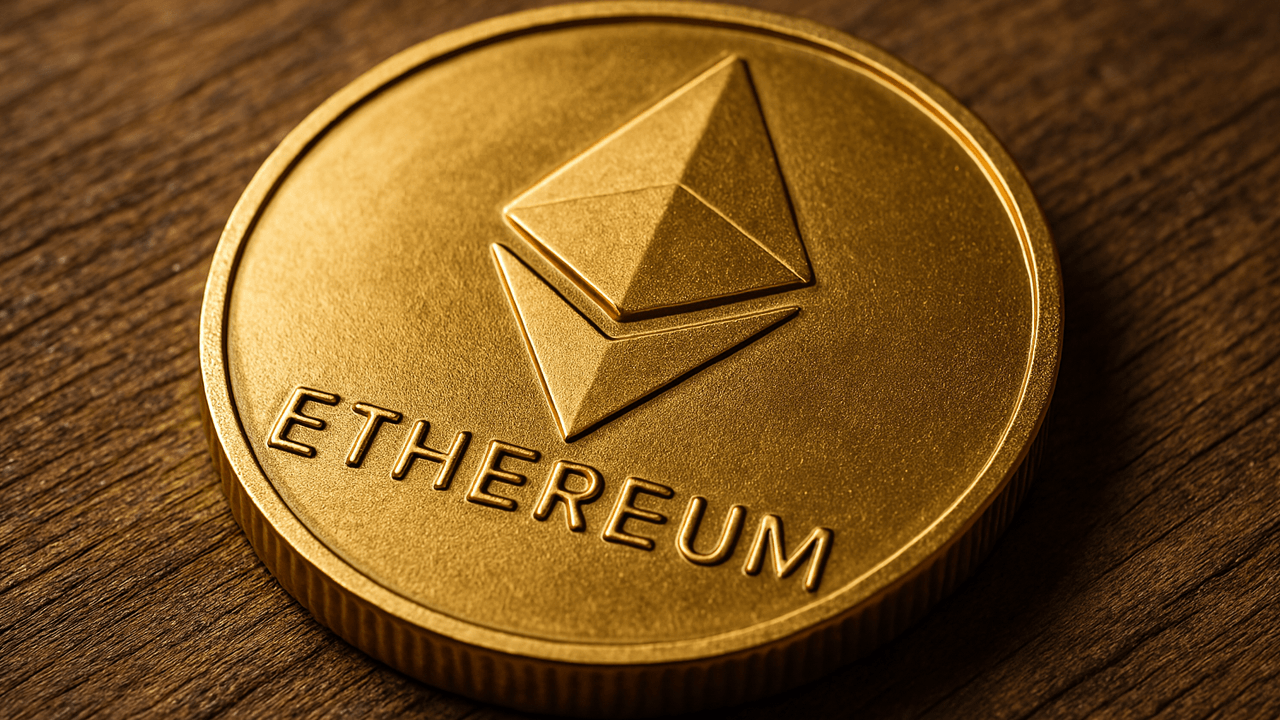

Australia shuts down 95 firms linked to pig butchering crypto scams

$35.8 million in reported losses across 14 countries. Scam used fake relationships to lure crypto investments. Court-appointed liquidators found only 3 firms held assets. Australian regulators have intensified their crackdown on crypto-related fraud, targeting a web of 95 companies involved in a widespread “pig butchering” scheme. The Australian Securities and Investments Commission (ASIC) confirmed on […] The post Australia shuts down 95 firms linked to pig butchering crypto scams appeared first on CoinJournal.

- $35.8 million in reported losses across 14 countries.

- Scam used fake relationships to lure crypto investments.

- Court-appointed liquidators found only 3 firms held assets.

Australian regulators have intensified their crackdown on crypto-related fraud, targeting a web of 95 companies involved in a widespread “pig butchering” scheme.

The Australian Securities and Investments Commission (ASIC) confirmed on April 8 that the Federal Court had ordered the winding up of these entities, citing false or misleading business registration information and links to fraudulent activity.

The investigation found that the companies, many of which operated under fake identities, used romance scams and impersonated legitimate trading platforms to siphon funds from victims across at least 14 countries.

Over 1,400 victims in $35.8m scam

The scam, spanning countries including Australia, the US, India, France, Nepal, and Ghana, has resulted in reported losses exceeding $35.8 million.

So far, nearly 1,500 claims have been lodged by individuals who say they were defrauded through schemes that involved emotional manipulation and fake crypto investment opportunities.

Victims were tricked into trusting scammers who posed as romantic partners or financial experts, using convincing fake platforms to gain access to funds.

These platforms mimicked legitimate investment and trading sites, making it difficult for users to detect the fraud.

The money was then rerouted into bank accounts controlled by the scammers.

ASIC blocks 130 scam sites weekly

The April 8 ruling follows a March 21 court review of 17 of the 95 implicated companies, which uncovered ties to fake websites and mobile apps.

Justice Angus Stewart described the evidence as “overwhelming” and ruled that the firms lacked credible management and operational legitimacy.

Catherine Conneely and Thomas Birch of Cor Cordis have been appointed as joint liquidators, with preliminary findings indicating that only three of the 95 companies held any assets.

The remaining 92 have been recommended for immediate deregistration.

ASIC has been stepping up its enforcement efforts against financial fraud, dismantling an average of 130 scam websites each week.

According to its records, more than 10,000 malicious sites have been taken down to date, including over 7,200 fake investment websites and 1,500 phishing platforms.

This surge in enforcement comes as scammers increasingly turn to online tools and platforms to mislead investors.

Many of the shut-down sites were set up to appear as reliable investment services, bolstered by fake registration records and misleading business names.

Crypto ATMs, fake Binance alerts probed

Alongside website takedowns, ASIC has targeted crypto ATM operators who failed to comply with anti-money laundering (AML) regulations.

These ATMs had seen a rise in suspicious transactions, prompting further investigations into potential misuse.

The Australian Federal Police (AFP), National Anti-Scam Centre (NASC), and Binance Australia also collaborated last month to issue public warnings against impersonation scams.

Fraudsters reportedly used SMS and encrypted messaging services to pose as Binance representatives, falsely claiming that victims’ accounts had been compromised and urging them to transfer funds to fake recovery wallets.

The scams, built around a combination of trust-building, fake urgency, and impersonation, reflect the growing sophistication of fraud techniques used in the digital asset space.

The post Australia shuts down 95 firms linked to pig butchering crypto scams appeared first on CoinJournal.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Accountant to Data Engineer with Alyson La [Podcast #168]](https://cdn.hashnode.com/res/hashnode/image/upload/v1744420903260/fae4b593-d653-41eb-b70b-031591aa2f35.png?#)

.png?#)

![What Google Messages features are rolling out [April 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/12/google-messages-name-cover.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPadOS 19 Will Be More Like macOS [Gurman]](https://www.iclarified.com/images/news/97001/97001/97001-640.jpg)

![Apple TV+ Summer Preview 2025 [Video]](https://www.iclarified.com/images/news/96999/96999/96999-640.jpg)

![Apple Watch SE 2 On Sale for Just $169.97 [Deal]](https://www.iclarified.com/images/news/96996/96996/96996-640.jpg)