Startup news and updates: Daily roundup (May 8, 2025)

YourStory presents the daily news roundup from the Indian startup ecosystem and beyond. Here's the roundup for Thursday, May 8, 2025.

From commercial vehicle platform 91Trucks raising $5 million in a Series A funding round to PB Healthcare Services securing $218 million in seed funding led by General Catalyst, YourStory brings you today’s top stories from the Indian startup ecosystem.

Feature story

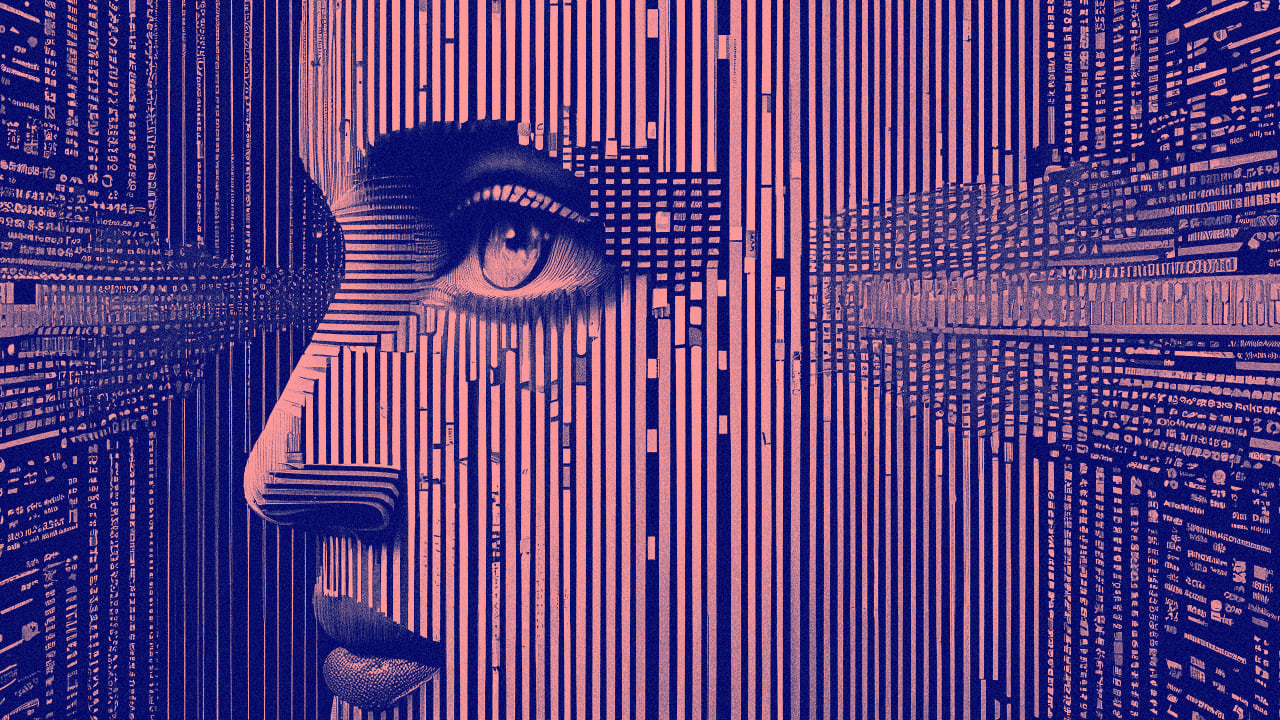

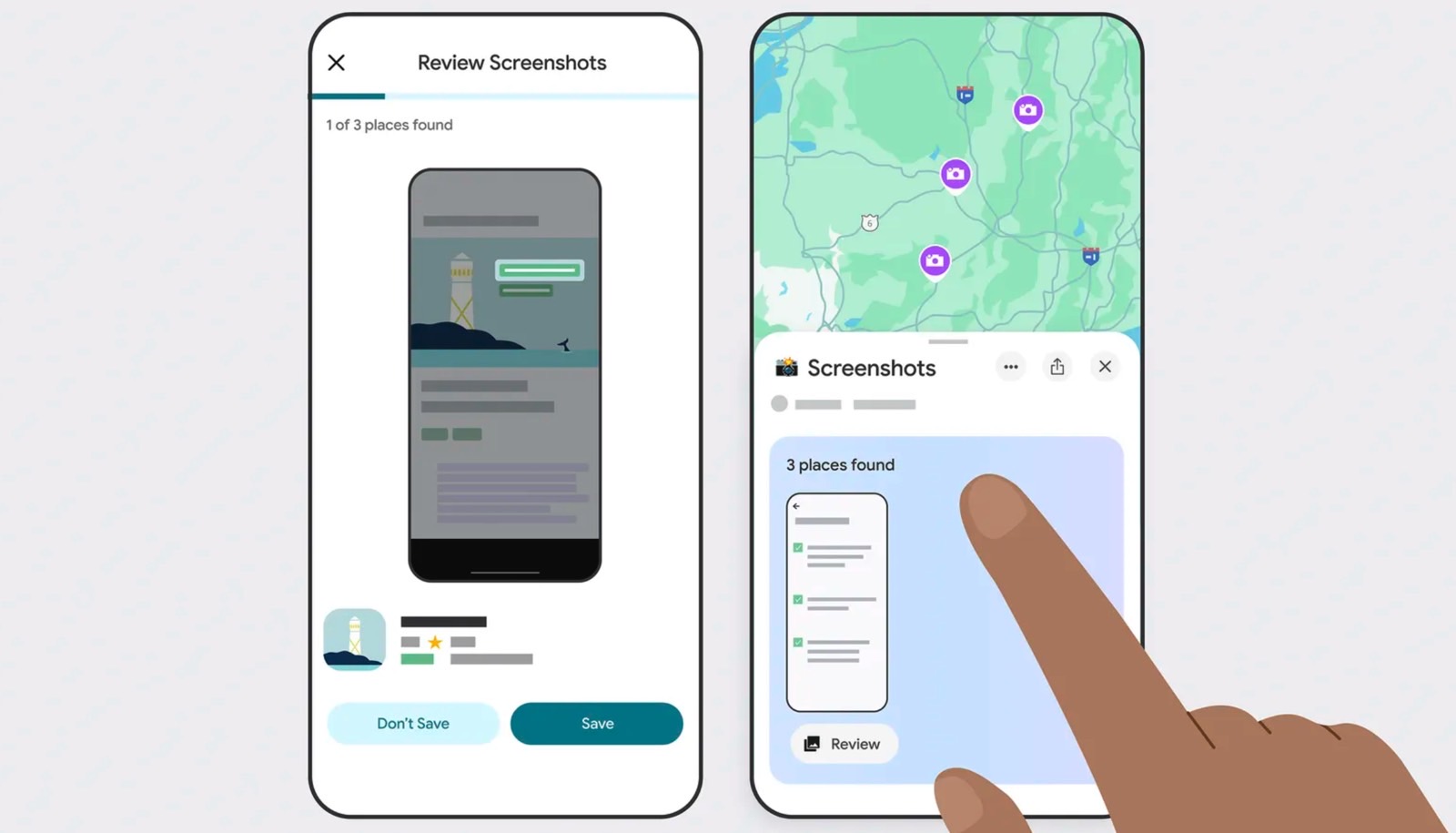

The new AI divide: Speeding software, cautious customers

A decade ago, (then SaaSx), a community for SaaS founders, rallied a handful of Indian entrepreneurs around one goal: to build world-class software. At this year’s edition in Chennai, that mission felt familiar, yet altered.

“Unlearn the constraints of the past,” said Freshworks Founder Girish Mathrubootham, as he gave a clarion call to Indian startup founders, whose lexicon encompasses AI, SaaS, and deeptech. For SaaS firms, the end-user has changed. Today, humans work alongside digital co-workers and AI agents, forcing software companies to build products as much for machines as for people.

This new intersection of artificial intelligence and SaaS has led founders to rewrite their playbooks overnight. Some founders, with their early experiments, have revamped their entire positioning overnight, while others wondered whether a rebrand was enough.

Read more here.

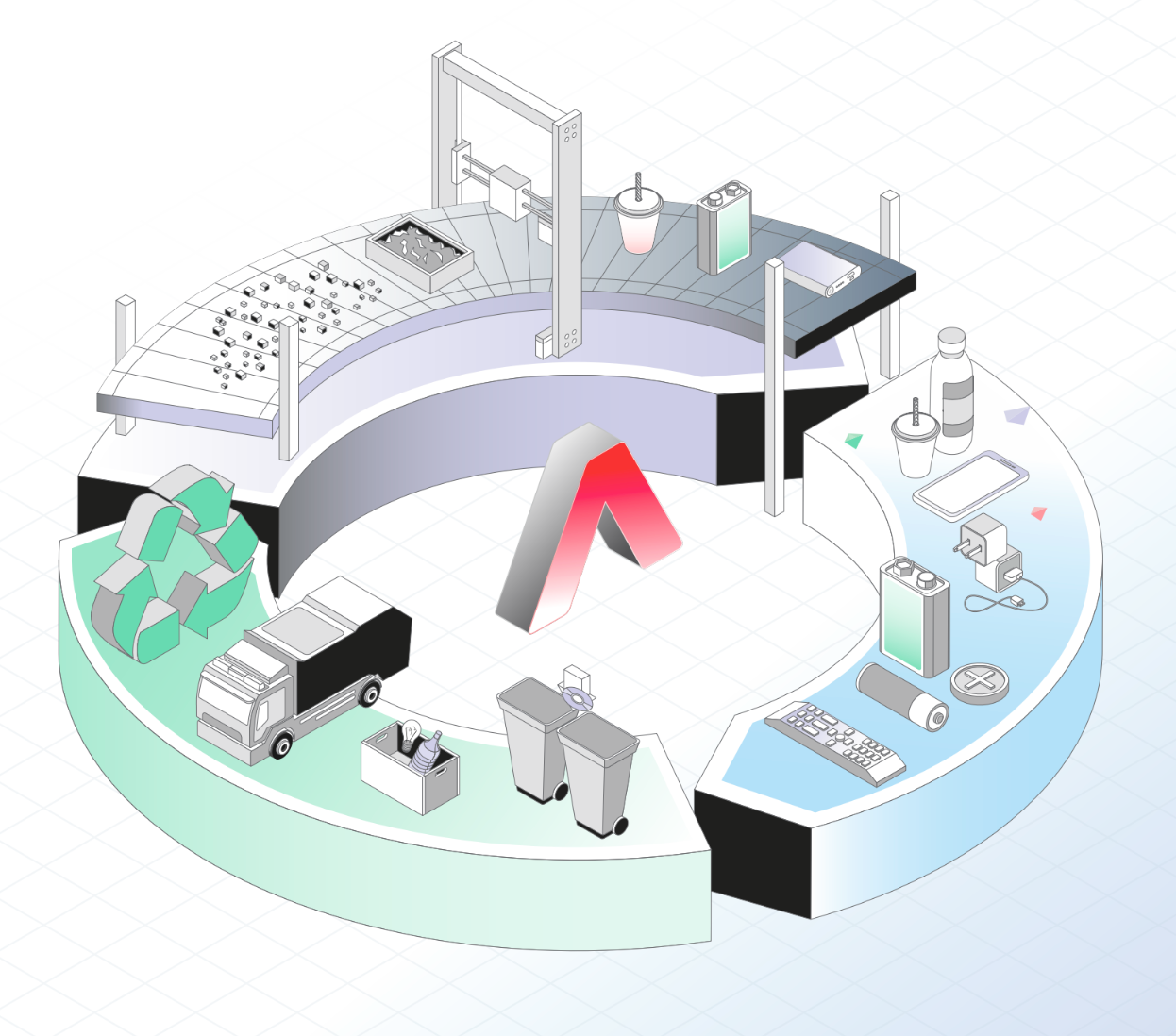

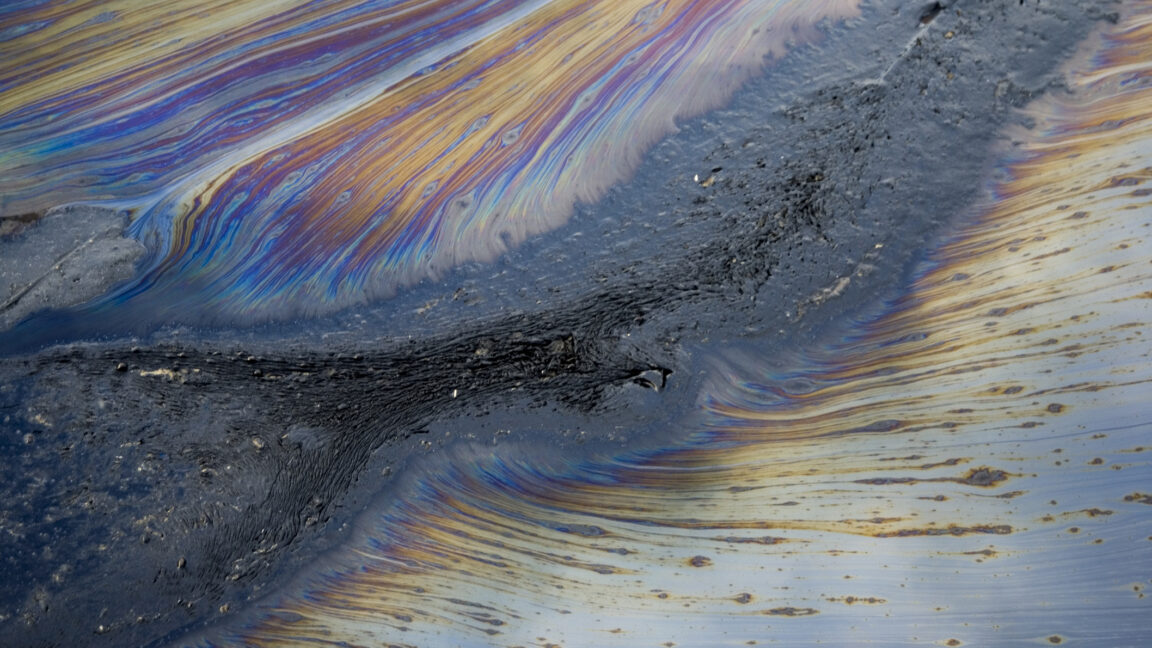

No ifs or butts: This startup is converting cigarette waste into sustainable products

After a 14-year stint in Australia, Ketan Prajapati returned to India and realised that a smoking habit doesn’t just affect lungs but also pollutes the environment—often spilling out onto the streets.

“In Warrnambool, where I used to live, there was a waste disposal site every 100 meters or so. Not so in our country. When I used to smoke, I ended up carrying the waste in a cigarette packet as I had developed a habit against littering. Eventually I realised many face this issue and started working towards solving it,” Prajapati says.

According to the National Institute of Cancer Prevention and Research, the environmental burden of tobacco product waste is huge. The waste produced by the packaging of tobacco products in India amounts to over 1,70,000 tonnes per year; of this, waste produced by cigarette consumption is about 40,846 tonnes per year.

Prajapati wants to tackle this problem with BuffIndia, the B2B waste management company he co-founded in 2018 with Nikhil Mangani to recycle cigarette waste.

Read more here.

Latest News:

Commercial vehicle platform 91Trucks raises $5M in Series A round led by Arkam Ventures

Commercial vehicle platform 91Trucks has raised $5 million in Series A round led by Arkam Ventures, with participation from existing investors Titan Capital Winners Fund, Sparrow Capital, and Atrium Angels. The funds will be used to expand the company's product and technology capabilities, scale its team, and expand its offline retail footprint to over 20 stores, 91Trucks said in a statement.

“Over 55% CV (commercial vehicle) sales in India comprise of small commercial vehicles, primarily used for last-mile delivery and owned by small fleet owners and driver operators. We are on a mission to organise and grow this segment. We are building a full-stack platform for fleet operators, removing the existing frictions plaguing the CV industry," said Siddharth Sharma, CEO & Cofounder, 91Trucks.

"In the last two years, our revenue has grown by 8x and, with this funding, we will accelerate our physical footprint across Tier II and III cities, invest in technology particularly in AI, and strengthen our team,” he added.

Read more here.

General Catalyst backs PB Fintech’s new health unit with $218M investment

has led a $218 million (Rs 1,816 crore) seed funding round in PB Healthcare Services, the newly-launched healthcare subsidiary of PB Fintech, the parent company of PolicyBazaar, said the company in a statement.

The round marks one of the largest early-stage capital infusions into India’s private healthcare delivery sector and saw participation from PB Fintech and other external investors. In a stock exchange filing last week, PB Fintech disclosed that it invested Rs 539.4 crore in the round by subscribing to 5.39 crore compulsory convertible preference shares (CCPS) at Rs 100 each.

Following completion of the fundraising, PB Fintech’s stake in PB Health will be diluted from 100% to 32.14% on a fully-diluted basis. The round also includes the establishment of an employee stock option pool.

The proceeds will be used to set up a 1,000-bed hospital network in the Delhi National Capital Region and invest in product development and technology, the company said.

Read more here.

Funding news:

CodeAnt AI raises $2M to revolutionise code review with AI

CodeAnt AI, an AI-powered code reviewer, has raised $2 million in seed funding to help engineering teams cut manual code review time and software bugs by over 50%. L-R Amartya Jha and Chinmay Bharti- Co-founders, CodeAnt AI

The round was led by Y Combinator, Uncorrelated Ventures, and VitalStage Ventures, with participation from DeVC, Transpose Platform, Entrepreneur First, and several prominent angel investors.

CodeAnt AI is transforming the traditionally manual and time-consuming process of code review by embedding artificial intelligence directly into the software development workflow. By integrating across IDEs, pull requests, and CI/CD pipelines, it automates tasks like summarising changes, flagging issues, suggesting one-click fixes, and continuously scanning for code quality concerns such as duplication, complexity, and missing documentation. On the security front, it monitors infrastructure, code, and dependencies in real time, detecting vulnerabilities and exposed secrets to help maintain enterprise-grade security.

Already trusted by over 50 companies—including Akasa Air, Cyient, Bureau, KukuFM, and several Fortune 1000 enterprises—CodeAnt AI also supports on-premise deployment for clients with stringent data governance needs. Its platform empowers engineering teams to move faster without compromising code quality or security.

Vaya raises $1.5M to modernise vedic astrology with AI

Vaya, an AI-powered Vedic astrology startup, has raised $1.5 million in seed funding to deliver culturally attuned, tech-enabled astrology services to India’s mass premium urban audience. L-R: Maahin Puri and Nitesh Kumar Niranjan, C-founders, Vaya

The funding will support team expansion, AI enhancement, and community-building among vetted Vedic astrology practitioners, as the company aims to reimagine astrology for modern India.

The round was co-led by Accel and Arkam Ventures, with participation from Weekend Fund and notable angel investors including Softbank’s Sumer Juneja and Sarthak Mishra, Darwinbox Co-founder Rohit C, and Legacy Ventures.

Founded by Maahin Puri and Nitesh Kumar Niranjan—former product and engineering leads at travel-tech startup Atlys—Vaya combines AI with expert human astrologers to offer personalised, nuanced consultations.

Feline Spirits raises Rs 5.2 Cr from IPV to expand premium craft alcohol portfolio

Feline Spirits, a homegrown craft alcoholic beverage brand, has raised Rs 5.2 crore in a funding round led by Inflection Point Ventures (IPV). The capital will support the company’s expansion into new geographies and further strengthen its premium product portfolio.

Founded by Prabhat Sharma (CEO) and Rohit Saxena (COO), the company merges the expertise of a third-generation master blender with modern consumer insights to create high-end yet approachable spirits. By combining traditional distillation with contemporary trends in flavor and branding, Feline Spirits has built a strong identity in India’s evolving alcohol market. The brand is currently active across eight states and union territories, with a customer base of over 20 lakh.

In FY23–24, the company achieved a monthly top-line of over 2 lakh bottles (10,303 cases) and revenue exceeding Rs 11 crore. This momentum continued into FY24–25, with over 4.1 lakh bottles (19,751 cases) sold, generating more than Rs 25 crore in sales. Feline Spirits has secured operating licenses in eight markets—five of which are government-run—positioning the brand for steady nationwide growth.

GoTrust secures Pre-Seed funding to scale privacy compliance platform

GoTrust, a next-generation privacy compliance and data governance startup, has closed its pre-seed funding round led by Aevitas Capital Private Limited, with participation from a prominent Indian actor and entrepreneur.

Though the investment amount remains undisclosed, the funds will be used to accelerate product development, grow the team, and expand the company’s presence in domestic and global markets.

Positioned at the forefront of data protection, GoTrust offers an integrated platform that simplifies regulatory compliance for businesses navigating complex privacy laws like GDPR, CCPA, HIPAA, and India’s DPDPA.

Its core capabilities include automated data discovery, consent and preference management, DSR automation, third-party risk management, centralised policy updates, and a compliance tracking runbook for Data Protection Officers.

Designed for seamless integration with existing systems, GoTrust replaces fragmented manual processes with a secure, scalable solution that reduces compliance risk, streamlines operations, and enhances customer trust in the digital age.

(The story will be updated)

Edited by Affirunisa Kankudti

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Honor 400 series officially launching on May 22 as design is revealed [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/honor-400-series-announcement-1.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)