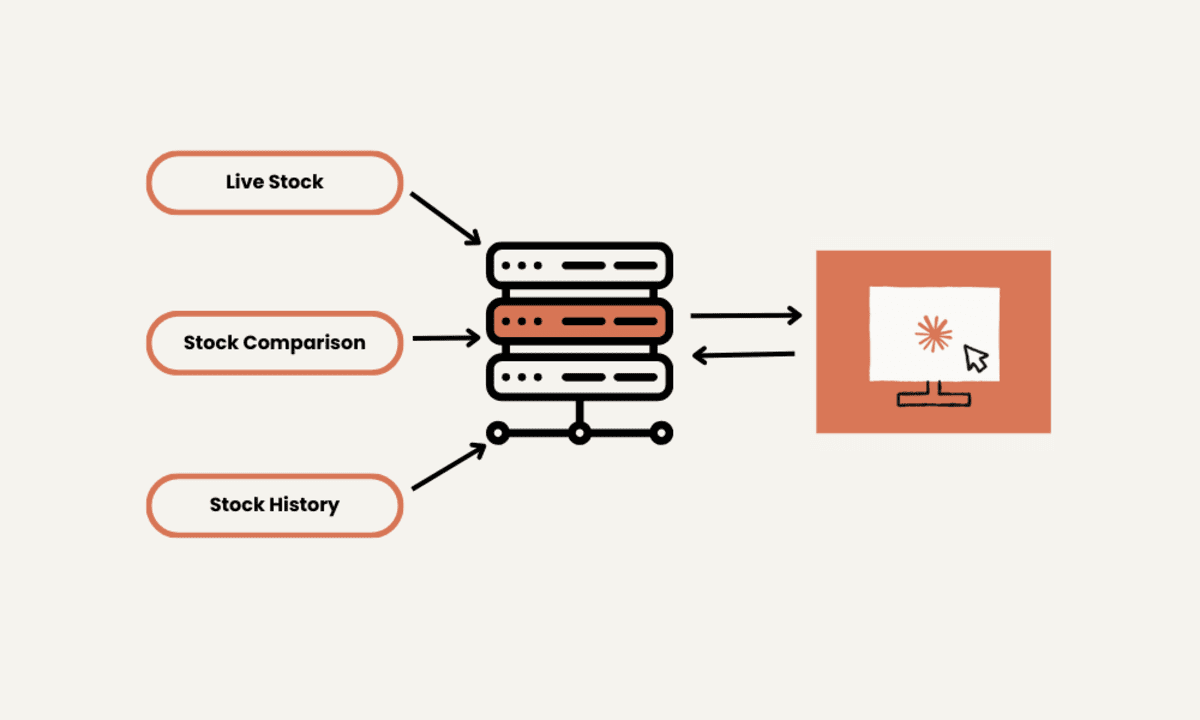

Of the $107 billion in net inflows to iShares ETFs, $3 billion, or 2.8% of the total ETF inflows, was directed to digital asset products in Q1, BlackRock said. BlackRock’s net flow data in Q1 2025 (in billions of US dollars). Source: BlackRock

Alternative investments also played a significant role in Q1, with private market inflows totaling $9.3 billion.

Digital assets remain small segment

As of March 31, 2025, digital assets accounted for $34 million in base fees or less than 1% of BlackRock’s long-term revenue.

By the end of the first quarter, BlackRock’s total digital assets under management amounted to $50.3 billion, which represents about 0.5% of the firm’s $11.6 trillion in total assets under management. BlackRock’s business results in Q1 2025 (in millions of US dollars). Source: BlackRock

BlackRock’s financial results suggest that digital assets still make up a modest share of the company’s business.

Despite the modest share, BlackRock’s $3 billion in digital asset inflows is notable given widespread liquidations in the Bitcoin ETF market earlier this year. The company’s figures suggest that investor interest in crypto-backed ETFs remains steady.

This is a developing story, and further information will be added as it becomes available.

Magazine: Bitcoin heading to $70K soon? Crypto baller funds SpaceX flight: Hodler’s Digest, March 30 – April 5

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![What Google Messages features are rolling out [April 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/12/google-messages-name-cover.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPadOS 19 Will Be More Like macOS [Gurman]](https://www.iclarified.com/images/news/97001/97001/97001-640.jpg)

![Apple TV+ Summer Preview 2025 [Video]](https://www.iclarified.com/images/news/96999/96999/96999-640.jpg)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)