Avendus raises Rs 1,000 Cr in first close of third private credit fund

ASCF III is expected to build a diversified portfolio of 12-18 investments, with ticket sizes ranging between Rs 200 crore and Rs 500 crore, and targeting gross IRRs of 16-18%.

Avendus has announced the first close of its Structured Credit Fund III (ASCF III), securing over Rs 1,000 crore in investor commitments since its launch in January 2025.

Registered as a Category-II Alternative Investment Fund with SEBI, ASCF III aims to raise Rs 2,000 crore, with a green shoe option of an additional Rs 2,000 crore.

ASCF III is expected to build a diversified portfolio of 12-18 investments, with ticket sizes ranging between Rs 200 crore and Rs 500 crore, and targeting gross IRRs of 16-18%.

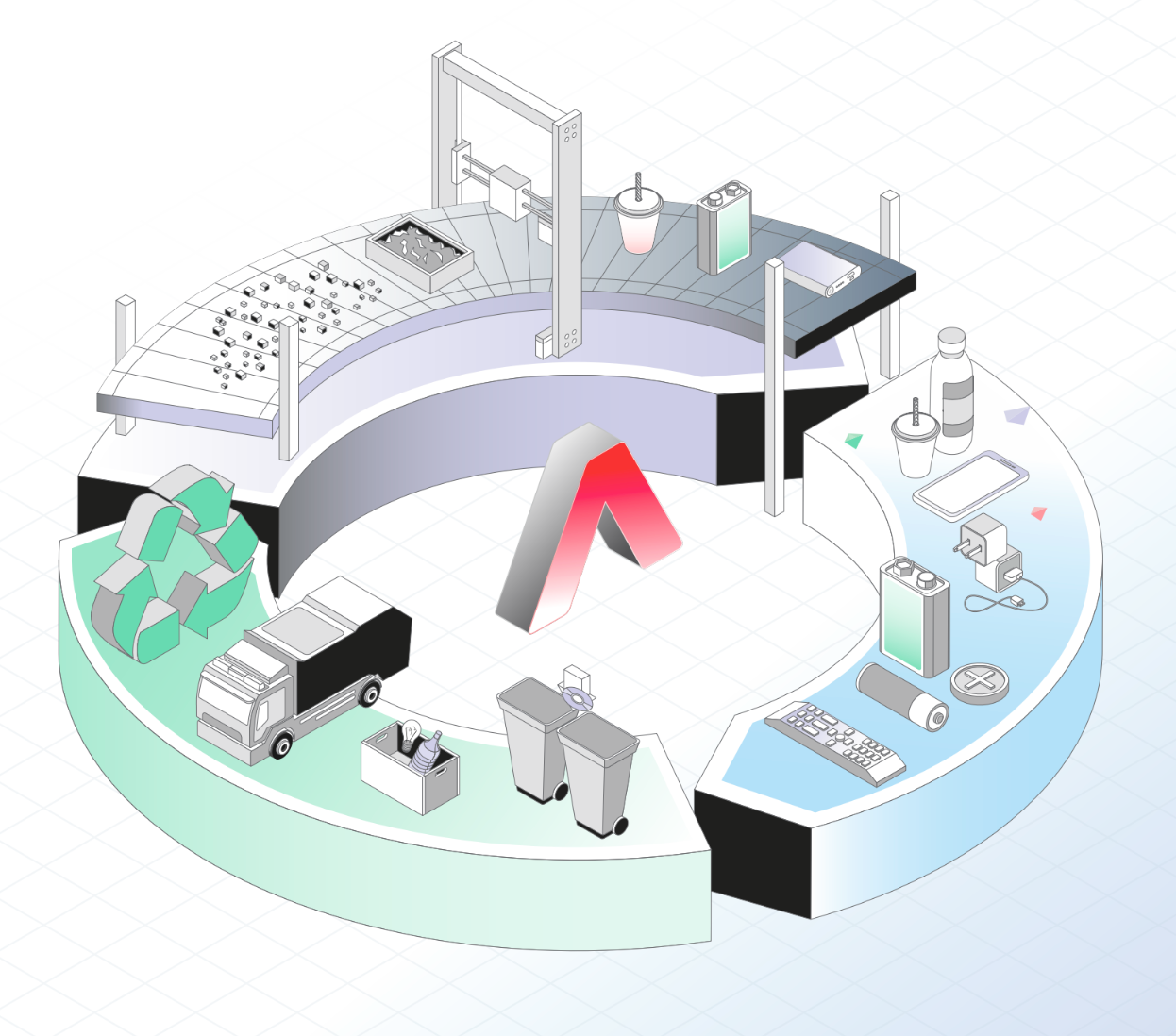

The fund is sector-agnostic but is expected to focus on industries where Avendus has proprietary corporate access and established domain expertise, including pharmaceuticals, healthcare, manufacturing, consumer, chemicals, technology, and B2B services.

"The fund has already drawn 15% of the capital and completed its first investment,” said Anshul Jain, Executive Director at Avendus Structured Credit Fund.

ASCF III is the latest in Avendus’ high-yield private credit fund series, targeting secured debt investments in operating and holding companies. The fund also considers selective exposure to hybrid instruments.

“The private credit space in India is evolving rapidly, driven by growing demand from mid-to-large companies and promoters seeking bespoke capital solutions,” said Nilesh Dhedhi, Managing Director at Avendus Finance.

“With traditional lenders constrained by a standardized lending approach coupled with volatility in other capital market sources, we see a rising preference for flexible capital that can help scale the ambitions of Indian companies and entrepreneurs,” he added.

The fund has drawn early support from both returning investors and new backers, including high-net-worth individuals and family offices, according to the company.

Avendus’ previous funds in this strategy include ASCF I, launched in 2017 and fully returned by 2022 with a gross portfolio IRR of 18%, and ASCF II, launched in January 2022, currently tracking an expected gross IRR of around 17%.

“As one of the earliest and most active private credit platforms in the country, Avendus has emerged as a trusted name in the high-yield performing credit segment,” said Kaushal Aggarwal, Co-founder of Avendus. “Leveraging the group’s deep sector expertise and extensive corporate relationships, the platform has been consistently offering differentiated investment opportunities and attractive outcomes for investors.”

Avendus Group, founded in 1999, operates across investment banking, institutional equities, wealth management, credit solutions, and asset management. It has a presence in 10 cities across India, the US, and Singapore.

Edited by Kanishk Singh

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

-Mafia-The-Old-Country---The-Initiation-Trailer-00-00-54.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2---Reveal-Trailer-00-01-52.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Instacart’s new Fizz alcohol delivery app is aimed at Gen Z [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Instacarts-new-Fizz-alcohol-delivery-app-is-aimed-at-Gen-Z.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)