[Weekly funding roundup May 31-June 6] VC inflow continues to remain stable

Venture capital funding on a weekly basis continues to move in the narrow range of lower value largely due to absence of large value deals.

![[Weekly funding roundup May 31-June 6] VC inflow continues to remain stable](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)

The Indian startup ecosystem continues to experience a stable flow of venture capital (VC) inflow, as the total funding amount on a weekly basis remains in the $100-200 million range.

The first week of June started on a sedate note, as the total amount raised by Indian startups came in $213 million across 17 deals. In contrast, the previous week saw a total amount of $209 million.

In fact, this week's saving grace was the $114 million deal by B2B ecommerce startup Udaan, otherwise the number would have been much lower. This shows the challenges that the Indian startup ecosystem continues to face in raising capital.

The number of deals on a weekly basis has also come down. This week there were just 17 transactions and this has been the average number over the last couple of weeks.

These developments do not augur well for the ecosystem as it is only the higher inflow of capital that gives the positive lift. The external macro economic environment is also not conducive to increasing the flow of money.

The startup ecosystem continues to see interesting developments. A new healthtech fund has been launched and this shows there is investor interest in Indian startups. On the other hand, Artha Venture Fund has delivered a strong performance.

Key transactions

B2B ecommerce company Udaan raised $114 million from M&G Investments and Lightspeed Venture Partners.

D2C menswear brand Snitch raised $40 million from 360 One Asset, IvyCap Ventures, SWC Global, Ravi Modi Family Office and angel investors.

Fintech startup Stable Money raised $20 million from Fundamentum Partnership, Aditya Birla Ventures, Z47, RTP Global, and Lightspeed.

Digital lending platform LoanTap raised Rs 74 crore ($6.3 million) from July Ventures, 3one4 Capital, Avaana Capital, Kae Capital, and the Swapurna Family Office.

Edited by Jyoti Narayan

_.png)

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[FREE EBOOKS] Solutions Architect’s Handbook, Continuous Testing, Quality, Security, and Feedback & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From electrical engineering student to CTO with Hitesh Choudhary [Podcast #175]](https://cdn.hashnode.com/res/hashnode/image/upload/v1749158756824/3996a2ad-53e5-4a8f-ab97-2c77a6f66ba3.png?#)

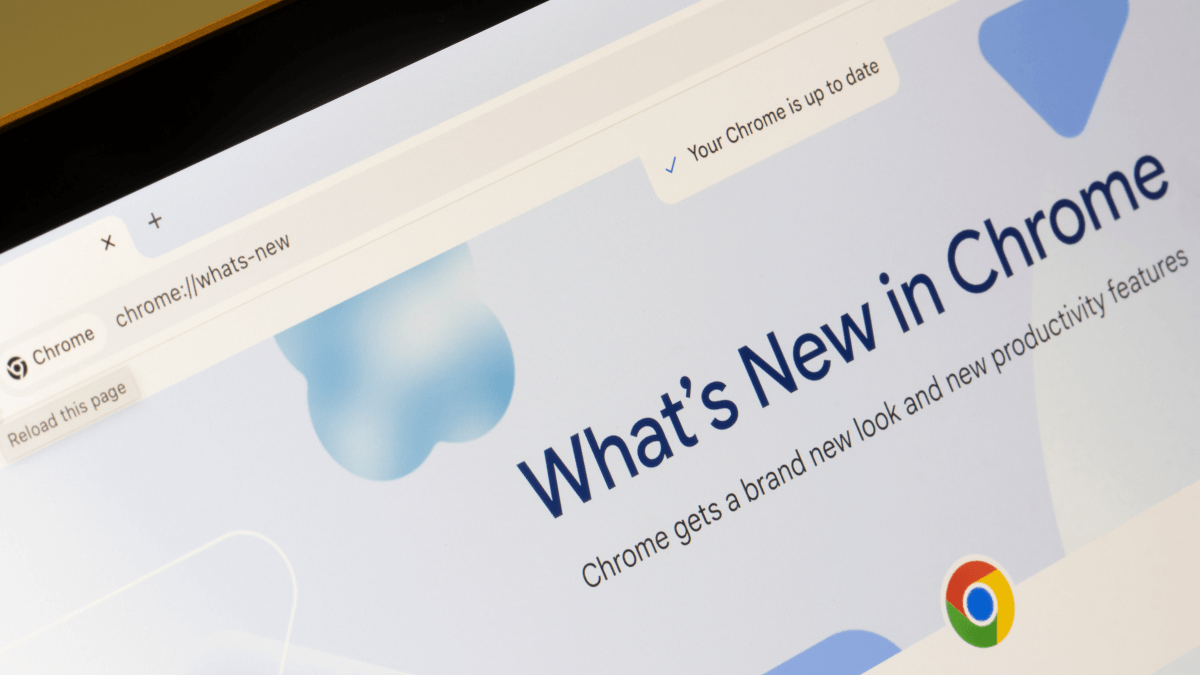

_Michael_Vi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![UGREEN FineTrack Smart Tracker With Apple Find My Support Drops to $9.99 [50% Off]](https://www.iclarified.com/images/news/97529/97529/97529-640.jpg)

![watchOS 26 May Bring Third-Party Widgets to Control Center [Report]](https://www.iclarified.com/images/news/97520/97520/97520-640.jpg)